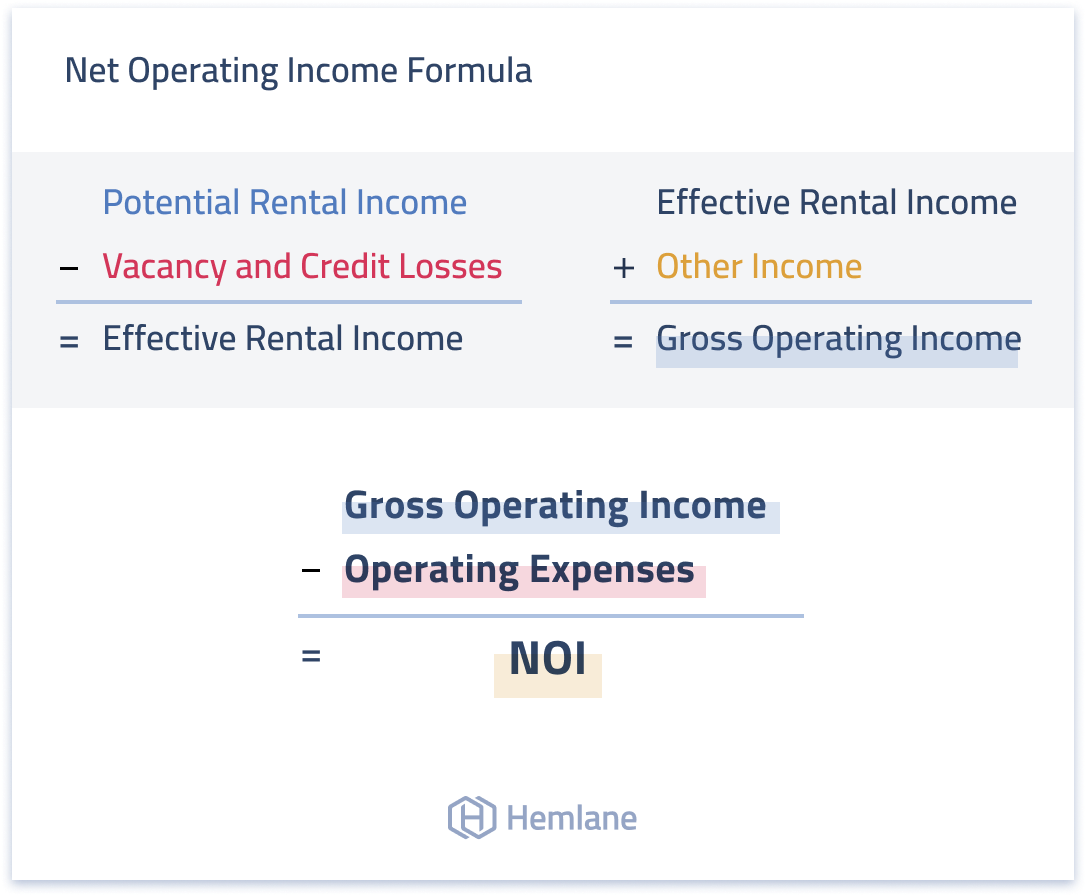

What Is Net Operating Income In Commercial Real Estate Net Operating Income As shown in the net operating income formula above net operating income is the final result which is simply effective gross income minus operating expenses Although these are the high level line items used to calculate NOI the format of a real estate proforma can vary widely depending on the property type intended

The net operating income is an important part of commercial real estate investments as it determines the profitability of a given property If you have any questions or looking to buy or sell a commercial property our team can assist you Contact American Investment Properties at 516 393 2300 or submit your inquiry here Net Operating Income Property Revenue Operating Expenses Property revenue would be the gross operating income of the building which would reflect Property related income fees vending machines signage etc You would total all of the property revenue and expenses then complete the calculation to find the NOI

What Is Net Operating Income In Commercial Real Estate

What Is Net Operating Income In Commercial Real Estate

https://i.pinimg.com/originals/32/b3/c4/32b3c4fd7417cb4abad1dd899610faf7.jpg

Net Operating Income Formula Astonishingceiyrs

https://resources.hemlane.com/content/images/2021/06/Net-operating-income--NOI--formula-for-real-estate-investors.png

Net Operating Income NOI Definition Calculation Examples

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1311870317/image_1311870317.jpg?io=getty-c-w640

Gross Rental Income 288 000 Now let s factor in the operating expenses for the real estate property These expenses include property taxes insurance property management fees maintenance and utilities which total 70 000 annually In other words the total operating expenses for the 20 unit property are 70 000 Net Operating Income FAQs FAQ 1 Operating Income vs Net Income Operating income and net income are similar but have several major differences While both are revenue operating income is the money left after operating expenses have been deducted This income would be from rents laundry or parking fees

Net operating income NOI is a real estate valuation method that measures the profitability of a real estate property based on revenue and expenses NOI is calculated by subtracting all operating expenses a property incurs from the revenue it generates The NOI of a real estate property is typically included on its cash flow and income statements NIBT Net Income Before Taxes NIBT is an accounting figure whether we re talking about an operating business or an investment property It s the total revenue minus the total expenses For real estate revenue is largely rental income Total Rental Income Total Expenses NIBT Because passive income tax rates tend to be high in

More picture related to What Is Net Operating Income In Commercial Real Estate

Our Services Commercial Real Estate

http://www.immobilireddito.com/wp-content/uploads/2014/10/I-Nostri-Servizi.jpg

Net Operating Income Calculator Commercial Real Estate Loans

https://www.commercialrealestate.loans/cdn-images-resized/v4szwI91ScG9AQbepaLb

How To Invest In Commercial Real Estate Prevail IWS

https://prevailiws.com/wp-content/uploads/2022/09/New-5.png

Net operating income NOI is a metric used to assess the viability of income producing real estate assets NOI is the sum of all commercial property revenue minus all required operational expenses NOI is a pre tax figure on a property s income and cash flow sheet and eliminates loan principal and interest capital spending depreciation This is a 3 8 surtax on your modified adjusted gross income MAGI or net investment income NII Next to calculate subtract 200 000 250 000 for joint filers from your MAGI and from your NII Then multiply the smaller positive number if any by 3 8 to obtain the tax amount

Net operating income NOI is not a complicated term to understand The NAIOP Commercial Real Estate Association defines it as the income generated after deducting operating costs from a company s total revenue but before deducting taxes and financing expenses Financing expenses include capital expenditures both principal and In commercial real estate these often include real estate and personal property taxes insurance property management fees utilities repairs and maintenance and other miscellaneous expenses such as accounting and legal services Net operating income This is the final result after deducting operating expenses from gross operating income

How To Calculate Noi Real Estate In Order To Figure Out A Property s

https://wsp-blog-images.s3.amazonaws.com/uploads/2020/10/01133418/noi-reconciliation.jpg

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

What Is Net Operating Income In Commercial Real Estate - Net operating income NOI is a real estate valuation method that measures the profitability of a real estate property based on revenue and expenses NOI is calculated by subtracting all operating expenses a property incurs from the revenue it generates The NOI of a real estate property is typically included on its cash flow and income statements