What Is The Difference Between Gross Dscr And Net Dscr Gross DSCR Cash accruals Profit after tax Depreciation Interest Installments of loan Interest

The biggest differentiating factor between individual creditors is between net DSCR and gross DSCR Each places importance on different financial factors that impact the debtor s ability to pay When to Use Net DSCR When using the operating income to cover debt service a lender or creditor is looking at the borrower s net DSCR The minimum debt service coverage ratio DSCR is widely recognized as 1 25x by commercial real estate lenders The more excess net operating income NOI the property generates relative to the annual debt service the more favorable lenders will perceive the loan application and financing request since the risk of default is far lower

What Is The Difference Between Gross Dscr And Net Dscr

What Is The Difference Between Gross Dscr And Net Dscr

https://i.ytimg.com/vi/2cFIwSgUOQM/maxresdefault.jpg

50 Gross Motor Skills Examples 2024

https://helpfulprofessor.com/wp-content/uploads/2023/06/gross-motor-skills-768x543.jpg

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

The debt service coverage ratio or DSCR measures a company s available cash flow against its debt obligations principal and interest In short the ratio hints at how likely a firm will be Debt Service Coverage Ratio DSCR is a measurement of an entity s cash flow vs its debt obligations It is typically used to assess risk in approving a new loan In contrast debt to income ratio is a measure of an individual s total monthly debt payments divided by their gross monthly income

The Debt Service Coverage Ratio DSCR is a metric used by lenders to measures the cash flow available to pay current debt obligations Here is an overview of the differences between them Parameter Interest Coverage Ratio The accounting team must calculate the company s net operating income to calculate the DSCR Net operating The debt service coverage ratio measures how well a company can manage its debt payments with its net operating income The debt service coverage ratio DSCR is an important metric for small business owners that measures the company s ability to pay its debts

More picture related to What Is The Difference Between Gross Dscr And Net Dscr

Difference Between DSCR And ICR YouTube

https://i.ytimg.com/vi/Vob2BH8fUxQ/maxresdefault.jpg

What Is The Difference DocsLib

https://data.docslib.org/img/6897163/what-is-the-difference.jpg

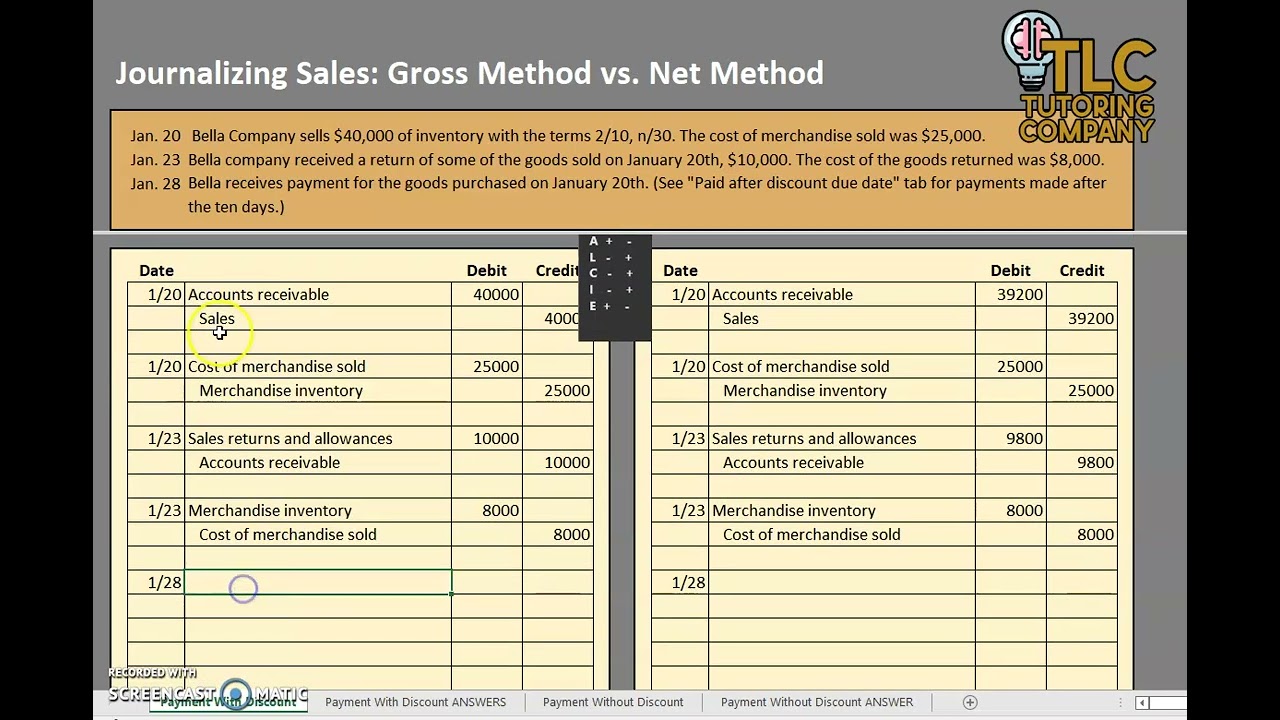

Gross Method Vs Net Method Recording Journal Entries For Sales YouTube

https://i.ytimg.com/vi/gol9h7T2xdY/maxresdefault.jpg

Here s an example of debt service coverage ratio Your business has 10 000 current and anticipated debt for this year You also forecast your net operating income to be 15 000 Your DSCR will be 15 000 10 000 1 5 DSCR How to read this In this example the business has more planned net income coming in than total debt The Debt Service Coverage Ratio DSCR is a key financial metric used by lenders to assess a company s ability to repay its existing and potentially new debt obligations It essentially measures how much cash flow a company generates compared to its annual debt service payments including both principal and interest

[desc-10] [desc-11]

The Difference Between A Conventional Investment Loan And A DSCR Loan

https://i.ytimg.com/vi/Onuec6EfNIU/maxresdefault.jpg

The Difference Between DTI And DSCR YouTube

https://i.ytimg.com/vi/tCP4zBXJ6vM/maxresdefault.jpg

What Is The Difference Between Gross Dscr And Net Dscr - Debt Service Coverage Ratio DSCR is a measurement of an entity s cash flow vs its debt obligations It is typically used to assess risk in approving a new loan In contrast debt to income ratio is a measure of an individual s total monthly debt payments divided by their gross monthly income