What Is Overtime For 18 An Hour Overtime pay of 15 5 hours 1 5 OT rate 112 50 Wage for the day 120 112 50 232 50 Don t forget that this is the minimum figure as laid down by law An employer may choose a higher rate of overtime pay Some companies pay 2 5 times the standard rate for overtime and sometimes even more Within the United States the

Calculate overtime pay for a salary of 18 Enter your details and click calculate Try the salary calculator to convert to an annual wage The formula to calculate for Time and a Half is 18 x 1 5 27 00 Overtime is typically paid for every hour over 40 hours in a week The standard overtime rate is 1 5 times an employee s regular hourly wage time and a half This means that if you earn 15 per hour your time and a half overtime rate will be 22 50 per hour 15 1 5 If you earn double time your overtime rate will be 30 per hour 15 2

What Is Overtime For 18 An Hour

What Is Overtime For 18 An Hour

https://kewlaw.com/wp-content/uploads/2020/01/bigstock-Overtime-Working-Concept-Stop-246547483.jpg

Overtime Rules To Change In 2020 Fingercheck

https://fingercheck.com/wp-content/uploads/2019/12/exemptvs2.jpg

What Is Overtime Pay AIHR HR Glossary

https://www.aihr.com/wp-content/uploads/Overtime-Pay-HR.png

15 overtime hours x 8 18 122 70 overtime premium pay 900 122 70 1 022 70 total pay due Calculating overtime pay for non hourly compensation Overtime isn t strictly based on an hourly or salary basis of pay Certain types of other compensation such as the following must be included in overtime calculations Conceptually the value of an overtime hour is the value of a regular hour with a percentage surcharge To calculate the overtime rate first calculate the regular hourly rate This is done by dividing the base salary by the number of regular hours agreed in the contract For example Example Monthly Contract

Use the following steps to calculate your overtime pay with this scenario 1 Calculate your regular hourly rate Start by dividing your weekly salary by the total number of hours you worked Perform the following calculation Weekly salary Total hours worked Regular hourly rate 600 60 hours 10 per hour 2 Calculate the standard weekly pay Number of regular hours x standard hourly rate 40 x 15 600 Calculate the overtime pay Number of overtime hours x overtime hourly rate 5 x 22 5 112 50 Calculate the total pay for the week Standard weekly pay overtime pay 600 112 50 712 50 Sasha s total pay for this week would be 712 50

More picture related to What Is Overtime For 18 An Hour

Q A Overtime Pay For Hourly Bonuses People Processes

https://peopleprocesses.com/wp-content/uploads/2018/08/overtime-1024x684.jpeg

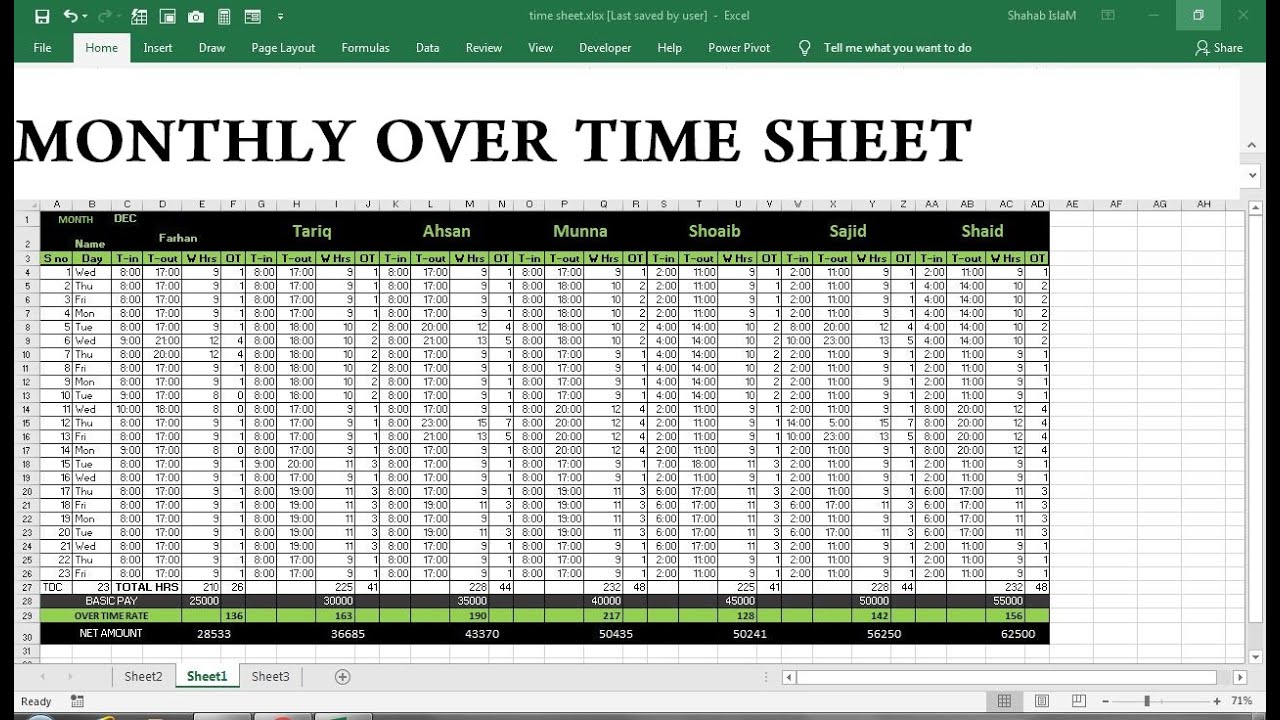

How To Make Monthly Overtime Sheet Excel YouTube

https://i.ytimg.com/vi/ZVvAeQMjmQA/maxresdefault.jpg

Overtime Sheet In Excel Basic

https://www.generalblue.com/overtime-sheet/p/t7rg541fg/f/basic-overtime-sheet-in-excel-lg.png?v=6400ff4cffb01b18c29965ce34bdf016

If you worked 45 hours the first week of the pay period you d get overtime wages of 150 30 x 5 in addition to your usual 800 20 x 40 in regular wages This means you earned a total of 950 during the first week During the second week you only worked 35 hours 20 x 35 earning 700 in regular wages Starting July 1 most salaried workers who earn less than 844 per week will become eligible for overtime pay under the final rule And on Jan 1 2025 most salaried workers who make less than 1 128 per week will become eligible for overtime pay As these changes occur job duties will continue to determine overtime exemption status for most

The Department of Labor s Wage and Hour Division enforces this right Employers must pay overtime if You are a covered nonexempt employee You work more than 40 hours during a workweek The overtime rate must be at least 1 5 times the amount of your hourly pay rate Your employer must pay you at the overtime rate for the extra hours you worked Overtime For covered nonexempt employees the Fair Labor Standards Act FLSA requires overtime pay PDF to be at least one and one half times an employee s regular rate of pay after 40 hours of work in a workweek Some exceptions apply under special circumstances to police and firefighters and to employees of hospitals and nursing homes

Overtime Pay Up To Speed On The Details Payroll Management Inc

https://payrollmgt.com/wp-content/uploads/2018/09/Understanding-Overtime-Pay-1.jpg

What s So Regular About The Rate For Overtime

https://blog.frankcrum.com/hubfs/images/Overtime_Pay.jpg

What Is Overtime For 18 An Hour - The federal minimum for overtime for hourly employees is that the person must be paid one and a half times the regular hourly rate for work over 40 hours a week For example an hourly employee making 10 an hour and working 45 hours a week would be paid 10 for 40 hours and 15 an hour for each of the 5 hours of overtime