Wage Attachment Vs Garnishment A wage attachment also called a wage garnishment is the process of deducting money from an employee s pay as the result of a court order or action by an authorized agency Common examples of debt that result in attachments include The wage garnishment amount will be based on the number of exemptions claimed The employee has seven

With a wage garnishment sometimes called a wage attachment your employer holds back some of your wages and gives them directly to the creditor Some creditors like the IRS get special treatment and can garnish your wages without a court judgment Federal and state laws limit how much can be garnished A wage garnishment or wage attachment is an order issued by a court or a government agency that directs your employer to deduct a certain amount of money from your paycheck and send it to a creditor Usually a creditor must have a judgment against you before it can garnish your wages There are a few exceptions to this though

Wage Attachment Vs Garnishment

Wage Attachment Vs Garnishment

https://news.blr.com/app/uploads/sites/3/2019/02/Wage-Garnishment-02.jpg

Is Wage Garnishment Allowed In Texas Law Office Of Maria Lowry

https://www.lowryfamilylaw.com/wp-content/uploads/2020/08/WageGarnish_01.jpg

How Do I Stop A Wage Garnishment Immediately Symmes Law Group

https://www.bankruptcy-law-seattle.com/wp-content/uploads/2015/11/Garnished-Wages.jpg

What if the employee has a wage attachment in place and another agency issues a garnishment The DOR wage attachment has priority over any subsequent garnishments except for past due child support You must continue withholding wages for the wage attachment Contact the other agency for their guidelines when there is an existing wage attachment The difference between garnishment and a levy is where the creditor can collect the money With a garnishment your employer withholds a portion of your paycheck and pays it to the creditor With a levy also called an attachment the bank freezes your account and the creditor can withdraw any future deposits

A wage garnishment sometimes called a wage attachment is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors Different garnishment rules apply to different types of debt And there are legal limits on how much of your paycheck can be garnished A wage garnishment also known as a wage attachment is a court order that directs an employer to deduct money from an employee s pay This money is then sent to the creditor that sought a judgment against the employee Wage garnishments are often used for back child support and credit card judgments

More picture related to Wage Attachment Vs Garnishment

Wage Garnishment Vs Income Deduction Order What You Need To Know

https://myirsteam.weebly.com/uploads/7/4/3/5/74358861/wage-garnishment_orig.jpg

Garnishment Free Of Charge Creative Commons Tablet Dictionary Image

https://www.thebluediamondgallery.com/dictionary/garnishment.jpg

Request For Wage Garnishment Form Fill Online Printable Fillable

https://www.pdffiller.com/preview/495/562/495562670/large.png

A wage attachment also known by the term wage garnishment happens when there is a court order requiring an employer to use attach some portion of an employee s wages to some other purpose such as repaying a debt or paying child support When an employer receives an order for wage attachment garnishment the employer must comply Wage garnishment is a legal process where employers withhold a portion of an employee s paycheck to pay off a debt as required by a court order or government agency Typical reasons include child support alimony back taxes court judgments and student loans The employer is legally responsible for deducting the funds as directed by the

[desc-10] [desc-11]

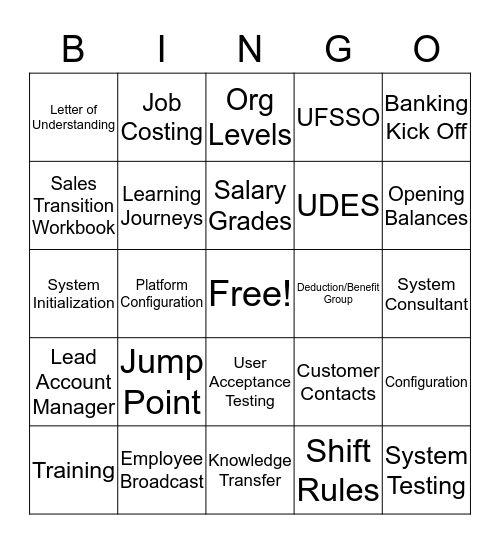

Launch BINGO Card

https://bingobaker.com/image/2303283/544/1/launch-bingo.png

Wage Attachment Earnings Rules In Payroll Management Tutorial 15 June

https://www.wisdomjobs.com/tutorials/garnishment-deductions-input-values.jpg

Wage Attachment Vs Garnishment - A wage garnishment sometimes called a wage attachment is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors Different garnishment rules apply to different types of debt And there are legal limits on how much of your paycheck can be garnished