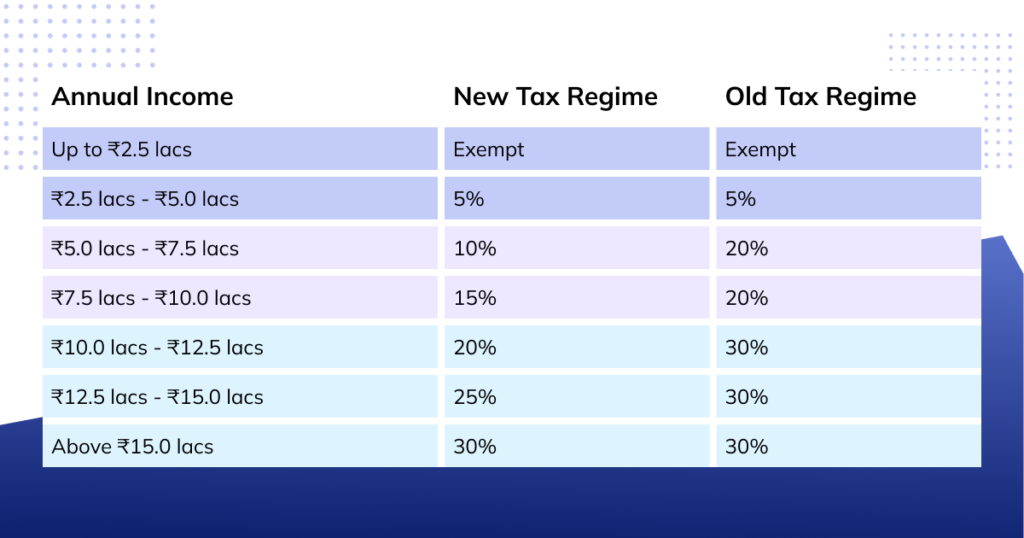

Tax For 80 000 Salary Per Month Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the U S sign in home financial households and 30 000 for married couples filing jointly for the tax year 2025 have the opportunity for a bigger paycheck by working over 40 hours per week

This income tax calculation for an individual earning a 80 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance US Salary Tax Calculation for 2025 Tax Year based on annual salary of 80 000 00 California You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher Here s how that works for a single person with taxable income of 58 000 per year 2024 tax rates for other filers Find the current tax rates for other filing statuses

Tax For 80 000 Salary Per Month

Tax For 80 000 Salary Per Month

https://i.ytimg.com/vi/dieGbkfnt1Q/maxresdefault.jpg

80000 Korean Won In Euro Deep Sale Www bharatagritech

https://steamdb.info/static/img/blog/101/table.png

Payslip Template And Employee s Salary Slip In Malaysia 50 OFF

https://www.hrcabin.com/wp-content/uploads/2021/05/Salary-slip-format-in-Excel-free-download.png

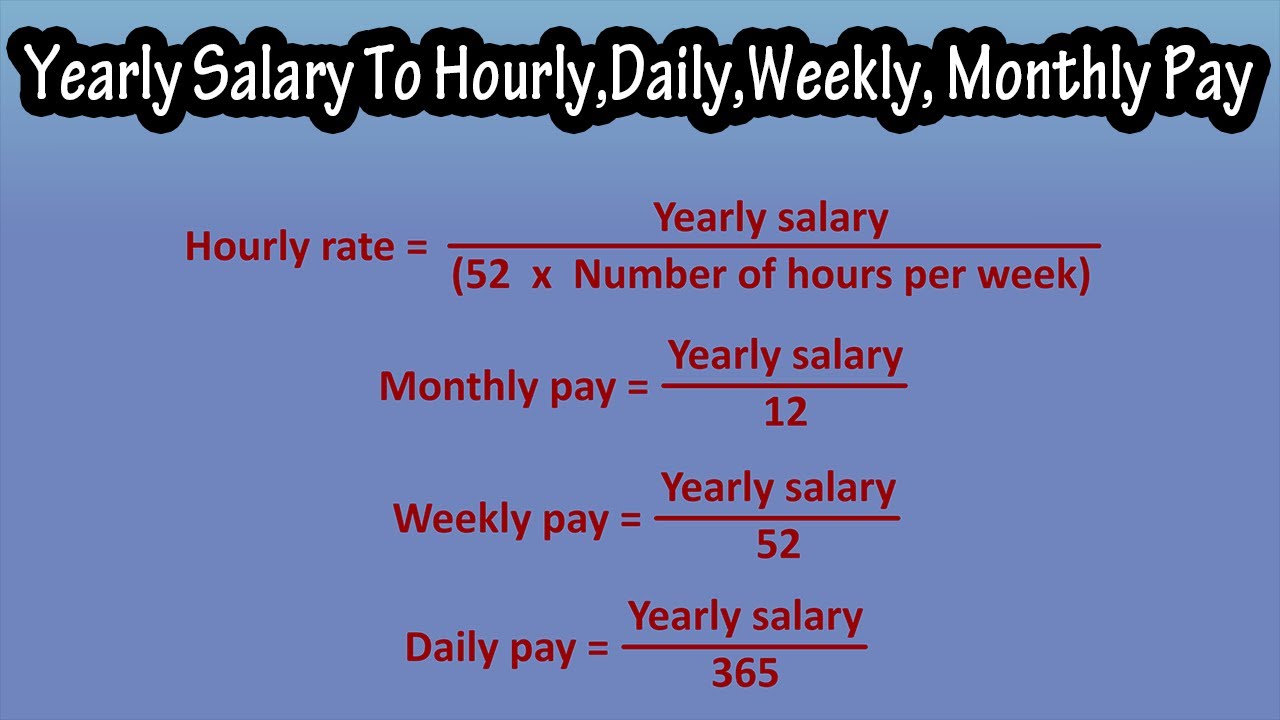

When analyzing a 80 000 a year after tax salary the associated hourly earnings can be calculated Take home NET hourly income 27 5 assuming a 40 hour work week To answer 80 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 27 5 The average annual salary in the United States is 72 280 translating to approximately 4 715 per month after taxes and contributions though the exact amount depends on where you live Since salaries can vary significantly across states we have compiled the average annual salary for each state in the table below along with the monthly take home pay estimated by our calculator

Starting with your salary of 40 000 your standard deduction of 14 600 is deducted the personal exemption of 4 050 is eliminated for 2018 2025 This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 When you are looking at the federal tax brackets you are able to determine which tax rate applies to you for the current tax season which allows you to go on and determine how much tax you will be paying based on your income Each year federal tax rates are changed meaning that each year the tax you pay will most likely differ from the previous year

More picture related to Tax For 80 000 Salary Per Month

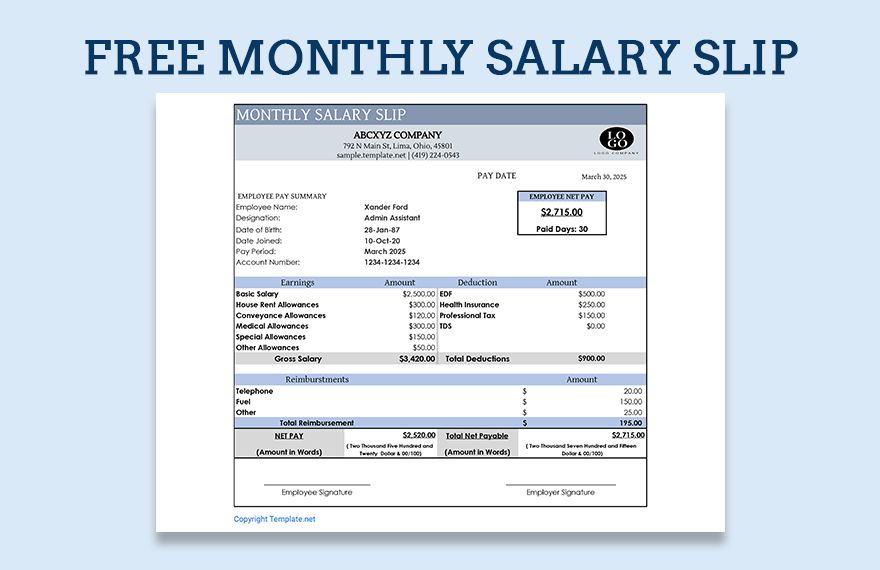

Free Monthly Salary Slip Google Sheets Excel Template

https://images.template.net/129074/monthly-salary-slip-gkv5f.png

Apply For Loan Landlordindia

https://landlordindia.com/wp-content/uploads/2023/07/imageedit_1_5779090026.jpg

Kaizer Chiefs Coach Salary Best Sale Emergencydentistry

http://www.thesouthafrican.com/wp-content/uploads/2023/03/Zwane.jpeg

The result is that the FICA taxes you pay are still only 6 2 for Social Security and 1 45 for Medicare How Your Paycheck Works Deductions 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi weekly 26 paychecks per year How to Calculate Tax Medicare and Social Security on a 80000 Salary in the US Assuming you earn a salary of 80 000 per year living in Illinois you will be required to pay a tax amount of 20 448 This includes your Federal Tax amount of 10 368 State Income Tax of 3 960 contribution towards Social Security of 4 960 and Medicare deduction of 1 160

[desc-10] [desc-11]

Sharif Atkins American Actor Age Height Wife Net Worth Trendgyan

https://trendgyan.com/wp-content/uploads/2021/12/Sharif-Atkins-American-Actor-Age-Height-Wife-Net-Worth.jpg

Taxes 2025 Estimator Salary Lisa P Becker

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Tax For 80 000 Salary Per Month - [desc-13]