What Is An Example Of A Progressive Tax America has a progressive tax system That means as a person earns more and progresses through tax brackets their tax rate increases for each level of income In 2020 the highest tax

A progressive tax is a tax system that increases rates as the taxable income goes up It is usually segmented into tax brackets that progress to successively higher rates For example a progressive tax rate may move from 0 to 45 from the lowest and highest brackets as the taxable amount increases Definition and Examples of Progressive Tax With a progressive tax the tax burden is higher for the wealthy than it is for those with lower incomes This kind of tax helps lower income families pay for basics such as shelter food and transportation A progressive tax allows them to spend a larger share of their incomes on cost of living expenses

What Is An Example Of A Progressive Tax

What Is An Example Of A Progressive Tax

https://i.ytimg.com/vi/kOjNIcFIZNA/maxresdefault.jpg

Is An Example Of A Progressive Tax While Is An Example Of A Regressive

https://i.ytimg.com/vi/o8uHqt69fLg/maxresdefault.jpg

Progressive Tax Definition 4 Examples Pros Cons BoyceWire

https://boycewire.com/wp-content/uploads/2020/10/Advantages-of-a-Progressive-Tax-e1603033748240.png

Progressive tax examples For an example of how progressive tax works let s consider John and Mark Both are single but John earns 80 000 per year while Mark earns 600 000 per year John s income would place him in the 22 federal income tax bracket in tax year 2022 so his federal tax bill would be 13 349 How Progressive Is the U S Tax System The U S has a progressive income tax system that taxes higher income individuals more heavily than lower income individuals Though the top 1 percent of taxpayers earn 19 7 percent of total adjusted gross income they pay 37 3 percent of all income taxes

A regressive tax is a type of tax that decreases based on someone s income At first glance a regressive tax is an average tax deduction that is uniformly applied to all tax paying A progressive tax is when the tax rate you pay increases as your income rises In the U S the federal income tax is progressive There are graduated tax brackets with rates ranging from 10 to 37 For the 2023 tax year tax returns filed in 2024 those tax brackets are

More picture related to What Is An Example Of A Progressive Tax

What Is Progressive Tax WorldAtlas

https://www.worldatlas.com/r/w1200-q80/upload/ed/42/3b/shutterstock-602405195.jpg

What Is The Difference Between A Progressive Tax And A Regressive Tax

https://img.homeworklib.com/images/e00303ae-f628-4111-a195-3c992997e393.png?x-oss-process=image/resize,w_560

/GettyImages-1096013688-bf6dc3750f904e12bd97df3691ecf1eb.jpg)

The Pros And Cons Of A Progressive Tax Policy

https://www.investopedia.com/thmb/HlGoYCT41eOBKC_qEs25mTD9hKo=/1500x1000/filters:fill(auto,1)/GettyImages-1096013688-bf6dc3750f904e12bd97df3691ecf1eb.jpg

Compare for example a system in which individual people s wages are taxed at a progressive rate an individual tax base to a system in which total wages earned by members of a household are combined and then taxed at a progressive rate a household tax base Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay as such taxes shift the incidence increasingly to those with a higher ability to pay The opposite of a progressive tax is a regressive tax where the relative tax rate or burden increases as an individual s ability to pay it decreases

Estate taxes act as progressive taxes because individuals with larger estates incur larger tax bills For instance an estate between 500 001 and 750 000 will be charged at a rate of 37 Those with estates over 1 million will pay taxes at a 40 rate Capital gains taxes These taxes are levied on investment returns Progressive taxes work by creating a tiered pay table for income taxes assigning low rates to people in the lowest income levels and a larger share of the tax burden to those who earn the most taxable income It may help to look at the 2023 tax rate brackets for US federal income taxes as an example 37 for individuals with taxable income

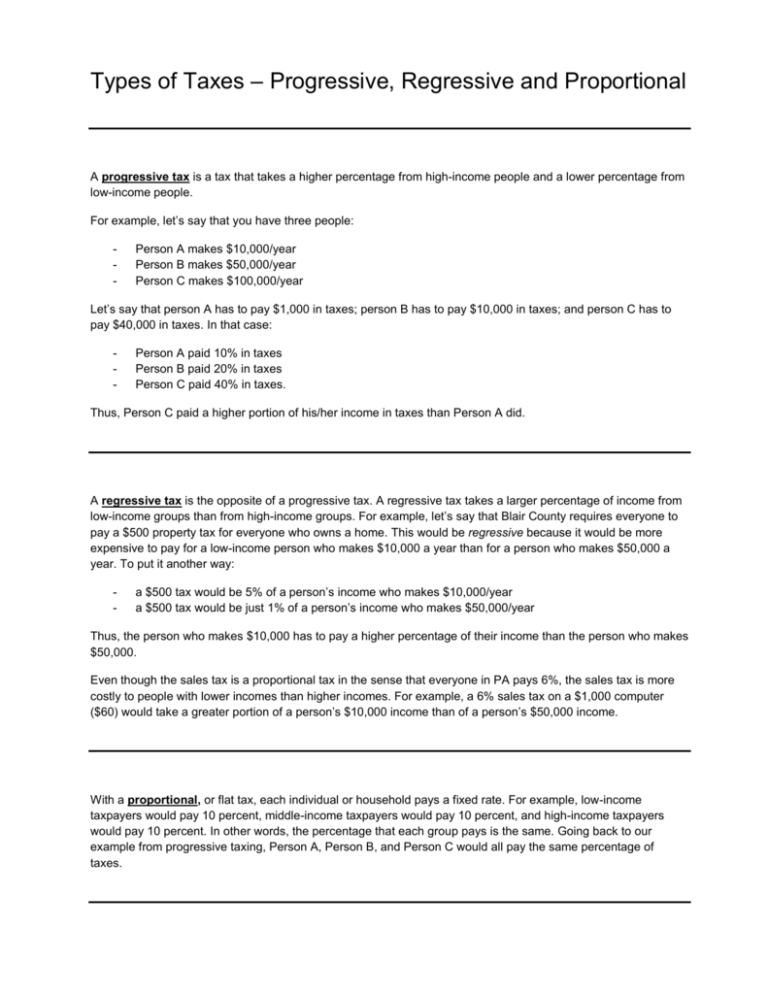

Types Of Taxes Progressive Regressive And Proportional

https://s3.studylib.net/store/data/008335135_1-f65f61ffe7af01e50d10d43613ba1c8c-768x994.png

Progressive Tax Examples Pros Cons How To Calculate

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhsgC17DRs86Wt67RR0aVyMHXfgva8MuuwIxDubgh3h4TSAPK0FvLSaDQpnqZcDwO9ZsAzryWIDlxe5dzChsYCWv309IFg9O2hvKcrf-f6wbRZpi4EbG5rLlbUmd-PL002D293OErsiisWCF9vBdvWyZjz4JMHHyNmVqGBlTTUpb4TUVbE-h48G3XMY/s888/PT.jpg

What Is An Example Of A Progressive Tax - Progressive taxes are based on your ability to pay Income tax is an example of a progressive tax Higher net worth individuals pay a higher percentage of their income in taxes than lower income