Postdoc Salary In Usa After Tax Learn about the average salary of postdocs in the United States and the variations in salary that can occur based on location institution or experience

PhD students earn between 15 000 and 30 000 a year depending on their institution field of study and location This stipend can be tax free if it is a fellowship award or taxable if it is a salary e g from a teaching position American PhD students are usually only paid for nine months of the year but many programs offer summer funding Taxes The University withholds state federal and FICA taxes from the salaries of employees including postdoctoral associates The tax situation for postdoctoral fellows is more complicated however and depends on the fellow s source of income nation of origin and immigration and residency status

Postdoc Salary In Usa After Tax

Postdoc Salary In Usa After Tax

https://pbs.twimg.com/media/FdGaRu_XoAEljfZ?format=jpg&name=4096x4096

How to Put Your New Postdoc Salary in Context - Personal Finance for PhDs

http://pfforphds.com/wp-content/uploads/2020/08/Screen-Shot-2020-08-05-at-5.26.19-PM-1.png

Jaki Noronha-Hostler on Twitter: "When I was a postdoc (with 2 kids and husband was stuck in another country at the time), my salary was such that I could not afford food

https://pbs.twimg.com/media/FF7SjX8XsBEM6wB.jpg:large

The same standard for compensation applies to all types however it is important to know what kind of postdoc you are as this may affect your retirement benefits and how you pay your taxes Note that a postdoc may be appointed under more than one title code since there may be more than one source of funding for an appointment Taxability of Salary Benefits Because of their status as non degree candidates income received by a Postdoctoral Scholar is considered fully taxable by the federal and state tax boards

Effective January 1 2024 the minimum salary stipend for all postdoctoral scholars Postdoctoral Associates and Postdoctoral Fellows is 66 950 The minimum salary stipend for postdoctoral scholars is reviewed each fall and adjustments take effect annually on January 1 The annual reappointment of a postdoc does not trigger an increase as a Salary The level for federal fiscal year 2024 is 61 008 The minimum rate is not applicable to postdoctoral fellows unless otherwise provided by the fellowship award Salary for postdoctoral associates and fellows on NIH awards must follow the minimum salary requirements based on years of experience

More picture related to Postdoc Salary In Usa After Tax

NYC Postdoc Coalition on Twitter: "On pause or not, the Big 🍎 is a very expensive city to live 🗽. Recently, some positive changes have been made related to #NYC #postdoc stipends.

https://pbs.twimg.com/media/EX-ry6lWoAcx0XR.jpg

How to Put Your New Postdoc Salary in Context - Personal Finance for PhDs

http://pfforphds.com/wp-content/uploads/2020/06/PhD-Tax-Workshop-Question.jpg

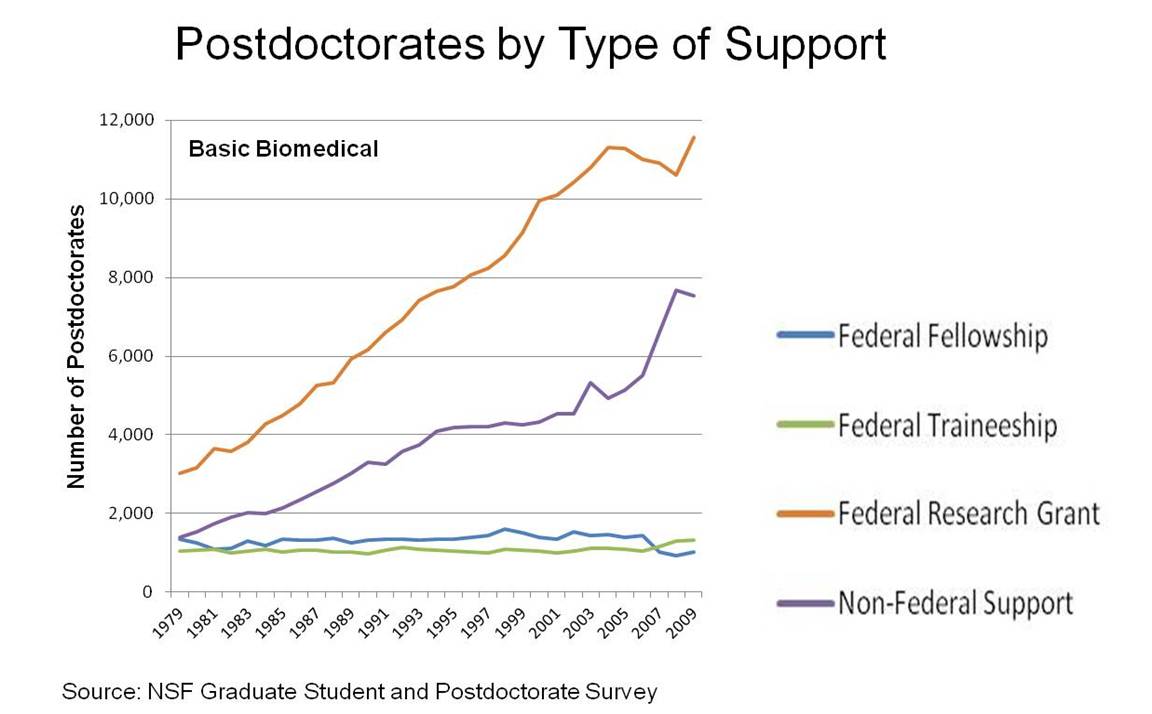

Postdoctoral Researchers—Facts, Trends, and Gaps – NIH Extramural Nexus

http://nexus.od.nih.gov/all/wp-content/uploads/2012/06/postdoc_number.jpg

Tax Information General information on taxes for postdocs is available below and from the Office of the Vice President for Finance VPF Because the taxability of your salary or fellowship depends on many factors MIT staff cannot answer any questions about your personal tax situation Compensation above salary extra comp for postdoctoral fellows and associates is expected to be rare and granted only in exceptional circumstances Requests for compensation above salary must be made in advance to the Office for Postdoctoral Affairs Please review the university policies on extra compensation prior to making a request

However postdoc employees will begin to pay FICA tax On the employee side the Social Security tax is 6 2 and the Medicare tax is 1 45 on all of your income up to 128 400 in 2018 If your new postdoc salary is 45 000 per year for example you will pay 3 442 50 in FICA tax All scholars paid on salary semi monthly payments through the payroll system must have a SSN on file Postdocs must submit withholding allowances in in AXESS or visit Student Financial Services Tax Information Funding regardless of the source is subject to US and California tax law Postdoc Tax Information

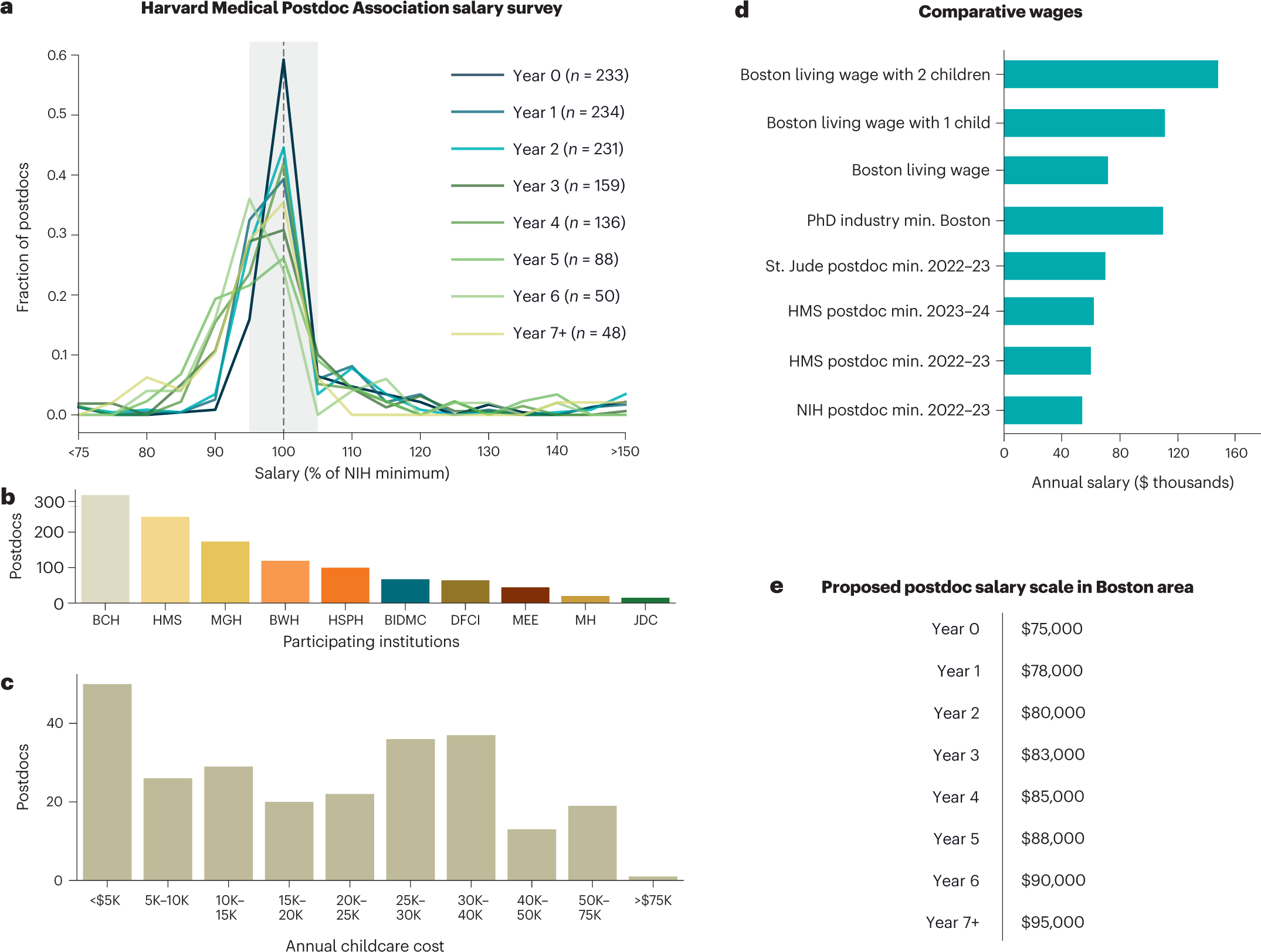

Retaining postdocs by recognizing their worth | Nature Biotechnology

https://media.springernature.com/full/springer-static/image/art%3A10.1038%2Fs41587-023-01656-4/MediaObjects/41587_2023_1656_Fig1_HTML.png

How to Put Your New Postdoc Salary in Context - Personal Finance for PhDs

http://pfforphds.com/wp-content/uploads/2020/06/QE-Tax-Workshop-Link-1.jpg

Postdoc Salary In Usa After Tax - Salary The level for federal fiscal year 2024 is 61 008 The minimum rate is not applicable to postdoctoral fellows unless otherwise provided by the fellowship award Salary for postdoctoral associates and fellows on NIH awards must follow the minimum salary requirements based on years of experience