What Percentage Do Wealth Managers Make The kind of salary and overall compensation you can expect to earn in wealth management will be contingent on a number of different factors such as AUM gross revenue and grid payouts I didn t discuss that in any detail as not all wealth managers will do that and it will make up a relatively small percent of your overall annual

Do you understand how they make theirs When choosing a financial advisor it s important to consider their fee structure costs and possibly their incentive for making recommendations AUM Assets Under Management fee model a percentage of the client s assets is charged annually typically ranging from 0 5 to 2 0 Commission based model wealth managers earn a commission for selling financial products such as insurance policies or investment products Fee only model wealth managers charge a flat fee for their services without any commission based income

What Percentage Do Wealth Managers Make

What Percentage Do Wealth Managers Make

https://www.tomic.com/wp-content/uploads/2019/11/ideal-body-fat-percentage.jpg

Everything You Need To Know About Wealth Management Fintoo Blog

https://static.fintoo.in/blog/wp-content/uploads/2021/07/2-1.jpg

Wealth Management Vs Financial Planning Overview Key Differences

https://learn.financestrategists.com/wp-content/uploads/Wealth_Management_vs_Financial_Planning-768x755.png

A percentage of assets under management AUM When wealth management involves investments as it typically does some wealth managers will retain a percentage of your assets under management This fee will often be paid annually or quarterly depending on the agreement The average annual salary of wealth managers in the United States can range from 60 000 to well over 120 000 with more experienced managers earning at the higher end of this spectrum The Bureau of Labor Statistics BLS classifies wealth managers under the broader category of Financial Managers

Like most financial advisors wealth managers earn their income by taking a percentage of the assets they manage These charges can vary between companies and even between different types of accounts within the same company You can expect commissions to start around 1 of assets managed Rise of Fee Based Compensation There has been a shift in the wealth management industry towards fee based compensation models where wealth managers charge a percentage of assets under management or provide services for a flat fee This move aligns the interests of wealth managers and clients as it ensures that the manager s compensation is

More picture related to What Percentage Do Wealth Managers Make

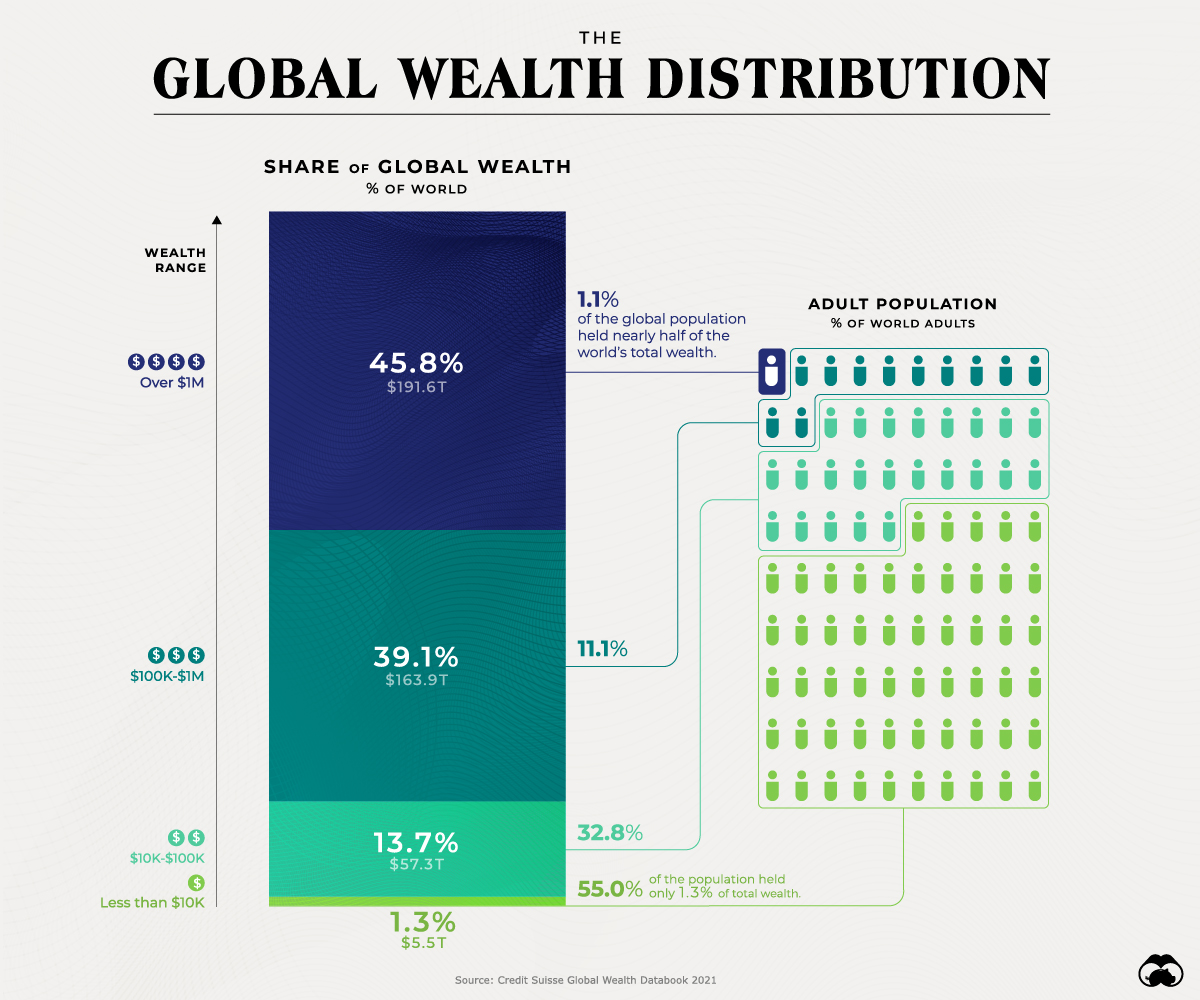

This Simple Chart Reveals The Distribution Of Global Wealth Visual

https://licensing.visualcapitalist.com/wp-content/uploads/2021/09/WealthDistribution_Main_Graphic.jpg

How To Grow Wealth Quickly And Effectively

https://argaamplus.s3.amazonaws.com/f4dd73b5-2a1d-4caa-9ba7-040a29017597.jpg

Houston s Top Wealth Managers Reveal Biggest Mistakes Houston

http://media.bizj.us/view/img/607251/wealth-management-biggest-mistake*1200.jpg

Wealth management firms make money by charging fees for the various services they provide In the investment area clients are often sold managed account services discretionary investment accounts that are traded on behalf of the client by one of the company s investment professionals A high percentage of private wealth managers charge Wealth manager compensation can vary widely based on factors like experience firm type and location Wealth managers at top Wall Street brokerages and wirehouses typically earn the highest salaries with base salaries starting around 100 000 and total compensation ranging from 250 000 to over 1 million annually for top performers

[desc-10] [desc-11]

Reasons Wealth Managers Are In Demand During The Pandemic Peace Takes

https://peacetakescourage.com/wp-content/uploads/2020/09/shutterstock_182371628-1024x683.jpg

How Much Do Wealth Managers Make Find Out Now 2023

https://investopediapro.com/wp-content/uploads/2023/03/Wealth-Manager.png

What Percentage Do Wealth Managers Make - [desc-13]