What Happens When Puts Expire Worthless If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option

Another advisor goes even further saying Selling covered call options and cash secured puts is a smarter strategy than buying options because 90 of options expire worthlessly It may feel good to write an option for 200 and see it expire worthless However if that happens as the price of your underlying stock declines from your The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

What Happens When Puts Expire Worthless

What Happens When Puts Expire Worthless

https://www.tastingtable.com/img/gallery/what-really-happens-when-you-eat-these-expired-foods/l-intro-1663695601.jpg

Short Reminder That 330 K Puts Expire Worthless Tomorrow TITS JACQUED

https://preview.redd.it/k5lqhtgg6wc81.jpg?auto=webp&s=87026ae5babed3f599c48b1ef06305817783cbec

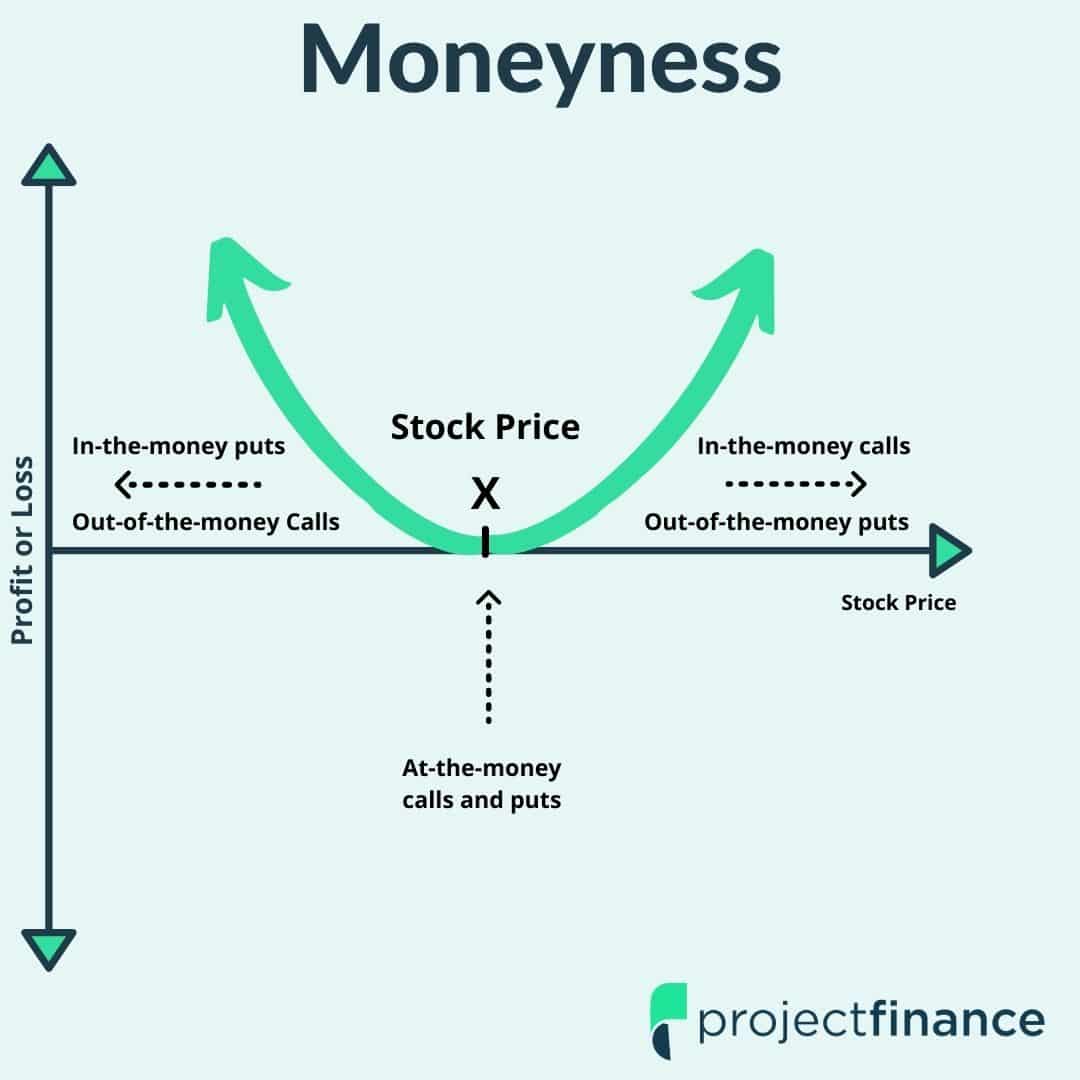

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

In IRS Publication 550 there s information about what happens to a call or put contract that expires come tax season When puts and calls expire the holder reports the cost of the contract as a The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14

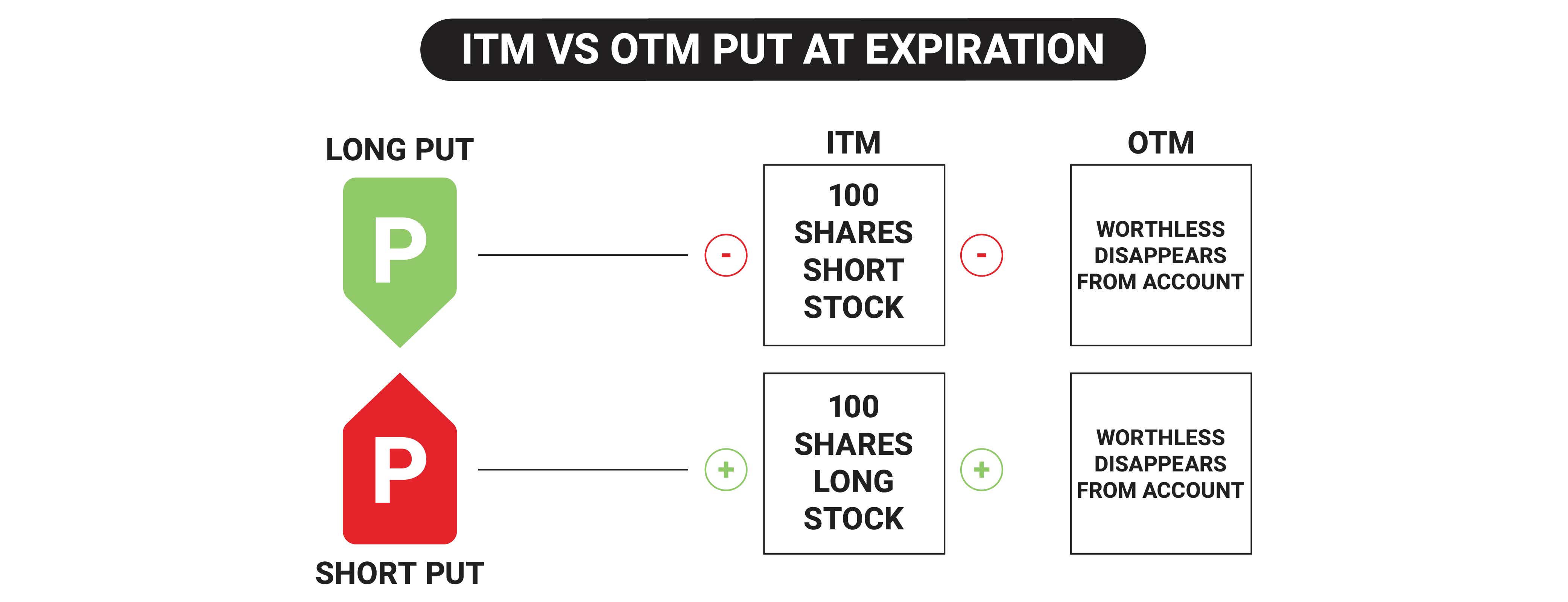

At expiration one of two things happens depending on whether one s option is in the money ITM or out of the money OTM If an option has intrinsic value to the owner it is considered ITM If it does not it is considered OTM Put options below the stock price are OTM and put options above the stock price are ITM Put option the holder of the option has the right to sell stock at the strike price while the writer of the option has the obligation to buy stock at the strike price In this example the 55 strike calls that John had sold expired worthless and the 50 strike calls that John owned were in the money As a result the calls were

More picture related to What Happens When Puts Expire Worthless

This Is What Happens Imgflip

https://i.imgflip.com/61fml0.jpg

Verdauungsorgan Borke Kartoffeln Xbox Live Expired But Still Working

https://cdn.windowsreport.com/wp-content/uploads/2021/10/Your-Windows-license-will-expire-soon.jpg

36 Miscellaneous Memes To Get You Back On Your A Game Chart Memes

https://i.pinimg.com/originals/c1/7d/21/c17d211b47fa05f037ad8a11c4f5cb05.jpg

For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying Expiration Time A specified time after which the options contract is no longer valid The expiration time gives a more specific deadline to an options contract on top of the expiration date by

55 60 of option contracts are closed out prior to expiration 30 35 of option contracts expire worthless out of the money with no intrinsic value For put sellers who do not want shares put to them and covered call writers who do not want their shares sold the 30 35 stat is still pretty impressive but it isn t 90 Now Max Pain The point at which options expire worthless The term max pain stems from the Maximum Pain theory which states that most traders who buy and hold options contracts until expiration

Does Vaseline Expire Is Petroleum Jelly Safe Or Toxic

https://thesurvivaldoctor.com/wp-content/uploads/2022/05/vaseline.jpeg

Options Expiration What Happens When Options Expire Tastylive

https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt02fd0c5584c0a3cf/63878e954005df1070b03de0/options_expiration_ITM-OTM-Put-at-Expiration-nl.png?format=pjpg&auto=webp&quality=50

What Happens When Puts Expire Worthless - At expiration one of two things happens depending on whether one s option is in the money ITM or out of the money OTM If an option has intrinsic value to the owner it is considered ITM If it does not it is considered OTM Put options below the stock price are OTM and put options above the stock price are ITM