What Is Minimum Wage Uk After Tax The average salary in the UK is 2 934 per month or 35 204 per year before tax according to ONS and HMRC However averages can be skewed by high income earners For a more reliable estimate we can look at the median gross salary in the UK which stands at 2 342 per month or 28 104 per year To more clearly illustrate what most

This means that most full time workers on minimum wage have to pay 20 of their wages in taxes Below is a table showing the various tax categories for each pay period as provided by the government It includes the minimum wage rate band These bands are only for part of the UK as tax bands are different in Scotland Your total weekly pay before tax is usually 540 This usually includes 100 in tips so you ll need to use 440 as the starting point to work out if you re getting the minimum wage Your average hourly rate is 11 440 divided by 40 This is below the minimum wage for a worker aged 22

What Is Minimum Wage Uk After Tax

What Is Minimum Wage Uk After Tax

https://towlawyer.com/wp-content/uploads/2017/09/Minimum-Wage-1200x800.jpg

Explaining National Living Wage National Minimum Wage 2020 The Legal

https://www.thelegalpartners.com/wp-content/uploads/2020/02/National-Living-and-Minimum-wages-2020-1024x793.jpg

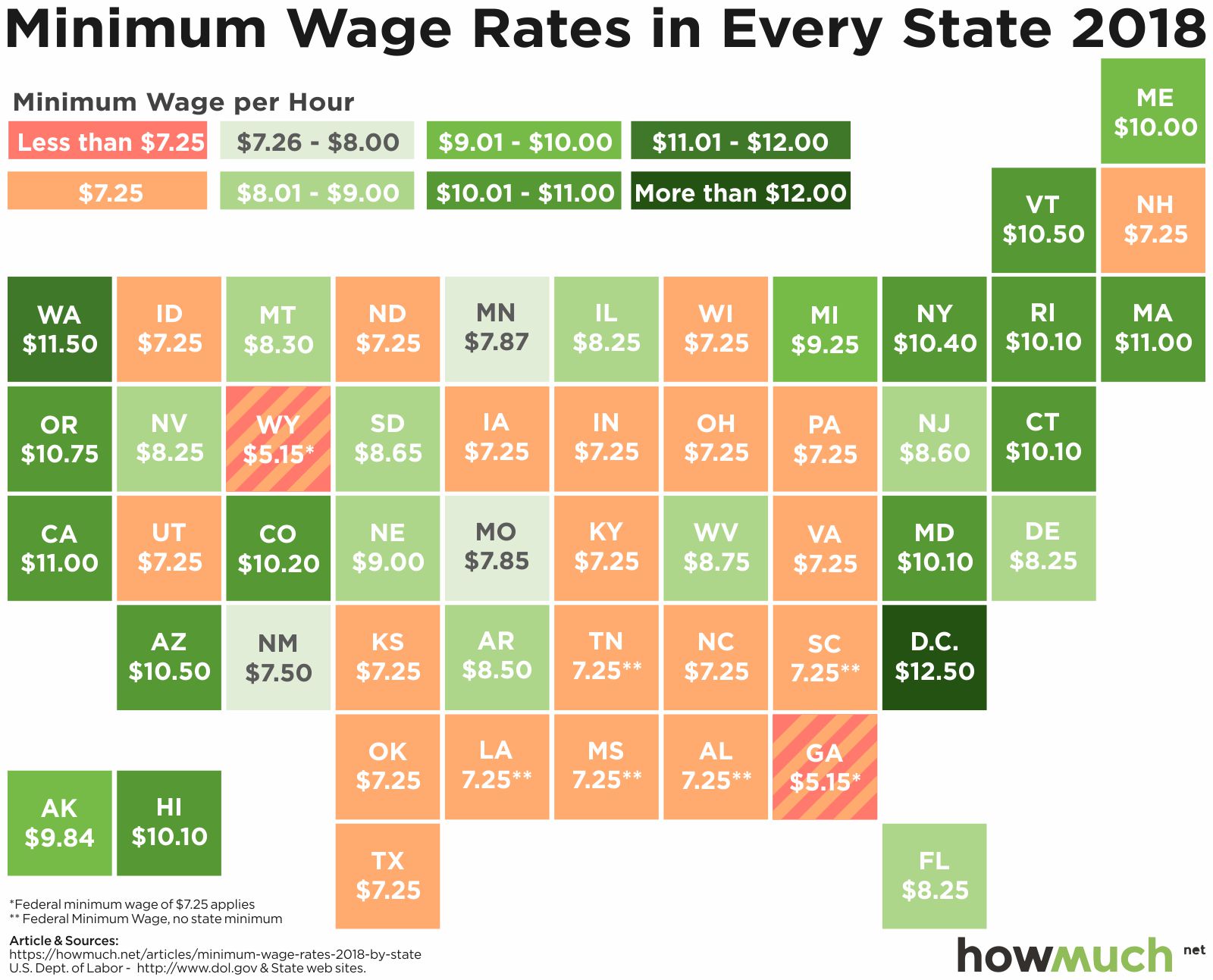

What Is The Minimum Wage In 2018

https://cdn.howmuch.net/articles/minimum-wage-by-state-b020.jpg

The rates which will apply from 1 April 2024 are as follows NMW Rate Increase in pence Percentage increase National Living Wage 21 and over 11 44 1 02 9 8 18 20 Year Old Rate The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know Hourly rates weekly pay and bonuses are also catered for Why not find your dream salary too

The latest figures for April 2023 2024 are now accessible providing you with the most current data Utilize our Take Home Salary Calculator to determine your salary after taxes For example a salary of 30 000 a year is about 24 424 after tax in the UK for a resident full year You will have to pay about 19 of your salary in taxes and From 1 April 2024 Age 21 and over national living wage 11 44 Age 18 to 20 8 60 Age 16 to 17 6 40 Apprentice rate payable to all apprentices under the age of 19 and to any apprentice in the first year of their apprenticeship regardless of age 6 40

More picture related to What Is Minimum Wage Uk After Tax

Federal Minimum Wage Worth Less Now Than Ever Before

https://s.yimg.com/uu/api/res/1.2/vDjbPwz5W5uGpS8YGFuPxQ--~B/aD0xMDgwO3c9MTA4MDtzbT0xO2FwcGlkPXl0YWNoeW9u/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2019-06/504f5280-929c-11e9-8ea1-57ad43edee9e

Minimum Wages Act Applicability IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/12/Minimum-Wages.jpg

CBO 15 Minimum Wage Would Boost Pay For 17 Million Workers Video

https://s.yimg.com/os/creatr-uploaded-images/2019-07/2b8a7880-a296-11e9-bdb3-120f0d6d7856

11 income tax and related need to knows 1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 After Tax If your salary is 40 000 then after tax and national insurance you will be left with 31 222 This means that after tax you will take home 2 602 every month or 600 per week 120 00 per day and your hourly rate will be 19 23 if you re working 40 hours week Scroll down to see more details about your 40 000 salary

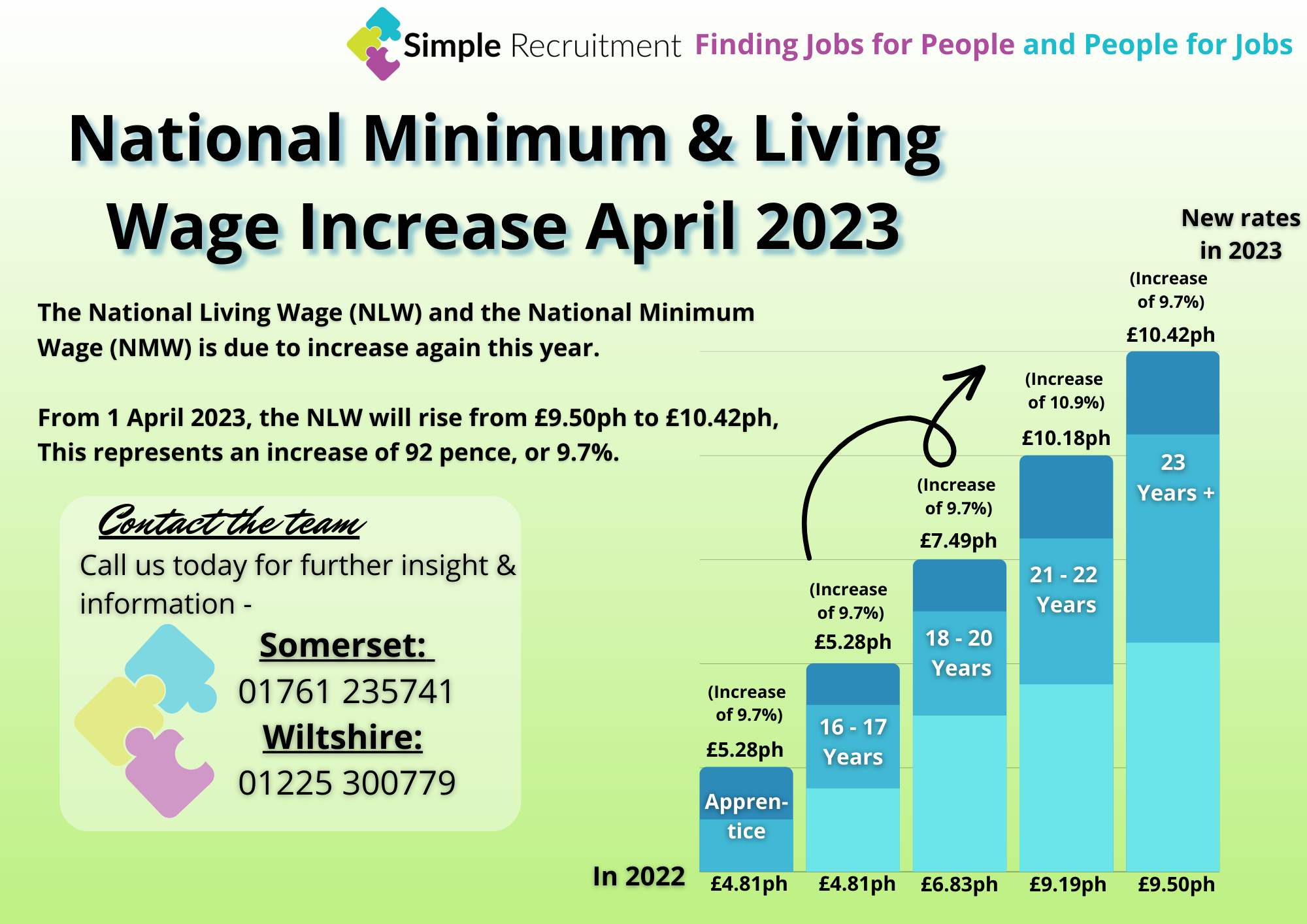

The National Living Wage basically the minimum wage for people aged 21 and above is to increase to 11 44 a rise of 1 02 starting April 2024 The current hourly living wage is 10 42 but this applies to people aged 23 and over 23 and over 21 to 22 18 to 20 Use Blue Arrow s salary calculator to quickly estimate your take home pay based on the Income Tax and National Insurance contributions you are required to pay Our calculator shows your estimated yearly monthly weekly daily and hourly pay We ensure all our candidates are paid in line with the National Minimum Wage NMW for workers aged under 23 and the National Living Wage NLW

National Minimum Wage National Living Wage Increase Simple Recruitment

https://simplerecruitmentltd.co.uk/wp-content/uploads/2023/04/2022-NMW-increase-2.png

WAGE JapaneseClass jp

https://www.policyalternatives.ca/sites/default/files/uploads/publications/facts-infographics/MinimumWage-2015-FB.png

What Is Minimum Wage Uk After Tax - An example of how the minimum wage works if your employer provides accommodation Freddie Farmhand is a 27 year old farm worker who earns 564 week for 48 hours of work This works out to be 11 75 hour more than the current minimum wage 11 44 However Freddie lives in accommodation provided by his employer