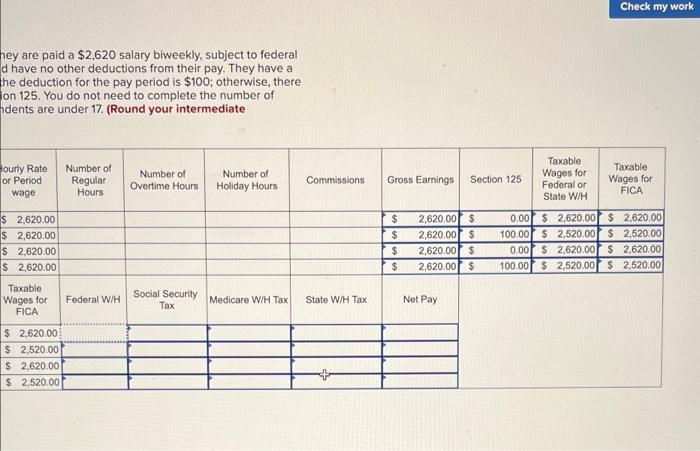

What Is The Net Pay For 55000 A Year This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

What Is The Net Pay For 55000 A Year

What Is The Net Pay For 55000 A Year

https://media.cheggcdn.com/study/e10/e10a9f3c-af39-4b2c-b34b-19f9a58a4982/image

55000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/55000-a-year.jpg

Calculating Gross And Net Pay For An Hourly Employee YouTube

https://i.ytimg.com/vi/DANd_DAK-as/maxresdefault.jpg

Income tax calculator Texas Find out how much your salary is after tax Enter your gross income Per Where do you work Calculate Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5 This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and

Income tax calculator New York Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 571 Social Security 3 410 Medicare 798 SDI State Disability Insurance 31 20 Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 151 Social Security 3 410 Medicare 798 Total tax 11 227 Net pay 43 774 Marginal tax rate 34 7 Average tax rate 20 4 79 6 Net pay 20 4 Total tax Want to send us feedback Click here

More picture related to What Is The Net Pay For 55000 A Year

What Is The Net Pay For 40 Hours Worked At 8 95 An Hour With

https://us-static.z-dn.net/files/d15/d7e18462fecbc58de9f96e93bf30fea1.png

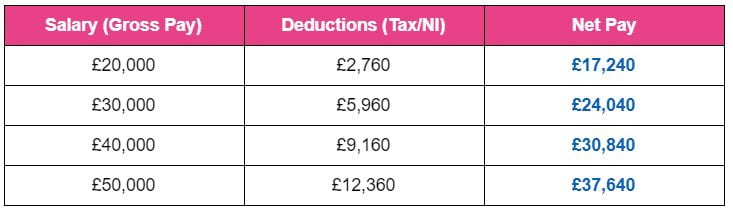

How To Calculate Net Pay From Gross Pay In Uk

https://www.reed.co.uk/career-advice/wp-content/uploads/sites/6/2020/08/Net-pay-examples.jpg

Earn 55 000 year Academy For Massage

https://academyformassage.com/wp-content/uploads/2022/06/AMTT-BB-mobile-2022-enrollNow.png

55 000 yearly is how much per hour 27 83 hourly is how much per year What is the average salary in Australia Summary If you make 55 000 a year living in Australia you will be taxed 9 442 That means that your net pay will be 45 558 per year or 3 797 per month Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal tax deduction 7 750 Provincial tax deduction 3 545 CPP deduction 2 936 EI deduction 869 Total tax 15 100 Net pay 39 900 Marginal tax rate 35 5 Average tax rate 27 5 72 5 Net pay 27 5 Total tax Want to send us feedback

In this article we ll calculate estimates for a salary of 55 000 dollars a year for a taxpayer filing single We also have an article for 55 thousand dollars of combined earned income after taxes when declaring the filing status as married filing jointly 3 410 in social security tax 797 5 in medicare tax 4 718 in federal tax This amount is an estimate and the amount you pay for taxes could be higher or lower but 25 is a good starting point So after taking out 25 for taxes here s what you ll clear on 55 000 per year after taxes Per Hour 26 44 x 25 taxes 6 61 for taxes 26 44 6 61 19 83 Net Per Hour after taxes

Pensions Tax Changes What Is The Net Pay Anomaly Vintage Corporate

https://www.vintagecorporate.co.uk/wp-content/uploads/2022/07/AdobeStock_252346960_1000.jpg

How Much Is 55 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-55000-dollars-sm-2-1024x768.png

What Is The Net Pay For 55000 A Year - Both federal income tax brackets and the standard deduction were raised for 2024 The higher amounts will apply to your 2024 taxes which you ll file in 2025 It s normal for the IRS to make tax