What Percentage Does A Business Owner Get Paid Patty can choose to take an owner s draw at any time She could take some or even all of her 80 000 owner s equity balance out of the business and the draw amount would reduce her equity balance So if she chose to draw 40 000 her owner s equity would now be 40 000 Keep in mind that Patty pays taxes on the 30 000 profit

For owner pay you ll subtract your monthly tax savings from your net income number This will be what you the business owner has access to personally Or in other words it s your owner access number Net Income 30 Monthly Tax Savings Net Income Monthly Tax Savings Owner Access Step 3 Factor in your business debt According to the 2016 American Express OPEN Small Business Monitor just over half 51 percent of business owners pay themselves a salary But Alice Bredin

What Percentage Does A Business Owner Get Paid

What Percentage Does A Business Owner Get Paid

https://online.grace.edu/wp-content/uploads/2020/09/How-to-be-a-Better-Business-Owner-D04258-1024x768-V2jpg-1200x800-c-default.jpg

Business Broker Fees Everything You Need To Know

https://acquira.com/wp-content/uploads/2023/08/What-is-a-Business-Broker-1-1024x684.jpg

What Is The Average Small Business Owner Salary In The U S

https://assets-blog.fundera.com/assets/wp-content/uploads/2017/08/22163927/small-salary-big-boss-5.png

You can divide that by 12 for your monthly salary or by 52 for your weekly salary Further divide your weekly salary by the number of hours you work to find your hourly pay U S small business owners make around 70 000 on average but many do not take a salary in the first couple of years On the other hand some business owners may pay 4 Ways To Pay Yourself From an LLC Here are four main ways you can receive payments from your LLC 1 Pay Yourself as a W 2 Employee For many LLC owners the most advantageous way to receive

What to pay yourself may be one of the most controversial issues for entrepreneurs According to Payscale U S small business owners make on average 70 300 However many company founders take As a small business owner you can pay yourself through an owner s draw salary or combination method Owner s draw This allows business owners to pay themselves without issuing regular paychecks or withholding employment taxes You can simply write a check to yourself from the business checking account or transfer money from your business

More picture related to What Percentage Does A Business Owner Get Paid

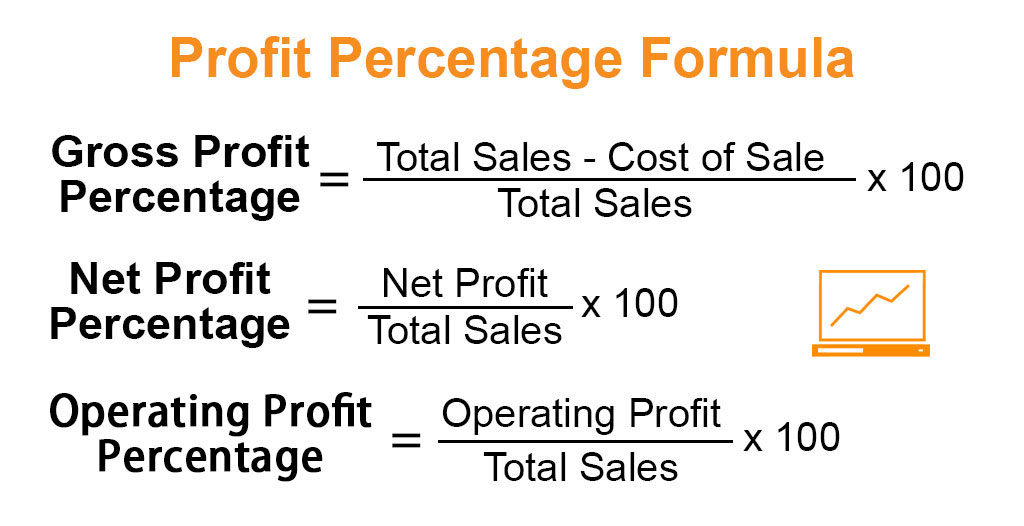

How To Calculate Net Profit Percentage Haiper

https://www.educba.com/academy/wp-content/uploads/2019/08/Profit-Percentage-Formula-educba.jpg

How Does A Small Business Owner Get Paid MOD Ventures LLC

https://res.cloudinary.com/mod-ventures-llc/images/f_auto,q_auto/v1630444241/1-2/1-2.png?_i=AA

Tax Advantage Character Fictional Characters Tax

https://i.pinimg.com/736x/73/1a/a7/731aa7d30e28866cbad16475bca7e488.jpg

1 Owner s Draw The owner s draw is the distribution of funds from your equity account This leads to a reduction in your total share in the business Also you cannot deduct the owner s draw as a business expense unlike salary So if you are a sole proprietor a partner or an LLC you can go for the owner s draw Here s a step by step guide to help you understand how to pay yourself what to pay yourself and more Fortunately Gusto makes paying yourself easy Start setting up your account today 1 Determine Your Business Type Your business entity is where it all begins In fact it s the foundation for the entire payroll process and will help

KEY POINTS Small business owners should pay themselves a salary when their businesses are profitable Base your salary on your net business income after setting aside 30 for taxes Divide the July 12 2024 The average small business owner pays 19 8 to 20 of their business s gross income per tax year sole proprietorships and partnerships pay 20 to 30 and S corporations usually pay 15 to 25 However this figure can vary widely depending on the type of company in question

What Is The Typical Consignment Percentage Around The Block

https://www.aroundtheblock.com/cdn/shop/articles/what-percentage-does-a-consignment-shop-take.png?v=1665514668

How Much Of A Percentage Does A Real Estate Agent Get Pay Flickr

https://live.staticflickr.com/889/42355805302_6a4f94bcc3.jpg

What Percentage Does A Business Owner Get Paid - As a small business owner you can pay yourself through an owner s draw salary or combination method Owner s draw This allows business owners to pay themselves without issuing regular paychecks or withholding employment taxes You can simply write a check to yourself from the business checking account or transfer money from your business