Salary Slip Sample For 25000 Ctc In the salary slip s income section essential components include the Basic constituting 35 50 of the salary At junior levels Basic is higher while as employees progress other allowances increase Organisations often maintain a lower Basic to prevent topping up the allowance pay Basic 100 taxable appears first in the earnings section

The sample salary slip template Excel files can be accessed from the following page Everything can be downloaded with just a click Gross pay Gross salary CTC total deduction and net pay Basic salary 40 of CTC DA 50 of basic HRA 20 of basic pay 8 Special Allowance Salary Structure A salary breakup divides the CTC to determine your in hand salary Learn about basic salary allowances deductions and benefits to understand your total earnings Salary Slip or Payslip Meaning Template Components August 1 2024 6 Job Offer Letter Formats August 1 2024 Write A Comment Cancel Reply

Salary Slip Sample For 25000 Ctc

Salary Slip Sample For 25000 Ctc

https://newdocer.cache.wpscdn.com/photo/20190827/77628f8f47614c8ca37c85581e680d82.jpg

Excel Format Salary Slip Tonegase

https://i.pinimg.com/736x/3c/90/f0/3c90f0e9c6917e44cb429ea2ac285d34.jpg

CTC Structure Salary Slip

https://www.firstnaukri.com/career-guidance/wp-content/uploads/2023/07/CTC-structure-Salary-slip-1024x600.jpg

1 Enter the Annual Income CTC Amount Start by entering the annual salary amounts in the designated fields This includes basic salary HRA LTA special allowance and other allowances 2 Select Compliance Settings Next select the compliance settings as per your establishment s applicability The compliance settings include Provident Do you want to know how your CTC Cost to Company is calculated and how it affects your take home salary Use IPTM s CTC Calculator to get a detailed salary breakup in India including various payroll components and deductions IPTM is a leading payroll training institute in India offering online and offline courses tools and tutorials for payroll professionals

Usually the basic salary is 40 50 of CTC It is a part of Take Home Salary Taxability Basic salary is 100 taxable if it crosses the Income Tax Slabs Part of Take Home Salary Yes Salary Slip template with yearly bonus consists of additional space for the payroll assistant or accountants to enter the bonus pays a and when required A salary slip pay slip is a document issued by an employer to an employee It contains a detailed description of the employee s salary components like HRA House Rent Allowance LTA Leave Travel Allowance Bonus paid etc and deductions for a specified time period usually a month It may be issued on paper or digital salary slips may be

More picture related to Salary Slip Sample For 25000 Ctc

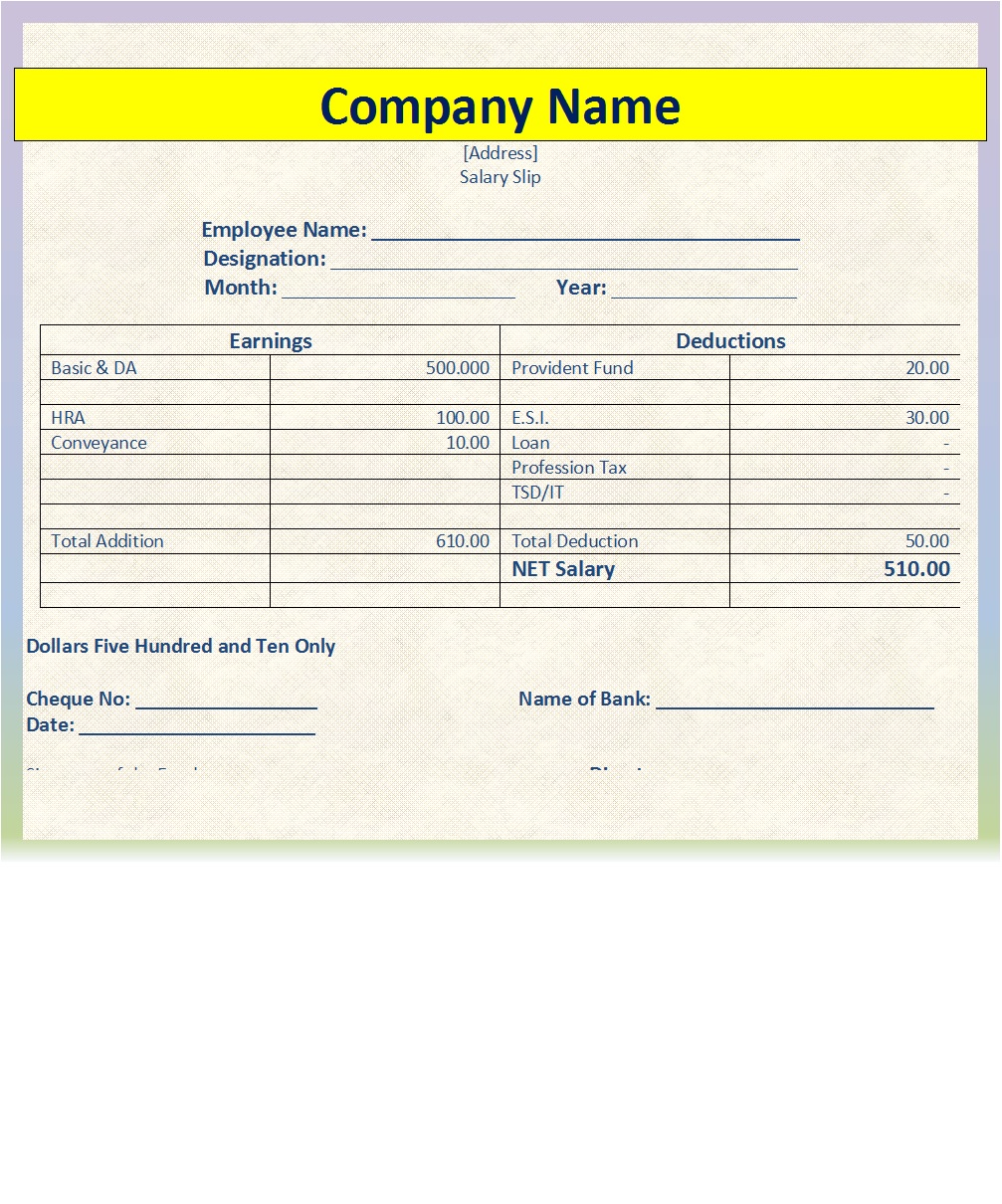

Simple Salary Slip Drugleqwer

https://www.freereporttemplate.com/wp-content/uploads/2021/10/Salary-Slip-303ghd.jpg

Salary Receipt Template Excel Laxenforsale

http://laxenforsale.weebly.com/uploads/1/3/8/3/138366734/571859100_orig.jpg

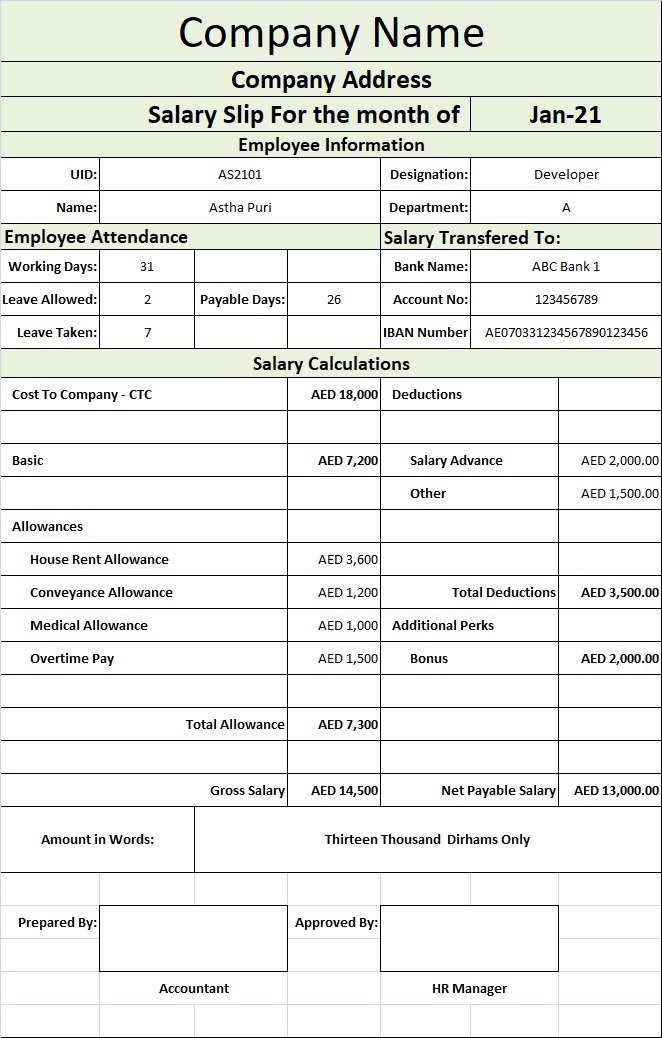

Ready To Use Salary Slip Format UAE MSOfficeGeek

http://msofficegeek.com/wp-content/uploads/2021/06/Salary-Slip-Format-UAE-Englsih.jpg

Every employer needs to pay 13 of the employee s basic salary towards the EPF account of the employee and 3 25 of the employee s gross salary as ESIC contribution if applicable Also Read Download salary slip format in Excel and PDF How to calculate PF if the basic wage is more than 15 000 Rs Download Form 16 in Excel format for Ay How to Create a Salary Slip in Excel Step 1 To create a salary slip pay slip open a new Excel sheet and write your company name address and payslip month year in the first three rows of the Excel file Step 2 Now enter the employee s general details like name designation department date of joining gross salary bank details and any other required information as per your choice

Salary Slip Template is a ready to use template in Excel Google Sheets OpenOffice Calc and Apple Numbers that helps to issue salary slip to the employees with ease This template performs the calculations automatically Insert the salary and it calculates the PF and EPS amount based on Indian law Let s understand the difference between cost to company and gross salary with a sample pay slip Mr Charan s CTC is INR 5 50 000 Below is the break of his cost to company Basic Salary INR 2 75 000 50 of salary DA INR 82 500 30 of basic HRA INR 1 43 000 40 of basic DA

Salary Slip Or Payslip Format Validity C Importance And Components

https://i.pinimg.com/originals/4f/5a/85/4f5a85257447c0b23bc523fcbe5d5c88.png

Hotel Salary Slip Format Kloeditor

https://www.hrcabin.com/wp-content/uploads/2022/09/Salary-slip-format-in-Excel-download.png

Salary Slip Sample For 25000 Ctc - Your total yearly take home salary gross salary total deductions 9 50 lakhs 48 700 9 01 300 Now your monthly take home salary annual salary 12 9 01 300 12 75 108 To do away with the tedious calculations most people prefer the take home salary calculator in India If you use the tool it will determine the