State Of Maine Income Tax Calculator Maine Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Maine you will be taxed 11 500 Your average tax rate is 11 67 and your

SmartAsset s Maine paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow right sm arrow right Loading Home Buying Calculators How Much House Can I Afford Mortgage Calculator Rent vs Buy You can quickly estimate your Maine State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Maine and for quickly estimating your tax commitments in 2024

State Of Maine Income Tax Calculator

State Of Maine Income Tax Calculator

https://www.signnow.com/preview/6/962/6962350/large.png

J Zack And Associates Tax Solutions For Individuals And Businesses

https://jzackandassociates.com/wp-content/uploads/2021/02/cropped-17831164-A6F0-4A6D-8CC1-CDB54B4F37A1.jpeg

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1-768x705.png

Maine Income Tax Salary Calculator Hourly Wage Calculation Gross Salary Wages Salaries Filing Status Tax State No Dependents Other Taxable Monthly Deductions Claim an exemption for myself Calculation Results Currently 3 25 5 1 2 3 4 5 Rating 3 2 5 61 votes Try our Free Android app Using our Maine Salary Tax Calculator Maine generally imposes an income tax on all individuals that have Maine source income The income tax rates are graduated with rates ranging from 5 8 to 7 15 for tax years beginning after 2015 The rates ranged from 0 to 7 95 for tax years beginning after December 31 2012 but before January 1 2016 Prior to January 1 2013 the

Maine Income Tax Calculator Estimate your Maine income tax burden Updated for 2023 tax year on Dec 8 2023 What was updated Annual income Tax year State Filing status Self employed 401 k contribution IRA contribution Deductions Total income taxes 0 00 NaN of gross income Total federal income tax 0 00 Total FICA 0 00 Use ADP s Maine Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

More picture related to State Of Maine Income Tax Calculator

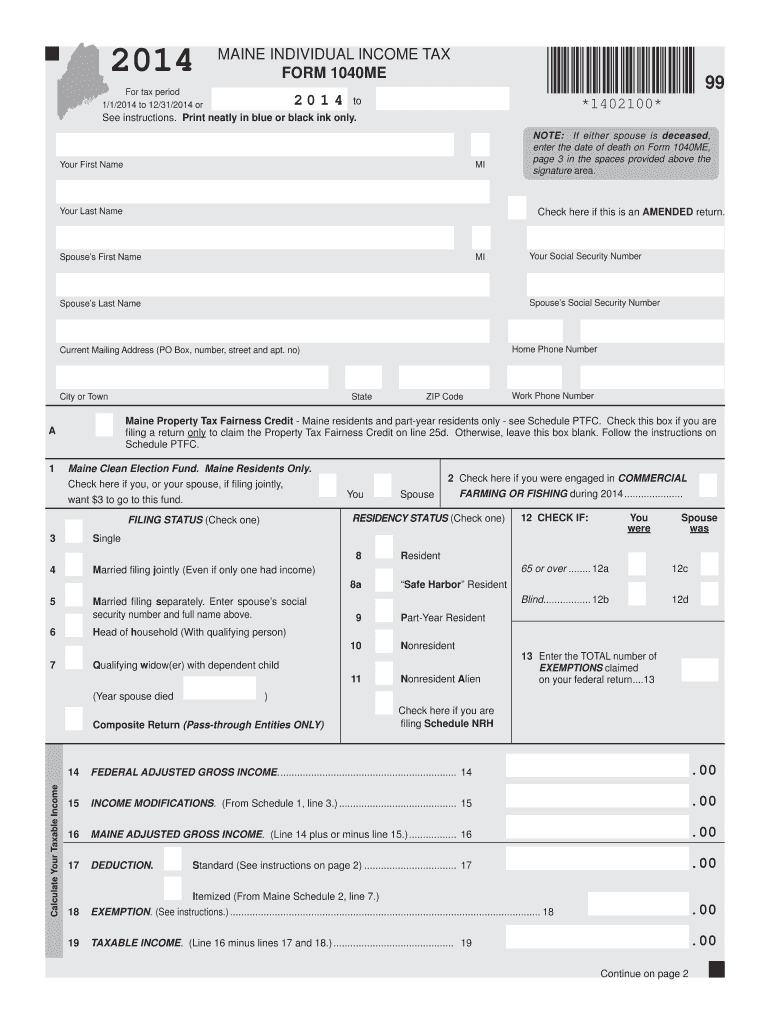

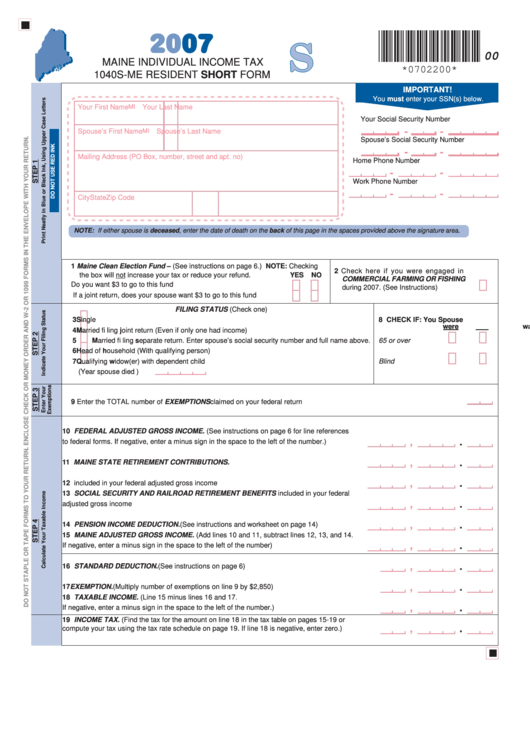

Form 1040s Me Maine Individual Income Tax 2007 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/272/2725/272530/page_1_thumb_big.png

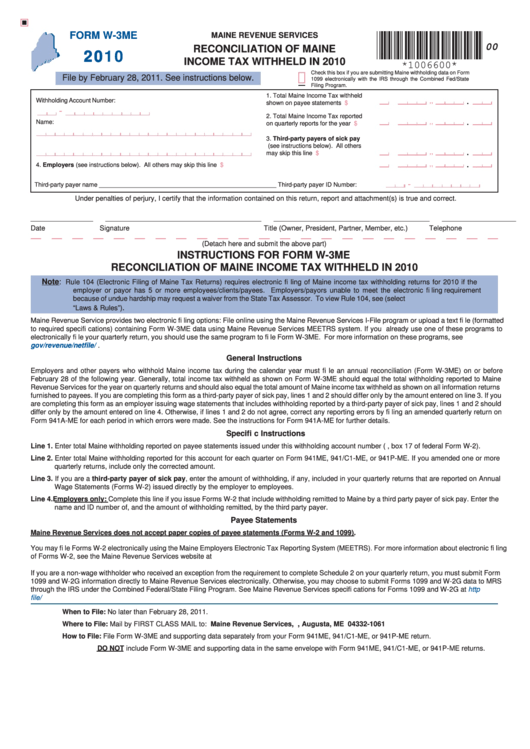

Form W 3me Reconciliation Of Maine Income Tax Withheld In 2010

https://data.formsbank.com/pdf_docs_html/231/2314/231489/page_1_thumb_big.png

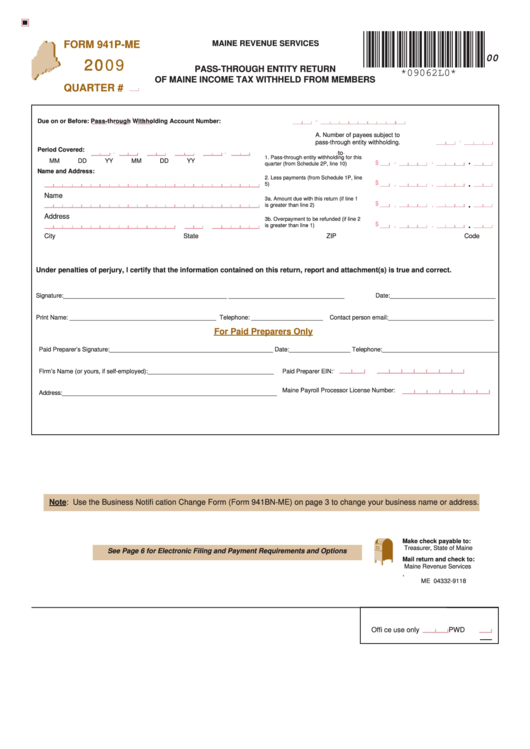

Form 941p Me Pass Through Entity Return Of Maine Income Tax Withheld

https://data.formsbank.com/pdf_docs_html/234/2346/234608/page_1_thumb_big.png

Maine Paycheck Calculator For Salary Hourly Payment 2023 Everything You Need To Know About The Earned Income Tax Credit EITC In 2024 This calculator assumes that state and local taxes How much taxes are deducted from a 57 000 paycheck in Maine The total taxes deducted for a single filer are 973 43 monthly or 449 27 bi weekly Updated on Dec 05 2023 Free tool to calculate your hourly and salary income after federal state and local taxes in Maine

Enter your employment income into the paycheck calculator above to estimate how taxes in Maine USA may affect your finances You ll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when planning your budget The Maine Income Taxes Calculator Estimate Your Federal and Maine Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow er C3 Number of Dependents C4 Annual Income C5 Annual Federal Deductions Credits C6 Annual State Deductions Credits

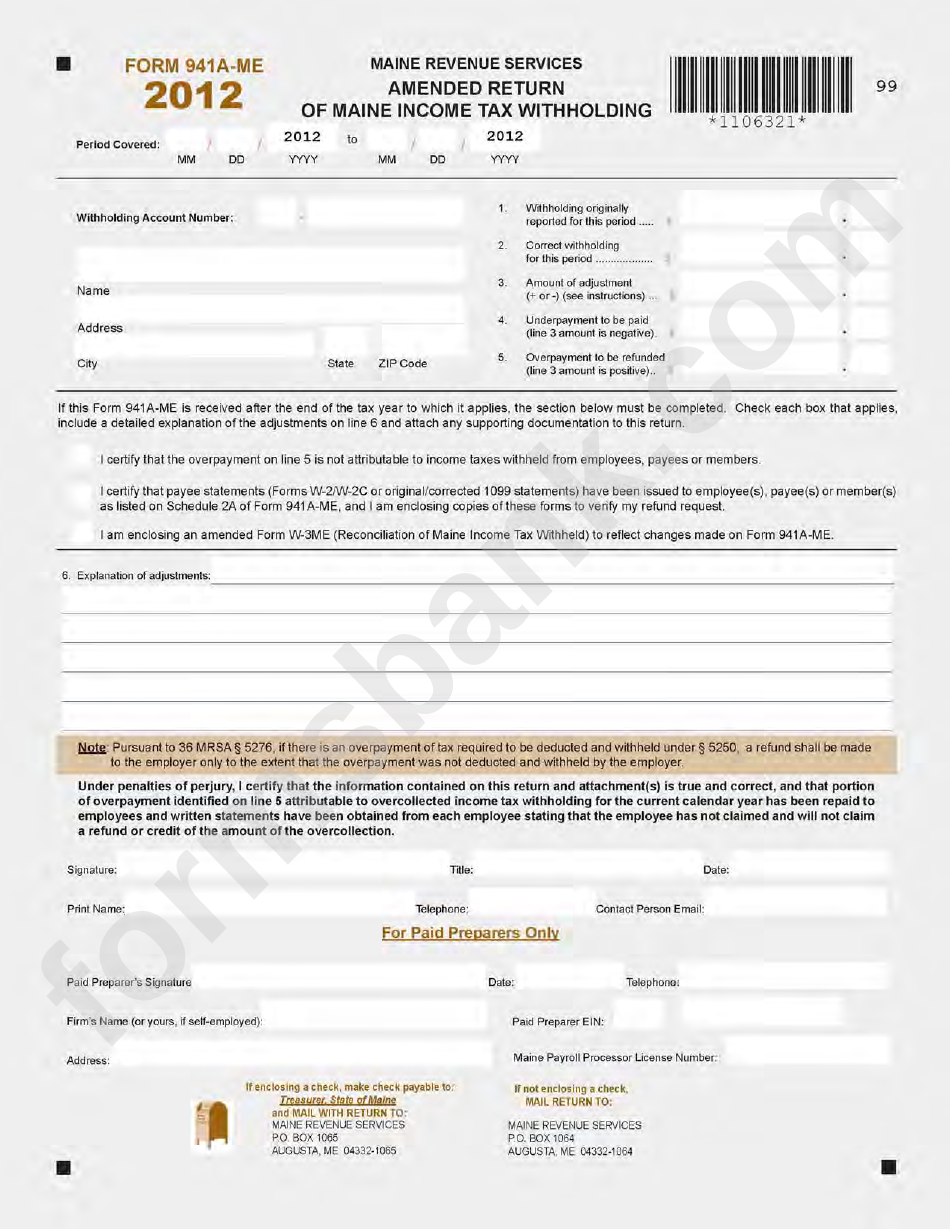

Fillable Form 941a Me Amended Return Of Maine Income Tax Withholding

https://data.formsbank.com/pdf_docs_html/380/3807/380729/page_1_bg.png

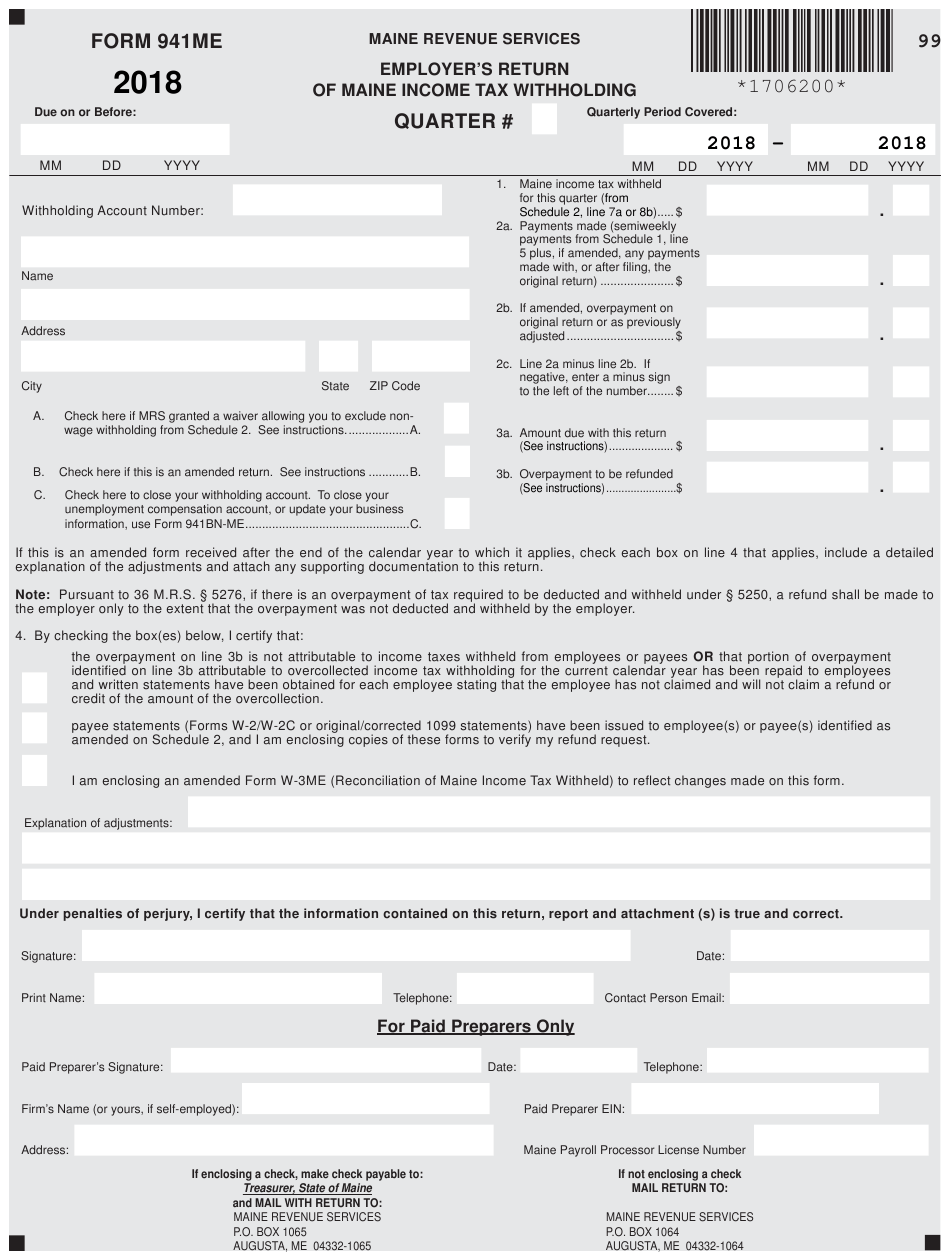

State Of Maine Tax Withholding Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/form-941me-download-printable-pdf-or-fill-online-employer-s-return-of.png

State Of Maine Income Tax Calculator - Use ADP s Maine Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest