10 Dollars An Hour 40 Hours A Week After Taxes The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate There is in depth information on how to estimate salary earnings per each period below the form Method 1 Method 2 How much do you get paid How many hours per day do you work First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 How do I calculate taxes from paycheck

10 Dollars An Hour 40 Hours A Week After Taxes

10 Dollars An Hour 40 Hours A Week After Taxes

https://petadvisers.com/wp-content/uploads/2021/09/shutterstock_1907614591.jpg

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

19 00 Per Jam Gaji Ikhtisar Sederhana Perbedaanantara

https://perbedaanantara.com/wp-content/uploads/2021/12/19.00-dollars-an-hour-is-how-much-a-year-_-hourly-to-yearly-salary-conversion.png

Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis Select a state Paycheck FAQs Switch to salary calculator State Date State Federal taxes only Select a state to include state local taxes Check Date Hourly Rates Amount Hours Earnings Gross Pay 0 00 Gross Pay Method Gross Pay YTD Pay Frequency

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime To enter your time card times for a payroll related calculation use this time card calculator Gross Pay or Salary Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiply it by 40 which means adding a zero behind the hourly rate then multiplying that number by 4 To convert into a biweekly period this number would then be doubled

More picture related to 10 Dollars An Hour 40 Hours A Week After Taxes

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://www.income-tax.co.uk/images/33000-after-tax-salary-uk-2020.png

10 Dollars An Hour 40 Hours A Week After Taxes Eleanore Negrete

https://www.physicianonfire.com/wp-content/uploads/2020/12/Taxes-Overview.png

Food For Thought These Numbers Are Pretty Low But Let s Go With It

https://i.pinimg.com/originals/8c/9b/a1/8c9ba19734c09f8eb370e6960e04139c.jpg

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the U S etc For those who do not use itemized deductions a standard deduction can be used The standard deduction dollar amount is 13 850 for single households and 27 700 for married couples filing If you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre tax will be 15 40 52 31 200 Using this formula we can calculate the following annual incomes from basic hourly pay It s important to remember that these figures are pre tax and deductions

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as 30 8 260 62 400 This would mean you are working 2 080 hours every year since 40 multiplied by 52 weeks is 2 080 Assuming you get 2 weeks of paid leave and are working 2 080 hours every year you have to multiply your hourly wage by the number of hours you are working So 10 multiplied by 2 080 20 800 yearly income What if you do not have any paid leave

I Work In HUGE Rose Garden And Have Recently Got Way Down In My Back I

https://cdn-fastly.hometalk.com/media/42a22aeab0b70fc82a24fe8ef13d588b.jpg?size=720x845&nocrop=1

13 Dollars An Hour 40 Hours A Week After Taxes Lucila Zaragoza

https://clockify.me/assets/images/40-hour-calculator.png

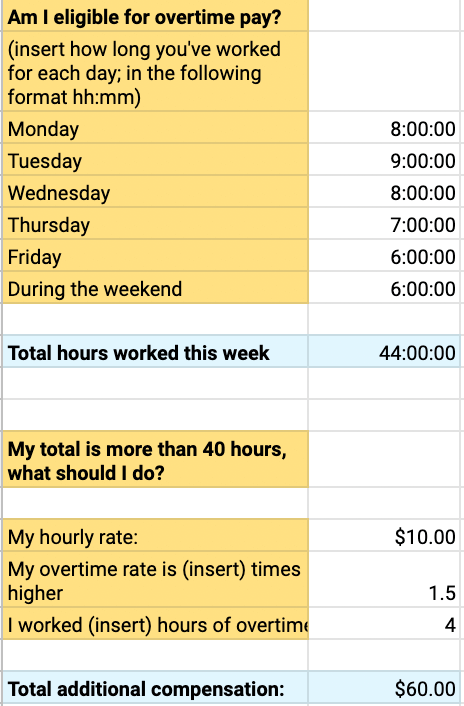

10 Dollars An Hour 40 Hours A Week After Taxes - Biweekly wage 2 Weekly wage For a wage earner who gets paid hourly we can calculate the biweekly salary from the formula above Remembering that the weekly wage is the hourly wage times the hours worked per week Biweekly wage 2 Hourly wage Hours per week We can also express the first formula in terms of the daily wage