What Is The Primary Purpose Of Cost Accounting Quantify Productivity The first important purpose of cost accounting revolves around the quantification of productivity In translation it allows companies to tangibly record their employees performances based on the output levels This is extremely useful as it can be utilized for important decisions that have to be made subsequently

Cost accounting is a financial discipline that systematically tracks analyzes and manages a business s costs It categorizes costs as direct related to production and indirect overhead aiding in budgeting pricing and decision making Cost accountants provide valuable insights by evaluating expenses helping businesses streamline The primary purpose of the Cost Accounting Standards is to ensure that costs incurred by federal agencies are consistent with generally accepted accounting principles and practices And those costs are allocated to the specific projects or activities they incurred The Cost Accounting Standards also guide giving costs among different cost

What Is The Primary Purpose Of Cost Accounting

What Is The Primary Purpose Of Cost Accounting

https://i.ytimg.com/vi/BiXRfhVwC-I/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AGUA4AC0AWKAgwIABABGH8gRCgTMA8=&rs=AOn4CLAG5240ud0T2VWsNBb2SAJqikwpXQ

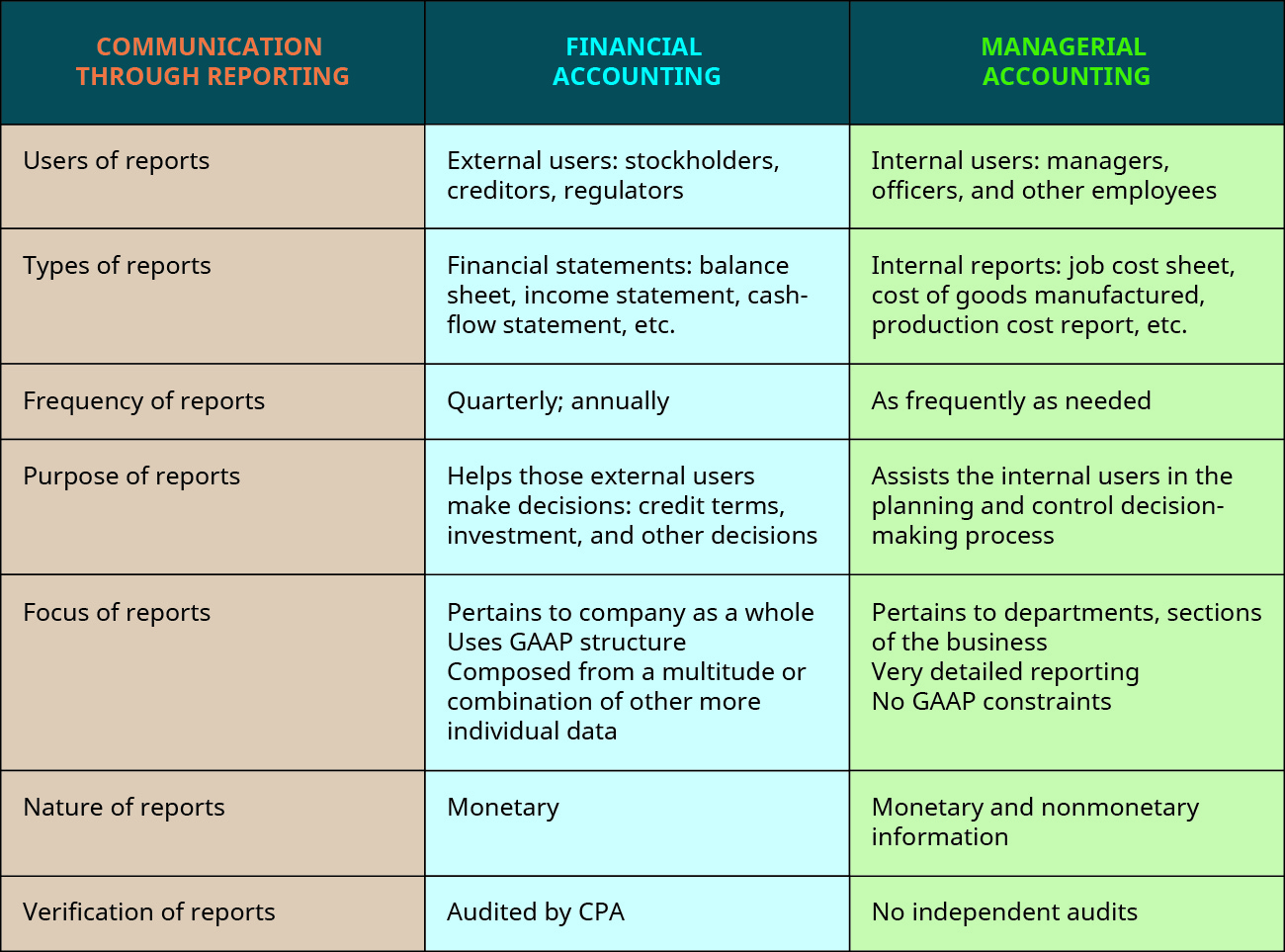

External Users Of Accounting Information Are Not Mcq Malayzaza

https://opentextbc.ca/principlesofaccountingv1openstax/wp-content/uploads/sites/267/2019/07/OSX_Acct_F01_02_FvsMAcct.jpg

What Is Cost Accounting It s Cost Control FreshBooks Resource Hub

https://media.freshbooks.com/wp-content/uploads/2022/02/cost-accounting.jpg

Cost accounting is concerned with the collection processing and evaluation of operating data in order to achieve goals relating to internal planning control and external reporting In this definition examples of operating data include the cost of products operations processes jobs quantities of materials consumed and labor time Cost accounting is an accounting method that aims to capture a company s costs of production by assessing the input costs of each step of production as well as fixed costs such as depreciation of

Definition and Purpose Cost accounting refers to the process of recording classifying analyzing and summarizing costs associated with the production or service provision Its primary purpose is to provide detailed information for decision making cost control and performance evaluation Importance in Business Management In the business Cost accounting is a type of managerial accounting that focuses on the cost structure of a business It assigns costs to products services processes projects and related activities Through

More picture related to What Is The Primary Purpose Of Cost Accounting

How To Make Your Trading Office Profitable DTTW

https://www.daytradetheworld.com/wp-content/uploads/2021/10/profitable-trading-office.jpg

NATURE OF COST ACCOUNTING 10 IMPORTANT POINTS COMMERCEIETS

https://commerceiets.com/wp-content/uploads/2019/11/Slide8-1.jpg

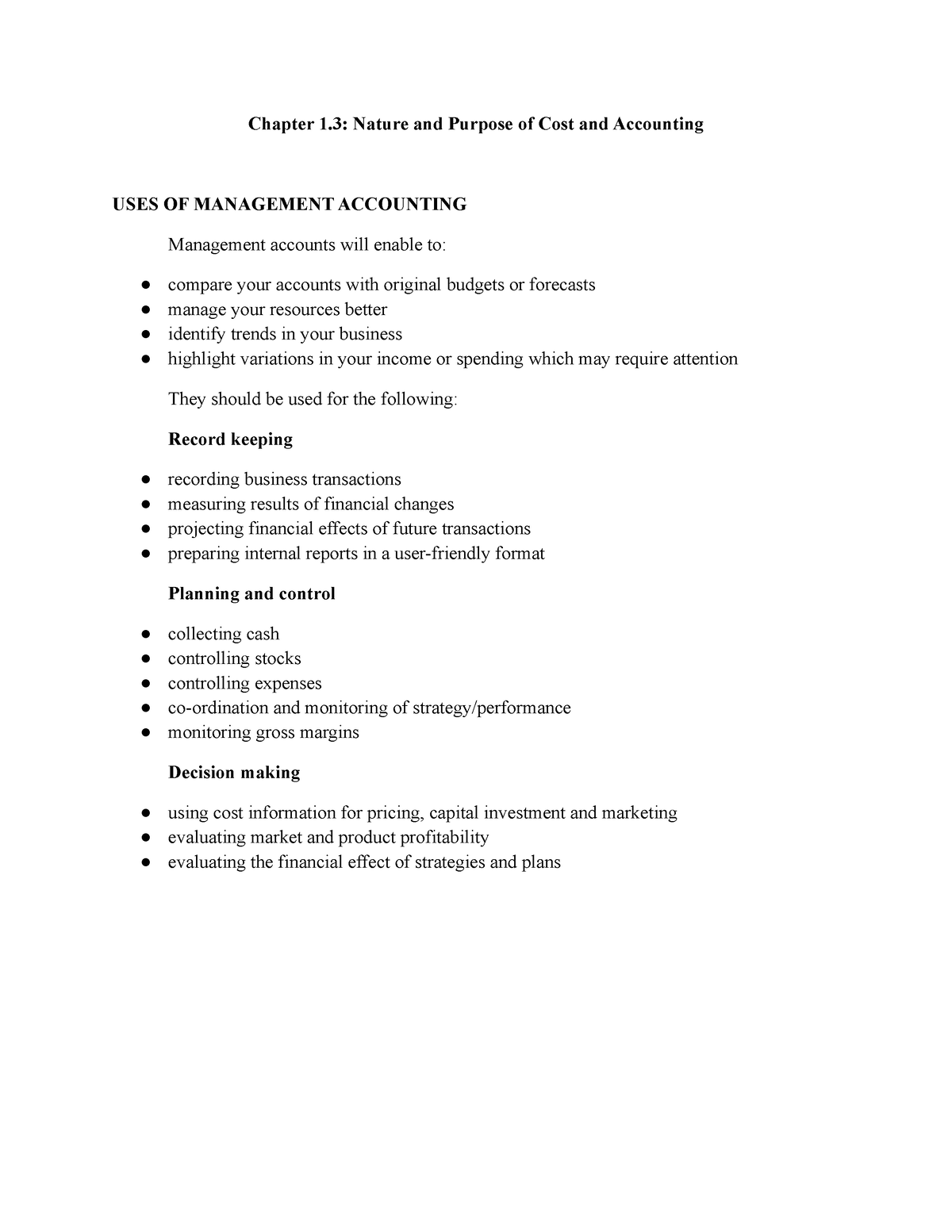

Chapter 1 3 Nature And Purpose Of Cost And Accounting Chapter 1

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/be6fea65771f2c3bbb0ee6414ffd8ff8/thumb_1200_1553.png

Cost accounting basics July 15 2024 Activity based costing This is a methodology for more precisely allocating overhead costs to products and services This approach is more accurate than the traditional less targeted methods for allocating overhead costs Activity based costing is useful for gaining a greater understanding of which Cost accounting is defined by the Institute of Management Accountants as a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail It includes methods for recognizing allocating aggregating and reporting such costs and comparing them with standard costs 1

Cost accounting is the process of tracking analyzing and summarizing all fixed and variable input costs related to the production of a product acquisition of goods for sale or the delivery of a service These include material and labor costs as well as operating costs associated with a product or service Cost accounting is a business practice in which you record examine summarize and understand the money that a business spent on a process product or service It can help an organization control costs and engage in strategic planning to improve cost efficiency Cost accounting helps management decide where they need to cut back and where

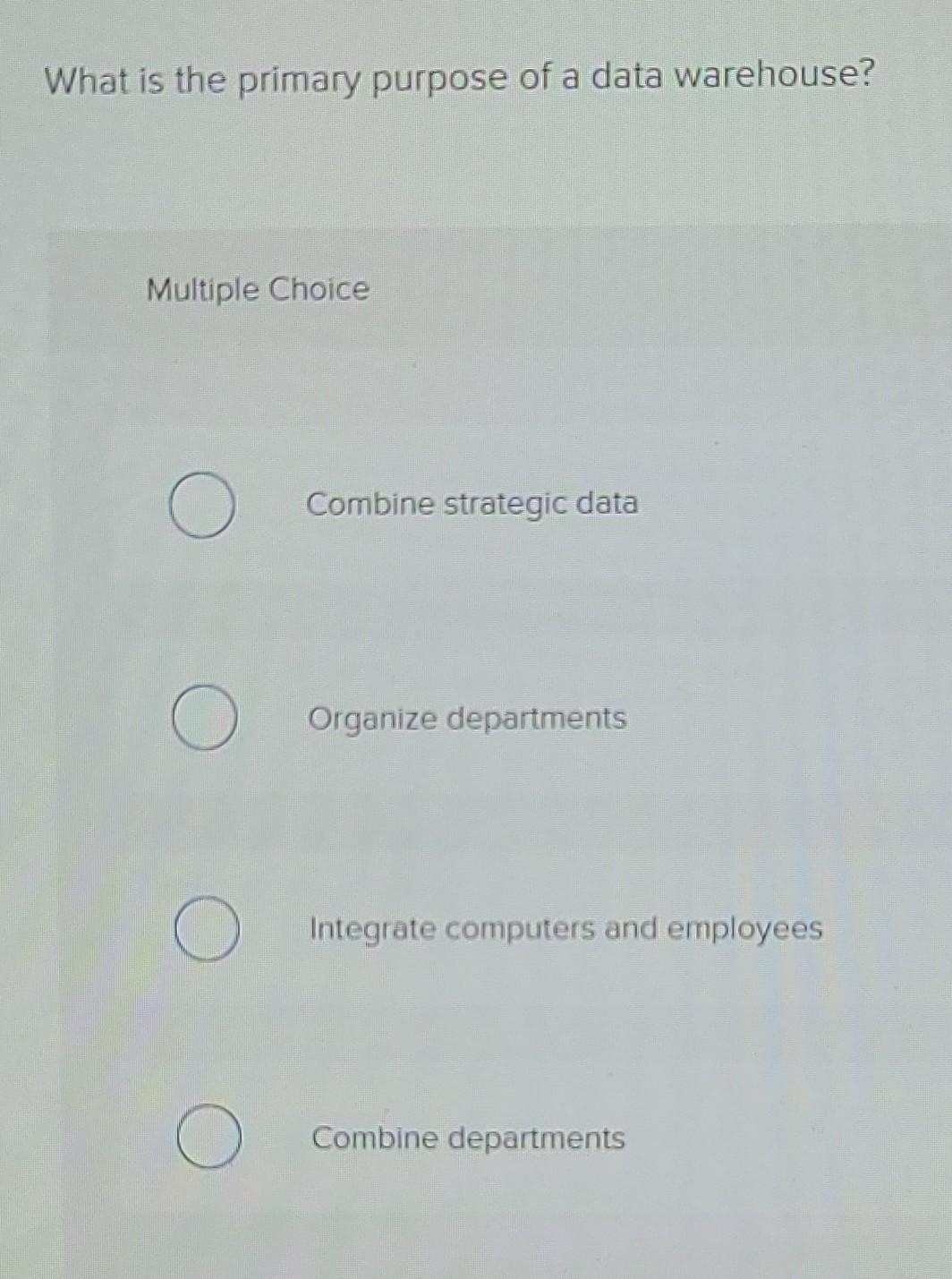

Solved What Is The Primary Purpose Of A Data Warehouse Chegg

https://media.cheggcdn.com/study/abc/abcc2db5-f136-40bc-95e2-87efa34c6165/image.jpg

Nature AND Purpose OF COST Accounting LESSON ONE NATURE AND PURPOSE

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/68a4d9282b826c9e6bf469b4e633bc5f/thumb_1200_1553.png

What Is The Primary Purpose Of Cost Accounting - Cost accounting is a type of managerial accounting that focuses on the cost structure of a business It assigns costs to products services processes projects and related activities Through