What Is The Tax Rate In Utah On Paychecks Under legislation passed last year approval of the amendment would remove the state s share of the sales tax from food purchases 1 75 of the 3 total tax charged statewide on food since 2008 about 200 million a year But the Utah Legislature s Republican supermajority is gearing up for yet another drop in Utah s income tax rate as well

Tax Rates Utah has a single tax rate for all income levels as follows A listing of the Utah individual income tax rates Calculate Gross Wages For all your hourly employees multiply their hours worked by the pay rate Don t forget to increase the rate for any overtime hours For all your salaried employees divide each employee s annual salary by the number of pay periods you have Also add in commissions tips or bonuses into gross wages

What Is The Tax Rate In Utah On Paychecks

What Is The Tax Rate In Utah On Paychecks

https://www.newyorkdaily.net/wp-content/uploads/exploring-nys-top-heavy-pit-base-empire-center-for.png

State Of California Tax Calculator TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/tax-calculator-2022-california-united-drrw.png

Divorce Rate In Utah The Latest Statistics Updated 2023

https://divorce.com/blog/og_blog_img/divorce-rate-utah.jpg

Your average tax rate is 11 67 and your marginal tax rate is 22 This marginal tax rate means that your immediate additional income will be taxed at this rate Use our income tax Utah stands out with its flat state income tax rate 4 95 meaning all taxpayers pay the same percentage regardless of income This simplified tax system makes calculating your state tax obligation a breeze Utah does not impose a state payroll tax making things even easier for its residents

Oregon and Utah are two states that have shifts in gas tax rates for 2024 Utah s gas tax climbed to 36 5 cents for the new year from 34 5 The California 1 1 payroll tax now applies to Utah has an income tax credit equal to 6 of the current federal personal exemption as an applicable standard deduction There are 1360 days left until Tax Day on April 16th 2020 The IRS will start accepting eFiled tax returns in January 2020 you can start your online tax return today for free with TurboTax

More picture related to What Is The Tax Rate In Utah On Paychecks

Utah Sales Tax Sales Tax Utah UT Sales Tax Rate

https://1stopvat.com/wp-content/uploads/2022/08/45-1024x1024.png

.png)

What s Your State s Dividend Income Tax ThinkAdvisor

https://taxfoundation.org/sites/taxfoundation.org/files/docs/Dividends-Income-Tax-(large).png

Tax Brackets For Every US State Released California BAD

https://thefederalistpapers.org/wp-content/uploads/2017/03/PIT-01.png

You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 2023 24 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates It has been specially developed to provide users not only with the amount of tax they will be paying but also Utah Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last reviewed on January 29 2023 Optional Criteria See values per Year Month Biweekly Week Day Hour Results Income Before Tax Take Home Pay Total Tax Average Tax Rate US Dollar Net Pay Total Tax

A list of Income Tax Brackets and Rates By Which You Income is Calculated W 4 Paycheck Based Complete W4 RATEucator Income Brackets Rates 2023 Tax Year Calculator Due in 2024 2024 Tax Calculator Returns due in 2025 Find Utah income tax forms tax brackets and rates by tax year Here s how it works Let s say you earned 75 000 in 2023 and you re single For the first 11 000 of that income you ll pay the lowest 2023 tax rate 10 on that tier of income For the tier

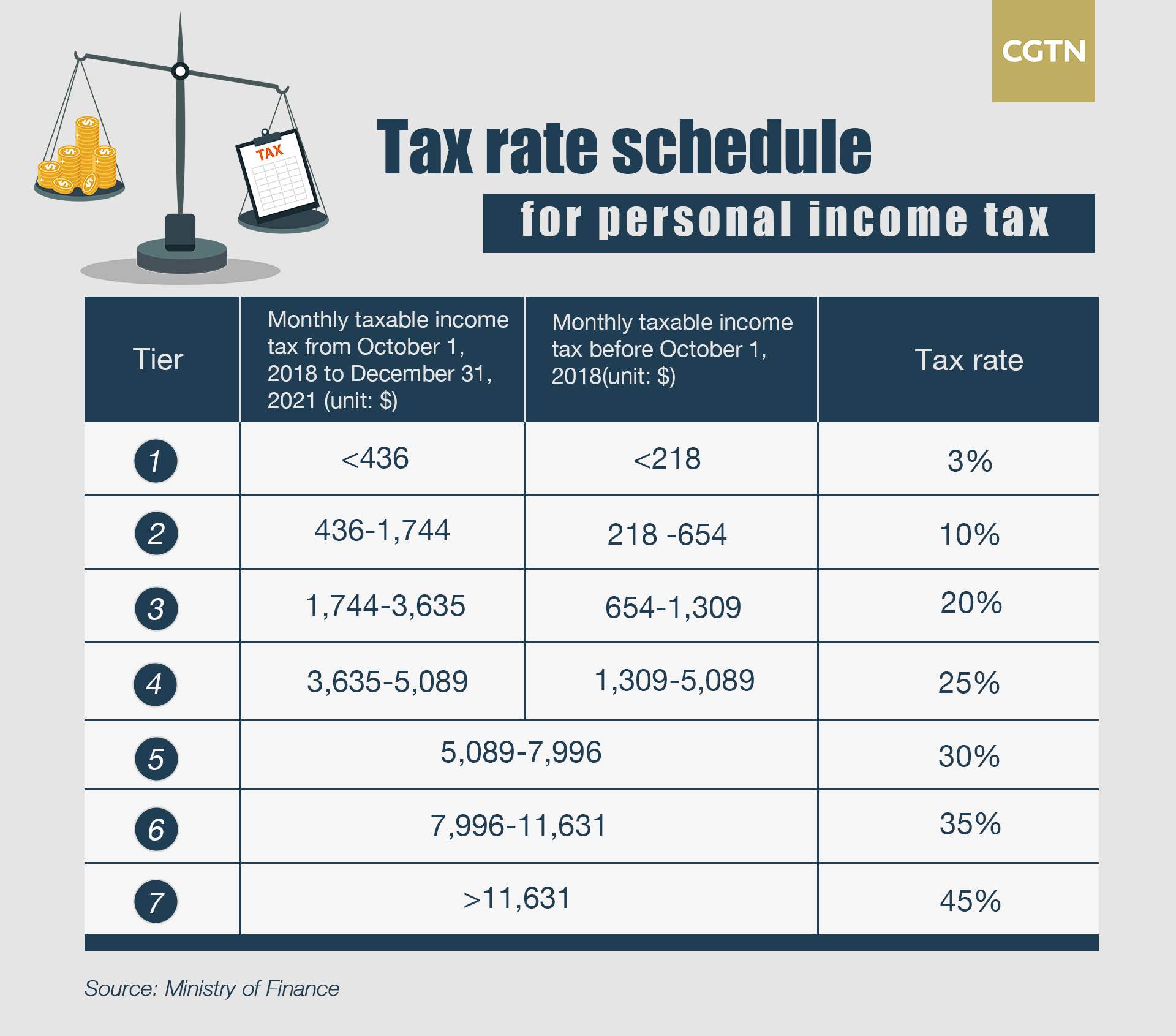

China Releases Tax Rate Schedule For Year end Bonuses CGTN

https://news.cgtn.com/news/3d3d414e784d6a4e31457a6333566d54/img/8e605c90778c47f3b531e5cd2b9a5502/8e605c90778c47f3b531e5cd2b9a5502.jpg

Tax Rates At The Federal Level For Years 2022 And 2023 Stonnamangreenhome

https://lawyer.stonnamangreenhome.com/wp-content/uploads/2022/08/Top_Marginal_State_Income_Tax_Rate.svg_.png

What Is The Tax Rate In Utah On Paychecks - Utah has a flat income tax rate This means that whether you file taxes as an individual a head of the household or with your spouse you face the same percentage of tax liability This is true for income level as well In turn all filers pay the same flat rate of 4 95