Salary Structure Template India Salary Structure A salary breakup divides the CTC to determine your in hand salary Learn about basic salary allowances deductions and benefits to understand your total earnings Salary Slip or Payslip Meaning Template Components August 1 2024 6 Job Offer Letter Formats August 1 2024 Write A Comment Cancel Reply

There are various factors that influence the appropriate salary structure in India for an employee Some of the most significant factors are 1 Education and years of experience The more educated and experienced an employee is the higher their salary will be Additionally an employee s expectations regarding salary components change with This article aims to inform you about the revised salary structure for FY 2022 23 as per the new wage code to be implemented Salary Structure in India All You Need to Know 2022 23 As a layman often employees struggle to understand the salary structure format implemented by their organisation

Salary Structure Template India

Salary Structure Template India

https://newdocer.cache.wpscdn.com/photo/20191009/b44770a54754472dbfcaca6d7d1c3587.jpg

Salary Slip Format in Excel, Salary Calculation Sheet 2022

https://caknowledge.com///wp-content/uploads/2021/10/Salary-Slip-Format-in-PDF.jpg

Salary Slip Format in Excel With Formula, Free Download Payslip Samples

https://orbitcareers.com/wp-content/uploads/2020/11/salary-slip-format-1200x825.jpg

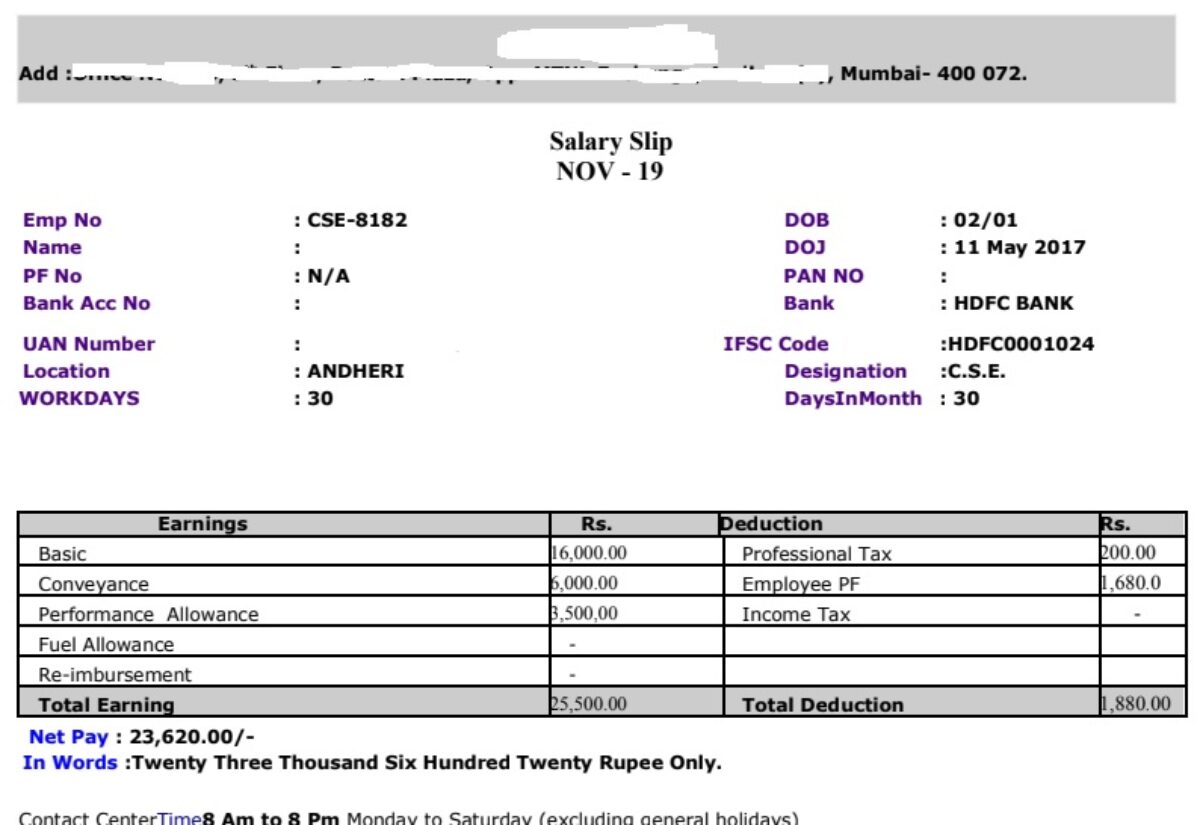

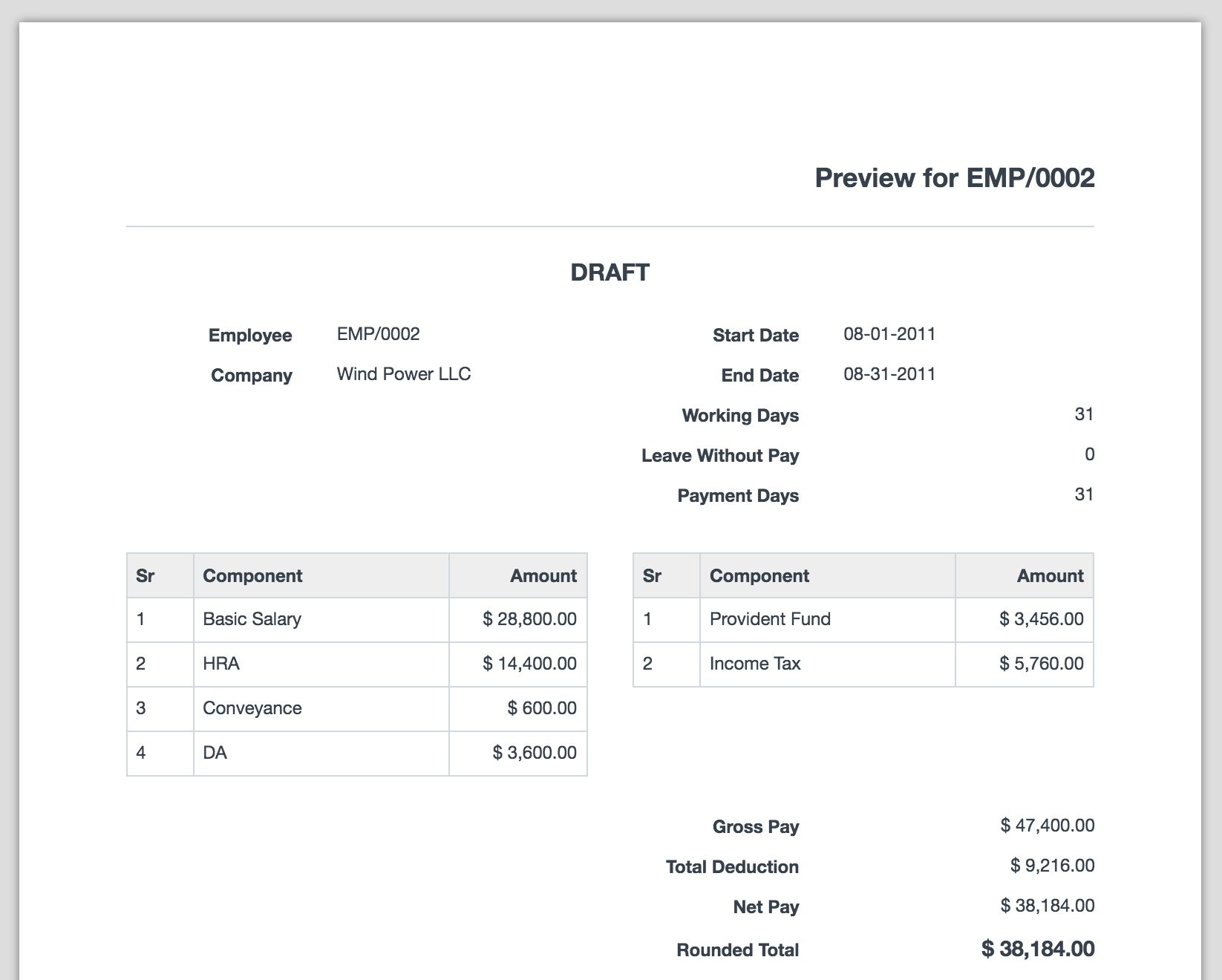

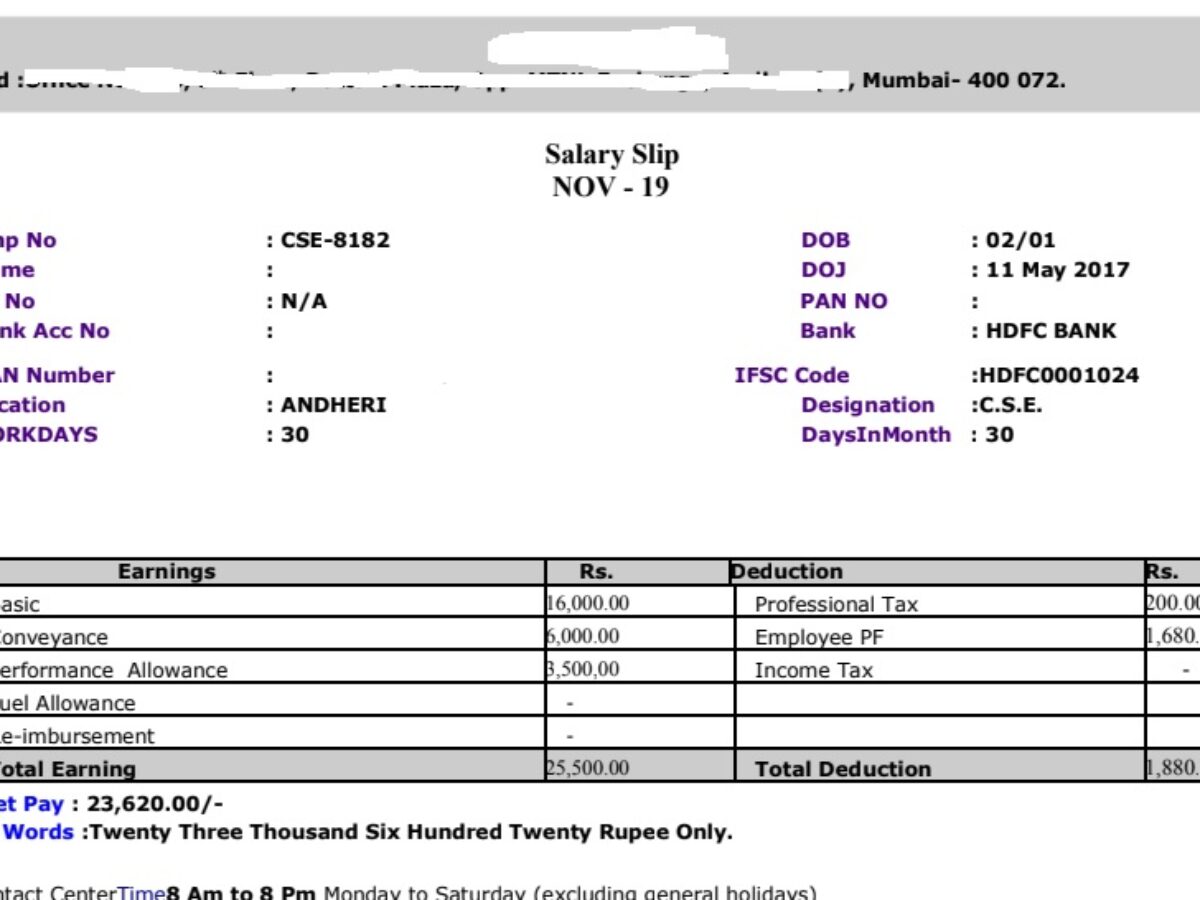

You can calculate an employee s salary in three easy steps 1 Enter the Annual CTC amount for a specific employee 2 Select Compliance Settings as per your organization s applicability 3 While you are there you can view the salary structure according to the details provided by you Salary structure in India Key terms A salary structure aims to lay out the anatomy of the salary being offered in terms of the different components constituting the compensation plan From the employee s perspective it is imperative to have basic knowledge of the different components of their salary to plan their finances with an aim to

Every employer needs to pay 13 of the employee s basic salary towards the EPF account of the employee and 3 25 of the employee s gross salary as ESIC contribution if applicable Also Read Download salary slip format in Excel and PDF How to calculate PF if the basic wage is more than 15 000 Rs Download Form 16 in Excel format for Ay The same template can be used for salary revisions for current employees as per company policies and rules This data capture template is available for download in Excel format This CTC Structure template lets you achieve Consistency while making offers or during revisions Define budgets for such offers Ensure proper approvals

More picture related to Salary Structure Template India

EXCEL of Salary Slip Calculator.xlsx | WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191105/ebe1a408764049e6af51e8269fef1772.jpg

EXCEL of Simple Salary Slip.xlsx | WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190827/77628f8f47614c8ca37c85581e680d82.jpg

EXCEL of Salary Slip Template.xlsx | WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190827/1db313cad2e84ebeab5ce66b3ec2f35e.jpg

A salary breakup structure typically includes the following components Basic Salary The fixed component of an employee s salary typically constitutes 40 60 of the employee s CTC including the gross and net salary Dearness Allowance DA Employees get this allowance to cover the cost of living It is usually a percentage of their basic A salary structure is a detailed breakdown of the various components that define an employee s compensation package It comprises elements beyond basic pay including allowances bonuses deductions and benefits From the employee s perspective it is imperative to have basic knowledge of the different components of their salary to plan

1 Net Salary Net salary not to be confused with a gross salary is the wages an employee received after all deductions and additions Specifically the net salary is synonymous with the CTC which means that it can be used interchangeably that s why it is important to use gross salary instead of net salary 2 ESIC Employer Contribution is 3 25 of Gross Salary Employee Contribution is 0 75 of Gross Salary If a company has 10 or more employees who have a gross salary of less than Rs 21 000 a month then it is applicable to all those employees Professional Tax

Redesigned Salary Structure

https://frappe.io/files/Screen%20Shot%202016-08-24%20at%206.05.35%20PM.png

Salary Slip Format in Excel With Formula, Free Download Payslip Samples

https://orbitcareers.com/wp-content/uploads/2020/11/salary-slip-format-1200x900.jpg

Salary Structure Template India - 50 of basic salary DA for those living in metro cities 40 of basic salary DA for those living in non metro locations Actual rent paid should be less than 10 of basic salary DA Note that HRA cannot be availed by employees living in their own houses