Sample Of Payslip Salary Philippines Free payslip template Create a payslip for your employees in no time with this easy to use template Or try Xero accounting software for free Download payslip template Try Xero for free Download the payslip template Fill in the form to get a free payslip template as an editable PDF We ll throw in a guide to help you use it Your email address

4 Print out the payslip and deliver it to the employee They can then use it to receive their salary Following these steps will ensure that you create a payslip correctly and efficiently Related De minimis Benefits and a 90 000 Tax Exemption Philippines Payslip Sample in the Philippines In the Philippines a payslip is often called a Here s a Philippine payroll sample and formula for the calculation to guide your payroll processing Philippine payroll sample pays deductions and formula Before you can become an employer in the Philippines you must first get familiar with the ins and outs of doing business in the country One such important aspect is payroll

Sample Of Payslip Salary Philippines

Sample Of Payslip Salary Philippines

https://paysliper.com/assets/templates/image/grid1.jpg

Sample Excel Format For Payroll In The Philippines Yahoo Image Search

https://i.pinimg.com/originals/00/57/b8/0057b8902d04535b3a7eda3de3f704df.jpg

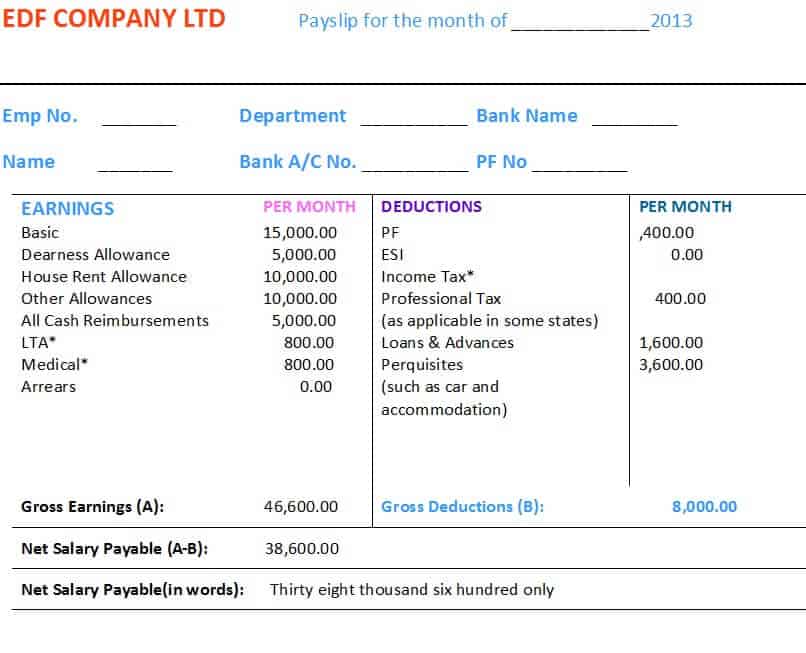

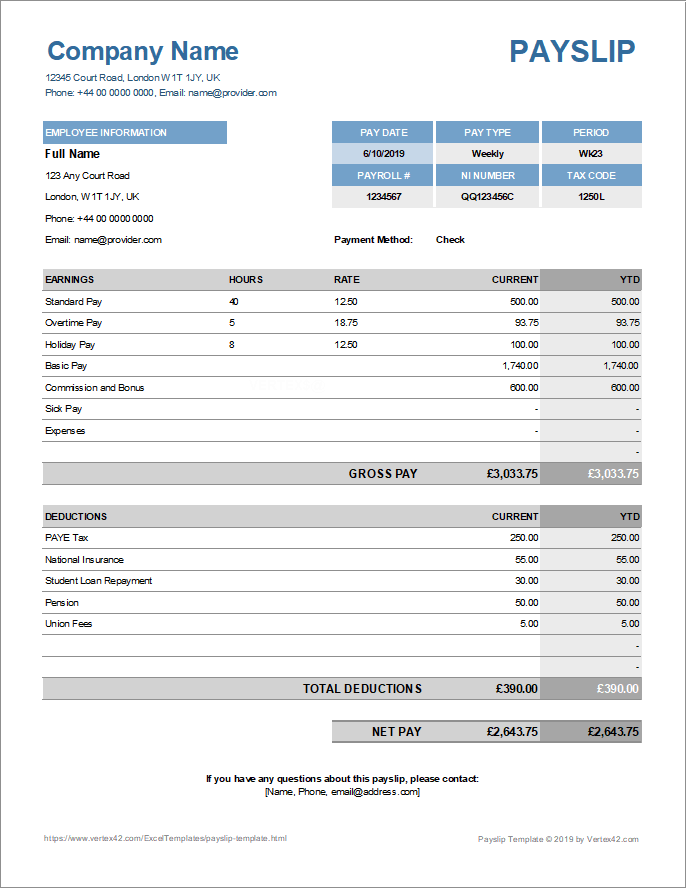

10 Payslip Formats Word And Excel Free Sample Templates

https://www.freesampletemplates.com/wp-content/uploads/2018/10/payslip-7-1.jpg

Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSS GSIS PhilHealth and PAG IBIG In 2024 the deductions for PhilHealth and Pag IBIG Fund have increased You can now find out how much your salary will be Learn more Download free and simple payroll and payslip template samples in excel formatted for use in the Philippines Calculate your payroll for free today

Step 1 Set Up Your Business as an Employer When you run payroll in the Philippines you must first register your company with the Bureau of Internal Revenue Doing this will give you an employer identification number EIN similar to the one you d get when doing payroll in the US Here is an example of payroll computation for an Employee earning 85 000 00 per month In this specific case The increase in deductions from SSS Employee Contribution of 225 00 is lower than the decrease in Withholding Taxes of 3 123 18 resulting in an increase of 2 898 18 in the Net Pay of the employee

More picture related to Sample Of Payslip Salary Philippines

Sample Payslip Format Philippines Classles Democracy

https://3.bp.blogspot.com/-XAUn-nieerE/WUonQkzj4jI/AAAAAAAAa_w/AuxDxeUW8_o2VJrAvlafKN4JAAst64A4wCLcBGAs/s0/Capture.JPG

Free Printable Payslip Template South Africa

https://cdn.vertex42.com/ExcelTemplates/Images/payslip-template.png

7 Payslip Templates Excel PDF Formats

https://www.wordmstemplates.com/wp-content/uploads/2015/06/payslip-template-22.jpg

The key factors of payroll in the Philippines are The minimum wage in the Philippines The daily minimum wage requirement in the Philippines varies across the country A Tripartite Regional Wage Board determines the minimum wage based on the region size and industry 1 How to Compute the SSS Deduction The amount deducted every month for the SSS contribution is 3 63 of an employee s monthly salary credit Employees earning PHP 15 750 and above per month have a monthly salary credit of PHP 16 000 which means the SSS deduction per month is PHP 581 30

Payroll Salary Compensation and Benefits in the Philippines as provided under the Labor Code of the Philippines and other relevant laws Wage and Wage Related Benefits Overview At least the minimum wage per region and or sector Holiday wage and overtime pay for work during holidays or rest days Overtime pay when working in excess of 8 hours Employee Payroll Template Excel Sample of Payslip in the Philippines For the companies located in Philippines region they are required to prepare their pay slips in accordance to the policy of the area It can handle all your salary information of the employees from initial till the end

Payroll Software Free Download In Excel Philippines Annisido

http://www.isuweldo.com/img/payslip_with_hrs_mins.jpg

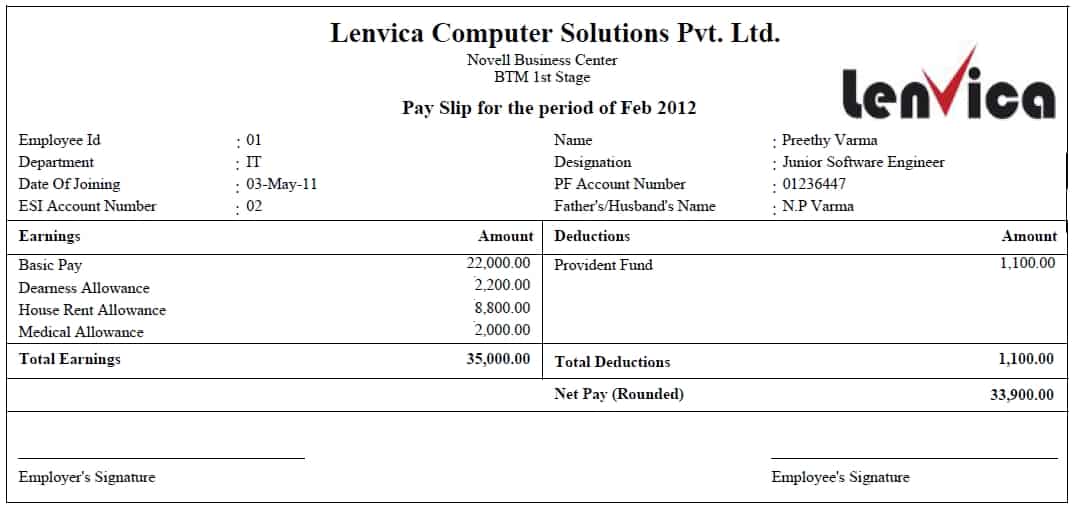

Report Payslip YTD Lenvica HRMS

https://lenvica.com/wp-content/uploads/2018/06/Payslip-YTD.png

Sample Of Payslip Salary Philippines - Here is an example of payroll computation for an Employee earning 85 000 00 per month In this specific case The increase in deductions from SSS Employee Contribution of 225 00 is lower than the decrease in Withholding Taxes of 3 123 18 resulting in an increase of 2 898 18 in the Net Pay of the employee