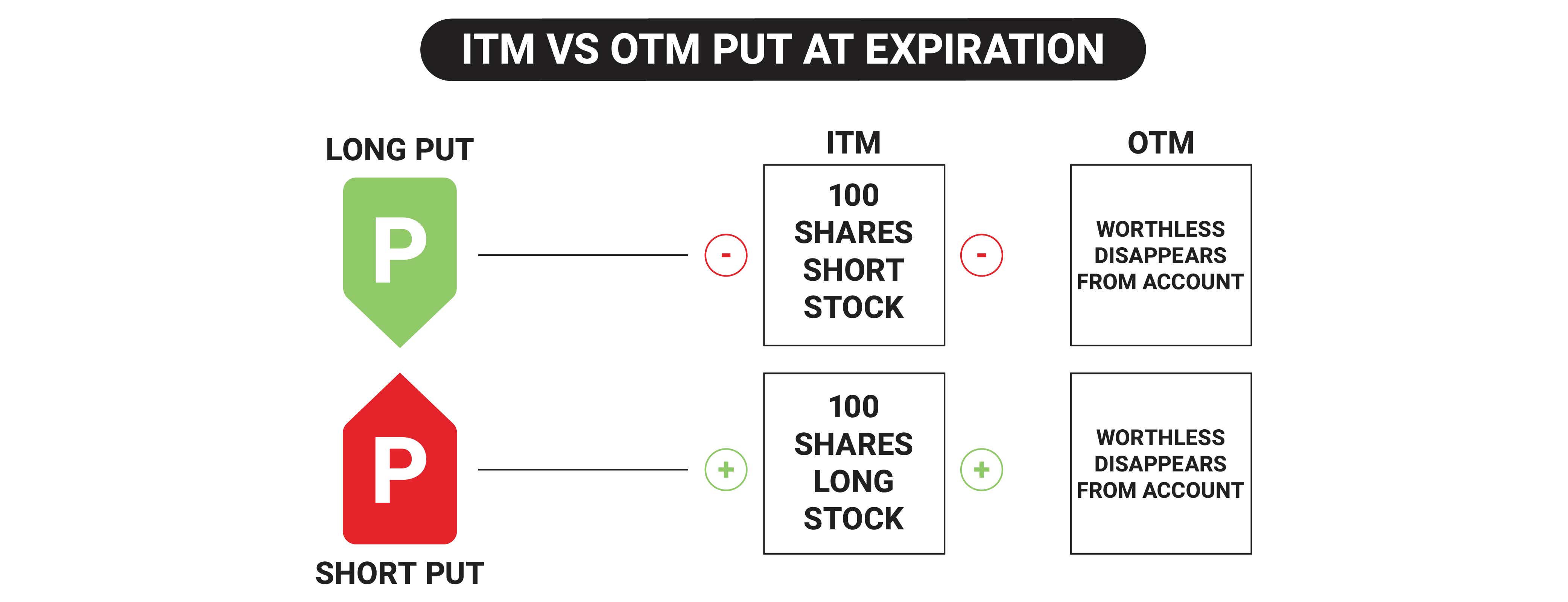

What Happens To Otm Call Options On Expiry Fact checked by Michael Logan When options expire any in the money options are typically exercised automatically meaning the holder will buy for calls or sell for puts the underlying asset

Example 2 OTM Call Option On the other hand let s say the market price of the stock is 45 on the expiration date This option is now OTM If you exercised it you d buy the stock for more than it s worth which doesn t make much financial sense So in this case the option expires worthless and you re out the premium you paid for it At expiration one of two things happens depending on whether one s option is in the money ITM or out of the money OTM If an option has intrinsic value to the owner it is considered ITM If it does not it is considered OTM Put options below the stock price are OTM and put options above the stock price are ITM

What Happens To Otm Call Options On Expiry

_121721.png)

What Happens To Otm Call Options On Expiry

https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/61bd0a563a1dc20dd09b508d_1257975_OptionMoneyness_03_LongCall(OTM)_121721.png

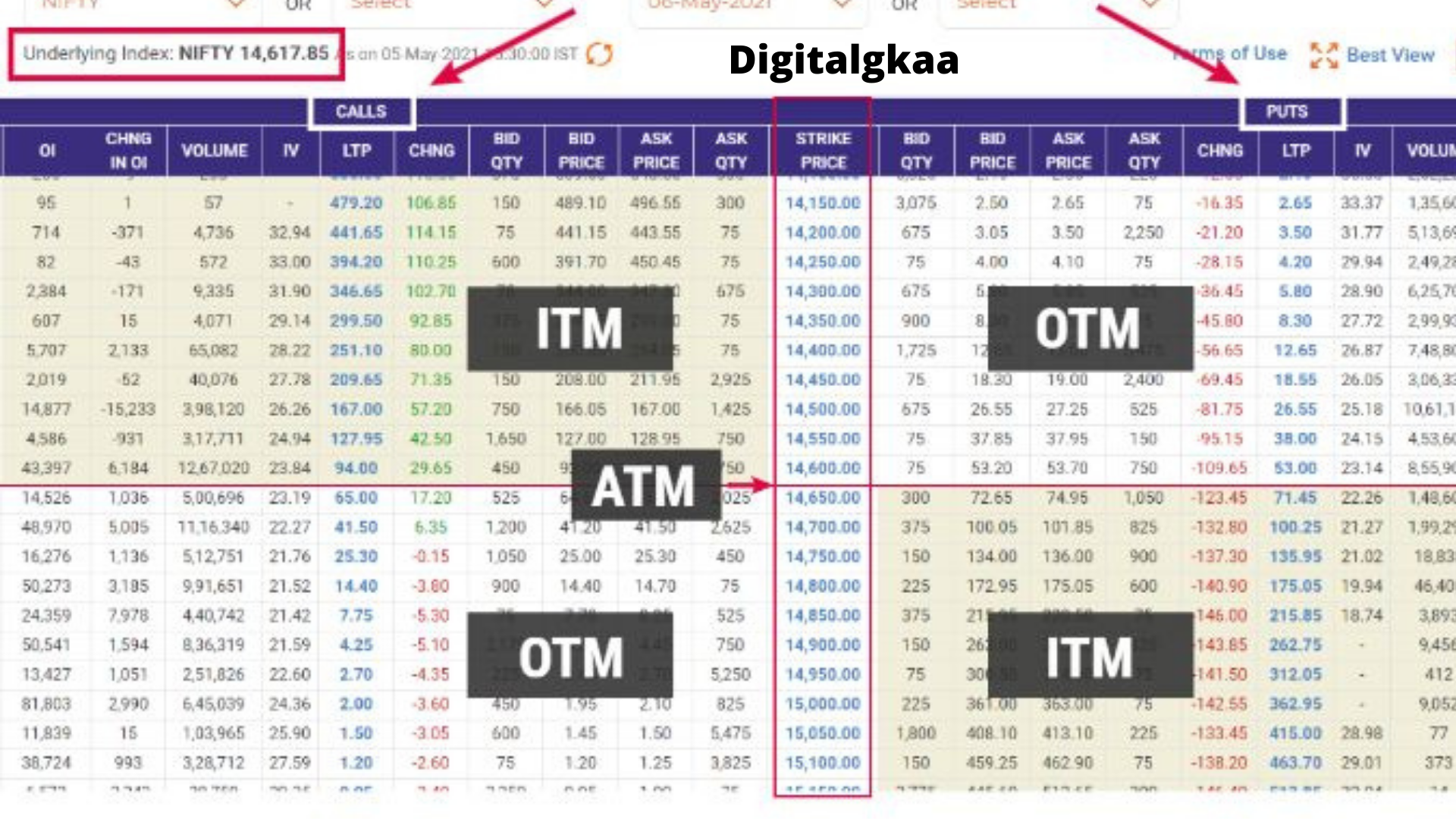

Otm Atm Itm In Hindi Option Chain Analysis Hindi YouTube

https://i.ytimg.com/vi/nbV8XekdfOk/maxresdefault.jpg

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-b0aa70d4f6004811811f8b07f034efd4.png)

At The Money ATM Definition How It Works In Options Trading

https://www.investopedia.com/thmb/Y_VX34xCfqzqN9gmgXfQawOob90=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-b0aa70d4f6004811811f8b07f034efd4.png

A put option is OTM if its strike price is below the price of the underlying stock 3 An options contract gives the owner the right but not the obligation to buy in the case of a call or sell in the case of a put the underlying security at the strike price on or before the option s expiration date When the owner claims the right i e For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying

When the option is OTM and expiration arrives the investor accepts the 100 loss of their purchase price and allows the option to expire Professional traders or market makers people who purchase stocks that are being sold by an investor then resell them essentially creating a market will have instances when they exercise OTM options at All options have an expiration date It is part of the creation and listing of all new series of calls and puts on the various underlying stocks ETFs indexes and futures on which options are made available to buy and sell The expiration date is the end of the contract the last day the owner of the option has the right to buy or sell the underlying asset at the strike price

More picture related to What Happens To Otm Call Options On Expiry

What Is Option Chain ITM OTM ATM Explained DIGITALGKAA A Small

https://1.bp.blogspot.com/-_YiBu6RKjc0/YOFn0fVKqEI/AAAAAAAAAWA/L1WOmwCXKKgLrNLJQj1pnw8h4nWNCD56wCLcBGAsYHQ/s16000/Digitalgkaa.png

What Is The Max Profit On A Credit Spread Leia Aqui What Is Max Risk

https://images.ctfassets.net/fomw95h5b4ty/5EdLnQxYEjrePndfUYvBoN/b9a6a7275f22d553f8439083820aac29/Email_Light-Mode-2x.gif.gif

What Is ITM And OTM In Options In Hindi ITM Vs OTM Vs ATM

https://i.ytimg.com/vi/-G0x_FVXAH0/maxresdefault.jpg

Out Of The Money OTM Out of the money OTM is term used to describe a call option with a strike price that is higher than the market price of the underlying asset or a put option with a Fair enough Solution 1 Never get down to options expiration with in the money options Be proactive with your trades Solution 2 Close out the in the money option completely This may be difficult into options expiration as the liquidity will dry up and you will be forced to take a worse price

The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14 A deep OTM call option typically features a delta of 0 1 to 0 2 and an expiration date that is roughly to a year from the current date A one year timeline gives the underlying security more time to reach its fair value price or strike price and therefore result in a profitable trade Assuming a trader holds a deep OTM call option until

Options Expiration What Happens When Options Expire Tastylive

https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt02fd0c5584c0a3cf/63878e954005df1070b03de0/options_expiration_ITM-OTM-Put-at-Expiration-nl.png?format=pjpg&auto=webp&quality=50

What Happens When You Trade In ATM OTM Options On Expiry Day

https://www.marketcalls.in/wp-content/uploads/2021/09/image-1.png

What Happens To Otm Call Options On Expiry - A call option provides the buyer the right but not the obligation to buy the underlying stock at the pre set strike price before the option s expiry Call options are considered out of the money