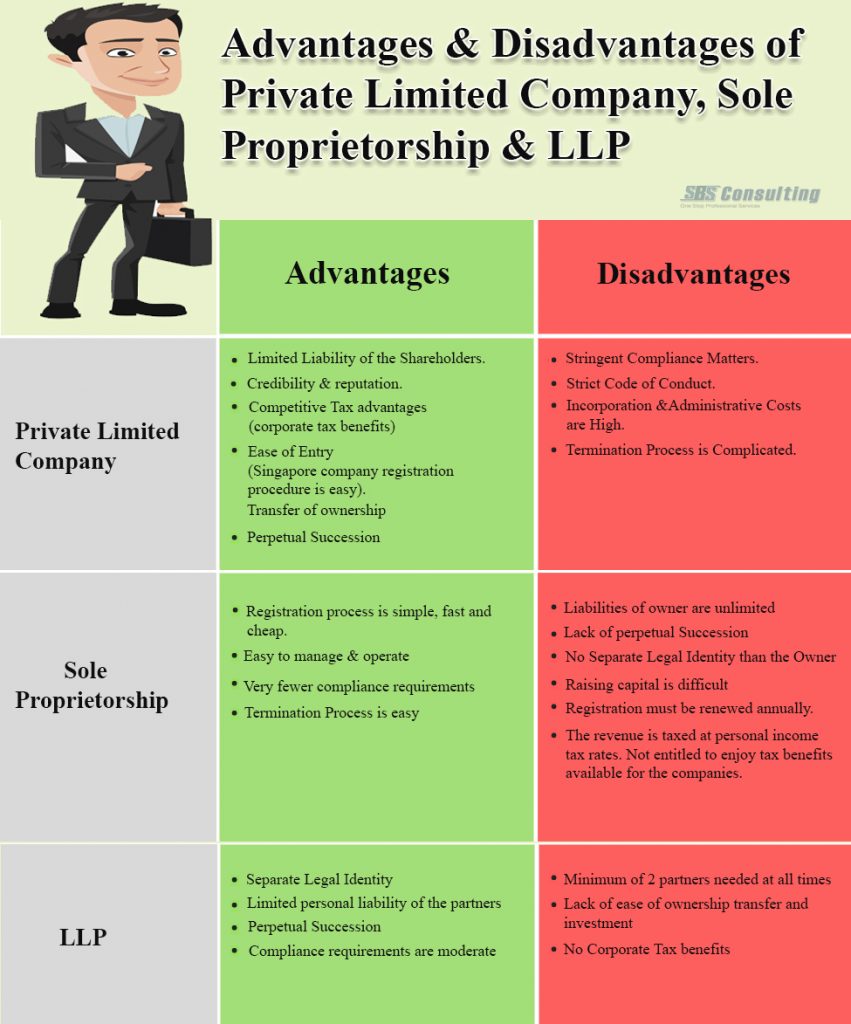

Which Is Better Llp Or Sole Proprietorship A limited liability partnership LLP is a form of partnership firm in which some or all partners have limited responsibility Consequently it combines aspects of partnership and corporate structure Partners in an LLP are not held accountable for the wrongdoings of their other partners

A limited liability partnership is a formal structure that offers the partners at least some legal protection from the partnerships liabilities Sole Proprietorship Vs LLC Here s What A sole proprietorship means that you are an individual independent contractor who is in business for and with yourself the terminology solopreneur perfectly embodies this type of business entity Sole proprietorships are the most popular business structure in the United States See also Bookkeeping for Startups Best Practices Steps FAQs

Which Is Better Llp Or Sole Proprietorship

Which Is Better Llp Or Sole Proprietorship

https://www.sbsgroup.com.sg/wp-content/uploads/Advantages-Disadvantages-of-Private-Limited-Company-Sole-Proprietorship-LLP-851x1024.jpg

Differences Between Sole Proprietorship And LLC Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/LLC-vs-Sole-Proprietorship.png

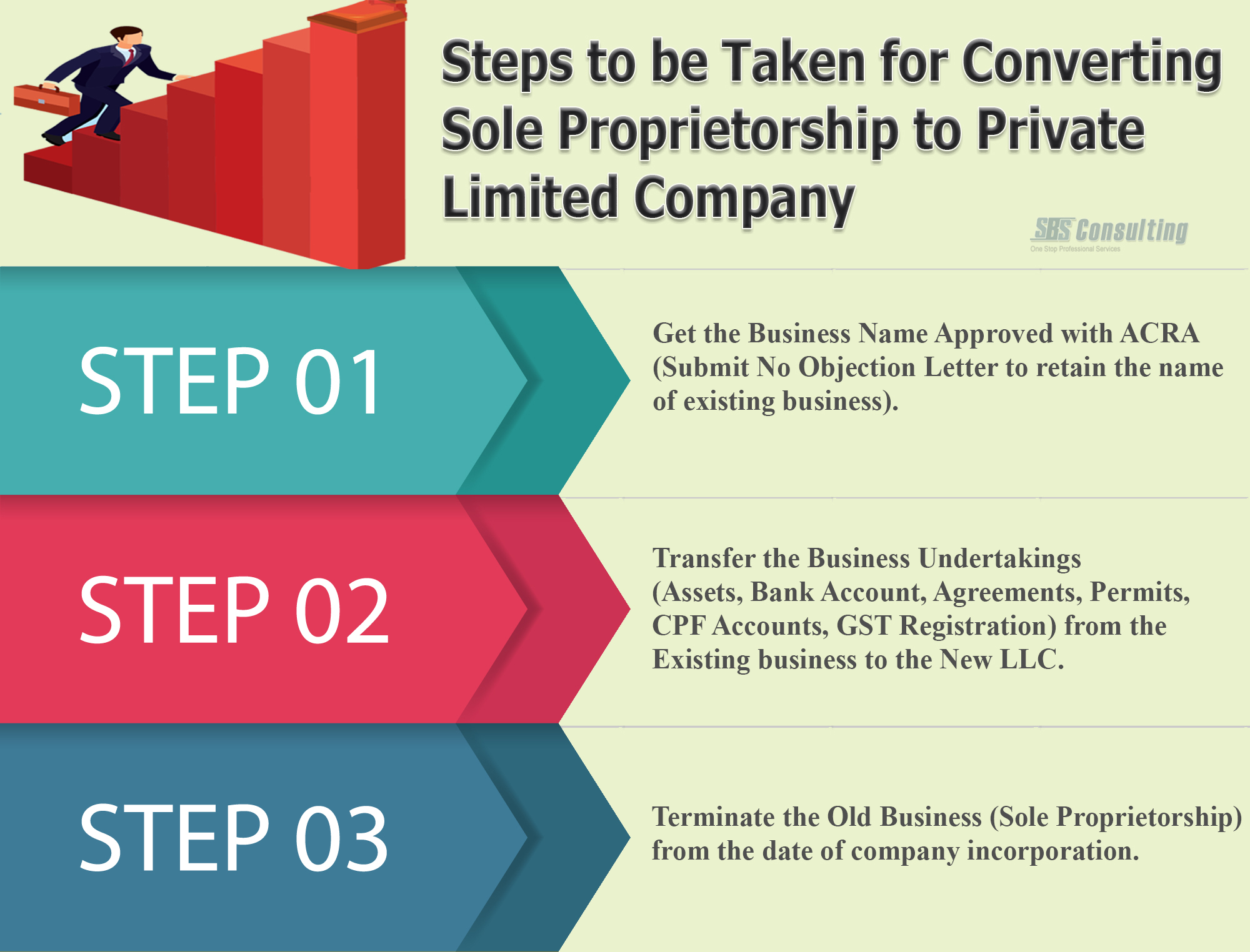

Pte Ltd Company Pros Cons How To Convert From Sole Proprietorship LLP

https://www.sbsgroup.com.sg/wp-content/uploads/Steps-to-be-Taken-for-Converting-Sole-Proprietorship-to-Private-Limited-Company.jpg

At a Glance Sole Proprietorship Vs LLC Sole proprietorships and limited liability companies LLC are two of the most common business structures for individuals and small businesses An individual who operates a business on their own is by default a sole proprietor For example if you operate as a retailer freelance run an online business or otherwise sell goods and

A sole proprietorship can be riskier than an LLC A sole proprietorship is not a separate legal entity from the owner and does not provide the same legal protections as an LLC This means the A limited liability partnership is a business entity type that affords personal liability protection to business partners LLPs are subject to more stringent regulations than other business structures such as sole proprietorships or corporations which can increase administrative costs by Michael Keenan Published Sep 13 2023 Share

More picture related to Which Is Better Llp Or Sole Proprietorship

Start A Successful Business At Home The Ultimate Guide Smart Money Mamas

https://smartmoneymamas.com/wp-content/uploads/2019/01/Sole-Proprietorship-v-LLC-1024x613.jpg

Sole Proprietorship Definition Pros Cons And Tax Implications

https://learn.financestrategists.com/wp-content/uploads/Advantages-and-Disadvantages-of-Sole-Proprietorship.png

What Is Sole Proprietorship Explained Along With Examples

https://www.vizaca.com/wp-content/uploads/2020/08/Sole-Proprietorship.jpg

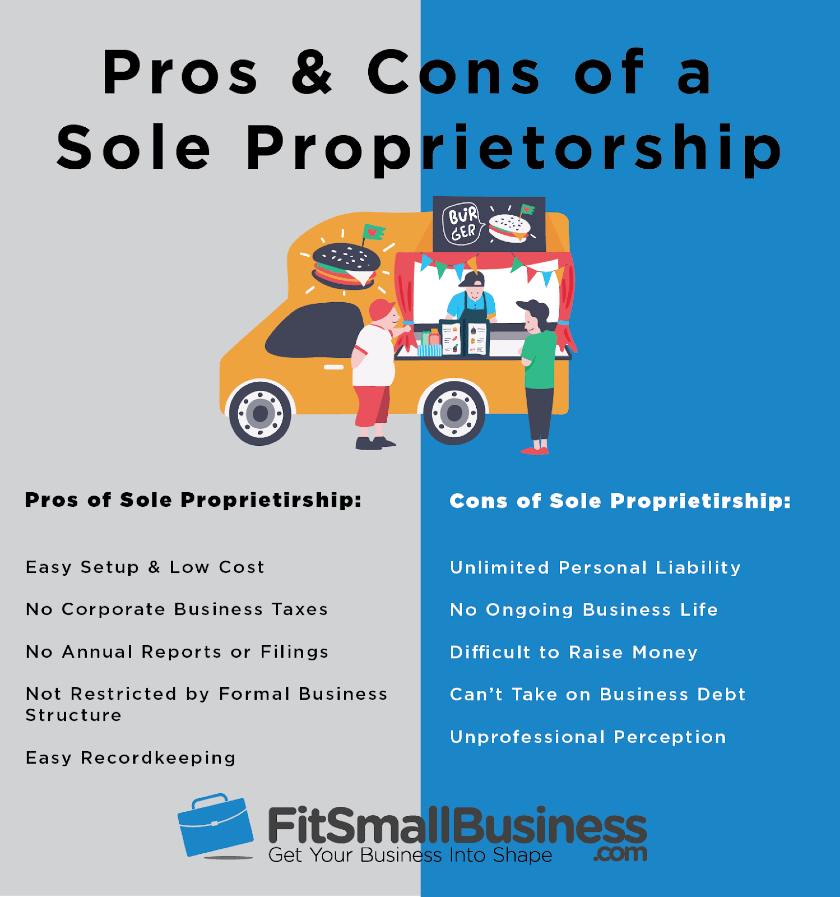

A sole proprietorship or sole prop is the most basic type of business This structure is an unincorporated business owned by a single individual with no legal separation between entity and owner Creating and operating a sole prop is a relatively simple process which makes it a popular choice among the self employed like freelancers or Advantages of an LLC The main advantage of an LLC vs a sole proprietor is the legal and financial protection it provides for its members An LLC also provides greater flexibility in ownership and

27 December 2023 4 507 6 mins read One of the first decisions you ll need to make is what type of legal entity to choose Two common options are a limited liability partnership LLP and a sole proprietorship company Here s a comparison of the two Sole Proprietorship A sole proprietorship is a business that is owned and operated by an individual person it s one of the easiest and most common types of business for individuals to set up

5 Sole Proprietorship Pros And Cons

https://fitsmallbusiness.com/wp-content/uploads/2018/05/Inforgraphic_Pros_and_Cons_of_a_Sole_Proprietorship.jpg

Pros And Cons Of Sole Proprietorship SimplifyLLC

https://www.simplifyllc.com/wp-content/uploads/2021/12/should-i-start-a-sole-proprietorship.png

Which Is Better Llp Or Sole Proprietorship - Key Takeaways Sole proprietorships are typically businesses owned by a single person who is liable for the business and who includes business income in their personal tax return Limited liability companies are businesses that separate the owner or owners from the liability but in the case of non corporate LLCs taxes pass through to the owners