Texas State Employee Salary Calculator Use ADP s Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

Texas Salary Paycheck Calculator Calculate your Texas net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator Switch to hourly calculator Texas paycheck FAQs Texas payroll State Date State Texas Change state Check Date Texas Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re an

Texas State Employee Salary Calculator

Texas State Employee Salary Calculator

https://assets-global.website-files.com/61cda68a44d8582ffab97e14/63454a3d62712975315c427c_Payroll%20calculator.jpg

Calculation of Federal Employment Taxes | Payroll Services

https://payroll.utexas.edu/sites/default/files/W4%20WH%20Tables%202021.png

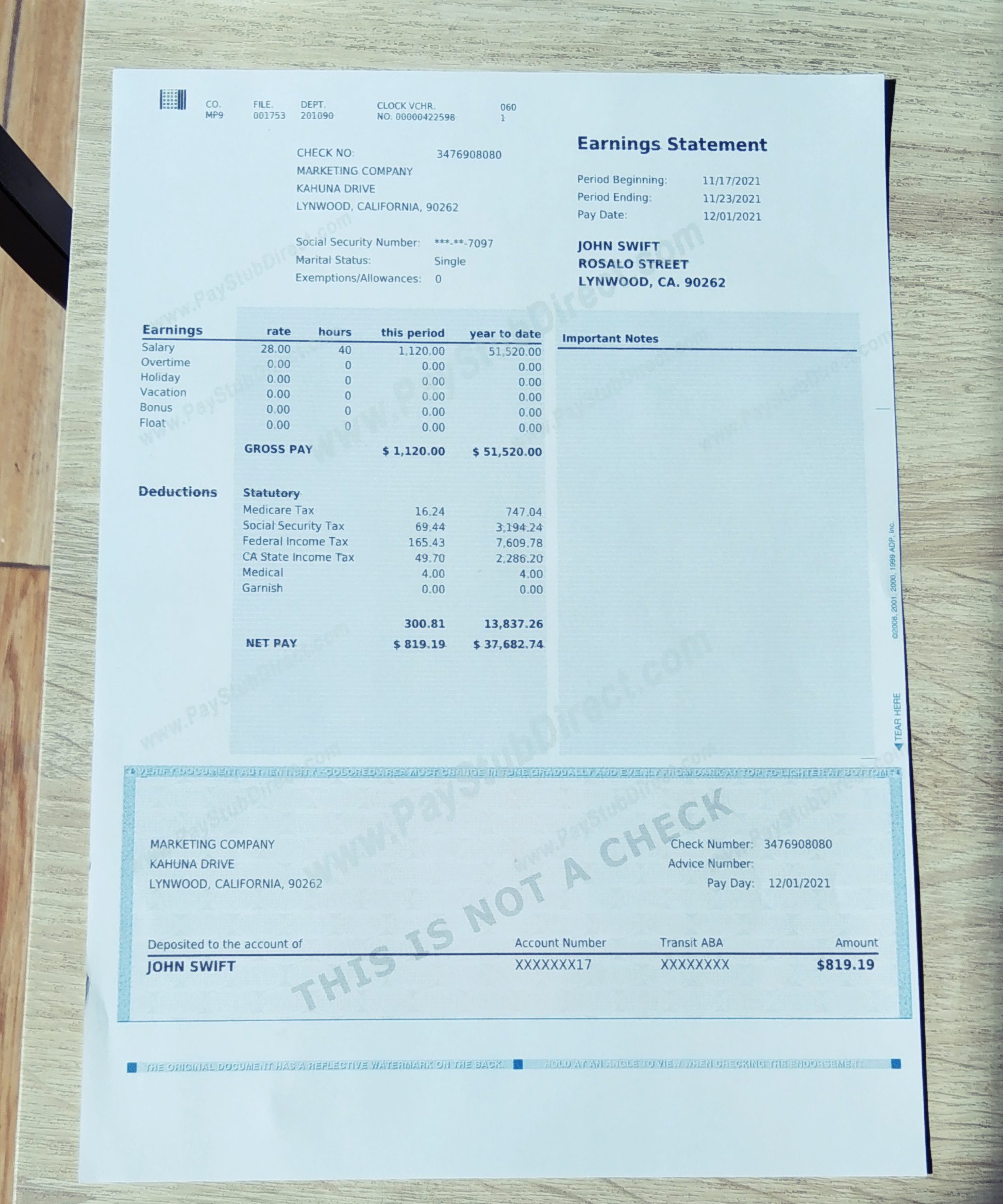

Texas Pay Stub Generator - Create pay stubs with Taxes

https://static.paystubdirect.com/uploads/2021/12/portra.jpg

Use Gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in Texas We ll do the math for you all you need to do is enter the applicable information on salary federal and state W 4s deductions and benefits Paid by the hour Switch to hourly Salaried Employee Use Texas Paycheck Calculator to estimate net or take home pay for salaried employees Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest State Where are you employed Salary How much do you get paid annual Salary frequency How often are you paid

1 Enter personal details Input any employee s first and last name Then select the primary state they work in 2 Payment information Type in the employee s payroll schedule hourly wage or salary pay type hours worked if applicable and pay date 3 Additional pay Take note of any financial benefits like bonuses or commissions 4 Enter your gross salary pay frequency and other relevant details to calculate your net income after all state and federal taxes To effectively use the Texas Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly

More picture related to Texas State Employee Salary Calculator

Paycheck Calculator for $100,000 Salary: What Is My Take-Home Pay?

https://i.insider.com/5e613c58fee23d33111dd372?width=1000&format=jpeg&auto=webp

Salary Calculator | Employee Salary Calculator Tool

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt38c9e4ab285f1a20/5c79cab920191ed64d3836a0/[email protected]

Salary Paycheck Calculator: How do you calculate your take home pay | Marca

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/09/08/16626250197666.jpg

Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2024 tax year on Feb 14 2024 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s Texas Paycheck Calculator Payroll check calculator is updated for payroll year 2024 and new W4 It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employee s W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions

FUTA is an annual tax an employer pays on the first 7 000 of each employee s wages The FUTA rate for 2023 is 6 0 but many employers are able to pay less for instance up to 5 4 each year due to tax credits Most employers will pay this tax annually with Form 940 To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Texas Salary Paycheck Calculator | Gusto

https://prod.gusto-assets.com/wp-content/uploads/Hiring-and-onboarding%402x.png

Indeed Salary Calculator - Indeed.com

https://www.indeed.com/career/salary-calculator/v3/static/images/personalized-pay-range-4e4efc.svg

Texas State Employee Salary Calculator - Use Texas Paycheck Calculator to estimate net or take home pay for salaried employees Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest State Where are you employed Salary How much do you get paid annual Salary frequency How often are you paid