State Of North Dakota Income Tax You can file electronically on paper or through a software program North Dakota participates in the Internal Revenue Service s Federal State E File program This allows you to file both your federal and North Dakota income tax return at the same time If you are filing a paper return mail your completed North Dakota Individual Income Tax

Fiduciary Tax Form 38 Schedule K 1 Beneficiary s Share of ND Income Deductions Adjustment Form 38 ES 2024 Estimated Income Tax Estates and Trusts Form PWA 2023 Passthrough Entity Withholding Nonresident Member Adjustment Form PWE Nonresident Passthrough Entity Member Withholding Exemption Certif Sales tax 5 9 2 Property tax 1 00 average effective rate Gas tax 23 00 cents per gallon of regular gasoline and diesel The booming economy in North Dakota in recent years has allowed the state to significantly cut taxes The current income tax rates are the lowest in the country ranging from 0 to 2 5

State Of North Dakota Income Tax

State Of North Dakota Income Tax

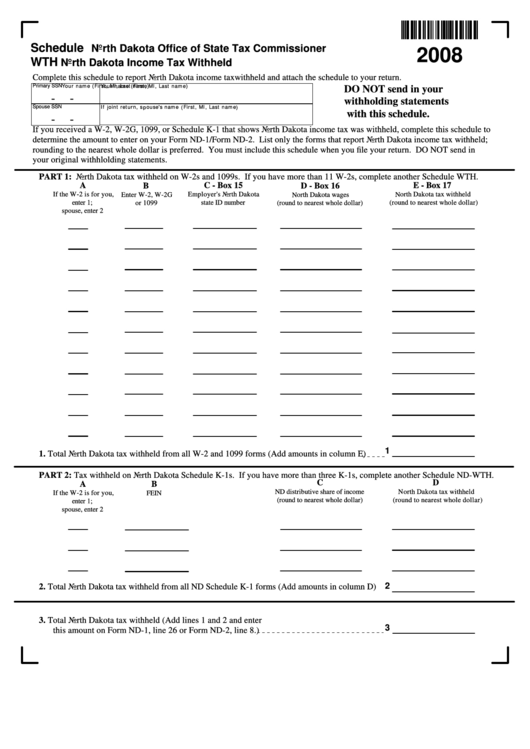

https://data.formsbank.com/pdf_docs_html/239/2392/239293/page_1_thumb_big.png

North Dakota Joins Growing List Of States To Exempt Military Pay From

https://spotterup.com/wp-content/uploads/2023/07/North-Dakota-Joins-Growing-List-of-States-to-Exempt-Military-Pay-from-State-Income-Taxes.jpg

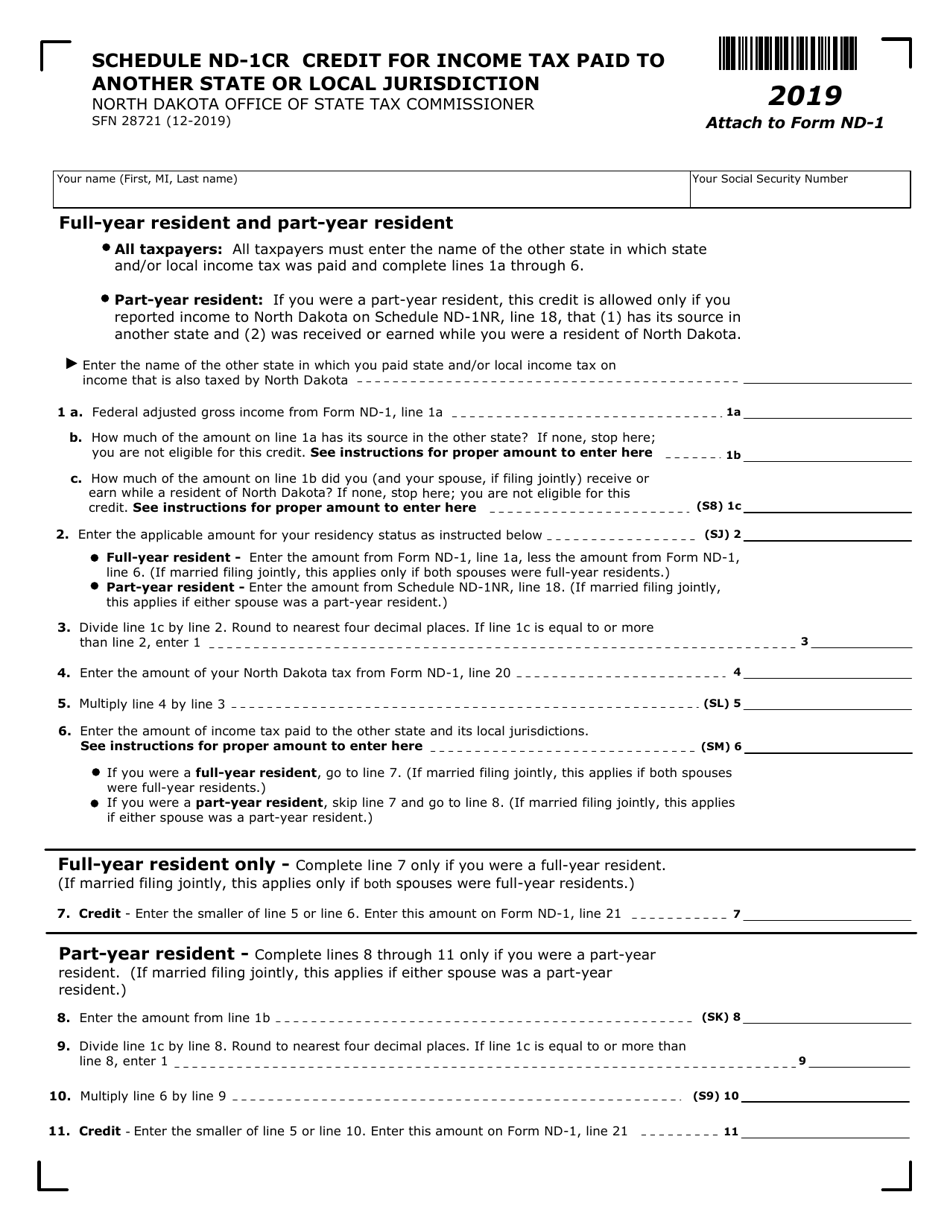

Form ND 1 SFN28721 Schedule ND 1CR Download Fillable PDF Or Fill

https://data.templateroller.com/pdf_docs_html/2018/20183/2018304/form-nd-1-sfn28721-schedule-nd-1cr-credit-for-income-tax-paid-to-another-state-north-dakota_print_big.png

Manage your North Dakota business tax accounts with Taxpayer Access point TAP TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a 1099G manage your Burgum also signed Senate Bill 2351 which exempts Social Security income from state income tax becoming the 38th state to do so The bill introduced by Sen David Hogue of Minot will provide an estimated 14 6 million in savings per biennium to approximately 20 000 North Dakotans

North Dakota Income Tax Calculator 2023 2024 If you make 70 000 a year living in North Dakota you will be taxed 8 431 Your average tax rate is 10 94 and your marginal tax rate is 22 This PHOTO CUTLINE Gov Doug Burgum announces the Relief for All income tax relief proposal on Wednesday Aug 24 2022 at the North Dakota Capitol in Bismarck joined by from left Rep Glenn Bosch

More picture related to State Of North Dakota Income Tax

North Dakota State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/north-dakota-tax-rates.jpg

15 States That Tax Your Income The Least Page 11 Of 16 Legal

https://cdn.legalguidancenow.com/wp-content/uploads/2019/03/10-north-dakota.jpg

Printable North Dakota Income Tax Forms For Tax Year 2023

https://www.taxformfinder.org/img/state_seals/north-dakota.svg

North Dakota Income Tax Range Due to new legislation in 2023 there is no state income tax for single filers with taxable income up to 41 775 Joint filers with taxable income below 69 700 won t Please make sure the North Dakota forms you are using are up to date The North Dakota income tax has four tax brackets with a maximum marginal income tax of 2 640 as of 2024 Detailed North Dakota state income tax rates and brackets are available on this page

North Dakota s state income tax system comprised just three brackets down from five in previous years For single filers income up to 51 650 is exempt from state income tax Then income between 51 650 and 232 900 is subject to a 1 95 rate while income above the 232 900 threshold is taxed at 2 50 If you re married married filing North Dakota was unable to add its name to the long list of states that enacted individual income taxAn individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns The U S imposes a progressive income tax where rates increase with income The Federal Income Tax was established in 1913 with the

Income Tax Season Opens In North Dakota Minnesota InForum Fargo

https://cdn.forumcomm.com/dims4/default/59f22b3/2147483647/strip/true/crop/1280x622+0+49/resize/1440x700!/quality/90/?url=https:%2F%2Ffcc-cue-exports-brightspot.s3.us-west-2.amazonaws.com%2Finforum%2Fbinary%2FTax_binary_6926244.jpg

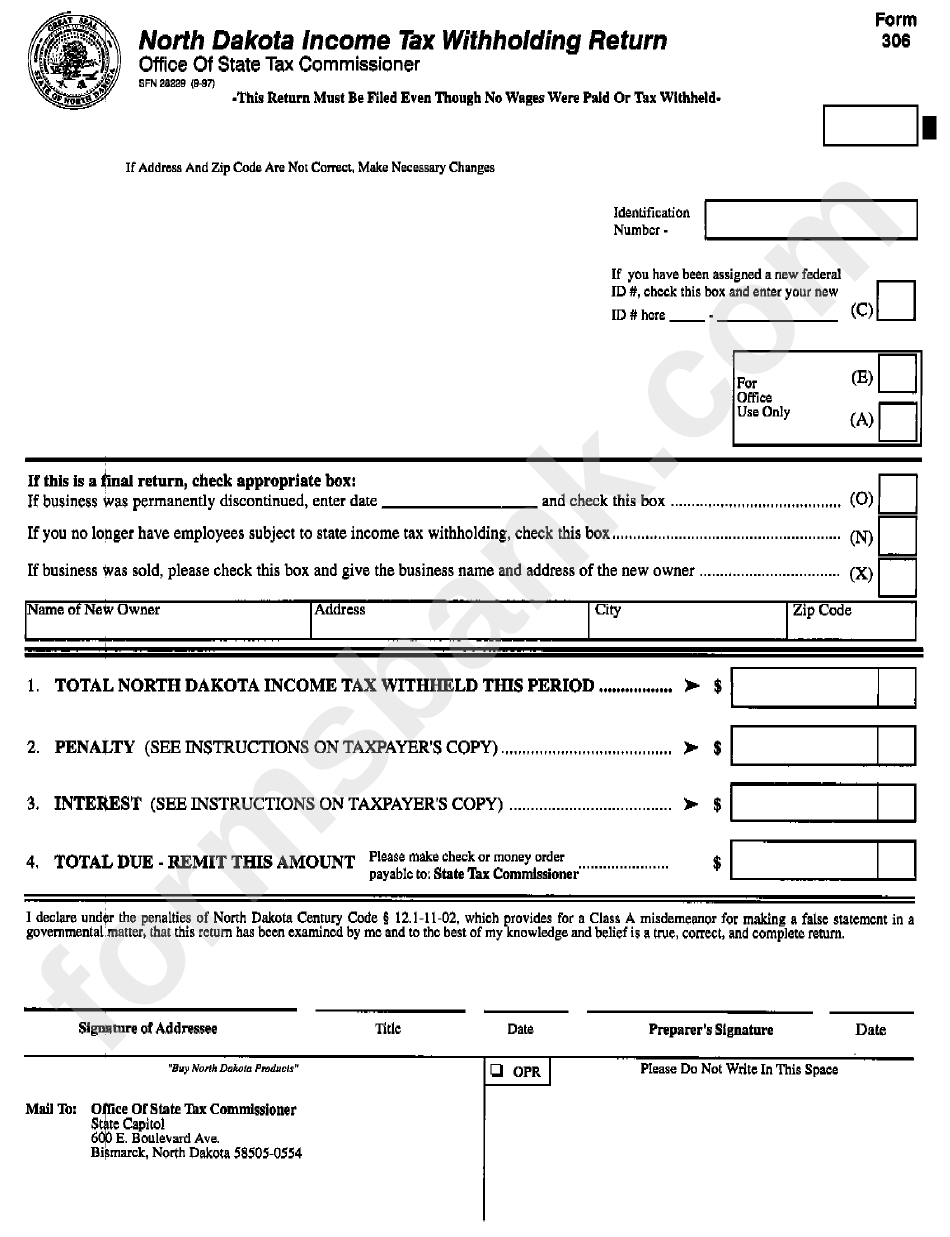

North Carolina State Withholding Tax Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/form-306-north-dakota-income-tax-withholding-return-printable-pdf.png

State Of North Dakota Income Tax - If you filed Form ND EZ the Filing Status is shown on Page 1 just below your name and address information in Section A circles 1 through 5 If you filed Form ND 1 the Refund Amount is found on page 2 line 32 If you filed Form ND EZ the Refund Amount is found on Page 1 line 6 Use Where s My Refund tool to check the status of your