What Does A Payroll Tax Manager Do What does a Payroll Tax Manager do Tax managers are primarily responsible for accurately preparing and filing state and federal tax documents In addition tax managers develop tax strategies and policies that help the client or business maintain compliance with local and federal tax laws and regulations Lastly tax managers work to identify

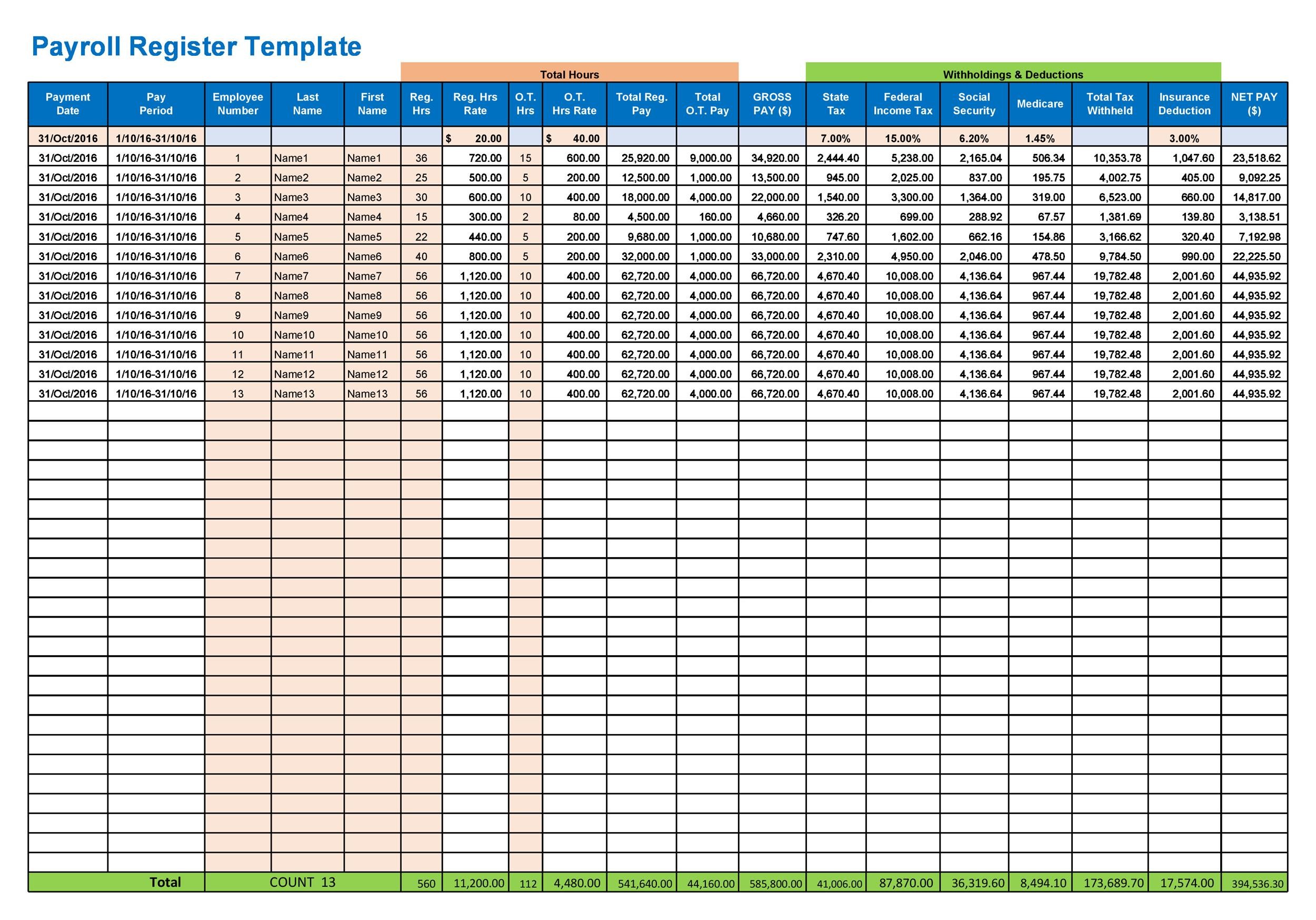

A payroll manager is a business finance and human resources professional who handles all aspects of preparing and distributing employees payments This includes maintaining payroll records calculating taxes balancing payroll accounts and overseeing other members of the payroll staff A payroll manager s job responsibilities typically What you ll do Duties responsibilities Oversee all aspects of the payroll process ensuring accurate and timely payment of employees Manage and train payroll staff Ensure compliance with federal state and local wage and hour laws Administer and maintain payroll systems and software

What Does A Payroll Tax Manager Do

What Does A Payroll Tax Manager Do

https://razorpay.com/blog-content/uploads/2020/09/Payroll_In_India_Steps_02.png

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

What Does The New Payroll Tax Mean For Connecticut Employees

https://s.hdnux.com/photos/74/37/41/15857732/3/1200x0.jpg

Desired experience for payroll tax manager includes Works hand in hand with Payroll Lead to ensure continuity of service delivery Participate in cross departmental initiatives to ensure proper consideration of tax impacting changes Address complex tax questions received via case from Employee Service Center What Does a Payroll Tax Manager Do The payroll tax manager offers input into an organization s payroll tax policies standards He she is primarily in charge of the company s adherence to all payroll related local state federal and other applicable foreign tax laws and procedures

A Payroll Manager is a pivotal professional within the finance or human resources department of an organization responsible for overseeing the entire payroll process to ensure employees are paid accurately and on time This role involves a blend of accounting expertise and regulatory knowledge as the manager ensures compliance with tax laws All you have to do is process payroll each period and the rest is done for you Payroll software can be extremely affordable costing from 40 per month plus 10 or less per employee With all of

More picture related to What Does A Payroll Tax Manager Do

The Benefits Of Using A Payroll Service AllBusiness

https://www.allbusiness.com/asset/2018/10/Payroll.jpg

What Are Payroll Taxes Types Employer Obligations More

https://www.patriotsoftware.com/wp-content/uploads/2019/12/payroll-tax-rate-2019-1-scaled.jpg

Indiana Paycheck Taxes

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Payroll is the sum total of all compensation a business must pay to its employees for a set period of time or on a given date It is usually managed by the accounting department of a business Payroll tax is a tax that an employer withholds and pays on behalf of his employees The payroll tax is based on the wage or salary of the employee In most countries including the United States

Payroll Managers are responsible for managing payroll systems preparing payroll reports and ensuring compliance with tax laws and regulations They also have to stay up to date with changes in payroll laws and regulations and ensure that their organization is adhering to them By Ana Bentes January 17 2024 Payroll taxes definition Payroll taxes employment taxes refer to the taxes business owners pay and withhold from their employees salaries The government uses this money to fund social insurance programs such as Social Security Medicare and unemployment benefits

How Payroll Software Manages HR Functions Of A Business Effectively

https://www.million.my/wp-content/uploads/2018/01/Payroll.jpg

Payroll Tax Withholding Everything That You Need To Know Human Resource

https://humanresource.com/wp-content/uploads/2022/09/What-is-a-Payroll-Tax-Withholding-1.jpg

What Does A Payroll Tax Manager Do - What Does a Payroll Tax Manager Do The payroll tax manager offers input into an organization s payroll tax policies standards He she is primarily in charge of the company s adherence to all payroll related local state federal and other applicable foreign tax laws and procedures