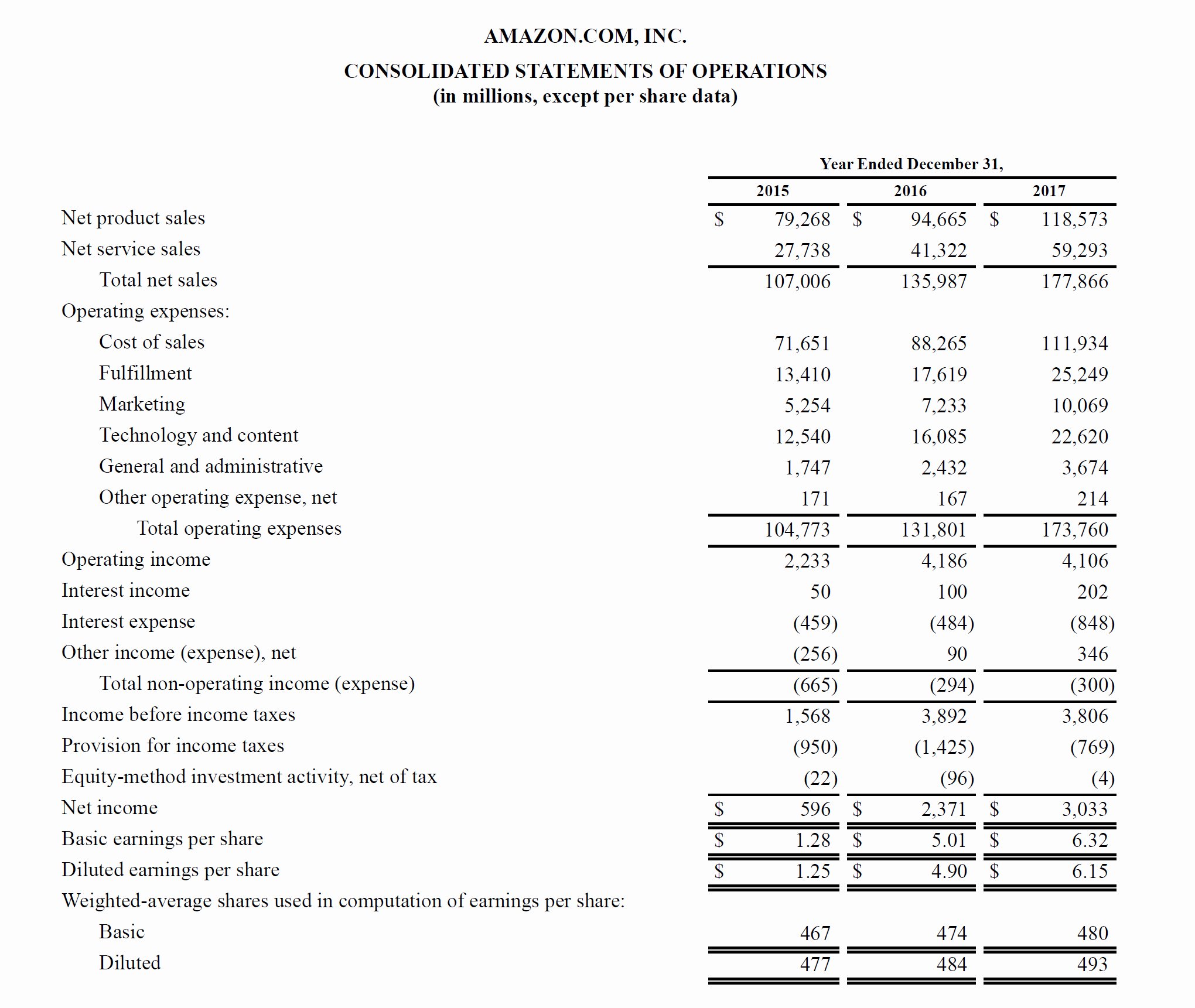

What Is Interest Expense On An Income Statement Where does the Expense Appear on the Income Statement Below is an example of where interest expense appears on the income statement Interest is found in the income statement but can also be calculated using a debt schedule The schedule outlines all the major pieces of debt a company has on its balance sheet and the balances on each period

In Walmart s income statement the company nets its interest income interest it has earned from investors against its interest expense amounts it has paid to lenders Walmart also breaks down its interest expense into debt interest expense and finance lease interest expense which amount to 1 787 billion and 341 million in the The interest expense line item appears in the non operating section of the income statement because it is a non core component of a company s business model The interest expense is often recorded as Interest Expense net meaning the company s interest expense is net against its interest income i e the income generated from short

What Is Interest Expense On An Income Statement

What Is Interest Expense On An Income Statement

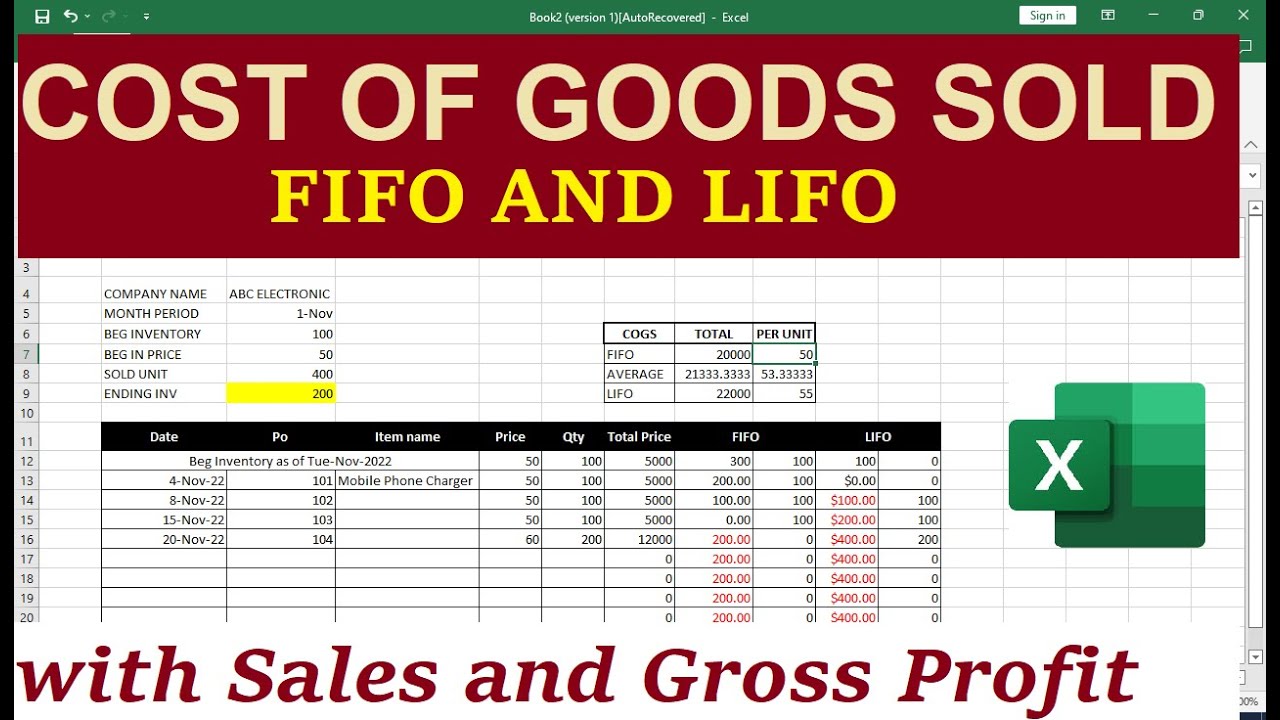

https://i.ytimg.com/vi/ZAKOMBxZd5s/maxresdefault.jpg

How To Use Expense Report Template In Excel Infoupdate

https://www.typecalendar.com/wp-content/uploads/2023/08/Expense-Report.jpg

Example Financial Statements Accounting Play

https://accountingplay.com/wp-content/uploads/2015/08/L_4F_Income_statement_example.png

Interest income and expense reflect the amount that companies pay on their debt on their deposit accounts reported as a net figure on the income statement Far more common and often much more important for most types of businesses is the interest expense on the income statement This figure shows how much it costs to borrow money from When we calculate interest expense reduces the overall taxes in the income statement and thus can be used as a way to reduce tax liabilities also called a tax shield For example for a firm with no Debt and EBT of 2 million tax rate 30 the tax payable will be 600 000 If the same firm assumes a debt and has an interest of say 500 000 the new Earnings before Profit would be 1 5

Interest expense relates to the cost of borrowing money 1 It is the price that a lender charges a borrower for the use of the lender s money On the income statement interest expense can represent the cost of borrowing money from banks bond investors and other sources An interest expense is the cost incurred by an entity for borrowed funds Total interest expense 150 000 0 08 5 60 000 Thus the company will pay a total of 60 000 in interest over the life of the loan But if they want to determine how much interest to report on the income statement for just one quarter they can first find the monthly interest expense amount

More picture related to What Is Interest Expense On An Income Statement

40 Profit Loss Statement Example Desalas Template

https://desalas.org/wp-content/uploads/2019/10/profit-loss-statement-example-unique-assumptions-for-your-profit-and-loss-spreadsheet-of-profit-loss-statement-example.jpg

Frosdwhiz Blog

https://efinancemanagement.com/wp-content/uploads/2019/07/Accrued-Expenses.png

Free Small Business Spreadsheet For Income And Expenses 2024

https://worksheets.clipart-library.com/images2/income-and-expense-worksheet/income-and-expense-worksheet-4.png

1 Income Statement It is recorded at the end of an income statement under operating activities Sometimes it can be combined into a single line called Interest Income Net or Interest Expense Net Interest Income Net is written when there is more interest income than expenses Interest expense is usually at the bottom of an income statement after operating expenses The former is used if there s more interest income than expense The latter is used if there s more interest expense than income For example if a business pays 100 in interest on a loan and earns 10 in interest from a savings account then

[desc-10] [desc-11]

Hromnfc Blog

https://www.asimplemodel.com/wp-content/uploads/2021/10/Monthly-3SM_Interest-Expense_ASM_202005_5.png

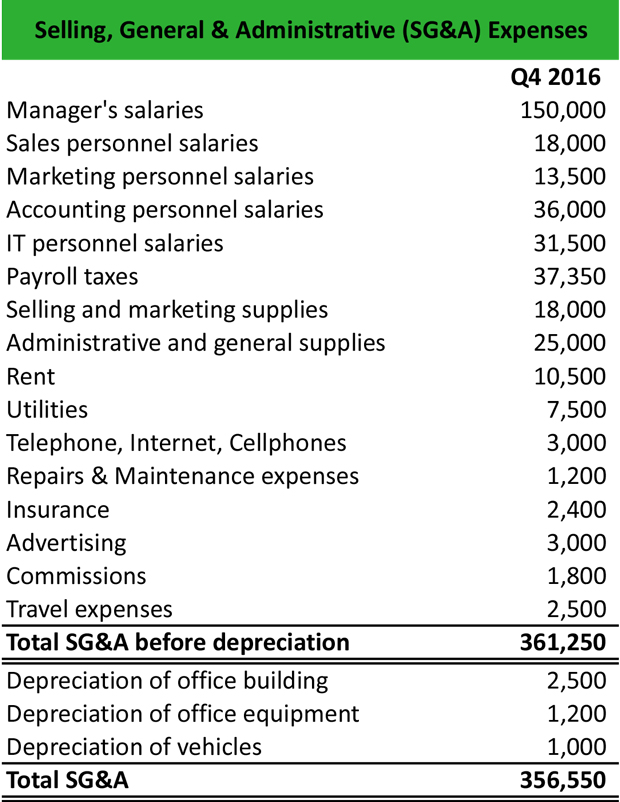

Cavefeti Blog

https://www.myaccountingcourse.com/accounting-dictionary/images/sga-example.jpg

What Is Interest Expense On An Income Statement - Total interest expense 150 000 0 08 5 60 000 Thus the company will pay a total of 60 000 in interest over the life of the loan But if they want to determine how much interest to report on the income statement for just one quarter they can first find the monthly interest expense amount