Ri State Payroll Tax Rate 2024 Rhode Island RI state payroll taxes Now that we re done with federal income taxes let s tackle Rhode Island state taxes The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax The rates range from 3 75 to 5 99

Withholding Tax In accordance with changes signed into law in June of 2022 a larger business registrant will be required to use electronic means to file returns and remit taxes to the State of Rhode Island for tax periods beginning on or after January 1 2023 In other states may wish to withhold Rhode Island income taxes from wages of their Rhode Island employees as a convenience to those employees Information regarding such withholding should be requested from the Rhode Island Division of Taxation One Capitol Hill Providence RI 02908 5800 4 COMPUTING THE AMOUNT OF RHODE ISLAND TAXES TO BE

Ri State Payroll Tax Rate

Ri State Payroll Tax Rate

https://files.taxfoundation.org/20200203173310/PIT-2020-dv2-01.png

2021 Withhholding Tables

x-raw-image:///aa37174ea0e07edded4aae2f055411c07e767662b1473ac413b3a03e4cdcdbd2

State Corporate Income Tax Rates and Brackets for 2022 | Tax Foundation

https://files.taxfoundation.org/20220114151353/2022-State-Corporate-Tax-Rates-including-State-Corporate-Income-Tax-Rates-and-Brackets-Corporate-Income-Tax-Rates-and-Brackets-by-State.png

Use if your Rhode Island taxable income is less than 100 000 If your taxable income is 100 000 or more use the Tax Rate Schedules located on page T 1 SAMPLE TABLE EXAMPLE 1 Your taxable income from RI 1040 or RI 1040NR page 1 line 7 is 25 300 00 Effective April 11 2022 the Employer Tax unit transferred from the RI Division of Taxation to the RI Department of Labor and Training The mailing address for tax returns payments and other correspondence for the Employer Tax unit is now RI Department of Labor and Training Employer Tax Unit 1511 Pontiac Ave Cranston RI 02920 0942

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income DO NOT use to figure your Rhode Island tax Instead if your taxable income is less than 100 000 use the Rhode Island Tax Table located on pages T 2 through T 7 If your taxable income is larger than 100 000 use the Rhode RI 1040 line 7 or Enter here and on RI 1040NR line 7 is RI 1040 line 8 or Over But not over RI 1040NR line 8 0 68 200 155 050 Over 155 050 0 00 682 00 2 604 62 RHODE ISLAND TAX COMPUTATION WORKSHEET a Enter the amount from RI 1040 line 7 or RI 1040NR line 7 Amount Taxable Income line 7 TAX RATES APPLICABLE TO ALL FILING STATUS

More picture related to Ri State Payroll Tax Rate

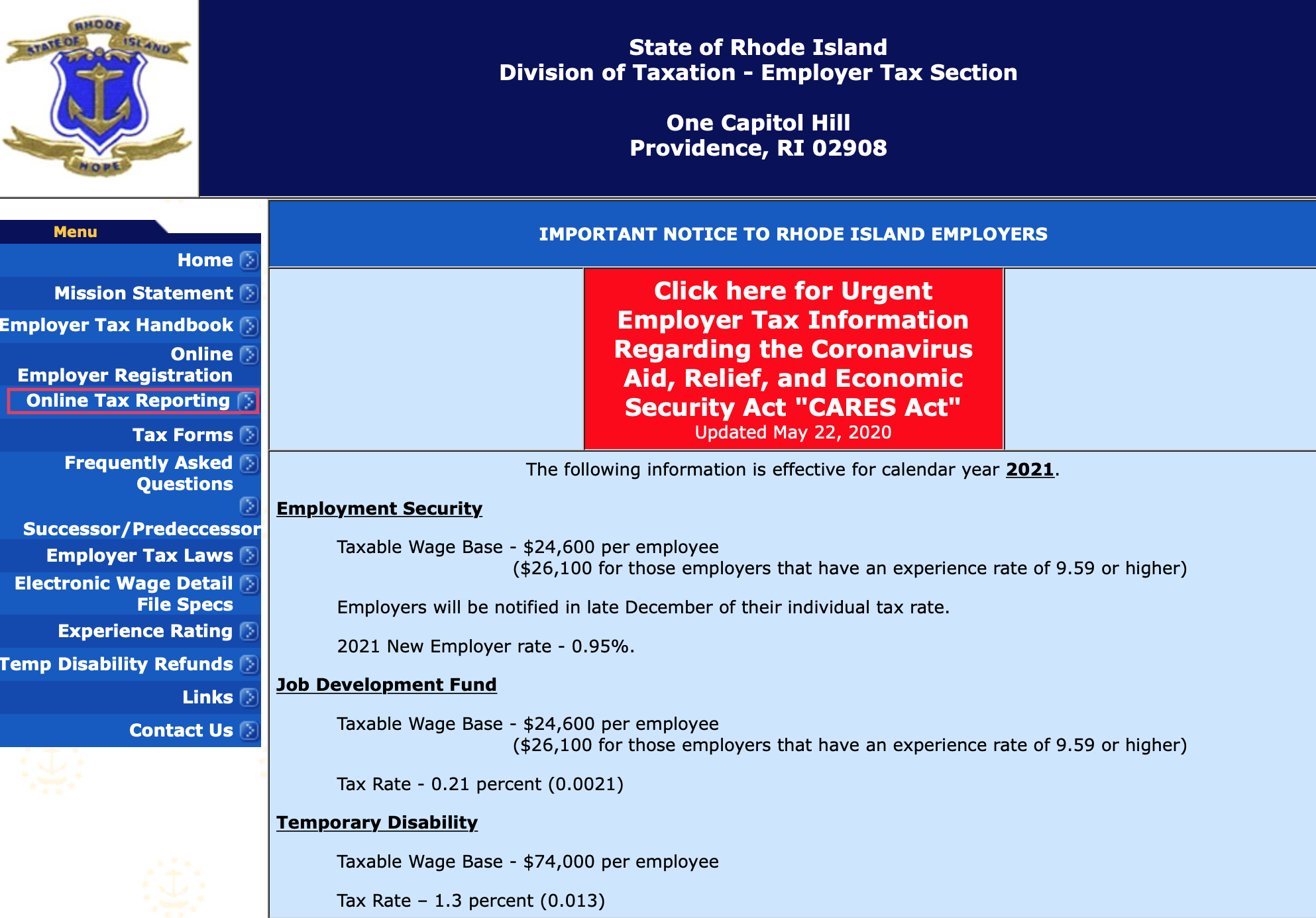

USA State Payroll Rates + Resources: State of Rhode Island: Unemployment Insurance Reporting & Payments

https://hibou.io/web/image/79866/ri-tax-reporting.png?access_token=50a75580-a35e-4a21-aa98-324c2f25ad81

An Updated Analysis of a Potential Payroll Tax Holiday – ITEP

https://itep.sfo2.digitaloceanspaces.com/table-1.jpg

State Corporate Income Taxes Increase Tax Burden on Corporate Profits

https://files.taxfoundation.org/20210303101855/2021-combined-federal-and-state-corporate-income-tax-rates.-Do-corporataions-pay-state-and-federal-taxes.png

The Central Payroll Office is responsible for processing the state payroll and for the administration of payroll taxes Central Payroll also serves as a liaison between the state and TIAA Voya Fidelity and ERSRI Working closely with the Division of Human Resources and the Office of Employee Benefits we are responsible for producing accurate Rhode Island unemployment tax rate Rhode Island requires most employers to pay unemployment insurance tax to help compensate workers who are out of work through no fault of their own Employers pay Rhode Island unemployment tax on the first 28 200 of an employee s wages New employers pay at a rate of 0 88

Social Security The current Social Security tax rate is 6 2 for employees and correspondingly for employers for a total of 12 4 The Social Security tax has a wage base limit which means that the tax only applies to a certain amount of money The starting salary for 2021 is 142 800 Rhode Island Payroll Taxes There are no local or city taxes in Rhode Island which makes the process of filing payroll taxes much simpler than states that do State Income Tax Rhode Island has three different state income tax brackets with the lowest income earners paying the lowest rates For the 2022 tax year the income tax rates are

Marginal Tax Rates for Pass-through Businesses by State | Tax Foundation

https://files.taxfoundation.org/20200714165332/Passthrough-2020-FV-01.png

Rhode Island Department of Revenue Division of Taxation

x-raw-image:///ec258b193c50aca240d7c9d19670a43f69db88a19165ad48c6a82cce2c15f060

Ri State Payroll Tax Rate - Use if your Rhode Island taxable income is less than 100 000 If your taxable income is 100 000 or more use the Tax Rate Schedules located on page T 1 SAMPLE TABLE EXAMPLE 1 Your taxable income from RI 1040 or RI 1040NR page 1 line 7 is 25 300 00