What Is Advance Salary Adjustment Deduction On Payslip Variously referred to as Advance Wage Payment Earned Wage Access or Wages on Demand products these services are becoming popular with employees especially those who work for minimum wage Employers who offer the programs often see a boost in employee morale and retention These programs however raise a number of tricky

With a payroll advance policy in place it should be easy to determine whether an employee is eligible for an advance and for how much Sign a payroll advance agreement You and the employee should both sign a standard agreement that states the amount of the advance and the repayment terms through payroll deductions Under federal law you may deduct an advance from your employee s paycheck However you may not deduct so much that it reduces your employee s pay to less than the hourly minimum wage 7 25 currently For low wage employees this means you may need to spread the repayment period out over several paychecks

What Is Advance Salary Adjustment Deduction On Payslip

What Is Advance Salary Adjustment Deduction On Payslip

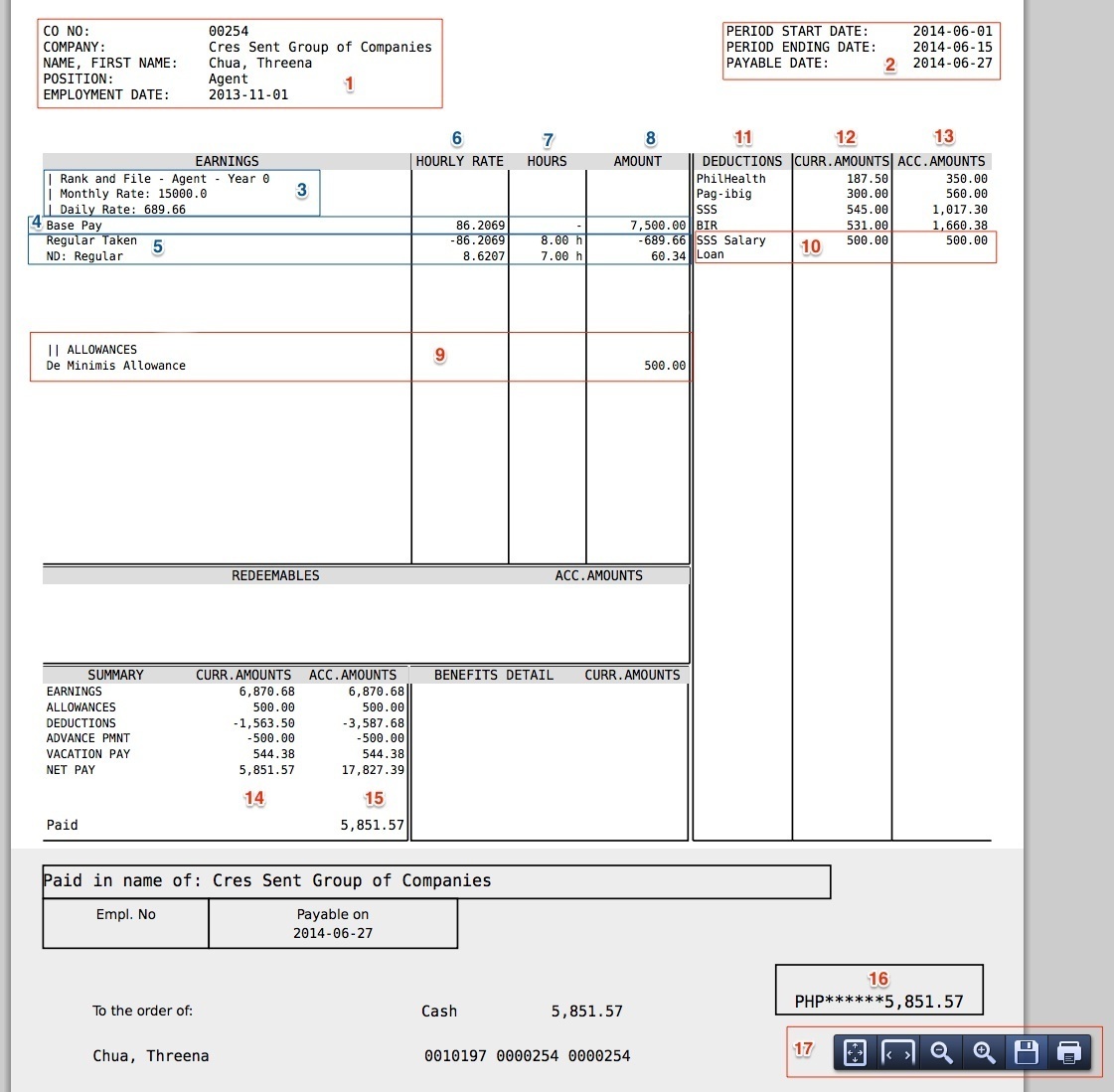

http://support.payrollhero.com/files/2015/06/WRLcLz2LKM3djsiepNUX.jpeg

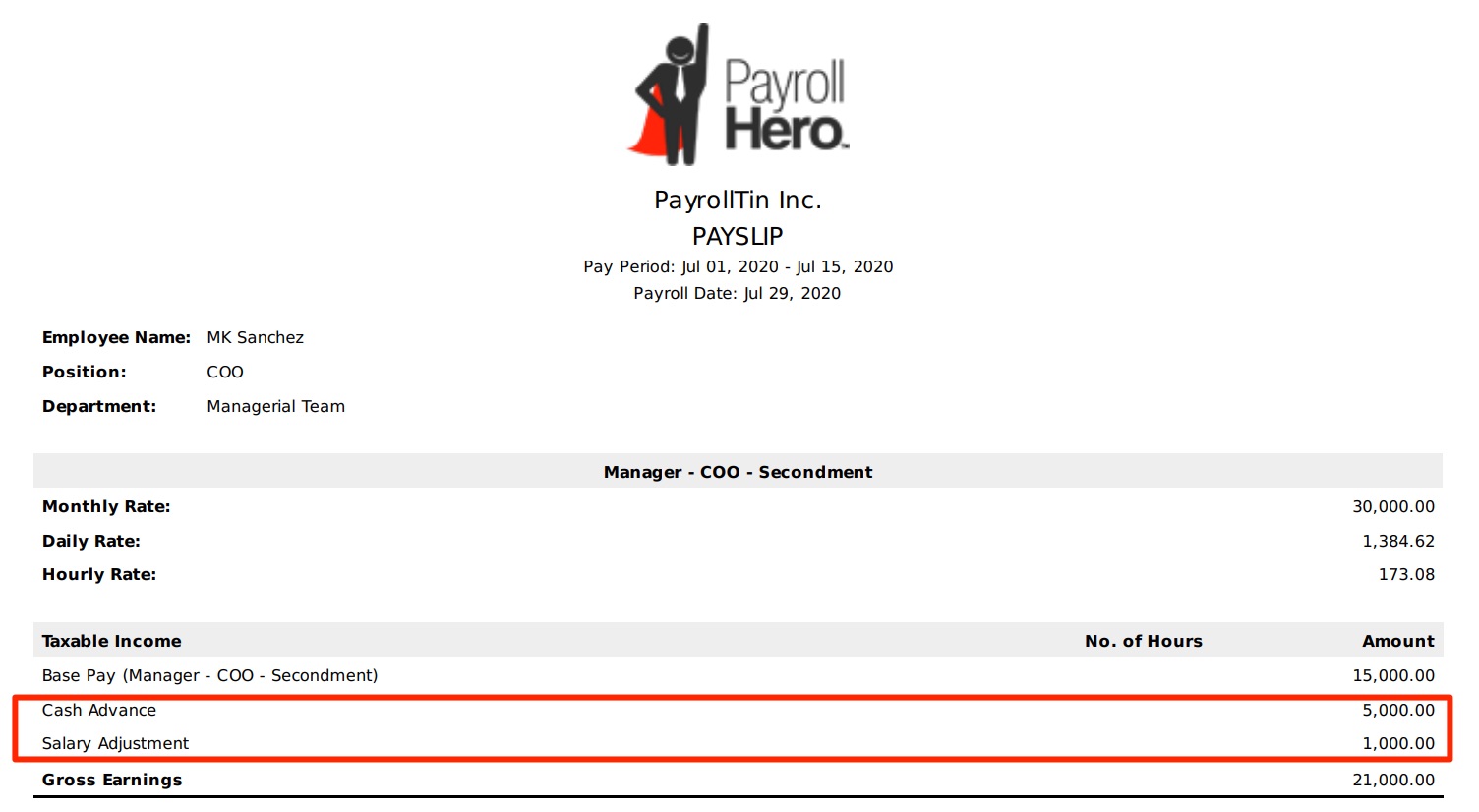

What does PayrollHero's Payslip look like? – PayrollHero Support

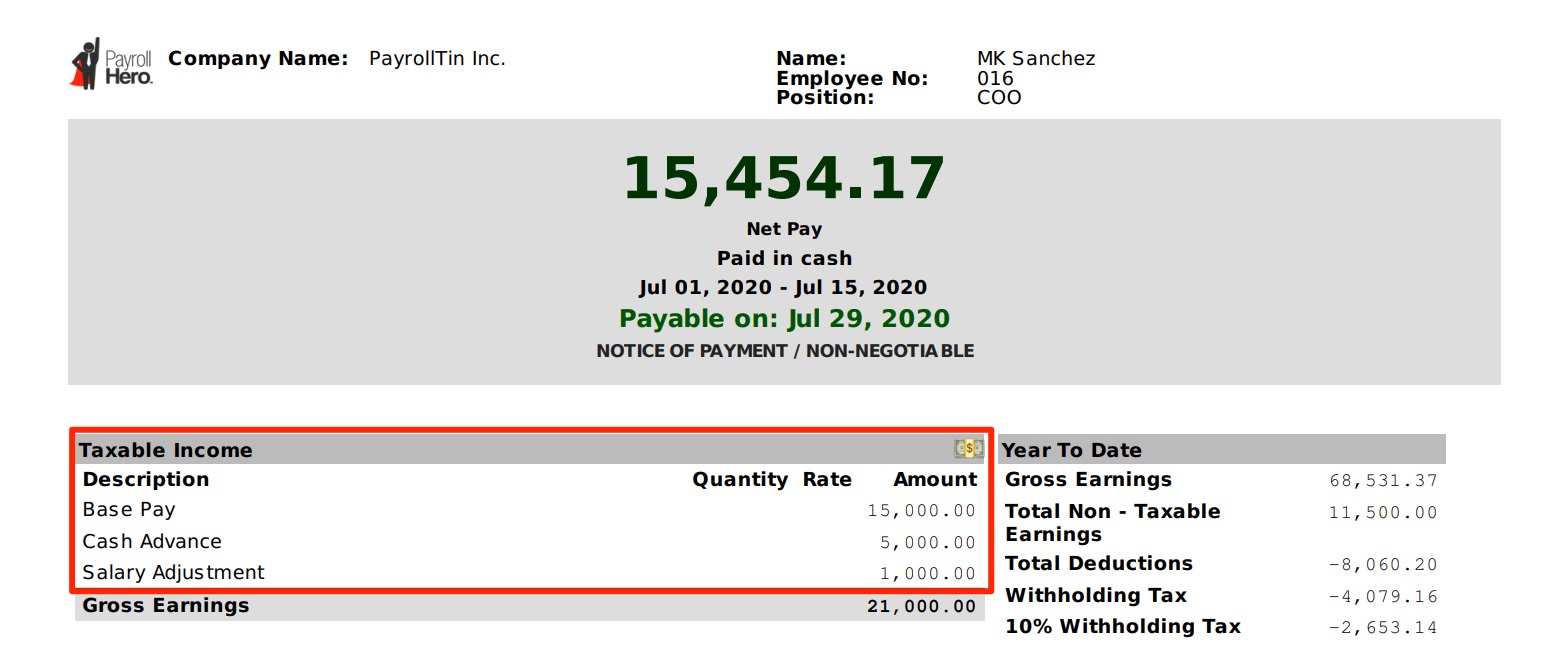

http://support.payrollhero.com/files/2015/06/Screenshot_2020-08-11_at_11_32_46_AM.jpg

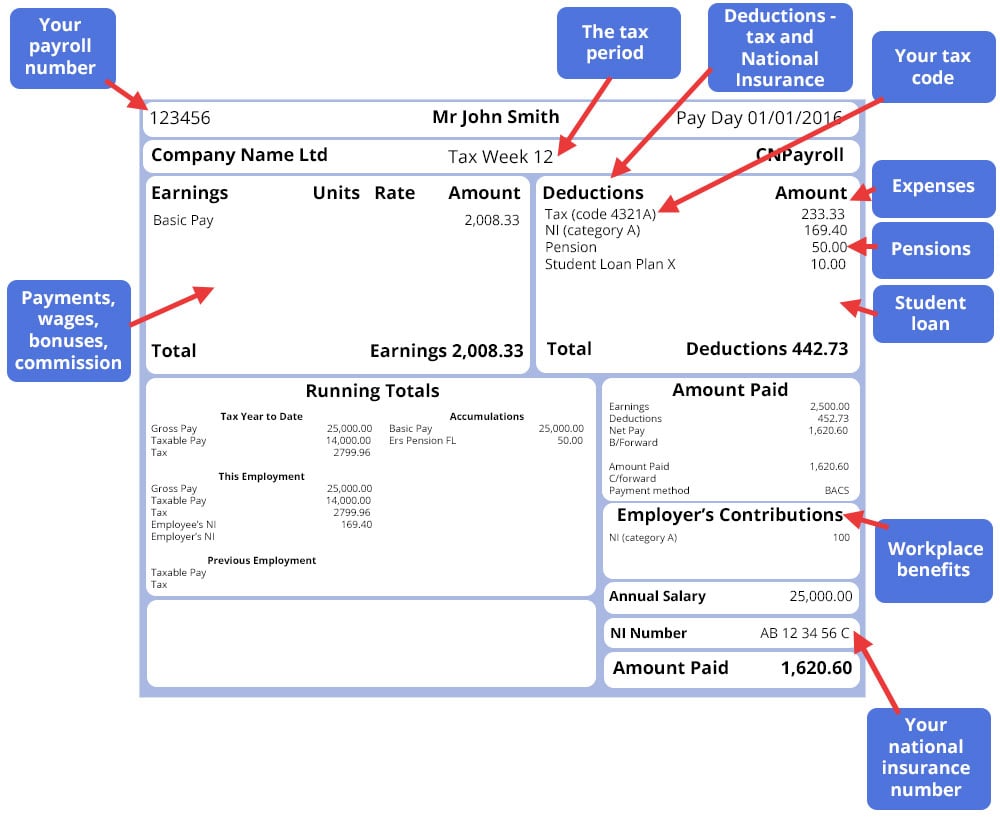

Payslip checker - your payslips explained | reed.co.uk

https://www.reed.co.uk/career-advice/wp-content/uploads/sites/6/2018/05/payslip-example.jpg

That means you must withhold 86 00 for federal income tax 1 000 76 50 86 00 837 50 The employee would have 837 50 after you withhold taxes For this example we re going to assume there aren t any state or local taxes Now you need to deduct the advance repayment 837 50 100 737 50 Retro pay short for retroactive pay is a compensation adjustment made to an employee s wages Usually retro pay is for work that was performed in the past but wasn t accurately compensated at the time This situation can arise due to a variety of reasons such as clerical errors changes in employment contracts or miscalculations in

A written agreement should be a part of any payroll advance The agreement should include Make sure both the employer and employee sign the agreement Advances should be paid out separately from your regular payroll This should be easy to do with payroll software but you can manually cut a check to cover the costs A payroll advance is a type of short term loan that employers grant employees to give them early access to wages they haven t earned yet With approximately 70 of Americans living paycheck to paycheck payroll advances can help employees through financial stress and support improved morale and productivity It s important that employers consider the challenges and restrictions that come

More picture related to What Is Advance Salary Adjustment Deduction On Payslip

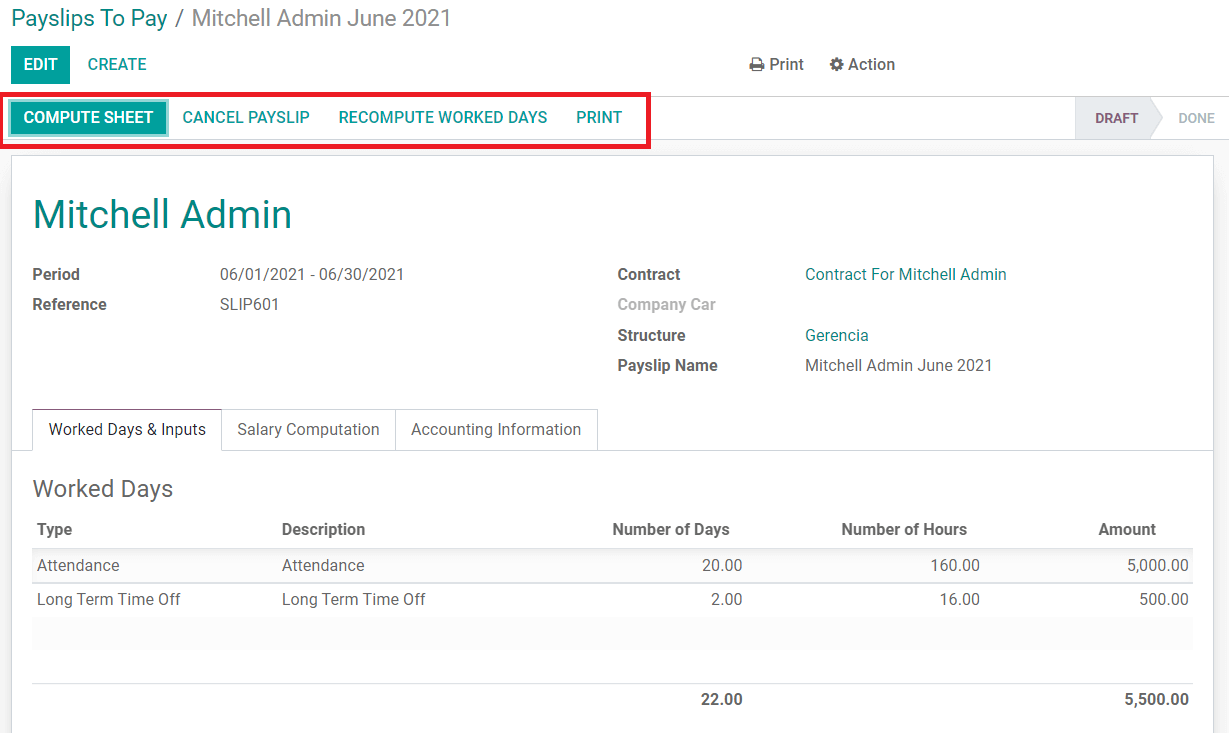

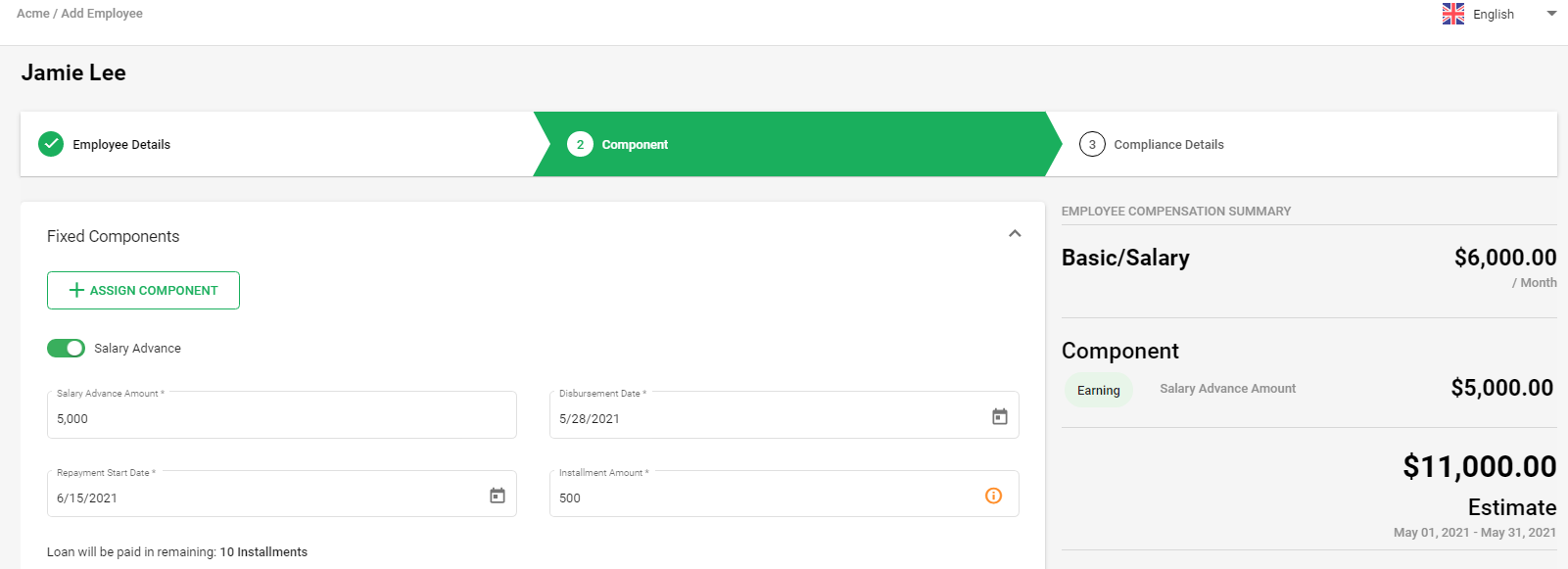

Advance Salary Rules Setting and Payslip Generation in Odoo 14

https://www.images.cybrosys.com/blog/Uploads/BlogImage/advance-salary-rules-setting-and-payslip-generation-in-odoo-14-9.png

What does PayrollHero's Payslip look like? – PayrollHero Support

http://support.payrollhero.com/files/2015/06/Screenshot_2020-08-13_at_11_46_02_AM.jpg

Payroll Advance to an Employee Journal Entry | Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/payroll-advance-journal-entry.png

The agreement should include the advance amount the repayment terms the amount to be deducted each pay period and when the deductions will start and end Both you and your employee need to sign Place a cap on the dollar amount of payroll advance each employee can receive within your policy A cap will help you get your money back and help the employee become financially responsible 4

When payday comes around the employee s payslip shows the salary advance as a deduction after tax Often the employee will be notified via a separate communication that the advance has been repaid We ve only been paying salaries monthly since the 1960s when there was a change in employment law says David What Is a Salary Advance If you re in a financial emergency you can ask your employer for a salary advance which pays an upfront sum that s deducted from future wages If they say yes it can save you from predatory lending options But it still has potential risks to be aware of such as reduced future paychecks

How to process Advance Payment for your employees using Deskera People?

https://www.deskera.com/care/content/images/2021/05/ap1-2.PNG

Wage advances - MYOB Essentials Accounting - MYOB Help Centre

https://help.myob.com/wiki/download/attachments/31930010/Wage%20advance%20on%20pay.png?version=1&modificationDate=1538696739000&api=v2

What Is Advance Salary Adjustment Deduction On Payslip - Retro pay short for retroactive pay is a compensation adjustment made to an employee s wages Usually retro pay is for work that was performed in the past but wasn t accurately compensated at the time This situation can arise due to a variety of reasons such as clerical errors changes in employment contracts or miscalculations in