What Is My Hourly Pay After Tax Paycheck Calculator Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2024 tax year on Jul 06 2024

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the page Enter your hourly wage the amount of money you are paid each hour

What Is My Hourly Pay After Tax

What Is My Hourly Pay After Tax

https://i.pinimg.com/originals/9e/9a/89/9e9a89d402145722433fbb212b204cc8.jpg

How Do You Figure Out Annual Income INVOMERT

https://i2.wp.com/www.wikihow.com/images/f/f7/Calculate-Your-Real-Hourly-Wage-Step-13.jpg

Maximum Affordable Monthly Rent Google Search Apartment Checklist

https://i.pinimg.com/474x/82/a4/c8/82a4c85e6a3125d005f08a208fe74daa.jpg

The gross pay in the hourly calculator is calculated by multiplying the hours times the rate You can add multiple rates This calculator will take a gross pay and calculate the net pay which is the employee s take home pay Gross pay Taxes Benefits other deductions Net pay your take home pay The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and 2014 55 173 2013 55 156 2012 51 904 Pennsylvania levies a flat state income tax rate of 3 07 Therefore your income level and filing status will not affect the income tax rate you pay at the state level Pennsylvania is one of just eight states that has a flat income tax rate and of those states it has the lowest rate

More picture related to What Is My Hourly Pay After Tax

Take Home Pay After Tax TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/how-much-money-you-take-home-from-a-100000-salary-after-taxes-1024x864.png

Monthly Pay After Tax Calculator ConhorGrier

https://i.pinimg.com/originals/47/75/bd/4775bdc4cb1069a72950bfef5eadcba2.jpg

This Ontario Restaurant Chain Owes Over 35K In Unpaid Wages Workers

https://i.cbc.ca/1.6481335.1655225252!/fileImage/httpImage/image.jpg_gen/derivatives/original_1180/neil-griffin.jpg

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know Hourly rates weekly pay and bonuses are also catered for Why not find your dream salary too Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect

Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator The calculator on this page is Step 2 Calculate Your Taxable Wages To calculate taxable annual wages subtract the standard deduction from the yearly gross wages 14 600 if single or married filing jointly otherwise 21 900 if head of household Annual Taxable Wages annual gross wages standard deduction 56 875 14 600

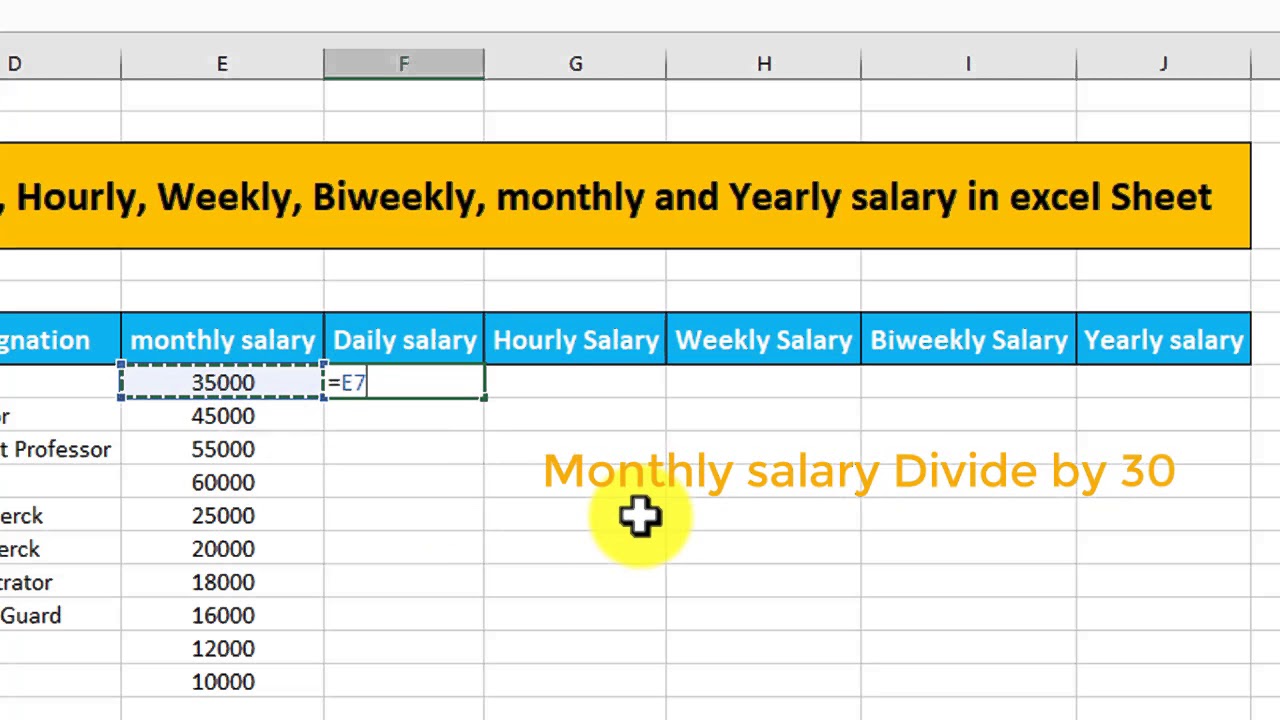

How To Calculate Daily Hourly weekly Biweekly And Yearly Salary

https://i.ytimg.com/vi/pXGxTL-GPjM/maxresdefault.jpg

First Look At ABC s TheFamily Family Tv Series Family Tv Abc Shows

https://i.pinimg.com/originals/52/ab/db/52abdb28f41ff770c3d6593be652f783.jpg

What Is My Hourly Pay After Tax - Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions health insurance 401k etc also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 of your paycheck Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas