What Happens When Options Expire Robinhood Options rolling Options rolling is where you close an options position and simultaneously open a new one typically with an expiration that s further out in time and sometimes using a different strike price Rolling options doesn t ensure a profit or guarantee against a loss You may also end up compounding your losses

If its on robinhood they ll automatically sell the option prior to close if you don t have enough money to exercise Its better to just sell if you don t have the cash to exercise because otherwise they expire worthless Robinhood treats you with kid gloves and liquidated you way before you get to actually expire Join me as I share my story of holding options through expiration on Robinhood Learn about the potential risks and what happens when options expire on this

What Happens When Options Expire Robinhood

What Happens When Options Expire Robinhood

https://beststockstrategy.com/wp-content/uploads/2021/04/options-expire-scaled.jpg

Robinhood App In India Vicamil

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/ihetfvvhNtgY/v0/-1x-1.jpg

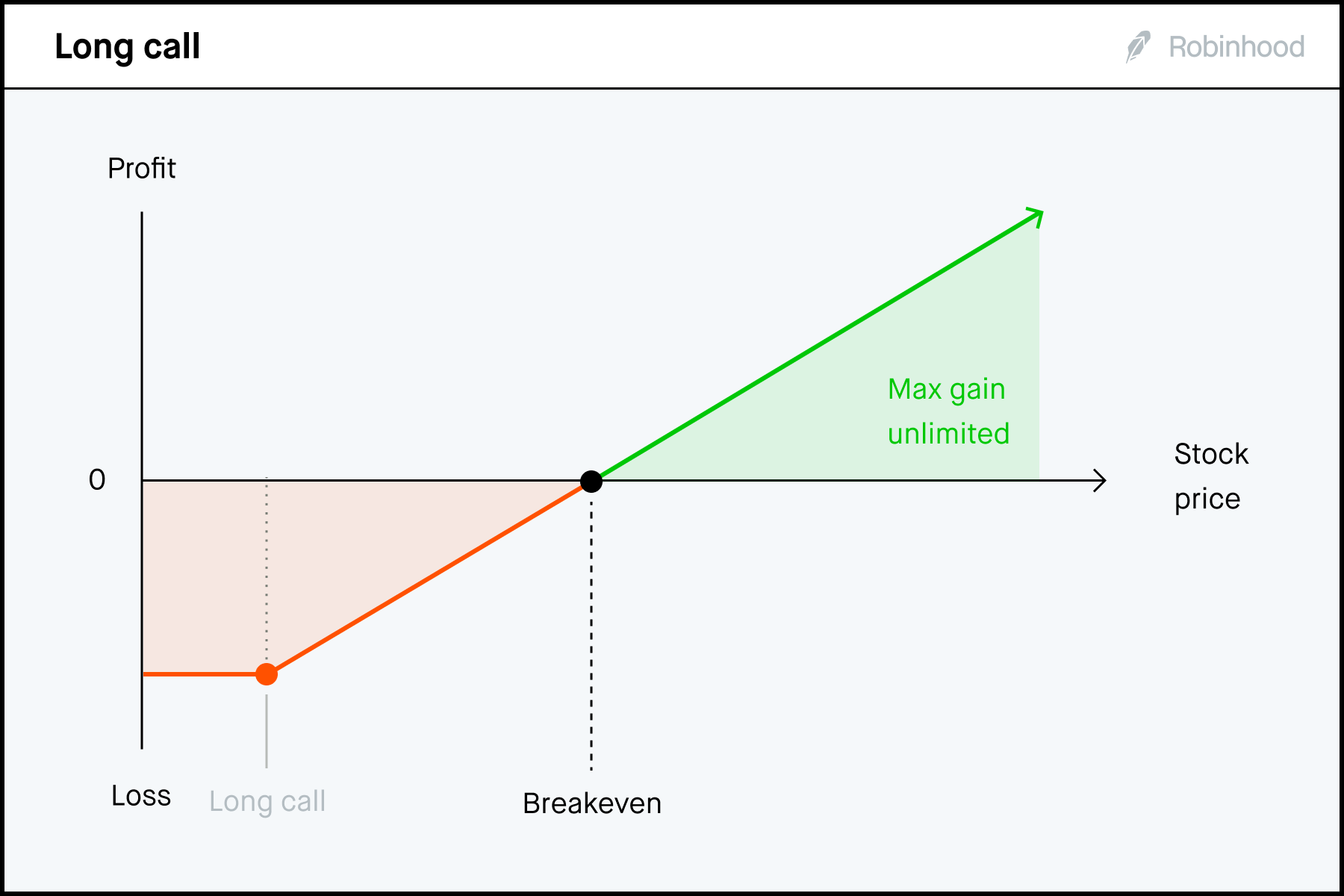

Basic Options Strategies Level 2 Robinhood

https://images.ctfassets.net/fomw95h5b4ty/0XsO6rKMDbax7Mvk1DZeA/c8bbee006256fef67e9019683c7044e2/long-call.png

As the expiration date of your option contract nears there are a few important things to keep in mind You can t open a position the day the contract expires All options contracts are set to position closing status the day before expiration We will automatically exercise any option in the money if your account has the required buying power Options can be tricky so it s important to know exactly how the actions you take will get you closer to your goal Buying to open an options position means that you re purchasing the contract You re the owner and have the right to place an order to sell the contract back into the market to exercise the contract or let it expire Selling to close a position means that you re

The first two the short call and put are known as naked strategies because you re exposed without a hedge protection in case something goes awry Since Robinhood Financial doesn t allow naked option selling we ll focus on the covered call and the cash secured put both of which happen to be bullish strategies In this video I will show you a live example of what happens when an option is exercised on Robinhood This is the part of the stock market that most people

More picture related to What Happens When Options Expire Robinhood

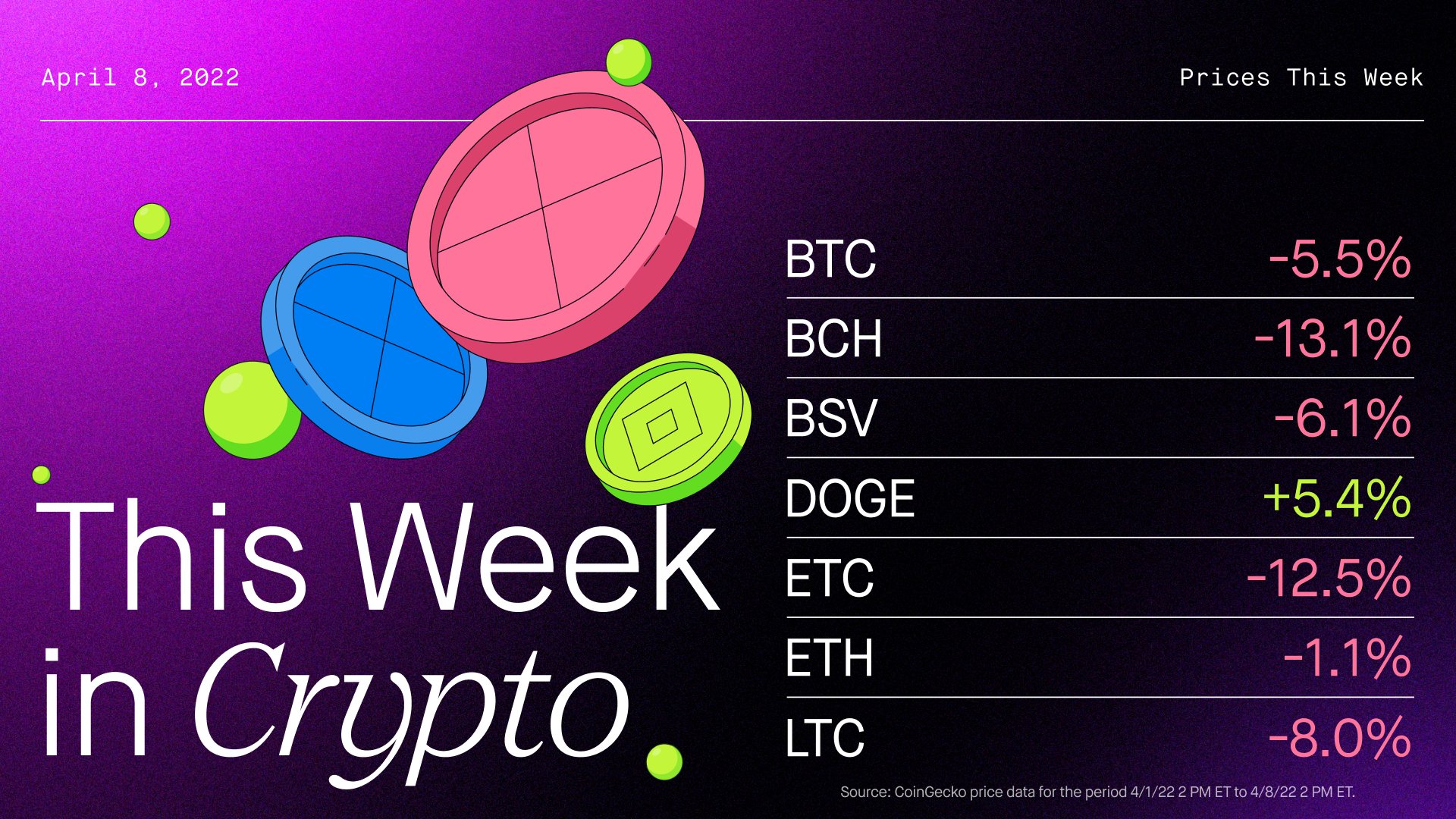

Robinhood On Twitter What Happened ThisWeekInCrypto The 19th

https://pbs.twimg.com/media/FP2z7GSVcAAtbh2.jpg:large

Robinhood Review TechRadar

https://cdn.mos.cms.futurecdn.net/5PthiEbges5xQW6ooJ2b2Y.png

EPISODE 13 STRIKE PRICE TO CHOOSE WHEN BUYING OPTIONS YouTube

https://i.ytimg.com/vi/lf0BCiE7vHQ/maxresdefault.jpg

Suppose a novice trader opens an online account with 5 000 with online trading platforms like e trade Ameritrade or Robinhood With the stock at 175 the trader buys 2 call options Option Price 20 Strike Price 200 Expiry 6 Months from now Cost 4 000 On the last day of trading the stock is 215 and the 200 call is in the money When your short options go in the money the longer you remain in the position the greater the chance you have of being assigned The Step by Step to Exercise If you need to exercise your long options Open Robinhood and go to your positions screen by tapping the chart icon in the lower left

A call option that has a strike price that s lower than the current stock price is said to be in the money A call with a 140 strike price is worth at least 10 1 000 per option That s an 8 profit on a 2 trade which is a 400 return and it might be smart to close the trade in this situation Delta is positive For each 1 increase in the underlying the option s price will theoretically increase by the delta value and vice versa As the call option becomes more in the money it will approach a 1 00 delta As it becomes more out of the money it will approach a 0 00 delta Gamma is positive

Robinhood s New Traders Ignore Danger Signs To Bet On Stocks Bloomberg

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/i8FqSIxcPr0c/v0/-1x-1.jpg

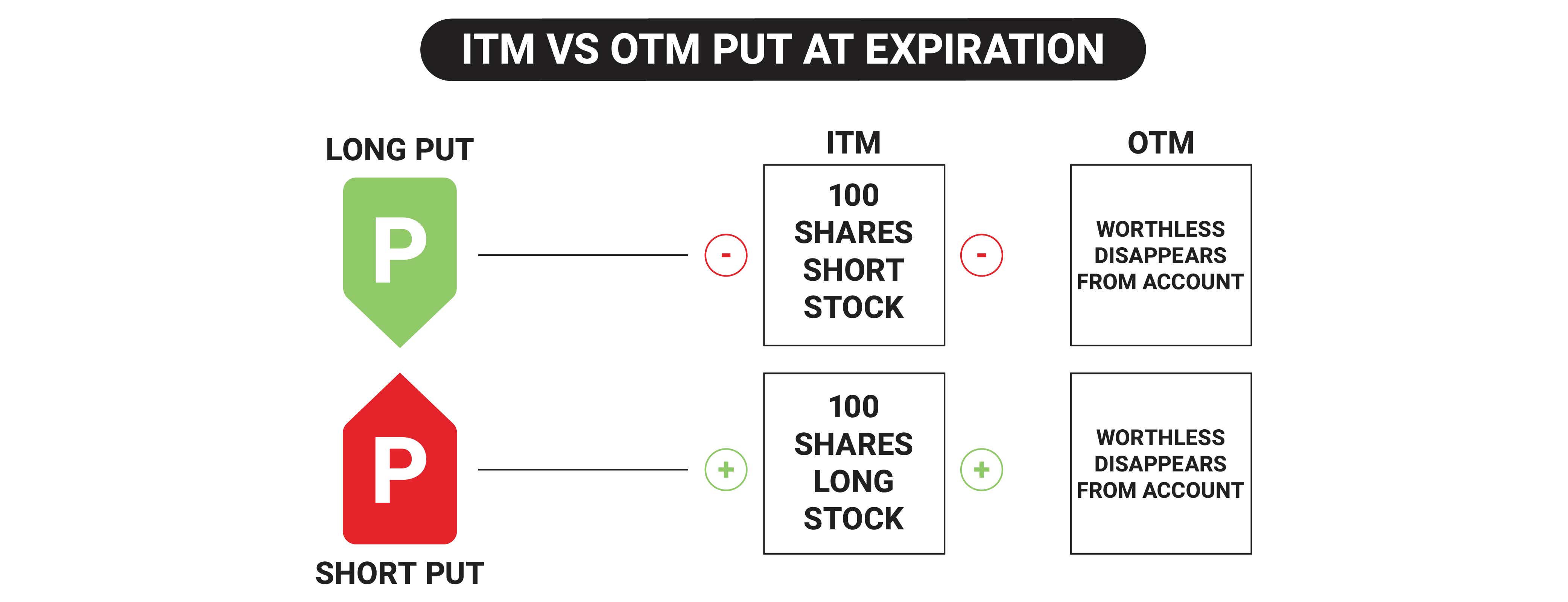

Options Expiration What Happens When Options Expire Tastylive

https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt02fd0c5584c0a3cf/63878e954005df1070b03de0/options_expiration_ITM-OTM-Put-at-Expiration-nl.png?format=pjpg&auto=webp&quality=50

What Happens When Options Expire Robinhood - The first two the short call and put are known as naked strategies because you re exposed without a hedge protection in case something goes awry Since Robinhood Financial doesn t allow naked option selling we ll focus on the covered call and the cash secured put both of which happen to be bullish strategies