What Is A Qualified Risk Manager The cost tends to be between 430 and 440 per course The courses include Principles of Risk Management Tests participants on the overall knowledge of risk management Analysis of Risk Addresses measuring and analyzing risk as well as possible loss of data Control of Risk Covers safety proficiency managing risks with crisis management

A certified risk manager examines a company for potential threats security breaches fraud and other acts that could bring significant legal or financial challenges harm employees and assets or limit company products or services Risk managers manage both internal and external risk factors 13 Qualified risk manager The term qualified risk manager means with respect to a policyholder of commercial insurance a person who meets all of the following requirements A The person is an employee of or third party consultant retained by the commercial policyholder

What Is A Qualified Risk Manager

What Is A Qualified Risk Manager

https://leverageedu.com/blog/wp-content/uploads/2020/10/How-to-Become-a-Risk-Manager.jpg

What Does A Risk Manager Do Career Insights Job Profile

https://www.freelancermap.com/blog/wp-content/uploads/2020/03/risk-manager-responsibilities-skill-background-salary.jpg

The Infinite Loop Of Risk Management CIP Reporting

https://www.cipreporting.com/wp-content/uploads/2021/04/Risk-infographics-1024x1024.png

4 Communicate and report risks As a risk manager you also have the responsibility to communicate and report the risks and their status to the relevant stakeholders such as senior management Risk managers develop systems and processes to monitor risks in real time providing timely reports to senior management This enables informed decision making and ensures that the organization remains proactive in addressing potential threats

Certified risk managers are in high demand due to their knowledge and skills in risk assessment and mitigation The benefits of becoming a CRM include increased income job security and opportunities for growth CRMs play an important role in organizations by helping to identify and mitigate risks The RIMS CRMP prepares you for senior financial operational and risk management roles Compensation Increase your earning potential Full time risk professionals with the RIMS CRMP certification earn 16 000 more annually than non RIMS CRMP holders Recognition Elevate your status and enhance your professional reputation

More picture related to What Is A Qualified Risk Manager

Risk Manager Job Description And Its FAQ Room Surf

http://uroomsurf.com/wp-content/uploads/2020/07/215.jpg

How To Become A Financial Risk Manager A Career Guide Path Intelligence

http://www.pathintelligence.com/wp-content/uploads/2021/01/158449.jpg

Risk Manager Job Description Velvet Jobs

https://asset.velvetjobs.com/job-description-examples/images/risk-manager-v2.png

What is a Risk Manager As a risk manager you are in charge of determining financial safety and security risks for a company or organization and you find ways to reduce those risks through planning and problem solving Institute of Qualified Risk Managers provides Qualified Risk Manager QRM certification is typically designed to validate the skills and knowledge of individuals in the field of risk management It is often offered by professional associations universities or certification bodies dedicated to risk management and insurance Here is a general

4 Reasons Why Risk Management Is Important 1 Protects Organization s Reputation In many cases effective risk management proactively protects your organization from incidents that can affect its reputation Franchise risk is a concern for all businesses Simons says in Strategy Execution However it s especially pressing for Discover the steps you should take to become a risk manager including the skills you need to develop what to expect at different stages of your career and how to move up the ladder The right educational background and work experience can help you start a career as a risk manager or transition into a risk management role from a different field

Certified Risk Manager CRM

https://cutcompcosts.com/wp-content/uploads/2011/01/Certified-Risk-Manager-1-1200x800.jpg

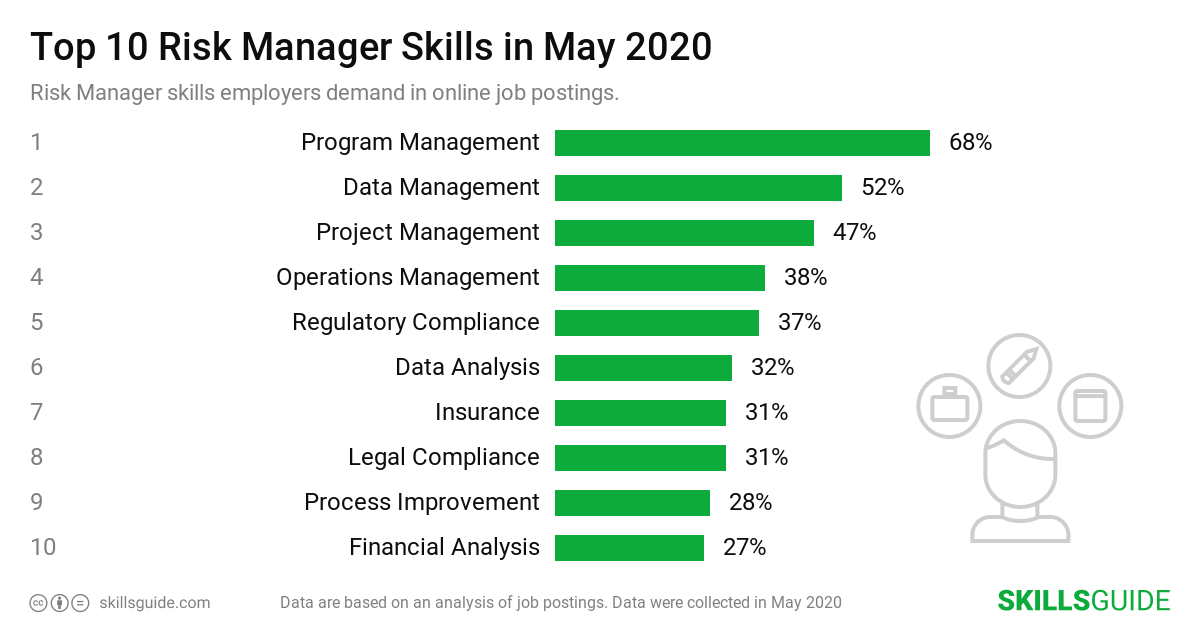

Risk Manager Skills For Resume 2020 SkillsGuide

https://skillsguide.com/assets/img/generated/risk-manager.png

What Is A Qualified Risk Manager - Certified risk managers are in high demand due to their knowledge and skills in risk assessment and mitigation The benefits of becoming a CRM include increased income job security and opportunities for growth CRMs play an important role in organizations by helping to identify and mitigate risks