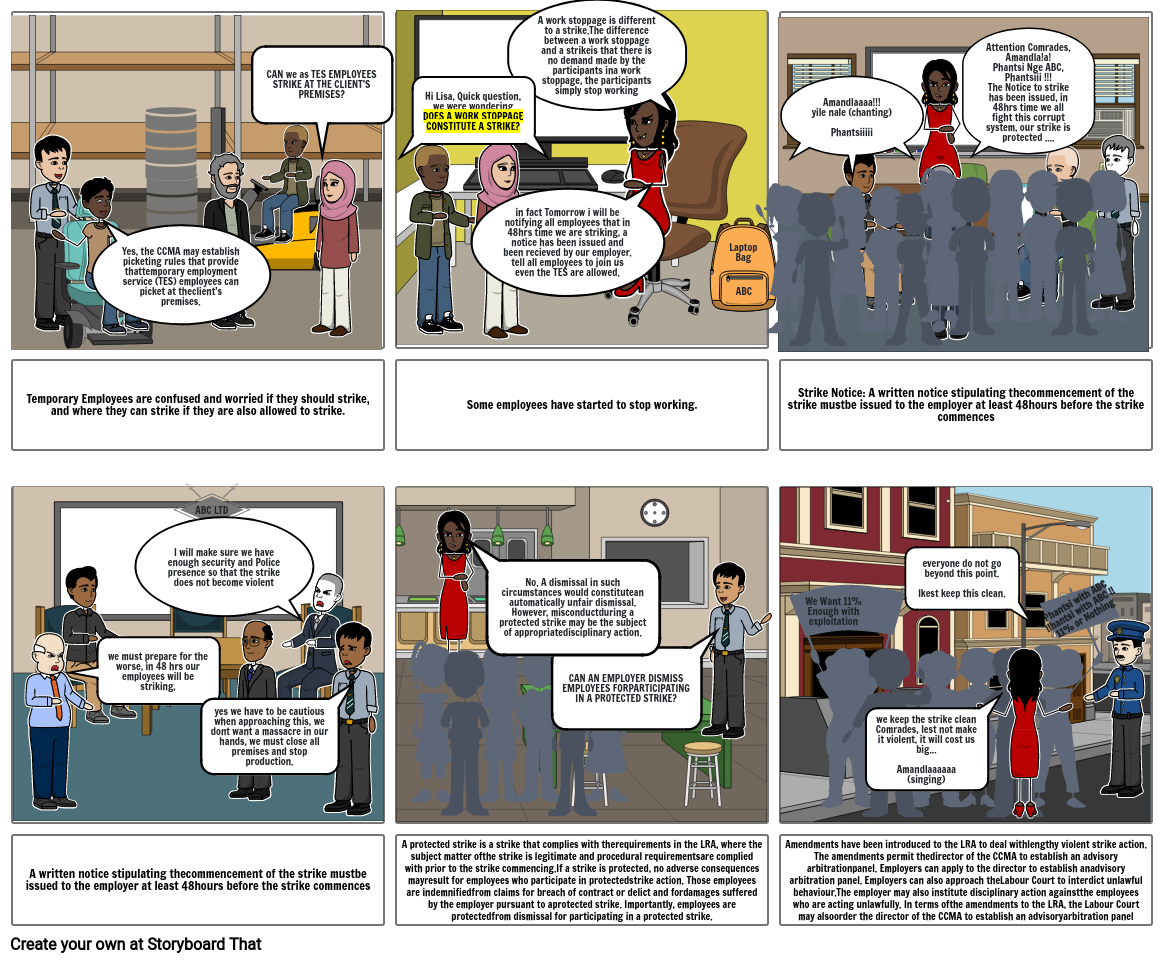

South Carolina Wage Deduction Law SOUTH CAROLINA PAYMENT OF WAGES LAW I DEFINITIONS 41 10 10 As used in this chapter Employer means every person firm This chapter applies to all employers in South Carolina except that 41 10 30 does not apply to 1 Employers of domestic labor in private homes showing his gross pay and the deductions made from his wages

Deductions Allowed South Carolina regulates paycheck deductions to ensure wages are not unlawfully withheld Deductions are only permitted if required by law authorized in writing by the employee or for employer provided benefits Statutory deductions include federal and state taxes Social Security and court ordered garnishments South Carolina does not have a law specifically addressing the payment of wages to an employee who quits However to ensure compliance with known laws an employer should pay employee all wages due no later than the regular pay day for the pay period not to exceed thirty 30 days during which the separation from employment occurred

South Carolina Wage Deduction Law

South Carolina Wage Deduction Law

https://sbt.blob.core.windows.net/storyboards/lwandeboss/deadlock-in-wage-negotiations.png

South Carolina Wage Claims Act YouTube

https://i.ytimg.com/vi/1rF4PpVdgUI/maxresdefault.jpg

Join Team UBC Pre Law Association

http://ubcprelaw.com/wp-content/uploads/2022/10/INVERTED-LOGO-1.png

the deductions an employer may make from wages including insurance Changes to these terms must be in writing at least seven 7 calendar days before they become effective South Carolina and federal laws prohibit discrimination on the basis of race sex age religion color national ori gin and disability You also have the right to The South Carolina Payment of Wages Act provides a remedy to South Carolina employees who are not paid their full wages in a timely manner The Act requires employers to notify all employees of the normal hours and wages of the position and any deductions that will be made from the wages such as payments to insurance programs that are often deducted from an employee s paycheck

Two of these laws are the South Carolina Payment of Wages Act and the Fair Labor Standards Act This brochure explains your rights under these laws and deductions made each payday give employees a statement each pay period showing the amount of their pay and any deductions notify each employee in writing at the time of hire of the 2016 South Carolina Code of Laws Title 41 Labor and Employment CHAPTER 10 PAYMENT OF WAGES Section 41 10 10 Definitions Section 41 10 20 Applicability of chapter Section 41 10 30 Notification to employees of wages and hours agreed upon recordkeeping requirements requirement of itemized statement of gross pay and deductions for each

More picture related to South Carolina Wage Deduction Law

Fired BCSD Superintendent Triples Down Further Questions Payout

https://abcnews4.com/resources/media/321fd46c-1a76-4ea0-aa2e-9545ef088811-large16x9_Capture.PNG?1670888110472

New Zealand Law Journal

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064846954210

New Reports Shed Little New Light On South Carolina Killings South

https://npr.brightspotcdn.com/dims4/default/66ef95f/2147483647/strip/true/crop/1760x1084+0+0/resize/1760x1084!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2F81%2Fce%2Fffb41cd543668e257dbbe1660477%2Fsc-law-enformence-division-sled-logo.jpg

Among other acts South Carolina employers are prohibited from discriminating in the amount or rate of pay based solely on membership in a protected class S C Code Ann 1 13 80 A 1 For more information on the South Carolina Human Affairs Law see State Q A Anti Discrimination Laws South Carolina 0 518 9039 Covered Employers Payment of Wages for Salaried Employees in South Carolina The South Carolina Payment of Wages Act S C Code Ann 41 10 30 A does not define a standard pay period Nevertheless employers must provide written notification to employees at the time of hiring informing them about the time and location of payment for the agreed upon wages and any deductions that will be made

[desc-10] [desc-11]

Employee Payroll Deduction Form Template Best Template Ideas

https://lh5.googleusercontent.com/proxy/xtnsHbF2gqHLtZQyQJ1rmc6UqQVM56VKE0WGd_FB3d0DePIK5MtnvtZNjegxi6dwINBrwFPGyh1l9JvkFHGjHUQzw4xspDoG-2GgiNS1EQaMIjgiKESr7rKsWQ=w1200-h630-p-k-no-nu

Topics For Elections Minimum Wage Increase Alan Dillon

https://alandillon.ie/wp-content/uploads/2020/01/Election-Topic-Minimum-Wage.jpg

South Carolina Wage Deduction Law - [desc-12]