What Is Included In Net Income But Not Taxable Income Employee Compensation Generally you must include in gross income everything you receive in payment for personal services In addition to wages salaries commissions fees and tips this includes other forms of compensation such as fringe benefits and stock options

What type of income is not taxable The Internal Revenue Code defines taxable income as gross income minus deductions And gross income federal law says means all income from Generally income can be received in three ways money services and property But you can also pay tax on income not yet in your bank account For example if you receive a check but don t cash it by the end of the tax year it is still considered income for the year you received the check

What Is Included In Net Income But Not Taxable Income

What Is Included In Net Income But Not Taxable Income

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/11005350/Net-Income-Definition.jpg

Make sure to enter 0 zero dollars for last year s adjusted gross income AGI on the 2023 tax return Everyone else should enter their prior year s AGI from last year s return 4 Free resources are available to help eligible taxpayers file online Free help may also be available to qualified taxpayers The House voted on Wednesday evening to pass a 78 billion bipartisan tax package that would temporarily expand the child tax credit and restore a number of business tax benefits The bill will

Suzanne Kvilhaug Taxable Income vs Gross Income An Overview Gross income includes all income you receive that isn t explicitly exempt from taxation under the Internal Revenue Code The House has overwhelmingly approved a bipartisan tax package that pairs a temporary expansion of the child tax credit with business tax breaks and credits to develop more low income housing The

More picture related to What Is Included In Net Income But Not Taxable Income

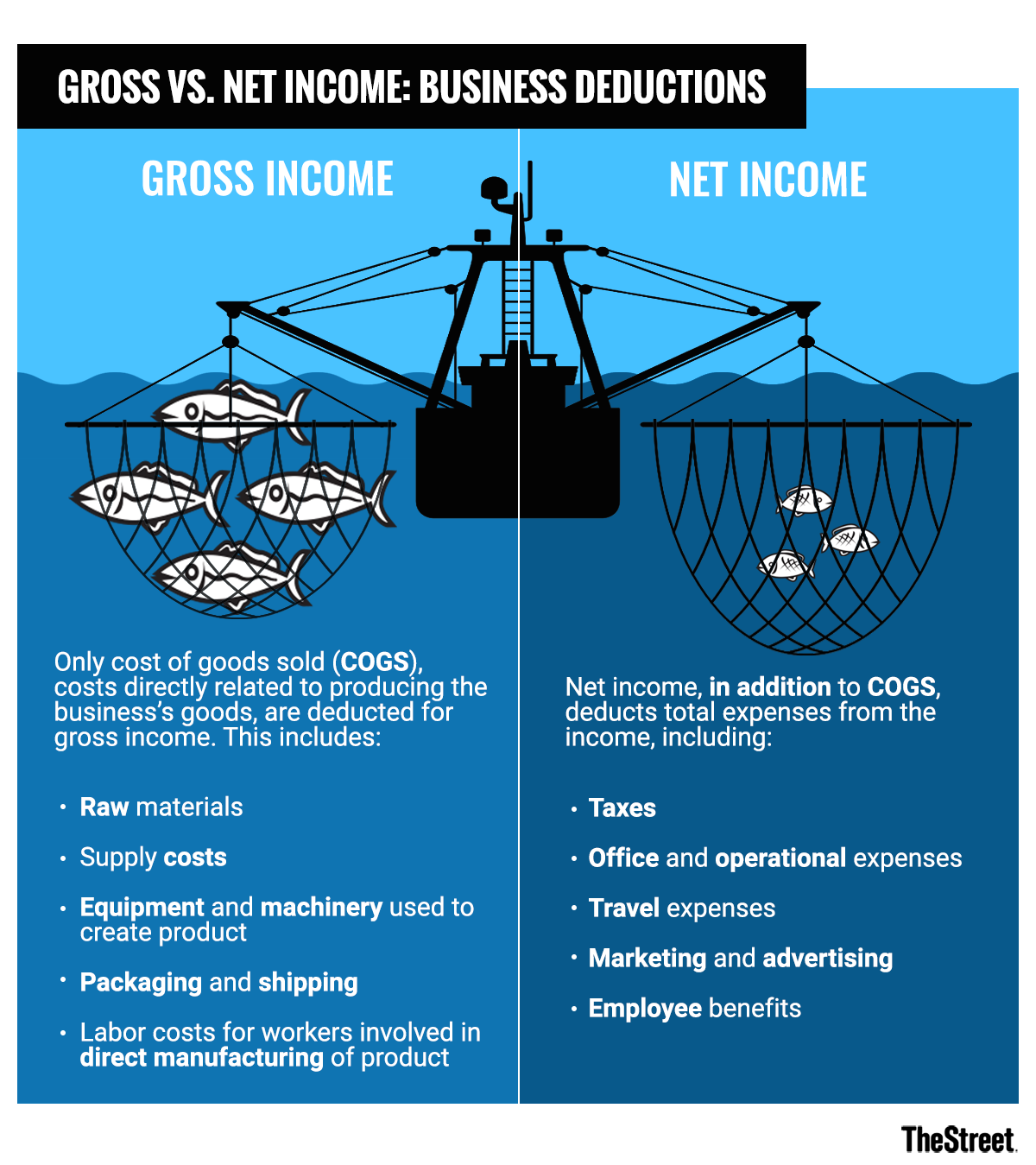

What s The Difference Between Gross Vs Net Income TheStreet

https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/a7febeae-8f6c-11e8-9c19-5150dbb86951.png

How Much Of My Income Should Go Towards A Mortgage Payment

https://assurancemortgage.com/wp-content/uploads/2022/04/iStock-473687780.jpg

How To Find Net Income Calculations For Business

https://www.patriotsoftware.com/wp-content/uploads/2019/12/net-income-visual.jpg

Taxable income is the part of your gross income the total income you receive that is subject to federal tax Taxable income and gross income differ for several reasons First Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable

There are seven tax brackets as of 2024 You would have to have an individual income above 100 525 including your winnings to move into the 24 tax bracket That increases to 201 050 for To calculate Taxable Income first Total Income for Tax Purposes is calculated then items are deducted to arrive at Net Income Before Adjustments then items are deducted to arrive at Net Income for Tax Purposes then other items are deducted to arrive at Taxable Income Total Income for Tax Purposes Line 15000

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Cogs Margin Haiper

https://www.investopedia.com/thmb/zEEqAuvgWlum5qEaY9GZkQGR4t0=/3884x3884/smart/filters:no_upscale()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

https://i0.wp.com/www.investopedia.com/thmb/3SNbuiCjlAyxtuWGNwzFvL96lOM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png

What Is Included In Net Income But Not Taxable Income - Make sure to enter 0 zero dollars for last year s adjusted gross income AGI on the 2023 tax return Everyone else should enter their prior year s AGI from last year s return 4 Free resources are available to help eligible taxpayers file online Free help may also be available to qualified taxpayers