What Is Operating Profit In Financial Statement Operating expenses are the ongoing costs of running the business and may include items such as rent employee payroll depreciation inventory costs and marketing expenses Operating profit is essential because it measures the profitability of a company s core business operations or the main way that a company generates revenue

This means that the company is likely in danger from high operating costs low revenue and or inefficient operations How does operating profit relate to business valuation Operating profit provides insights into a business s core performance its ability to generate cash flow and its potential for future growth Operating profit is an essential measure of a company s financial performance indicating how much money it has made after deducting all related expenses

What Is Operating Profit In Financial Statement

What Is Operating Profit In Financial Statement

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/25191359/Profit-and-Loss-Statement-Example-PL.jpg

Gross Auto

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

Cash Flow Equation Tessshebaylo

https://cdn.corporatefinanceinstitute.com/assets/amazon-operating-cash-flow-example-1024x1019.png

Operating profit is reported in the income statement and is the profit before the impact of financing and government expenses Operating Profit is a vital metric in financial statements offering valuable insights into a company s core operational performance By understanding how Operating Profit is calculated and why it matters stakeholders can make informed decisions about a company s efficiency sustainability and overall financial health

Operating profit is a crucial metric in financial analysis and valuation offering insights into a company s core business performance Unlike other profitability measures it focuses on the earnings generated from regular operations excluding non operational income and expenses Operating profit shows how much money your business earns from its core activities before interest and taxes Net profit is what s left after deducting all expenses including taxes and debt payments Solution When evaluating business performance focus on both operating profit and net profit to get a complete understanding of financial

More picture related to What Is Operating Profit In Financial Statement

Profit Formula

https://wise.com/imaginary/4fa44891874169b30c3c531c4e60fae5.jpg

Profit Margin

https://d1eipm3vz40hy0.cloudfront.net/images/AMER/net-profit-margin-formula.png

Income Statement Operating Expenses Formula In Excel Washour

https://online-accounting.net/wp-content/uploads/2020/10/image-ACgPvXKrmwDj9QSy.png

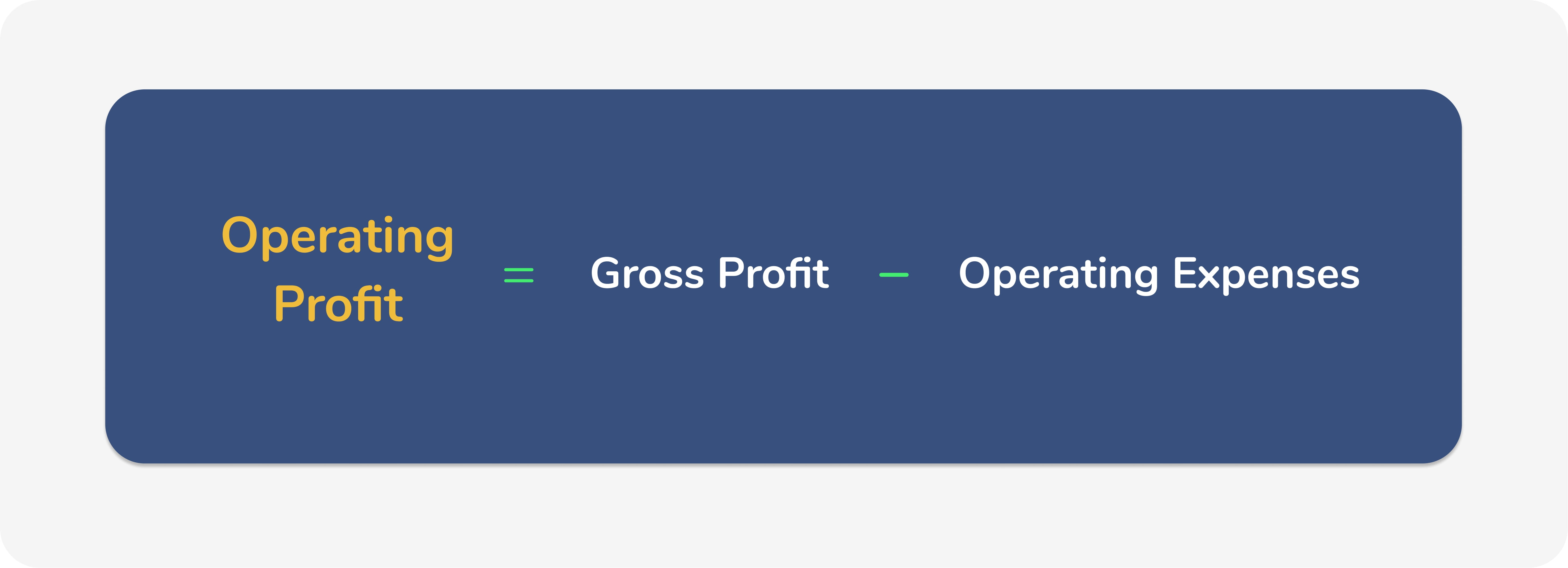

Definition Operating Profit is the type of profits recorded in the entity s financial statements for the period after the deduction of operating expenses from Gross Profit This profit is before charging interest expenses and tax expenses of the period Operating Profit is reported in Income Statements rather than Balance Sheet Definition Operating profit sometime called EBIT is a financial measurement that calculates how much profit a company makes from its core business activities This figure only includes income from core operations before taxes excluding all income from investments In this way it is a measure of a firm s efficiency to control its costs and run its operations effectively What Does

[desc-10] [desc-11]

Income Tax Statement

https://www.investopedia.com/thmb/ZokRYOxNbMDeWROSqaikeuh1vX4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeStatement-be0e5f09ecc94fd7ad5ced3018bb54d0.JPG

:max_bytes(150000):strip_icc()/operatingprofit_final_0901-256b1a92534f4125a0cc0dcfed40c395.jpg)

Operating Profit Ratio

https://www.investopedia.com/thmb/k7zs3_WLnrGb2ZSrw9_lW0V4rmw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/operatingprofit_final_0901-256b1a92534f4125a0cc0dcfed40c395.jpg

What Is Operating Profit In Financial Statement - Operating profit is reported in the income statement and is the profit before the impact of financing and government expenses