What Are The Main Purposes Of Cost Accounting Cost accounting is the process of tracking analyzing and summarizing all fixed and variable input costs related to the production of a product acquisition of goods for sale or the delivery of a service These include material and labor costs as well as operating costs associated with a product or service

Cost accounting is an accounting method that aims to capture a company s costs of production by assessing the input costs of each step of production as well as fixed costs such as depreciation of Cost accounting is a type of managerial accounting that focuses on the cost structure of a business It assigns costs to products services processes projects and related activities Through

What Are The Main Purposes Of Cost Accounting

What Are The Main Purposes Of Cost Accounting

https://commerceiets.com/wp-content/uploads/2019/11/Slide8-1.jpg

Solution Manual For Cost Accounting A Managerial Emphasis 14th Edition

https://image.isu.pub/200808084812-9ecba3fd544d8961577bf98c171a5bfa/jpg/page_1.jpg

Articles Of Incorporation Sample Of Purposes From SEC Bookkeeping And

https://i.pinimg.com/originals/93/00/fa/9300fa0302c6efccdacab9fa3fccef1e.png

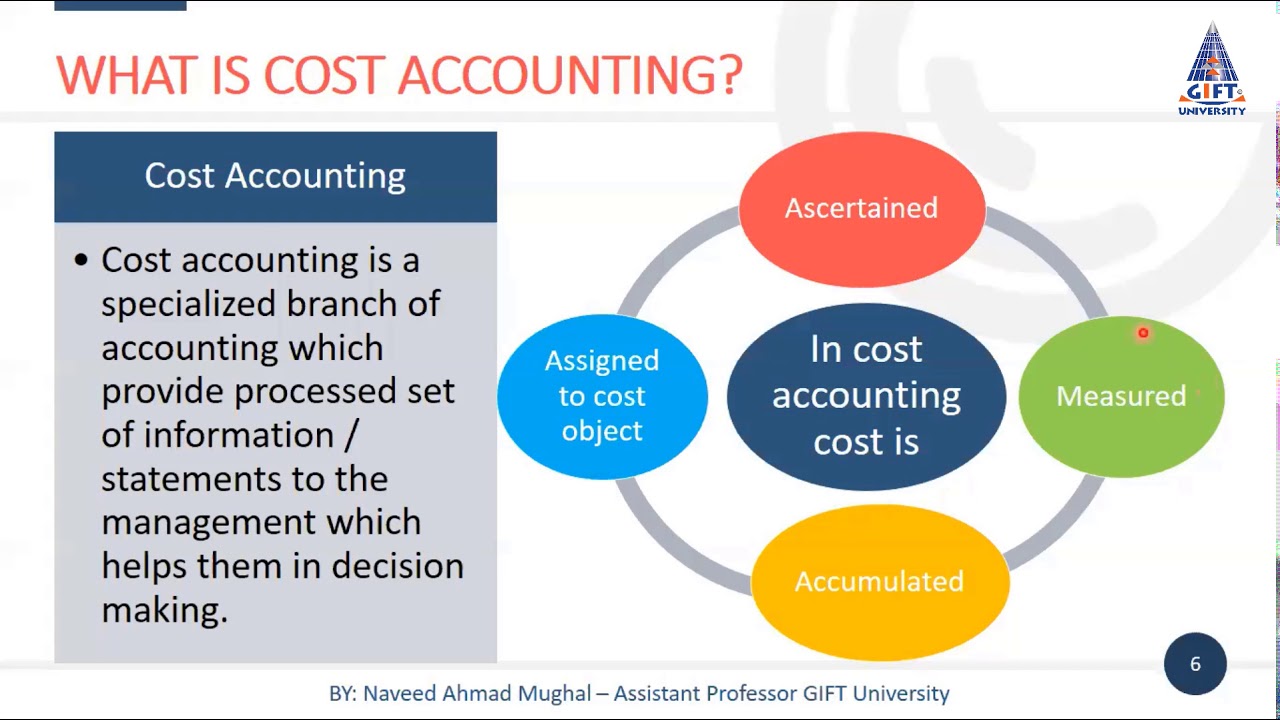

Cost accounting is a form of managerial accounting that aims to record analyze and report the costs associated with running an organization or project It involves tracking expenses such as labor materials administration costs and other related overhead to provide accurate financial information for decision making Cost accounting is a financial discipline that systematically tracks analyzes and manages a business s costs It categorizes costs as direct related to production and indirect overhead aiding in budgeting pricing and decision making Cost accountants provide valuable insights by evaluating expenses helping businesses streamline

Activity Center A pool of activity costs associated with particular processes and used in activity based costing ABC systems Each activity center is separately identified and can be assigned Marginal cost accounting is an accounting method that examines the relationship between the level of production costs and expenses It focuses on economies of scale and the additional cost of each new unit of production This costing method is more useful for short term decisions as it focuses on variable costs

More picture related to What Are The Main Purposes Of Cost Accounting

Introduction To Cost Accounting Need For Cost Accounting ScholarsZilla

https://scholarsclasses.com/blog/wp-content/uploads/2021/06/Introduction-to-Cost-Accounting.png

Cost Accounting And Control System

https://1.bp.blogspot.com/-dF7cwH2l-ik/YFM0Jr8tqqI/AAAAAAAADyI/lQWJrX35GKESAZuAhpZGBV0D09CFjow9ACLcBGAsYHQ/s1200/9780333346402.jpg

What Is Cost Accounting YouTube

https://i.ytimg.com/vi/8f6vYfwV7_E/maxresdefault.jpg

Definition and Purpose Cost accounting refers to the process of recording classifying analyzing and summarizing costs associated with the production or service provision Its primary purpose is to provide detailed information for decision making cost control and performance evaluation Importance in Business Management In the business Cost Accounting is a term used in management accounting to track and analyze the costs incurred in the production process of goods or services It involves collecting recording and analyzing various types of costs to provide valuable information for decision making purposes The main goal of Cost Accounting is to determine the true cost of

1 Controlling costs Cost accounting helps the management foresee the cost price and selling price of a product or a service which helps them formulate business policies With cost value as a reference the management can come up with techniques to control costs with an aim to achieve maximum profitability 2 Each of these methods is used by different types of companies or for various purposes For example lean cost accounting is ideal for manufacturing businesses that are implementing other lean

Kubin Company s Relevant Range Of Production Is 25 000 To 33 500 Units

https://us-static.z-dn.net/files/d94/1cf9748ccdb9441a95fcf22377498c46.png

For Financial Reporting Purposes The Total Amount Of Product Costs

https://us-static.z-dn.net/files/d1f/b6f198168d956fc9525da704c23d8677.png

What Are The Main Purposes Of Cost Accounting - Cost accounting is conducted through multiple procedures based on managerial decisions Here are the best types of cost accounting Direct cost accounting In the direct costing technique only variable costs are considered for cost accounting It does not include any fixed costs incurred by a company