What Is Good Fixed Asset Turnover Ratio The fixed asset turnover ratio formula measures the company s ability to generate sales using fixed assets investments One may calculate it by dividing the net sales by the average fixed assets The fixed asset turnover ratio measures a company s efficiency and evaluates it as a return on its investment in fixed assets such as property plants

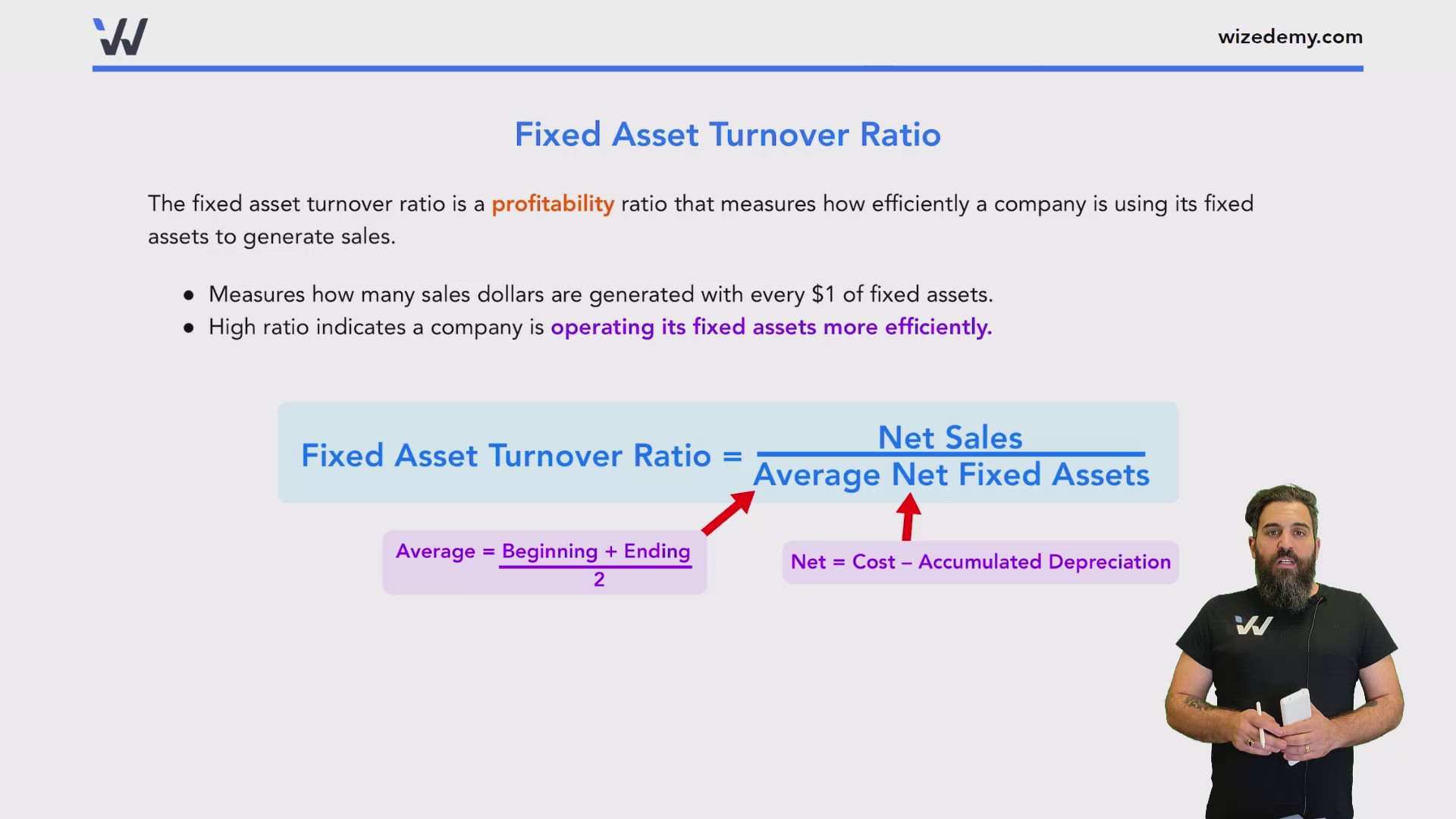

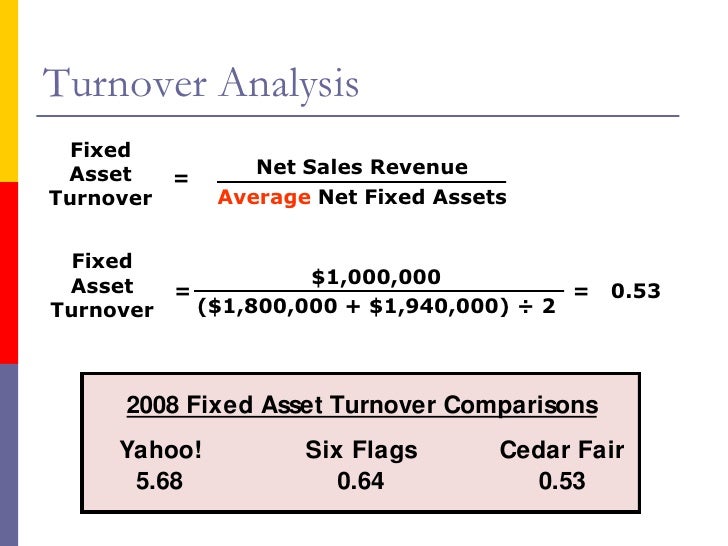

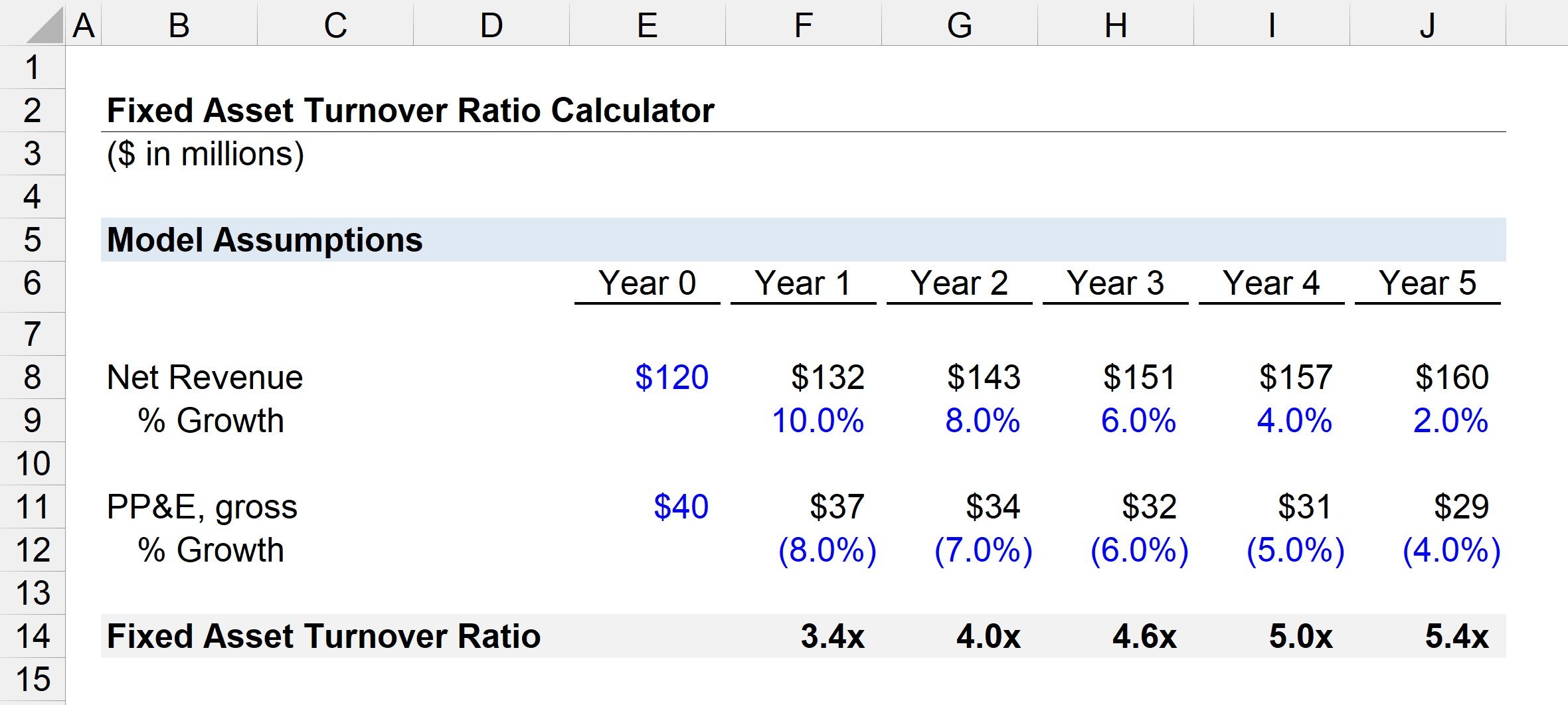

How to Calculate Your Fixed Asset Turnover Ratio Here is the formula for calculating the fixed asset turnover ratio Fixed Asset Turnover Ratio Net Sales Revenue Average Fixed Assets Value Net Sale s Revenue re presents the total amount of sale s generated by the company after deductions such as discounts within a specific period Fixed Asset Turnover FAT is an efficiency ratio that indicates how well or efficiently the business uses fixed assets to generate sales Based on the given figures the fixed asset turnover ratio for the year is 9 51 meaning that for every dollar invested in fixed assets a return of almost ten dollars is earned

What Is Good Fixed Asset Turnover Ratio

What Is Good Fixed Asset Turnover Ratio

https://d3rw207pwvlq3a.cloudfront.net/attachments/000/145/750/images/img_poster.0000000.jpg?1615772282

What Is A Good Percentage For Asset Turnover In Telecommunications

https://whatcdn.wharftt.com/what_is_a_good_asset_turnover_rate.png

Fixed Asset Turnover Ratio Explained With Examples SMM Medyan

https://necteo.com/images/fixed-asset-turnover-ratio-example-2.jpg

Definition The fixed asset turnover ratio is an efficiency ratio that measures a companies return on their investment in property plant and equipment by comparing net sales with fixed assets In other words it calculates how efficiently a company is a producing sales with its machines and equipment Investors and creditors use this formula to understand how well the company is utilizing Fixed Assets Turnover Ratio and Assets Turnover Ratios are important ratios used by analysts investors and lenders It indicates whether assets built are being appropriately utilized A higher fixed asset turnover ratio is always looked at positively However the use of ratios again should be comparison within the same industry segment

The fixed asset turnover ratio FAT is a comparison between net sales and average fixed assets to determine business efficiency By doing this calculation we can determine the amount of income made by a company per dollar invested in net fixed assets 2 What is the ideal Fixed Asset Turnover FAT ratio In the retail sector an asset Fixed Asset Turnover Ratio 10 000 000 1 000 000 10 According to the data provided the Fixed Asset Turnover Ratio for the year is 9 51 This indicates that for every pound invested in Fixed Assets nearly ten pounds are generated in return The average net Fixed Asset value is determined by summing the beginning and ending balances and

More picture related to What Is Good Fixed Asset Turnover Ratio

Fixed Asset Turnover Formula

https://media.wallstreetprep.com/uploads/2022/03/23225246/Fixed-Asset-Turnover-Ratio-Calculator.jpg

Which Of The Following Is An Asset Utilization Ratio

https://tutor2u-assets.ams3.digitaloceanspaces.com/transforms/s3business/diagrams/29388/asset-turnover-formula-example_2558ca17cfd574efc553cd677b3d659b.jpg

Fixed Asset Turnover Formula

https://media.wallstreetprep.com/uploads/2021/08/27013014/Fixed-Asset-Turnover-Formula.jpg

What is a good ratio for fixed asset turnover A good fixed asset turnover ratio depends on the industry but a ratio of 3 1 or higher is typically considered strong It shows that a company can earn at least 3 in sales for every 1 spent on fixed assets It s a good idea to compare the fixed asset turnover ratio of other companies in the This will give you a better idea of whether a company s ratio is bad or good Suppose the industry average ratio is 1 and a company s ratio is 2 This would be good because it means the company uses fixed asset bases more efficiently than its competitors The fixed asset turnover ratio demonstrates the effectiveness of a company s

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/TermDefinitions_Fixed_Asset_Turnover_Ratio_-d269a3bf50b040dcb50552ac0ac79e4f.jpg)

Fixed Asset Turnover Formula

https://www.investopedia.com/thmb/o-3u9k7G3IHymELZV__R1VOQrP0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TermDefinitions_Fixed_Asset_Turnover_Ratio_-d269a3bf50b040dcb50552ac0ac79e4f.jpg

Asset Turnover Ratio Meaning Formula Calculation Importance

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/08/asset-turnover-ratio-image.jpg

What Is Good Fixed Asset Turnover Ratio - Fixed Assets Turnover Ratio and Assets Turnover Ratios are important ratios used by analysts investors and lenders It indicates whether assets built are being appropriately utilized A higher fixed asset turnover ratio is always looked at positively However the use of ratios again should be comparison within the same industry segment