Utah Overtime Pay Calculator Use ADP s Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP

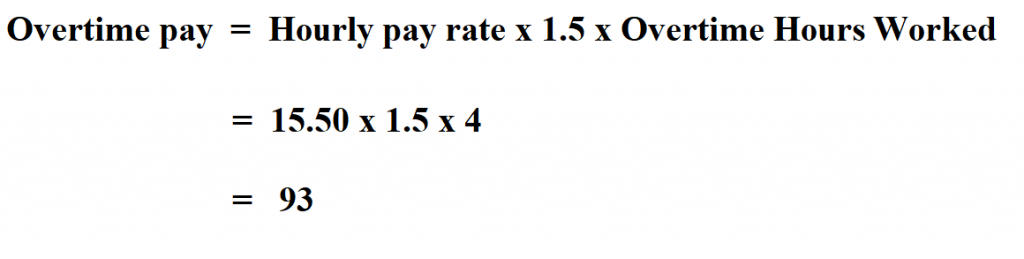

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total Overtime pay of 15 5 hours 1 5 OT rate 112 50 Wage for the day 120 112 50 232 50 Don t forget that this is the minimum figure as laid down by law An employer may choose a higher rate of overtime pay Some companies pay 2 5 times the standard rate for overtime and sometimes even more

Utah Overtime Pay Calculator

Utah Overtime Pay Calculator

https://www.fortmyerstipoff.com/wp-content/uploads/2021/11/DSC_4300-1024x663.jpg

How To Calculate Overtime Pay

https://www.learntocalculate.com/wp-content/uploads/2020/05/overtime-pay-2-1024x259.png

Calculate Overtime Pay For Monthly Rated Employee Singapore Classifieds

https://classifieds.singaporeexpats.com/data/21/1666771347overtime_calculator_singapore_sgEuTWq.jpg

Utah s payment frequencies are monthly quarterly annually Utah minimum wage In 2023 the minimum wage in Utah is 7 25 per hour for Utah overtime pay Because Utah doesn t have any state law governing overtime pay the federal rules under the Fair Labor Standards Act apply Generally speaking hourly employees are to be paid time and To find this number Calculate the product of the overtime monthly hours and the pay multiplier 10 1 5 15 Divide the result by your regular monthly hours 15 160 0 0938 To find your pay multiply the result by your monthly salary The result corresponds to 9 38 of that amount

This is the gross pay for the pay period before any deductions including wages tips bonuses etc You can calculate this from an annual salary by dividing the annual salary by the number of pay For any wages above 200 000 there is an Additional Medicare Tax of 0 9 which brings the rate to 2 35 Employers have to pay a matching 1 45 of Medicare tax but only the employee is responsible for paying the 0 9 Additional Medicare Tax Calculate the FUTA Unemployment Tax which is 6 of the first 7 000 of each employee s taxable

More picture related to Utah Overtime Pay Calculator

Child Labor Laws In North Dakota 2022 Minimum Wage

http://www.minimum-wage.org/img/state_seals/north-dakota.svg

Yearly Salary Calculator With Overtime BindertLahela

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/calculate-overtime-pay-infographic-us.jpg

Gianna Kneepkens Leads Utah To Overtime Win At California 80 75 YouTube

https://i.ytimg.com/vi/t1lglnx8U6E/maxresdefault.jpg

You can use this calculator to determine your pre tax earnings at an hourly wage earning job in Utah This calculator can determine overtime wages as well as calculate the total earnings for tipped employees regular time 0 0 hours 7 25 0 00 overtime 0 0 hours 7 25 0 00 Paycheck Calculator Utah Use PayCalculation s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and your average monthly expenses 3 310 770 Tax Rate Type Flat

Before we dive into how to calculate overtime pay in Utah let s first define what it is Overtime pay or time and a half is the extra amount of money an employee receives for working more than 40 hours per week This means that for every hour worked over 40 hours in a workweek the employee is entitled to receive one and a half times their Utah s Overtime Minimum Wage Overtime pay also called time and a half pay is one and a half times an employee s normal hourly wage Therefore Utah s overtime minimum wage is 10 88 per hour one and a half times the regular Utah minimum wage of 7 25 per hour If you earn more then the Utah minimum wage rate you are entitled to at least

Mom Overtime Pay Calculator ElsieMaeAihla

https://i.pinimg.com/originals/d4/7b/8a/d47b8a37339c51a0fa4e109d64ee28dc.jpg

Donovan Mitchell Ejected Rips Officials After Overtime Loss To 76ers

https://www.si.com/.image/t_share/MTc5MzUzOTc4MjA1NjQ0NDgz/donovan-mitchell.jpg

Utah Overtime Pay Calculator - For any wages above 200 000 there is an Additional Medicare Tax of 0 9 which brings the rate to 2 35 Employers have to pay a matching 1 45 of Medicare tax but only the employee is responsible for paying the 0 9 Additional Medicare Tax Calculate the FUTA Unemployment Tax which is 6 of the first 7 000 of each employee s taxable