State Of Vermont Income Tax Rate The Vermont income tax has four tax brackets with a maximum marginal income tax of 8 75 as of 2024 Detailed Vermont state income tax rates and brackets are available on this page Tax Rates The 2023 2024 Tax Resource

Vermont s tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes For the 2022 tax year the income tax in Vermont has a top rate of 8 75 which places it as one of the highest rates in the U S Vermont Income Tax Calculator 2022 2023 If you make 70 000 a year living in Vermont you will be taxed 10 751 Your average tax rate is 11 67 and your marginal tax rate is 22 This marginal

State Of Vermont Income Tax Rate

State Of Vermont Income Tax Rate

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/11/GettyImages-827345628-TXSTVT-e1543442832666.jpg

Vt Income Tax Rate INCOMUNTA

https://i2.wp.com/vermontbiz.com/files/corporate_income_tax_rates_2014_tax_foundation.png

Vermont Income Tax Forms Katlyn Goulet

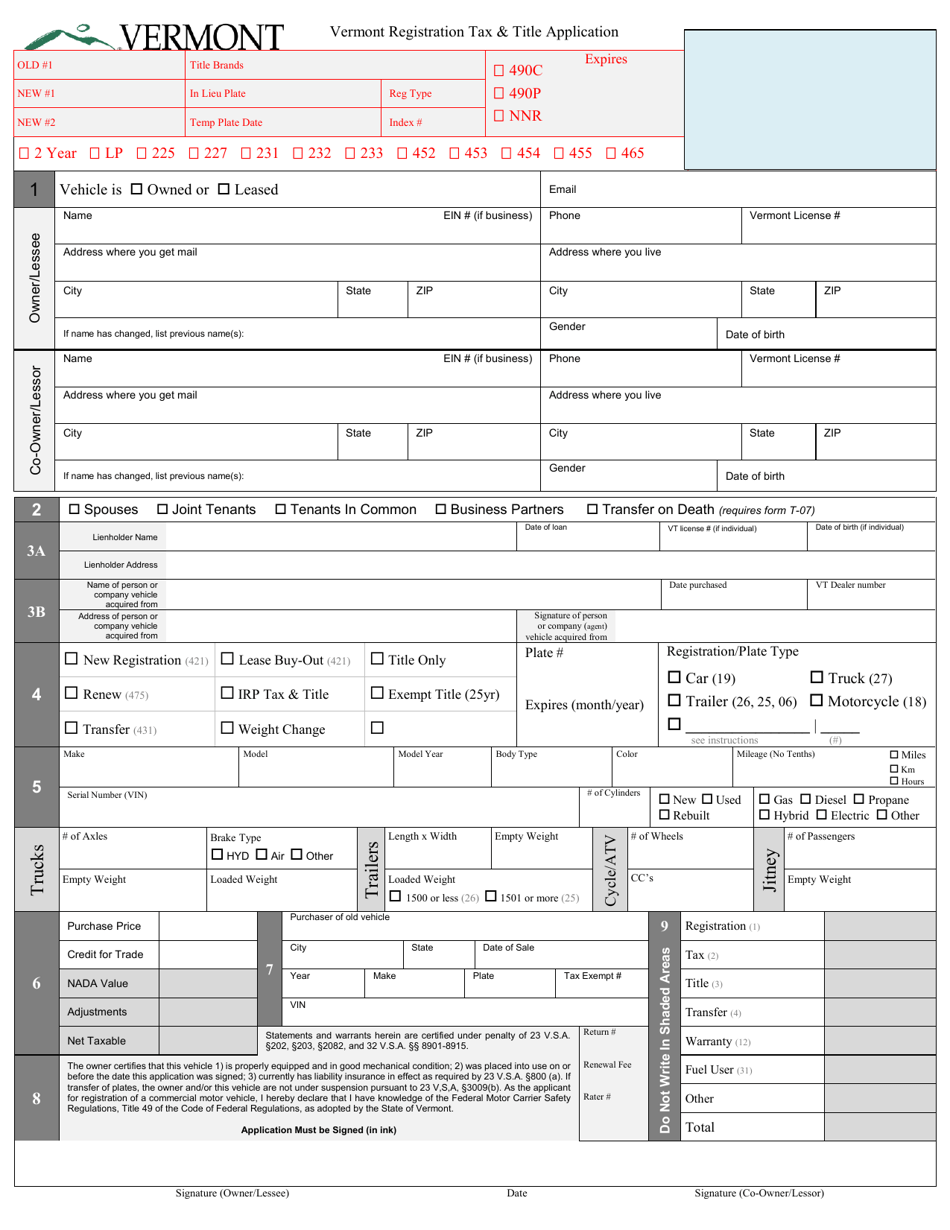

https://data.templateroller.com/pdf_docs_html/2100/21004/2100439/form-vd-119-vermont-registration-tax-title-application-vermont_print_big.png

Understand and comply with their state tax obligations Free File Offers November 30 2023 Commissioner of Taxes Releases FY2025 Education Tax Rate Letter October 4 2023 Vermont Homestead Declaration Property Tax Credit and Renter Credit Claim Deadlines are October 16 2023 April 12 2023 April 18 Vermont Personal Income Tax and State Rates And Tax Brackets Vermont state income tax rate table for the 2023 2024 filing season has four income tax brackets with VT tax rates of 3 35 6 6 7 6 and 8 75 2023 Vermont tax brackets and rates for all four VT filing statuses are shown in the table below

Vermont s state sales tax rate is 6 Localities can add up to 1 in additional sales taxes However the average combined sales tax rate in Vermont is 6 359 according to the Tax Foundation Vermont also has a graduated corporate income tax with rates ranging from 6 00 percent to 8 5 percent Vermont has a 6 00 percent state sales tax rate a max local sales tax rate of 1 00 percent and an average combined state and local sales tax rate of 6 30 percent Vermont s tax system ranks 44th overall on our 2023 State Business Tax

More picture related to State Of Vermont Income Tax Rate

Vermont Income Tax Rate 2021 Elvia Thurman

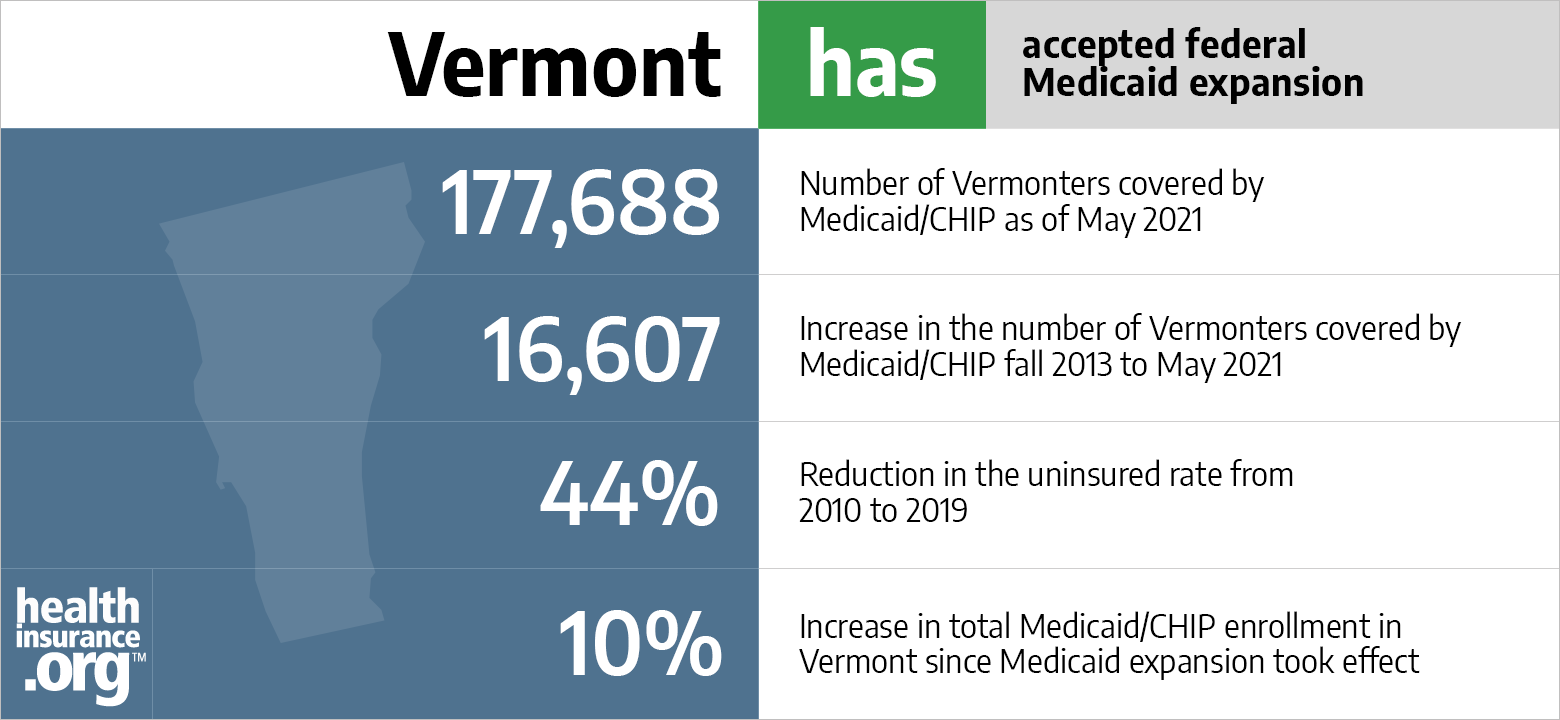

https://www.healthinsurance.org/wp-content/uploads/2020/10/2021-vermont-medicaid-expansion.png

What Is The State Income Tax Rate In Vermont DTAXC

https://i.pinimg.com/originals/be/02/87/be028745b5ebb170b7031bf606029532.jpg

Vermont Income Tax Rate 2021 Elvia Thurman

https://www.hrblock.com/tax-center/wp-content/uploads/2020/02/VermontTIC-V2-1280x720.jpg

Vermont State Income Tax Tables in 2021 As you navigate through the tax information for 2021 on this page it s important to note that Vermont does not impose its own income tax Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 10 Income from 000 00 to 19 900 00 12 Income from 19 900 01 Vermont State Income Tax Tables in 2023 As you navigate through the tax information for 2023 on this page it s important to note that Vermont does not impose its own income tax Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 10 Income from 000 00 to 22 000 00 12 Income from 22 000 01

Vermont s 2024 income tax ranges from 3 35 to 8 75 This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator Income tax tables and other tax information is sourced from the Vermont Department of Taxes The state income tax rate in Vermont is progressive and ranges from 3 35 to 8 75 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate

Vermont Income Tax Rate 2021 Elvia Thurman

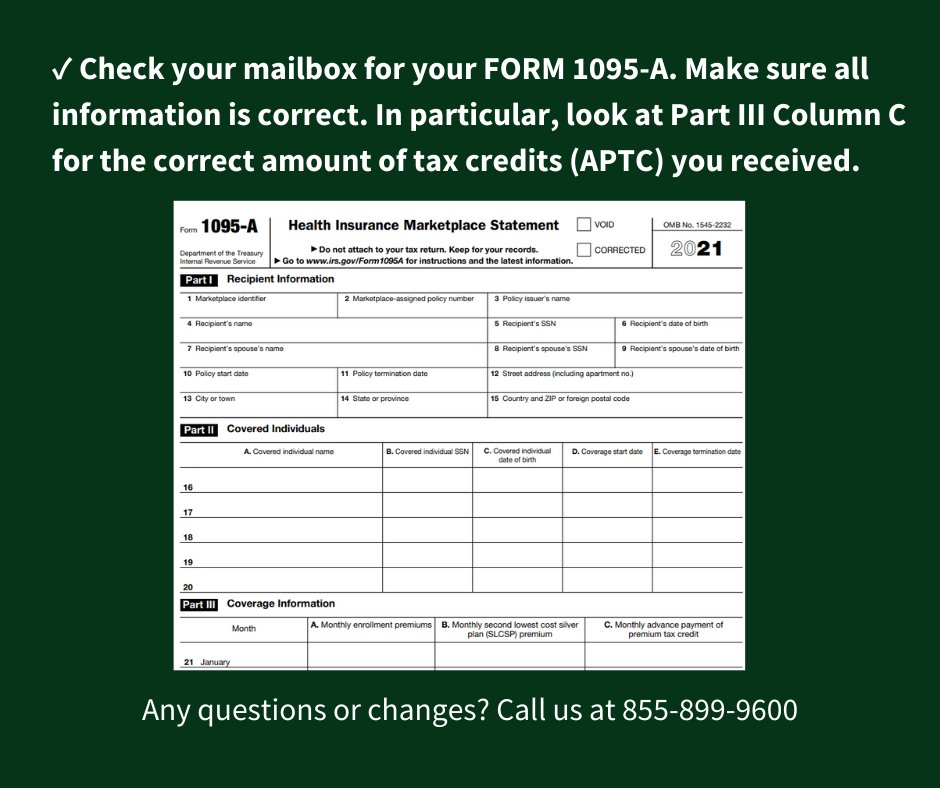

https://pbs.twimg.com/media/FLpQptbWUAo0bc2.jpg

Vermont s Effective Income Tax Rate Dropped In 2010 Public Assets

https://publicassets.org/wp-content/uploads/2012/12/F1-IB1203.jpg

State Of Vermont Income Tax Rate - Vermont also has a graduated corporate income tax with rates ranging from 6 00 percent to 8 5 percent Vermont has a 6 00 percent state sales tax rate a max local sales tax rate of 1 00 percent and an average combined state and local sales tax rate of 6 30 percent Vermont s tax system ranks 44th overall on our 2023 State Business Tax