State Of Vermont Income Tax Forms Understand and comply with their state tax obligations Free File Offers Where s My Refund File or Pay Online Schedule an Appointment Compliance Corner Tax Forms and Instructions November 30 2023 Property Tax Credit and Renter Credit Claim Deadlines are October 16 2023 April 12 2023 April 18 Vermont Personal Income Tax and

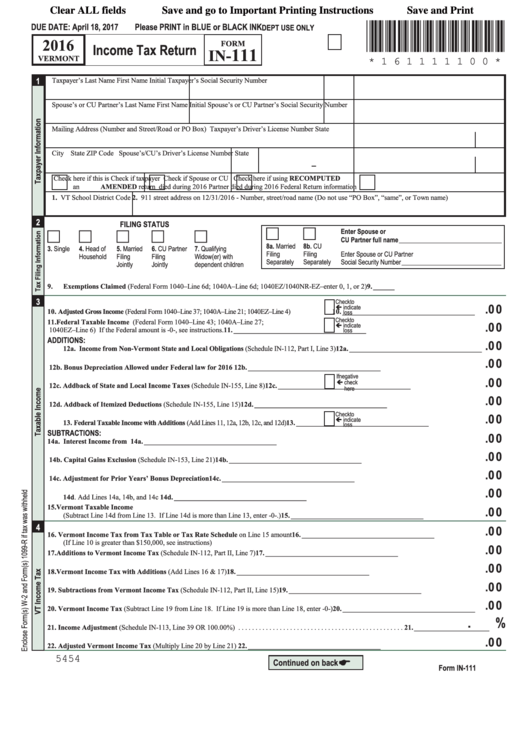

Vermont has a state income tax that ranges between 3 35 and 8 75 which is administered by the Vermont Department of Taxes TaxFormFinder provides printable PDF copies of 52 current Vermont income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 41 At tax vermont gov The following forms are not included in this booklet 17 IN 1 Vermont Credit for Income Tax Paid to Other State or Canadian Province 19 IN 1 Vermont Tax Adjustments and Nonrefundable Credits IN 153 Vermont Capital Gains Exclusion IN 151 Application for Extension of Time to File Form IN 111

State Of Vermont Income Tax Forms

State Of Vermont Income Tax Forms

https://tax.vermont.gov/sites/tax/files/images/slides_fullwidth/fullimg feature 28.9.jpg

Vermont Income Tax Forms Katlyn Goulet

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/11/GettyImages-827345628-TXSTVT-e1543442832666.jpg

Vermont Income Tax Forms Katlyn Goulet

https://data.templateroller.com/pdf_docs_html/2100/21004/2100439/form-vd-119-vermont-registration-tax-title-application-vermont_print_big.png

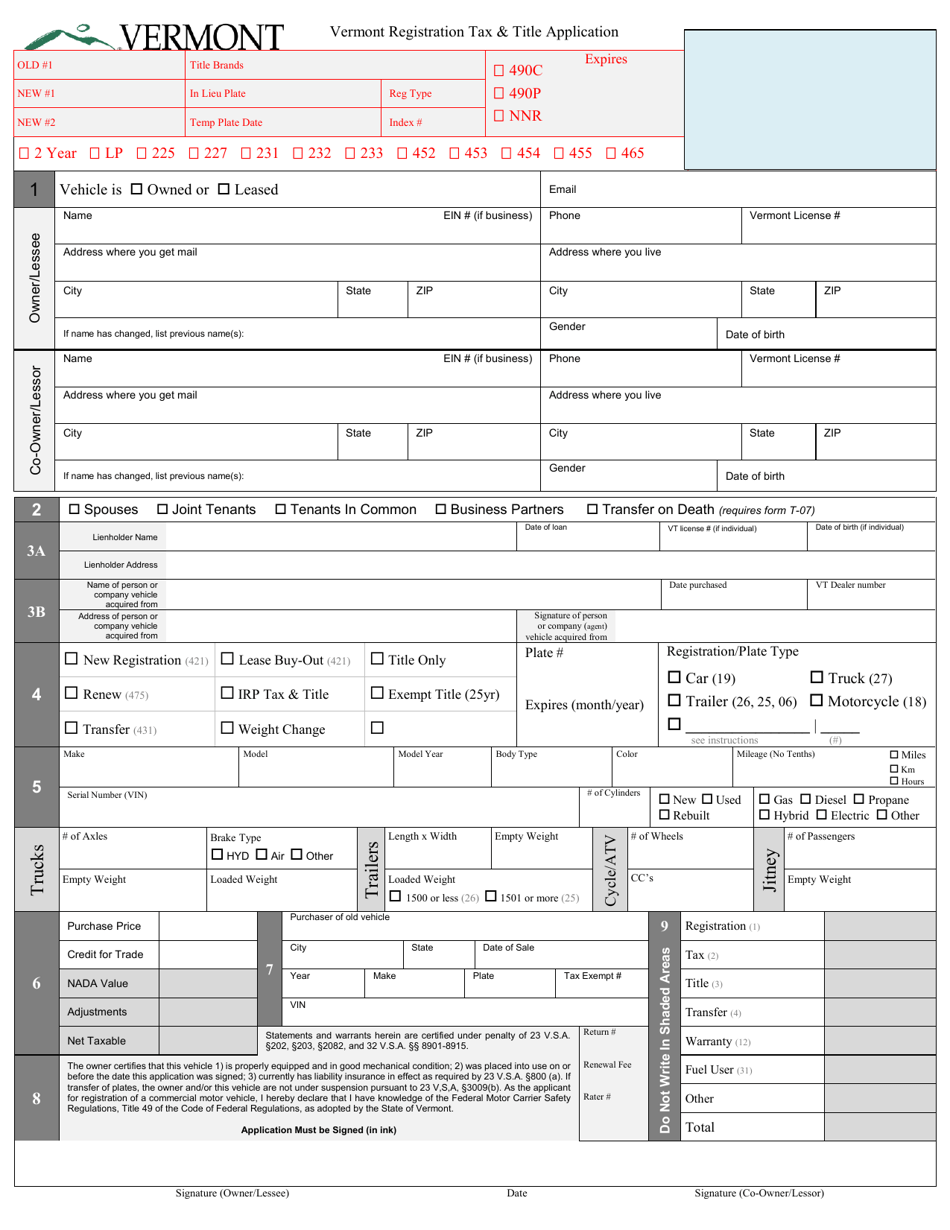

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone 802 828 2301 Toll Free 800 642 3191 PUBLIC INFORMATION REQUESTS TO Ashlynn Doyon at treasurers office vermont gov Click Here For Public Records Database They also must send them to the IRS and Vermont Department of Taxes You must file your federal Form 1040 U S Individual Income Tax Return and your state Form IN 111 Vermont Income Tax Return along with any necessary schedules by the April 15 due date If the 15th falls on a weekend or holiday it moves to the next weekday

Find out at www myfreetaxes tax vermont gov 2022 Form IN 111 Instructions Page 2 of 19 General Instructions Requirement to File a Vermont Income Tax Return A 2022 Vermont Income Tax Return must be filed by all full year or part year Vermont residents or a nonresident if you are required to file a 2022 federal income tax return AND You Income Tax Forms For Vermont Forms That You Can e File and Forms you Can Fill Out here on eFile Prepare Now IN 111 Vermont Individual Income State Tax Form 2023 eFileIT IN 116 Vermont Income Tax Payment Voucher 2023 FileIT IN 151 Vermont Application for Extension of Time to File 2023

More picture related to State Of Vermont Income Tax Forms

Vermont Tax Forms 2019 Printable State VT IN 111 Form And VT IN 111

https://www.incometaxpro.net/images/forms/state/2018-vermont-tax-forms.jpg

Vermont Tax Forms And Instructions For 2022 Form IN 111

https://www.incometaxpro.net/images/forms/2022/vermont-tax-forms.png

Fillable Form In 111 Vermont Income Tax Return 2016 Printable Pdf

https://data.formsbank.com/pdf_docs_html/286/2863/286398/page_1_thumb_big.png

Call Vermont Health Connect at 1 855 899 9600 or use the Request for Reconsideration Form within 30 days of receiving the notice Fill out the form and mail it to Vermont Health Connect 280 State Drive NOB1 South Waterbury Vermont 05671 8100 If you have concerns or questions about the decision call the office of the Health Care Advocate The credit is applied to your property tax and the town issues a bill for any balance due The 2023 property tax credit is based on 2022 household income and 2022 2023 property taxes To make a claim for property tax credit file Form HS 122 and form HI 144 with the Vermont Department of Taxes When to File

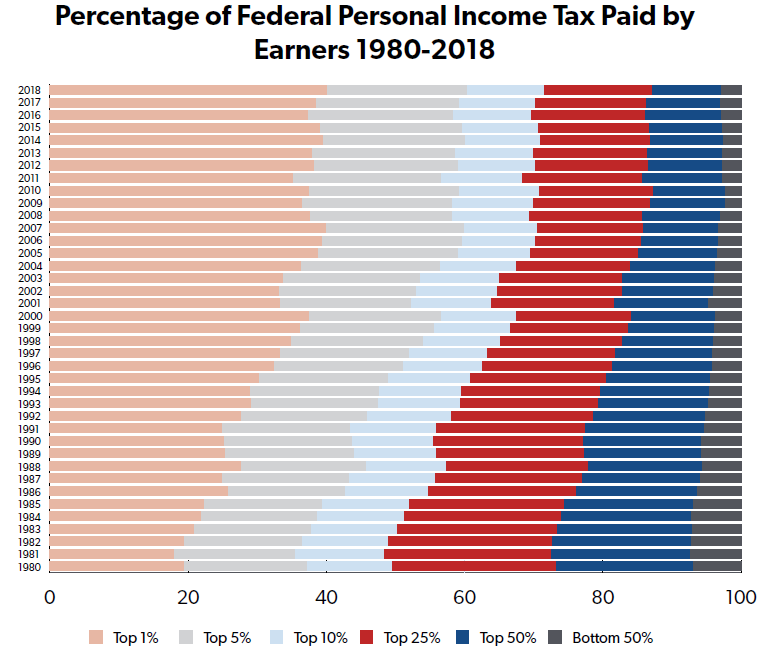

Vermont Tax Brackets for Tax Year 2023 As you can see your Vermont income is taxed at different rates within the given tax brackets Any income over 213 150 and 259 500 for Single Married Filing Jointly would be taxes at the rate of 8 75 Vermont s tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes For the 2022 tax year the income tax in Vermont has a top rate of 8 75 which places it as one of the highest rates in the U S

Vermont Income Tax Refund Hannelore Gamboa

https://www.ntu.org/Library/imglib/2020/12/WhoPays6.png

Vermont Income Tax Forms James Bourgeois

https://i.pinimg.com/originals/e8/ca/00/e8ca00b04f54434ad4211a1ac4008298.png

State Of Vermont Income Tax Forms - Find out at www myfreetaxes tax vermont gov 2022 Form IN 111 Instructions Page 2 of 19 General Instructions Requirement to File a Vermont Income Tax Return A 2022 Vermont Income Tax Return must be filed by all full year or part year Vermont residents or a nonresident if you are required to file a 2022 federal income tax return AND You