What Makes A Good Aml Analyst AML Analyst Salary The salary for an AML Anti Money Laundering Analyst position can vary depending on location experience and the specific employer However on average the following can be expected Entry level AML Analysts can expect to earn between 40 000 and 60 000 annually

What makes a good AML analyst A good AML analyst can understand the operations of all parts of the business They typically have worked in multiple departments of a business in order to coherently understand the finer details that impact overall risks They are also able to assess the details for risk on a consistent basis What does an AML Analyst do Fraud analysts work in organizations including insurance companies banks or realtors to detect and deter deceitful actions They strive to resolve fraud cases including identity theft or unauthorized usage of credit or debit cards Once they are alerted of potential fraud incidents they ask questions fill out

What Makes A Good Aml Analyst

What Makes A Good Aml Analyst

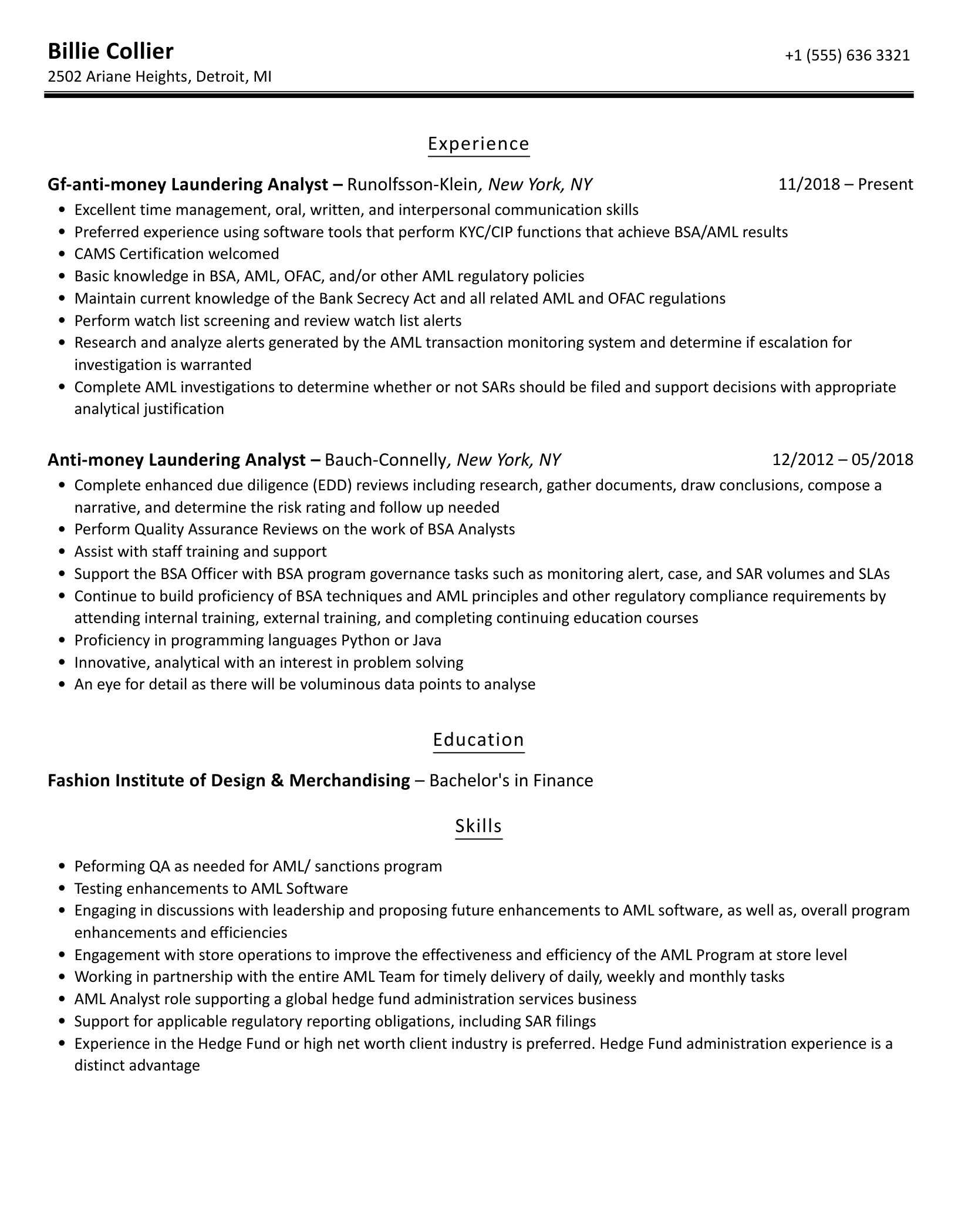

https://asset.velvetjobs.com/resume-sample-examples/images/anti-money-laundering-analyst-v2.png

Anti Money Laundering Analyst Resume Samples | Velvet Jobs

https://asset.velvetjobs.com/resume-sample-examples/images/anti-money-laundering-analyst-v1.png

AML Analyst Resume Samples | Velvet Jobs

https://asset.velvetjobs.com/resume-sample-examples/images/aml-analyst-v1.png

AML analysts play a crucial role in the fight against money laundering terrorist financing and other financial crimes They are responsible for examining customer transactions identifying suspicious activities and ensuring compliance with anti money laundering AML regulations Let s explore the job description required skills and AML Analysts are responsible for detecting and preventing illegal financial activities which requires a keen eye for detail analytical skills and a deep understanding of financial regulations They must stay updated on ever changing compliance requirements and be prepared to investigate a wide range of transactions and customer profiles

Attention to detail is a skill that can help an AML analyst review and interpret financial data This position requires close examination of large amounts of information so it s important for an AML analyst to be able to identify details in the data accurately For example if reviewing transactions from a bank account an AML analyst should This role is detail oriented and may be a good option for finance graduates and auditors Learning more about this role may help you make informed career decisions In this article we outline what an AML analyst is explain what a person in this role does and discuss the skills that may help you secure an AML analyst role Key takeaways

More picture related to What Makes A Good Aml Analyst

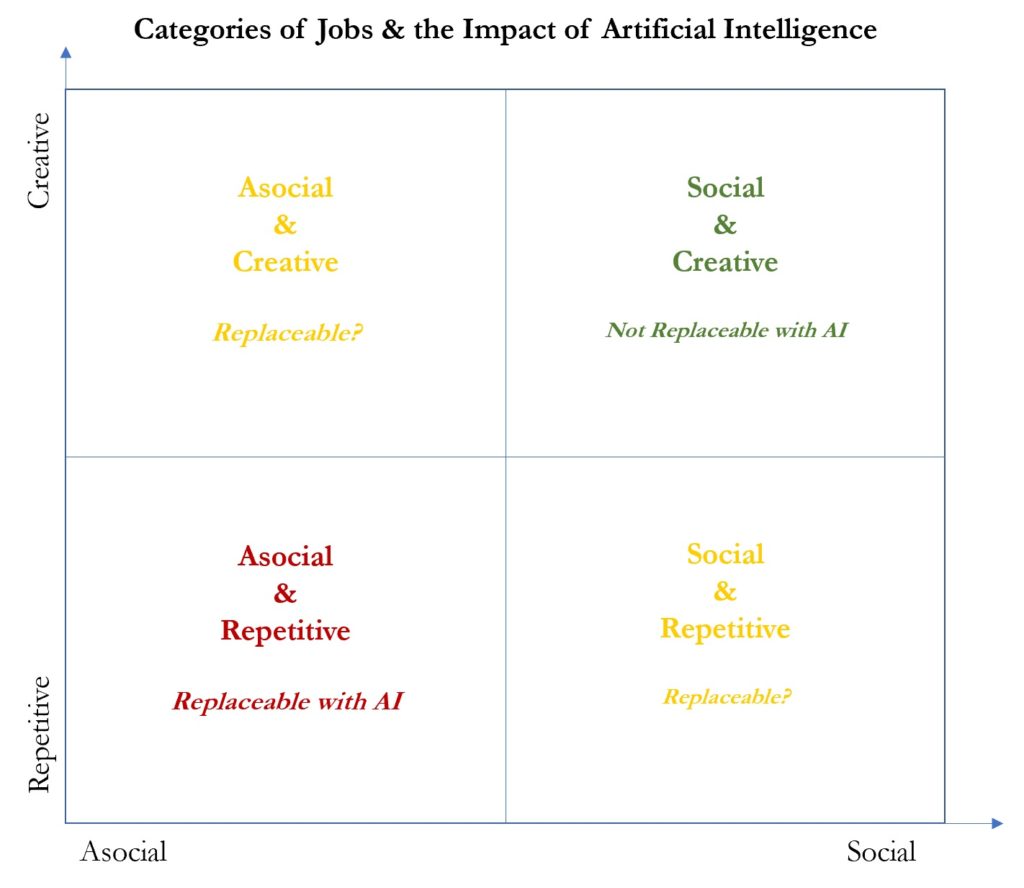

Flipping the Three AML Ratios with Machine Learning and Artificial Intelligence (why Bartenders and AML Analysts will survive the AI Apocalypse) - RegTech Consulting, LLC

https://regtechconsulting.net/wp-content/uploads/2018/12/AI-and-Jobs-1024x888.jpg

AML Analyst Cover Letter Examples - QwikResume

https://assets.qwikresume.com/cover-letters/images/aml-analyst-cover-letter-sample.jpg

What is an AML Analyst and What Are Their Analytic Skills? | SAS UK

https://www.sas.com/en_gb/insights/articles/analytics/what-is-an-aml-analyst/_jcr_content/socialShareImage.img.a3420ca26b644674b93259740db3daaa.png

An AML Analyst operates at the intersection of finance law and investigation utilising their unique skills to prevent money laundering and maintain regulatory compliance They sit at the very core of a financial institution s efforts to uphold the integrity of its operations One of their primary responsibilities is conducting detailed risk These are the questions that Anti Money Laundering AML Analysts must contend with on a daily basis An AML Analyst s primary role is to investigate the suspicious activity of clients at banks and other financial institutions Often they work in tandem with automated transaction monitoring systems that are able to parse through all of the

Technology Skills AML analysts need to be proficient in utilizing AML software and tools to efficiently analyze large volumes of data They should also possess data analysis and reporting skills to transform complex information into actionable insights Critical Thinking and Problem Solving The responsibilities of an AML analyst are varied and they are listed as follows Investigating and assessing the financial risks posed by a company s operations and monitoring regulating high risk activities Communicating with regulators and auditors regularly to explain their risk monitoring control and prioritization techniques

Anti Money Laundering Analyst Resume Samples | Velvet Jobs

https://asset.velvetjobs.com/resume-sample-examples/images/anti-money-laundering-analyst-v3.png

A Day in the Life at Anti-Money Laundering: Christina Piserchia - YouTube

https://i.ytimg.com/vi/7i-PY31fRzg/maxresdefault.jpg

What Makes A Good Aml Analyst - AML analysts play a crucial role in the fight against money laundering terrorist financing and other financial crimes They are responsible for examining customer transactions identifying suspicious activities and ensuring compliance with anti money laundering AML regulations Let s explore the job description required skills and