State Of Ri Income Tax Check the status of your state personal income tax refund Access this secure website to see if the Division of Taxation received your return and whether your refund was processed To view your refund status you will need the following information as shown on your return

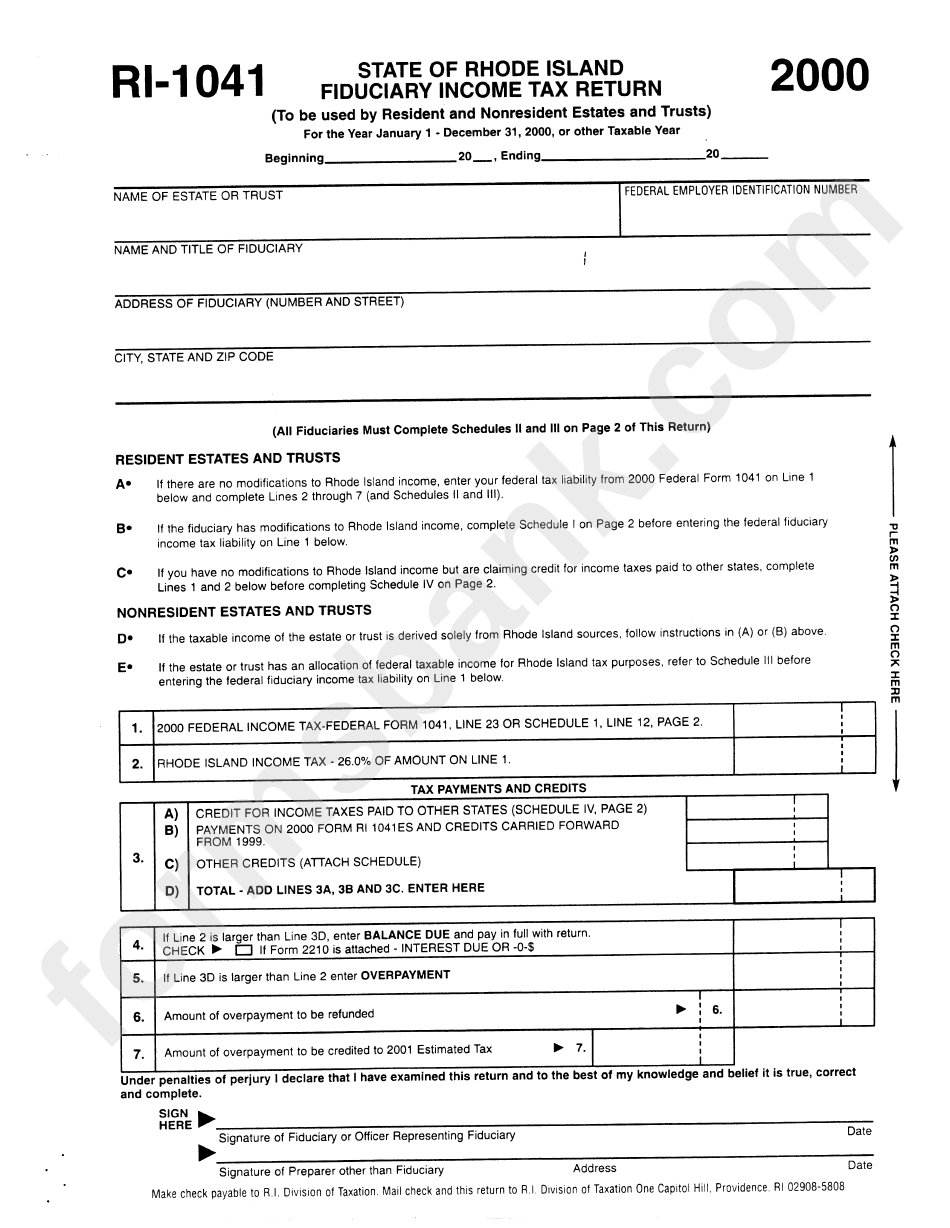

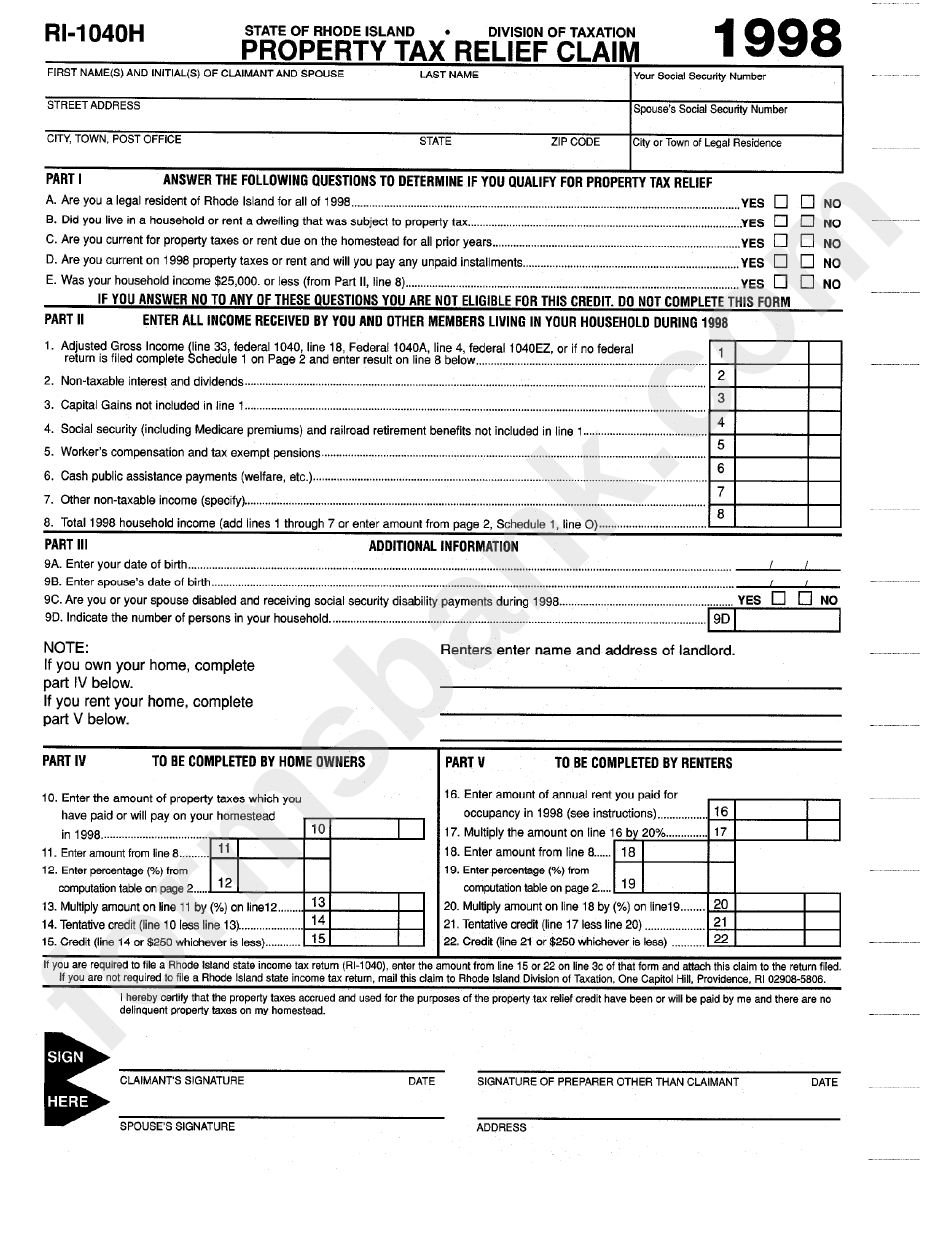

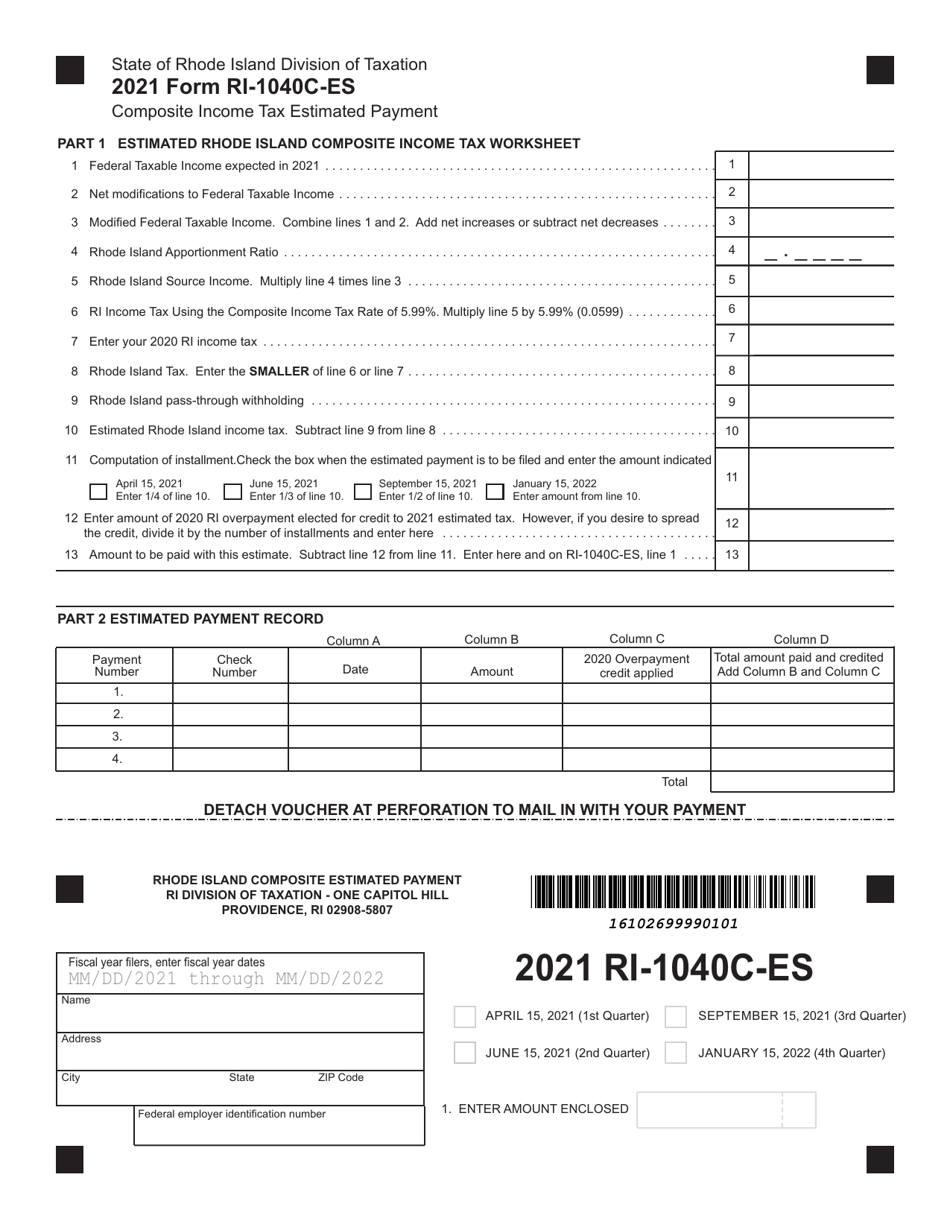

RI 1040H 2024 RI 1040H Rhode Island Property Tax Relief PDF file about 3 mb megabytes RI 1040MU 2024 Resident Credit for Taxes Paid to Multiple States PDF file less than 1 mb megabytes RI 1040NR Nonresident income Tax Return 2024 Nonresident Individual Income Tax Return including RI Schedule W Rhode Island Withholding information and Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax Residents and nonresidents including resident and nonresident estates and trusts are required to pay estimated taxes for each taxable year if the estimated tax can reasonably be expected to be 250 or more in excess of

State Of Ri Income Tax

State Of Ri Income Tax

https://data.formsbank.com/pdf_docs_html/270/2708/270845/page_1_bg.png

Fillable Form Ri 1040h Property Tax Relief Claim State Of Rhode

https://data.formsbank.com/pdf_docs_html/272/2723/272381/page_1_bg.png

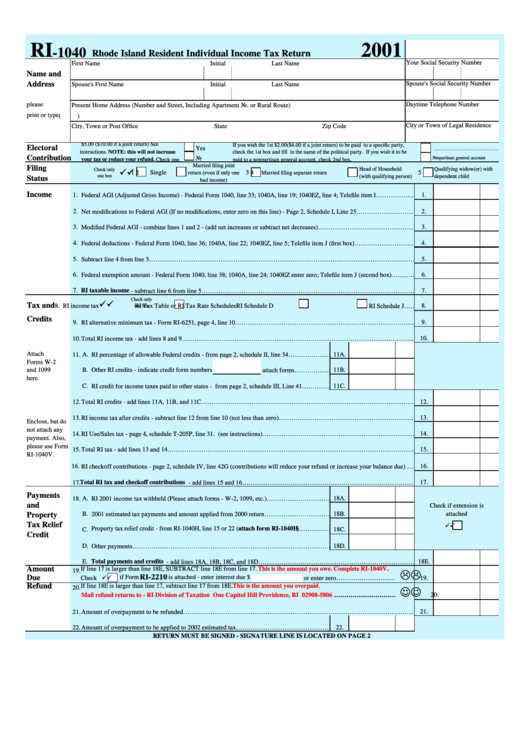

Form Ri 1040 Rhode Island Resident Individual Income Tax Return 2001

https://data.formsbank.com/pdf_docs_html/202/2020/202011/page_1_thumb_big.png

The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates The table below shows the income tax rates in Rhode Island for all filing statuses Income Tax Brackets All Filers All Filers Rhode Island Taxable Income Rate 0 77 450 3 75 77 450 176 050 Rhode Island s top Democrats are refusing to rule out an income tax increase due to the possibility of federal spending cuts that would leave the state to make up the difference Even before cuts

The filing year for which you would like to check the status you can only search for refunds starting with tax year 2020 Your social security number and The expected refund amount this is the amount on your return when you filed Complete Elimination In February 2023 Senator Morgan proposed to remove Rhode Island state taxes on Social Security benefits regardless of income level 2 Increased Thresholds Another bill also introduced in February 2023 suggests raising the income limits for Social Security state tax exemptions to 110 000 for single filers and

More picture related to State Of Ri Income Tax

Form RI 1040C ES Download Fillable PDF Or Fill Online Composite Income

https://data.templateroller.com/pdf_docs_html/2136/21360/2136046/form-ri-1040c-es-composite-income-tax-estimated-payment-rhode-island_print_big.png

Rhode Island Tax Forms And Instructions For 2020 Form RI 1040

https://www.incometaxpro.net/images/forms/2020/rhode-island-tax-forms.png

Tax Refund State Tax Refund Rhode Island

http://2.bp.blogspot.com/-oRLAN4wm21k/UQlvNhouU5I/AAAAAAAAVgY/DmT0pk5LTq4/s1600/RI+state+and+local+taxes.JPG

Our Mission The mission of the Department of Revenue is to administer its programs and consistently execute the laws and regulations with integrity and accountability thereby instilling public confidence in the work performed by the department Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets When you prepare your return on eFile this is all calculated for you based on your income Rhode Island Tax Brackets for Tax Year 2024 As you can see your income in Rhode Island is taxed at different rates within the given tax

[desc-10] [desc-11]

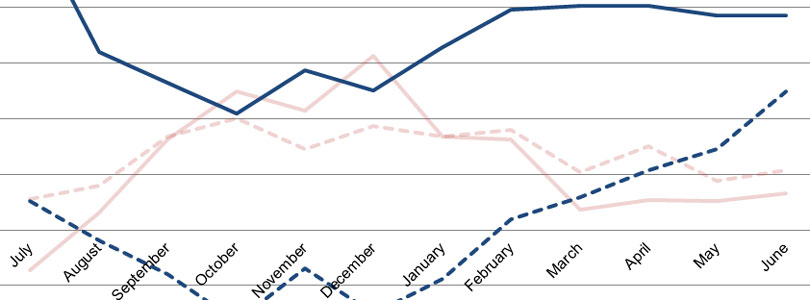

RI Income Tax Withholding Shows No Evidence Of Employment Boom But A

https://oceanstatecurrent.com/wp-content/uploads/2014/09/RI-withholdingsversusemployment-FY13-FY14-0614-featured.jpg

State Of Ri Tax Exemption Form Non profit ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-faw-1-download-printable-pdf-or-fill-online-application-for-sales.png

State Of Ri Income Tax - Complete Elimination In February 2023 Senator Morgan proposed to remove Rhode Island state taxes on Social Security benefits regardless of income level 2 Increased Thresholds Another bill also introduced in February 2023 suggests raising the income limits for Social Security state tax exemptions to 110 000 for single filers and