Salary Payment To Deceased Employee Any payments made after that first post death run are generally made from the employer to a beneficiary usually a surviving spouse or estate Revenue Ruling 86 109 which addresses salary or wages paid after the employee s death provides that these amounts are taxable income to the beneficiaries and or estate

How you handle deceased employee wages depends on when you pay the employee s final paycheck Your options vary slightly depending on when you distribute the deceased employee wages At the time of death you owe the employee 1 500 in wages and 500 in accrued vacation pay You make a payment to the employee s estate on May 27 2016 Most states limit the amount that can be paid directly to the surviving spouse The statutes range in amounts from 100 to 40 000 of wages Consequently amounts over and above the limits should

Salary Payment To Deceased Employee

Salary Payment To Deceased Employee

https://images.ctfassets.net/mnc2gcng0j8q/3f72SwKbyE6ImEI6OqK46I/2d817a293920065ae89923ab60793f6c/handle-wages-deceased-employee.jpg?w=672&

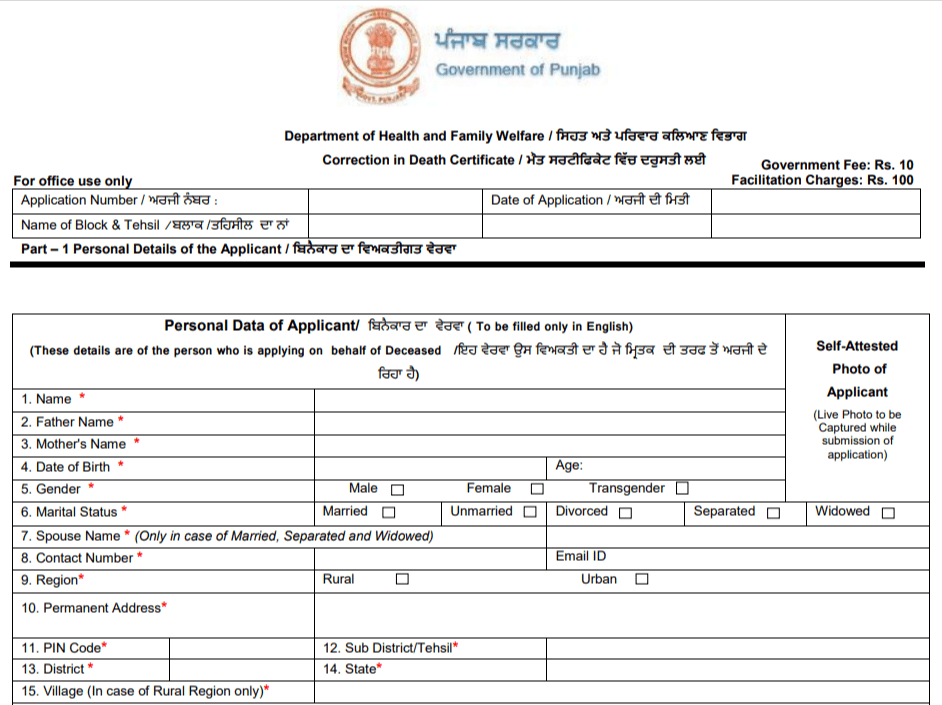

Death Certificate Form For The State Of Punjab PDF Govtempdiary

https://govtempdiary.com/wp-content/uploads/2022/04/Punjab-Death-Certificate-Form-PDF.png

How To Report A Deceased Employee s Wages Human Resources

https://blog.timesheets.com/wp-content/uploads/2019/10/rose-3063284_1920.jpg

Wages Paid in a Year After the Employee s Death The payment of accrued wages may not be paid until a later year because of delays in probating the employee s estate He was still due accrued vacation pay of 2 000 a week s wages of 250 and a production bonus of 800 for the month of May John had already been paid gross wages totaling Payroll professionals must ensure compliance with federal and local requirements for proper withholding of a deceased employee s final paycheck Employers should report any payments made to a deceased employee of over 600 on Form 1099 Dailey warned employers against using Form 1099 MISC to report these payments reflecting a 2020 update by

Wages Paid Prior to Employee s Death Check Not Cashed Reissue Check to Beneficiary Estate Yes Yes Yes wages for pay period included in Box 1 and as Medicare Box 6 SS Wages Box 4 Taxes should be reported for FIT and FICA N A A Last Paycheck Issued the Same Year Death Any wages paid to a beneficiary or the employee s estate Employers should check their state s specific requirements for any additional withholding that may apply to final wages paid to a deceased employee Some states may require state income tax to be withheld The survivor or estate will receive a Form 1099 MISC reporting the final pay as other income in Box 3

More picture related to Salary Payment To Deceased Employee

Reliance 5 Year Salary Children Education To Deceased Employees

https://cdn.gulte.com/wp-content/uploads/2021/06/Reliance-Employees.jpg

Cable Car Dedicated To Deceased Employee San Francisco News

https://www.thesfnews.com/wp-content/uploads/2019/10/Screen-Shot-2019-10-02-at-3.12.11-PM.png

Cheque Distribution To Family Of Deceased Employee

http://gwmc.com.pk/media/gallery/cheque-distribution-deceased/cheque-distribution-to-deceased-employee-family-april-2016-03.jpg

For example in California the maximum wage an employer may pay to the survivor of a deceased employee before the estate has been administered is 15 000 In New York the limit is 30 000 within 30 days of death 15 000 from 31 days to six months and 5 000 if more than six months after death Scenario 1 Employee dies before cashing a check Void the payment and reissue per state law to the employee s personal representative or beneficiary The new check should have the same amount withheld for tax purposes as the old check Wages get reported on deceased employee s Form W 2 No 1099 Misc form is needed

Find the specific requirements for deceased employee wages in the General Instructions for Forms W 2 and W 3 What types of non wage payments does my organization need to report on a 1099 series return If you made or received a payment during the calendar year you are most likely required to file an information return to the IRS The M Corporation the employer of A a deceased employee who died November 30 1954 makes payments in 1955 to the beneficiaries of A as follows 5 000 to W A s widow 2 000 to B the son of A and 3 000 to C the daughter of A

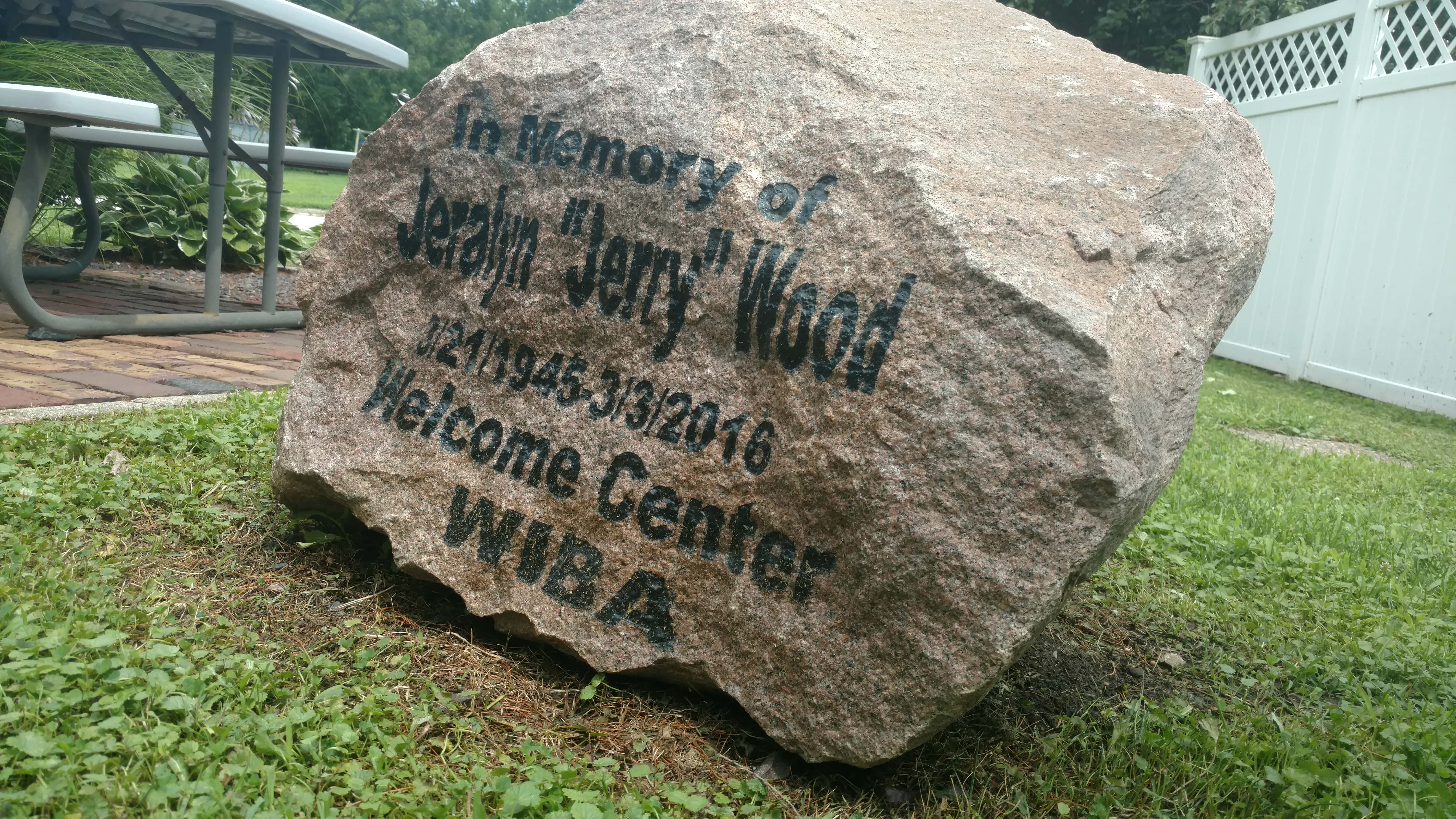

Visitors Bureau WIBA Honor Deceased Employee With Memorial Stone The

http://dehayf5mhw1h7.cloudfront.net/wp-content/uploads/sites/525/2016/07/22203123/IMG_20160722_120420754.jpg

Jharkhand HC Directs JUVNL To Provide Compassionate Appointment To

https://www.eduvast.com/wp-content/uploads/2022/08/jHARKHAND-HIGH-COURT-768x432.jpg

Salary Payment To Deceased Employee - Payroll professionals must ensure compliance with federal and local requirements for proper withholding of a deceased employee s final paycheck Employers should report any payments made to a deceased employee of over 600 on Form 1099 Dailey warned employers against using Form 1099 MISC to report these payments reflecting a 2020 update by