Tips Adjustment Treasury Inflation Protected Securities TIPS Treasury inflation protected securities TIPS refer to a treasury security that is indexed to inflation in order to protect investors from the

TIPS explained TIPS are a type of Treasury security whose principal value is indexed to inflation When inflation rises the TIPS principal value is adjusted up If there s deflation then the principal value is adjusted lower Like traditional Treasuries TIPS are backed by the full faith and credit of the U S government Because they adjust for inflation TIPS interest rates tend to be much smaller than non TIPS bonds For instance if bonds are yielding 3 inflation is only 2 and TIPS interest is 0 5 you

Tips Adjustment

Tips Adjustment

https://affinity.help/photo2/shared/adjustment_normals_after.jpg

How To Use The Targeted Adjustment Tool F64 Academy

https://f64academy.com/~f64academy/wp-content/uploads/2017/03/Targted-Adjustenet-Tool.gif

HSL Adjustment

https://affinity.help/publisher/shared/adjustment_hsl_before.jpg

Treasury inflation protected securities TIPS offer inflation protection appealing to investors when rising inflation is a concern Unlike traditional bonds TIPS adjust principal and interest To illustrate assume a 1 000 U S TIPS was purchased with a 3 coupon also assume inflation during the first year was 10 If this were the case the face value of the TIPS would adjust upward

Treasury Inflation Protected Securities or TIPS are inflation protected bonds IPBs that are issued by the U S Treasury Their face value is pegged to the CPI and adjusted in step with changes in the rate of inflation The Treasury then pays interest on the adjusted face value of the bond creating a gradually rising stream of interest When you look up the Index Ratio for your TIPS you see it is 1 01165 Multiplying your 1 000 by 1 01165 you get your adjusted principal 1 011 65 For this six month payment you get half of 0 125 your annual interest rate which is 0 0625 Turn the percent into a decimal by moving the decimal point 2 places to the left 0 000625

More picture related to Tips Adjustment

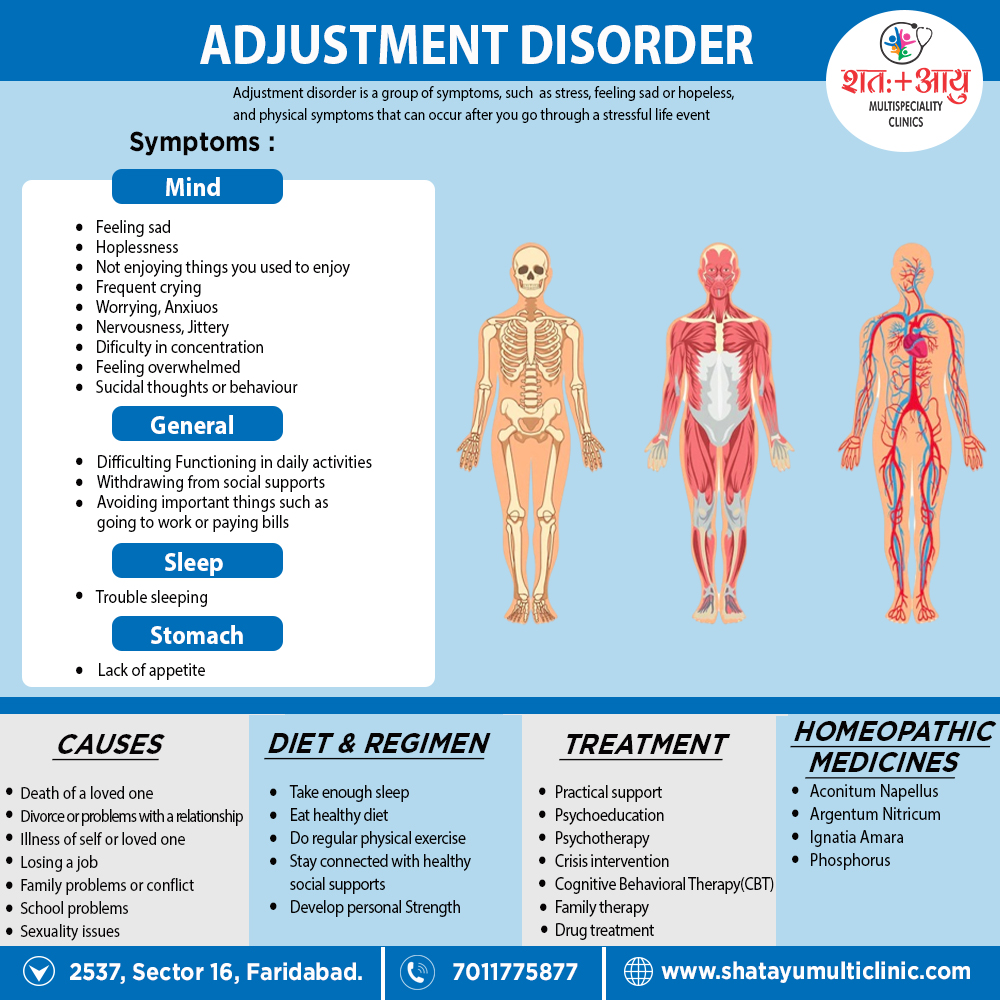

Adjustment Disorder SHATAYU MULTI SPECIALITY CLINIC

https://shatayumulticlinic.com/wp-content/uploads/2022/10/Poster-12-Adjusmment-disorder.jpg

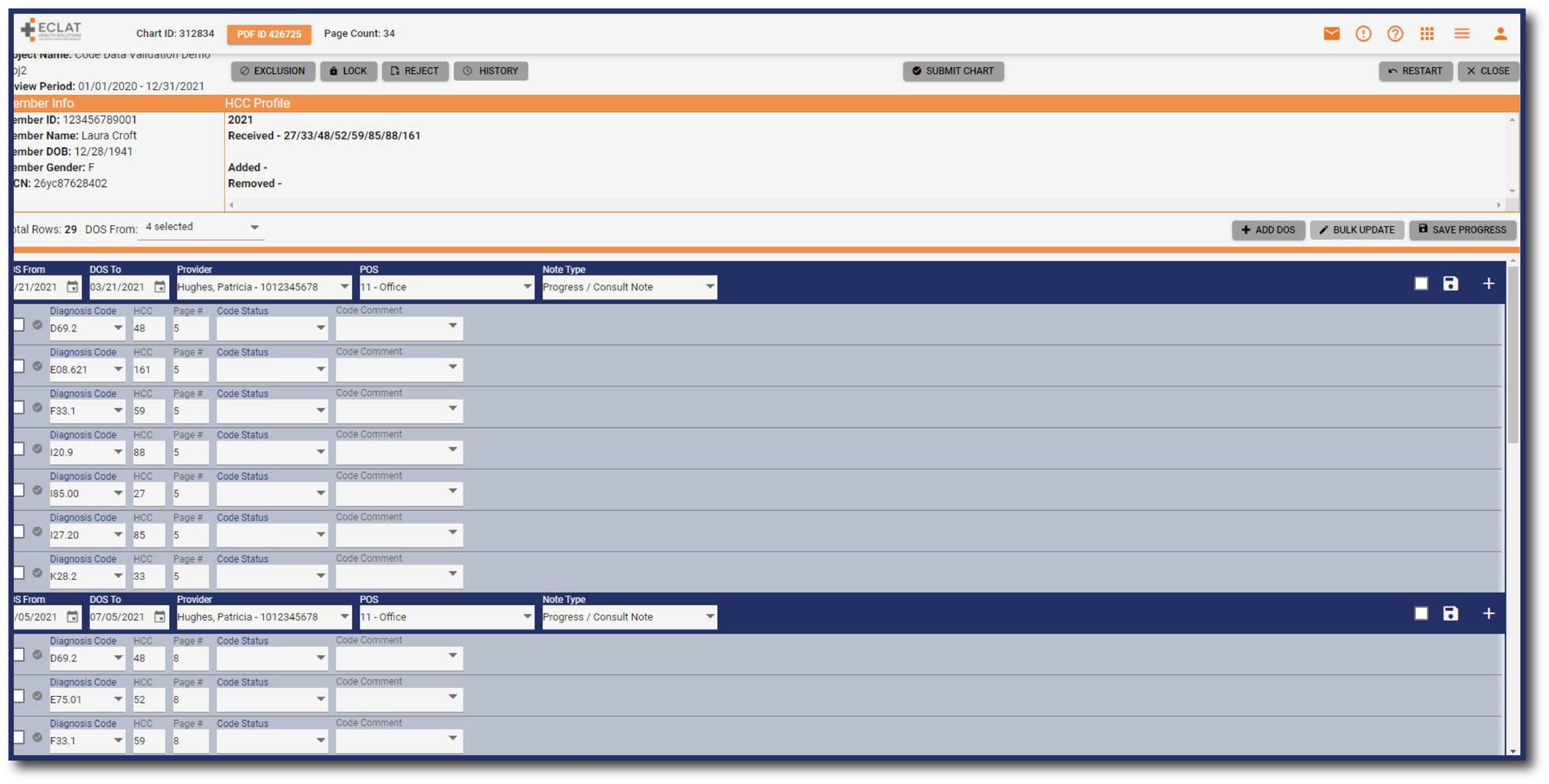

Risk Adjustment Solutions

https://www.eclathealth.com/hubfs/ECLAT-Risk-Adjustment-SaaS-Platform.png

Adjustment Disorder Christel Clear Gems

https://www.banyantreatmentcenter.com/wp-content/uploads/2022/10/Adjustment-Disorder.png

TIPS short for Treasury Inflation Protected Securities are a kind of U S government bond that can help safeguard your wealth from inflation TIPS are indexed to inflation so as prices Because the TIPS index ratio won t adjust for that information for three months the market price of TIPS will likely increase by 0 1 This can distort the measure of real yield on TIPS especially for shorter maturity TIPS In our example a 0 1 increase in price will cause the yield of a 10 year TIPS to decrease by 1 basis point 0 1

TIPS are bonds issued by the US Treasury with maturities of five 10 or 30 years They pay a fixed rate of interest every six months but the amount of interest varies based on any changes in the To help reduce the risk that inflation poses to bondholders the US Treasury created Treasury Inflation Protected Securities TIPS in 1997 These are bonds whose principal and interest payments are designed to rise when inflation does A year later the Treasury launched Series I savings bonds a savings account like product that also offers

Adjustment PDF

https://imgv2-2-f.scribdassets.com/img/document/678962222/original/e9b5a929b6/1704344527?v=1

Adjustment PDF

https://imgv2-1-f.scribdassets.com/img/document/442484735/original/ea837055f7/1704904431?v=1

Tips Adjustment - To illustrate assume a 1 000 U S TIPS was purchased with a 3 coupon also assume inflation during the first year was 10 If this were the case the face value of the TIPS would adjust upward