What Should Be Basic Salary Of Gross Salary Gross pay vs base pay You calculate both gross pay and base pay before taking out deductions such as taxes retirement plans and medical benefits Base pay is a part of gross pay for any job though sometimes gross pay and base pay are the same for organizations that offer salaries without bonuses or commissions

An employee s basic salary also known as their base salary is the amount they earn each year before additional pay taxes or other modifications Basic salary typically applies to FLSA exempt employees who receive an annual salary Hourly employees receive a base wage rate 1 Considered in Job Offers 2 Subject to Taxation 3 Reflects Employee s Worth What are Factors that may Affect Compensation salary wage 1 Education and Qualifications 2 Experience and Expertise 3 Job Role and Responsibilities 4 Industry and Sector 5 Geographic Location How to Calculate Basic and Gross Salary 1

What Should Be Basic Salary Of Gross Salary

What Should Be Basic Salary Of Gross Salary

https://99employee.com/wp-content/uploads/2021/01/gross-salary-employee.jpg

Gross Vs Net Salary Difference And Comparison

https://askanydifference.com/wp-content/uploads/2022/10/Gross-vs-Net-Salary.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Gross pay is the total amount of money an employee earns for time worked It includes the full amount of pay before any taxes or deductions Gross pay also includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay What is gross pay Gross pay is the total amount of money an employee receives before taxes and deductions are taken out For example when an employer pays you an annual salary of 40 000 per year this means you have earned 40 000 in gross pay Your gross pay will often appear as the highest number you see on your pay statement

1 Basic Salary How to calculate basic salary from gross salary Before learning basic salary calculation in India know what its definition is The basic salary is a fixed part of your pay before any deductions For basic salary calculation in India your firm will subtract bonuses This calculation follows Indian Labor Laws Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2023 In the third quarter of 2023 the average salary of a full time employee in the U S is 1 118 per week which comes out to 58 136 per year While this is an average keep in mind that it will vary according to many different factors

More picture related to What Should Be Basic Salary Of Gross Salary

Gross Salary Vs Net Salary Comparison Tuko co ke

https://netstorage-tuko.akamaized.net/images/0fgjhs17c608hjvn8o.jpg?imwidth=900

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

Gross Salary Vs Net Salary Key Differences Components And Calculation

https://uploads-ssl.webflow.com/60ae205a9765a905fb4d243c/626aefc44f197c209ab27fe9_Gross vs net salary c.jpg

So to compute Basic Salary from Net Salary we ll use the formula Basic Salary Net Salary Deductions from Tax and EPF Allowances For example An employee receives a take home pay of 40 000 INR It includes an HRA of 18 000 INR and Conveyance Fees of 3 000 INR He pays 5 in tax and contributes 3 to EPF What is Gross Salary In simple words gross salary is the monthly or yearly salary an employee receives before any deductions are made from it The gross salary an employee receives is never equal to the CTC or the Cost to Company Gross Salary Basic Salary All Allowances All Benefits

1 Basic salary Sum paid to an employee that does not include bonuses benefits perks and incentives 2 HRA or House Rent Allowance The sum is paid towards covering the housing expenses of an employee 3 Provident fund contribution The employee s share of the salary towards the Employment Provident Fund Basic salary refers to a fixed amount paid to employees for their services rendered to a company It serves as the foundation upon which most other salary components are calculated Unlike bonuses or commissions a basic salary does not include any additional allowances

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

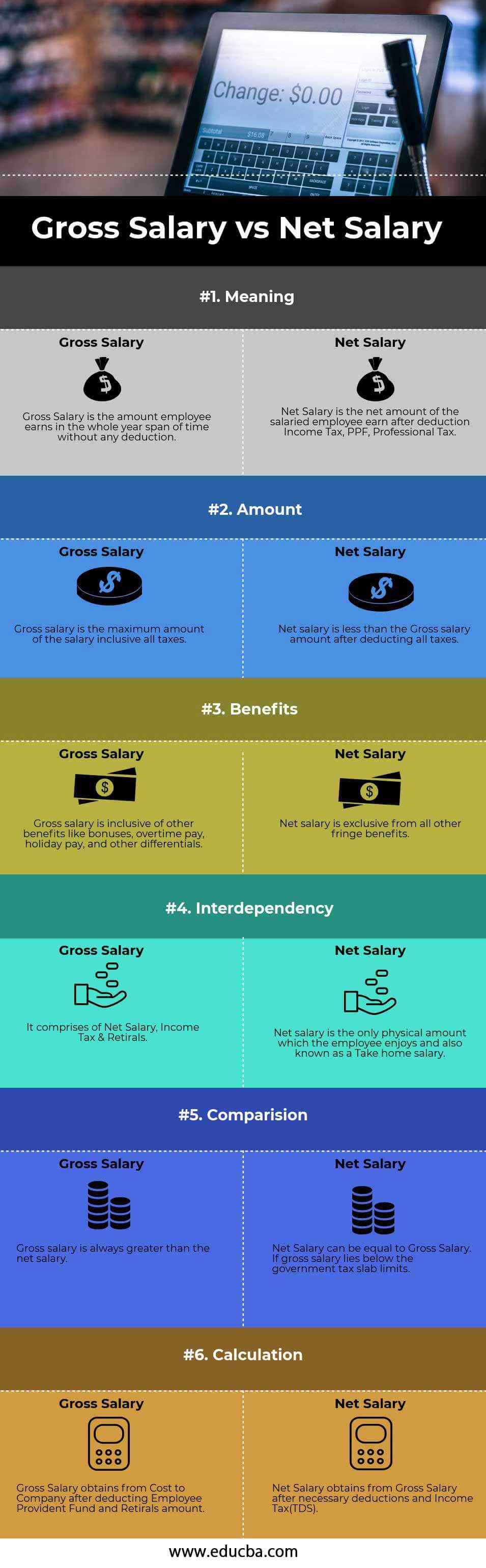

Gross Salary Vs Net Salary Top 6 Differences With Infographics

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Gross-Salary-vs-Net-Salary-info.jpg

What Should Be Basic Salary Of Gross Salary - Basic salary or base pay is the fixed amount of money paid to an employee excluding the deductions i e tax contributions benefits insurance etc and additions i e bonuses overtime pay etc The rate can be stated as hourly weekly or annual Base rates vary depending on many factors including 1 Labour law