What Account Is Salaries Payable Salaries payable is a type of entry in business accounting journals that describes how much a company owes their employees Accounting professionals or managers record salaries payable when they owe salary pay to their employees but haven t distributed the money yet

The money paid relates to a future accounting period It is presented as a current asset in the balance sheet as it is an advance payment made by the firm Journal Entry Being salary paid in advance prepaid salary adjusted at the end of the period Salary payable refers to the liability of the company towards its employees against the amount of salary of a period that became due but has not been paid yet to them by the company and it is shown in the balance of the company under the head liability

What Account Is Salaries Payable

What Account Is Salaries Payable

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/08/18221928/Wages-Payable-Journal-Entry-Debit-Credit.jpg

Accrued Salaries | Double Entry Bookkeeping

https://www.double-entry-bookkeeping.com/wp-content/uploads/accrued-salaries-accounting-equation.png

:max_bytes(150000):strip_icc()/accountspayable.asp-Final-3c648707e73b45699bd382aad4fc7bed.png)

Understanding Accounts Payable (AP) With Examples and How to Record AP

https://www.investopedia.com/thmb/NrKKNvXCCdc5IUmx5CCgKIBaO3c=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/accountspayable.asp-Final-3c648707e73b45699bd382aad4fc7bed.png

Definition Salary payable is the amount of liability or payment of the company towards its employees against the services provided by them but not yet paid at the end of the month year or for a specific period These amounts include the basic salary overtime bonus and Other allowance The Foundation of Salaries Payable is ACCRUAL BASED ACCOUNTING vs Cash Based Accounting I ll quickly summarize both of these for those of you who are new to the accounting world There are two ways in which a company can handle its Accounts Cash Accounting OR Accrual Accounting By far the more popular one is Accrual Based Accounting

Salaries payable definition The current liability account which reports the amount of salaries earned by a company s employees but which have not yet been paid by the company The term salary payable refers to the liability created to account for the number of salaries owed to the employees that are yet to be paid For example a company records the salary expense in its book immediately after determining the gross payroll but pays it off later creating a liability account known as salary payable Explanation

More picture related to What Account Is Salaries Payable

Salaries and Wages Payable (Introductory) - YouTube

https://i.ytimg.com/vi/MsczmIYJV24/maxresdefault.jpg

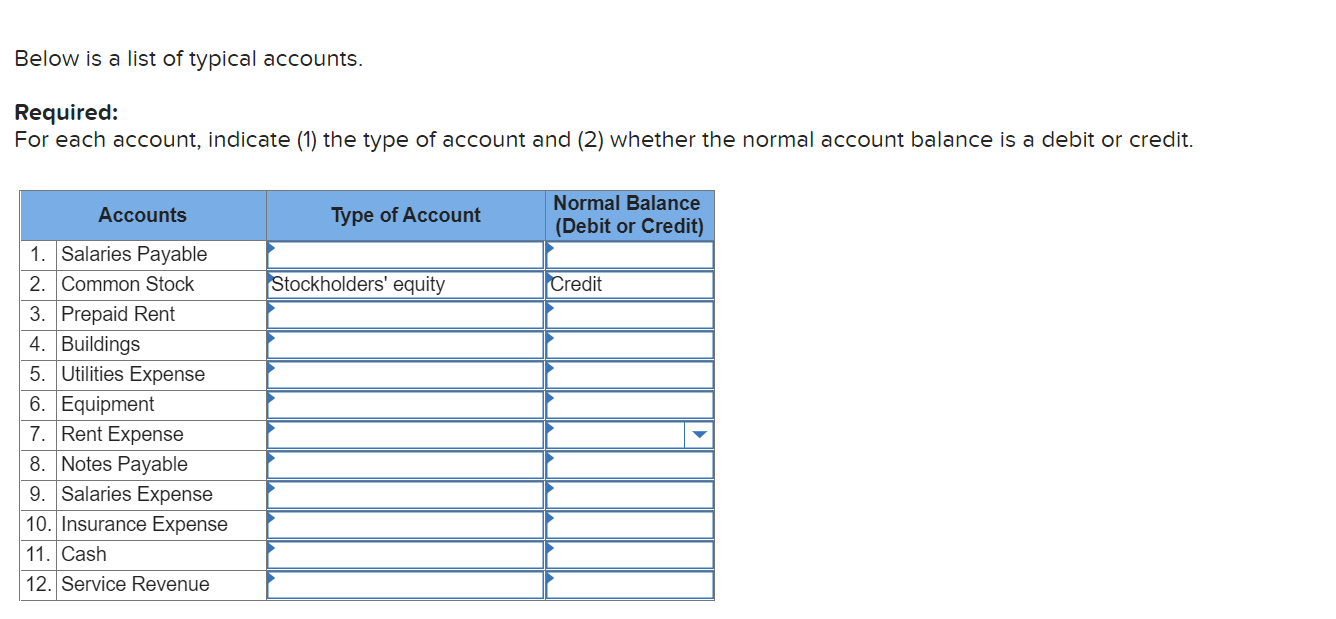

Solved Below is a list of typical accounts. Required: For | Chegg.com

https://media.cheggcdn.com/media/a9a/a9a31b03-a282-4e45-abac-fb3f837cc255/php0A0OlR

How to Pass Salary Payable Voucher in Tally

https://khatabook-assets.s3.amazonaws.com/media/post/2022-02-22_101952.7044220000.webp

Wages Payable or accrued wages represent the unmet payment obligations owed to employees remaining at the end of a reporting period On the balance sheet accrued wages are recognized as a current liability since they are near term cash outflows paid to employees that have earned the compensation yet have not been paid yet in cash to date Accounts payable AP are amounts due to vendors or suppliers for goods or services received that have not yet been paid for The sum of all outstanding amounts owed to vendors is shown as the

Salaries Payable is a liability account in accounting that represents the amounts owed to employees for services rendered but not yet paid It indicates the obligations a company has to its employees that will be settled in the future Key Takeaways Accrued expenses and accounts payable are two methods companies use to track accumulated expenses under accrual accounting Accrued expenses are liabilities that build up

Accrued Expenses vs. Accounts Payable | Definition + Differences

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/06231233/Accrued-Expenses-vs-Accounts-Payable-scaled.jpg

How to Create Salary, PF, ESI, NPS, PF Admin Expenses Payable Ledgers in TallyPrime (Payroll) | TallyHelp

https://help.tallysolutions.com/wp-content/uploads/2020/08/creating-salary-payable-ledger-tally-1.gif

What Account Is Salaries Payable - The term salary payable refers to the liability created to account for the number of salaries owed to the employees that are yet to be paid For example a company records the salary expense in its book immediately after determining the gross payroll but pays it off later creating a liability account known as salary payable Explanation