Va State Payroll Tax Calculator Virginia Paycheck Calculator Use ADP s Virginia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Looking for managed Payroll and benefits for your business

In Virginia approximately 20 to 35 of your paycheck may go to taxes The taxes on your paycheck include federal income tax 10 to 37 state income tax 2 to 5 75 Social Security 6 2 Medicare 1 45 to 2 35 Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Virginia 2024 Virginia state payroll taxes With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive Tax rates range from 2 0 5 75 Since the top tax bracket begins at just 17 000 in taxable income per year most Virginia taxpayers will pay the top rate

Va State Payroll Tax Calculator

Va State Payroll Tax Calculator

https://www.patriotsoftware.com/wp-content/uploads/2022/08/Copy-of-Payroll-Taxes-in-California-835-×-986-px-1.png

How To Calculate Payroll Taxes Methods Examples More 2022

https://www.patriotsoftware.com/wp-content/uploads/2022/01/2022-Publication-15-T-1-1.png

How To Calculate Payroll Taxes 2021 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/calculate-payroll-taxes-income-tax-brackets-chart-inforgraphic-us.png

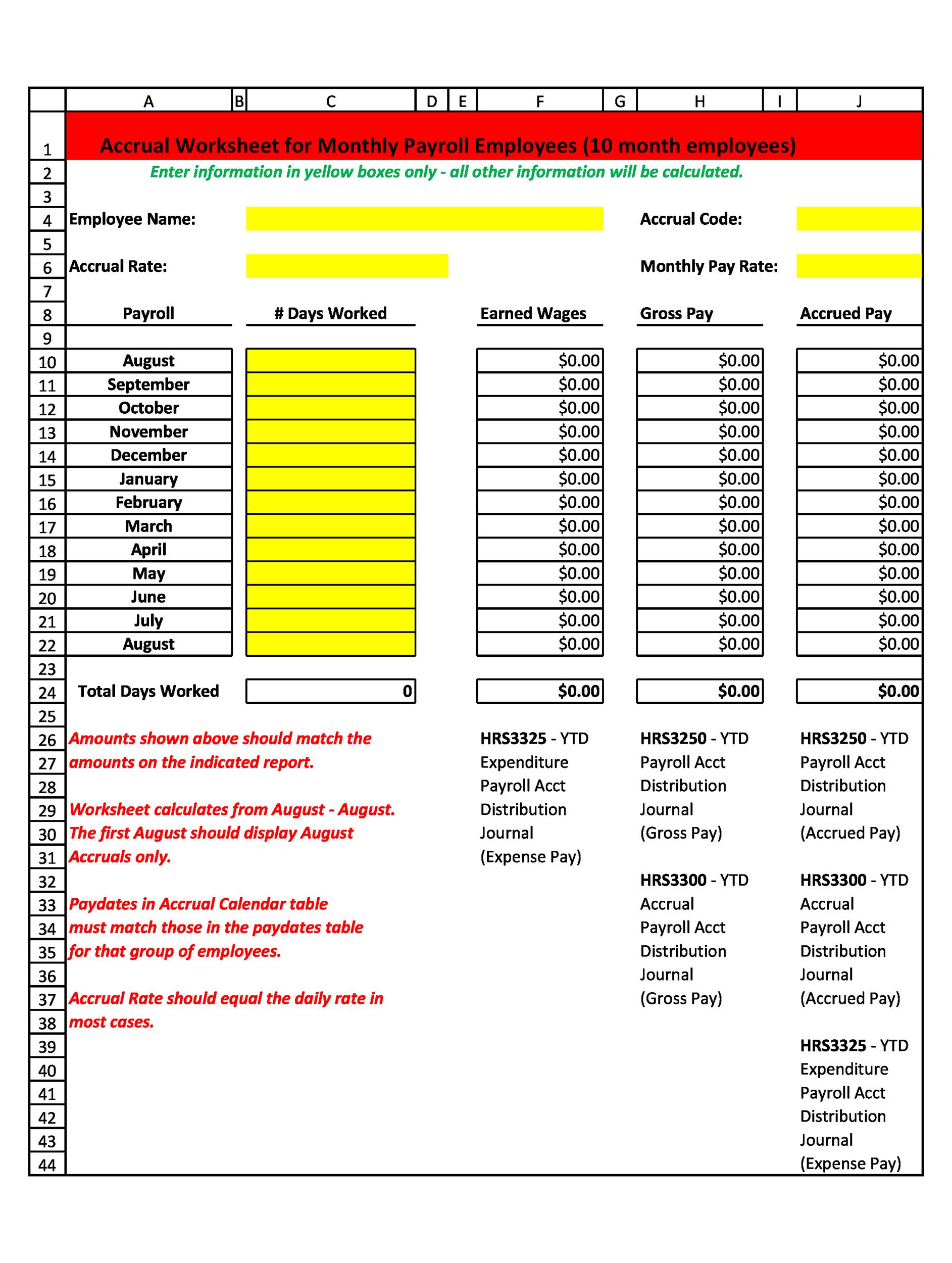

For assistance contact us at 804 367 8037 Once you register for a household employer s withholding tax account you must file a Form VA 6H for each year that you keep the account open even if you have no tax to report Failure to file could result in penalties of up to 30 of the tax due How to File and Pay For example let s look at a salaried employee who is paid 52 000 per year If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay

SmartAsset s Virginia paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay To use our Virginia Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button After a few seconds you will be provided with a full breakdown of the tax you are paying This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs

More picture related to Va State Payroll Tax Calculator

Tax Withholding Calculator 2020 MarieBryanni

https://m.foolcdn.com/media/affiliates/images/PayrollTaxes-01-IRSWithholdingTable_7CWWk0h.width-750.png

Payroll Calculator Template Microsoft PDF Template

https://templatelab.com/wp-content/uploads/2018/03/payroll-template-25.jpg

Hoeveel Betaalt Een Werkgever Aan Loonbelasting Loonbelasting UAC Blog

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Use our free hourly paycheck calculator to quickly run payroll for your hourly employees in Virginia Explore VA 2023 State Tax Rates Because Virginia doesn t have any state law governing overtime pay the federal rules under the Fair Labor Standards Act apply Generally speaking hourly employees are to be paid time and a half for all Virginia Paycheck Calculator Payroll check calculator is updated for payroll year 2024 and new W4 It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employee s W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions

Paycheck Calculator Virginia Use PayCalculation s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and your average monthly expenses Population in 2023 8 631 393 Tax Rate Type Progressive Median Household Income 2023 80 963 Virginia paycheck calculator is a state with a progressive income tax system that has four tax brackets ranging from 2 to 5 75 per cent The tax bracket that you fall into is based on your income As the highest tax rate applies to earnings that exceed 17 000 the majority of Virginia taxpayers will end up paying the highest tax rate or at least a part of it

Employer Payroll Tax Calculator 2023 DiannaValerie

https://m.foolcdn.com/media/affiliates/images/PayrollTaxes-02-IRSWageBracket_3KgTJVb.width-750.png

Taxcaster 2021 Calculator Jasprinter

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/dod-pay-chart-2021-best-picture-of-chart-anyimage-org-1024x534.png

Va State Payroll Tax Calculator - FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024