Pllc Tax Rate How Limited Liability Companies are Taxed By Eric Rosenberg Reviewed by Derek Watson EA on August 12 2022 This article is Tax Professional approved Many small business owners are curious about how taxes work when they re the boss of a limited liability company a popular type of business entity

The PLLC files a standard Form 1120 Corporate Income Tax Return and pays taxes at the regular corporate tax rate It retains earnings as a corporation however and doesn t distribute How Are LLCs Taxed may sound complicated to you but they re not The truth is that for most LLCs the LLC tax rate is the same as the personal federal income tax rate Since LLCs are business structures established by state statute the way they re taxed on a state level varies The 4 Ways an LLC Can be Taxed

Pllc Tax Rate

Pllc Tax Rate

https://www.ratemytaxaccountant.com/static/b-g.ca8d09489f64.png

Rate 1 10 R whiteboyem

https://preview.redd.it/k13s5mlquly91.jpg?auto=webp&s=e605b41b3994e5ed1f5bdb05755a93d5dd8acd79

Flat Income Tax Rate To Be Introduced In Armenia 2020

https://armenian-lawyer.com/wp-content/uploads/2019/01/Tax-Administration-under-the-risk-classification-method.jpg?x84312

Comments and suggestions We welcome your comments about this publication and your suggestions for future editions You can send us comments through IRS gov FormComments Or you can write to Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave NW IR 6526 Washington DC 20224 How Do Limited Liability Companies LLCs Pay Taxes LLC taxes know your tax burden in advance Learn what you re responsible for and how to reduce your tax bill By Priyanka Prakash

December 29th 2023 Why use LendingTree Small business taxes can be complicated as there isn t a single tax form or even a single tax rate that applies to all businesses How you file your taxes and the small business tax rates you ll pay on profits will depend on your business entity structure A PLLC or professional limited liability company LLC is a specific type of LLC formed by licensed professionals in some states A PLLC functions in the same way as a general limited liability company and is formed similarly Learn more about PLLCs and how they work What Is a PLLC

More picture related to Pllc Tax Rate

PLLC

http://img.mweb.com.tw/thumb/441/1000x1000/Product-image/Strengh/Plate-Load/13_PLLC/pllcmu_big.jpg

IRS Guidance On Recapturing Excess Employment Tax Credits McGlinchey

https://www.mcglinchey.com/wp-content/uploads/2020/07/Tax-Alert-Excess-Employment-Tax-Credits-07.28.20.jpg

What Is The Inheritance Tax Rate In The UK Gobernauta

https://inheritance-tax.co.uk/wp-content/uploads/2021/07/216417645_485287309235716_983929745416478314_n.png

A Limited Liability Company LLC is a business structure allowed by state statute Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company Owners of an LLC are called members Reviewed by Brooke Davis PLLC Meaning What does PLLC stand for PLLC stands for Professional Limited Liability Company What is a PLLC A PLLC is a type of limited liability company owned and operated by individuals holding the same professional licenses in the same state

How Is Income From an LLC Taxed The IRS treats your LLC like a sole proprietorship or a partnership depending on the number of members in your LLC Single Member LLCs The IRS treats single member LLCs LLCs with one owner as sole proprietorships for tax purposes Employment Tax and Certain Excise Tax Requirements In August 2007 final regulations T D 9356 PDF were issued requiring disregarded LLCs to be treated as the taxpayer for certain excise taxes accruing on or after January 1 2008 and employment taxes accruing on or after January 1 2009 Single member disregarded LLCs will continue to be

Taxes Tippinsights

https://tippinsights.com/content/images/size/w1304/2023/04/iss_3692_24380.jpg

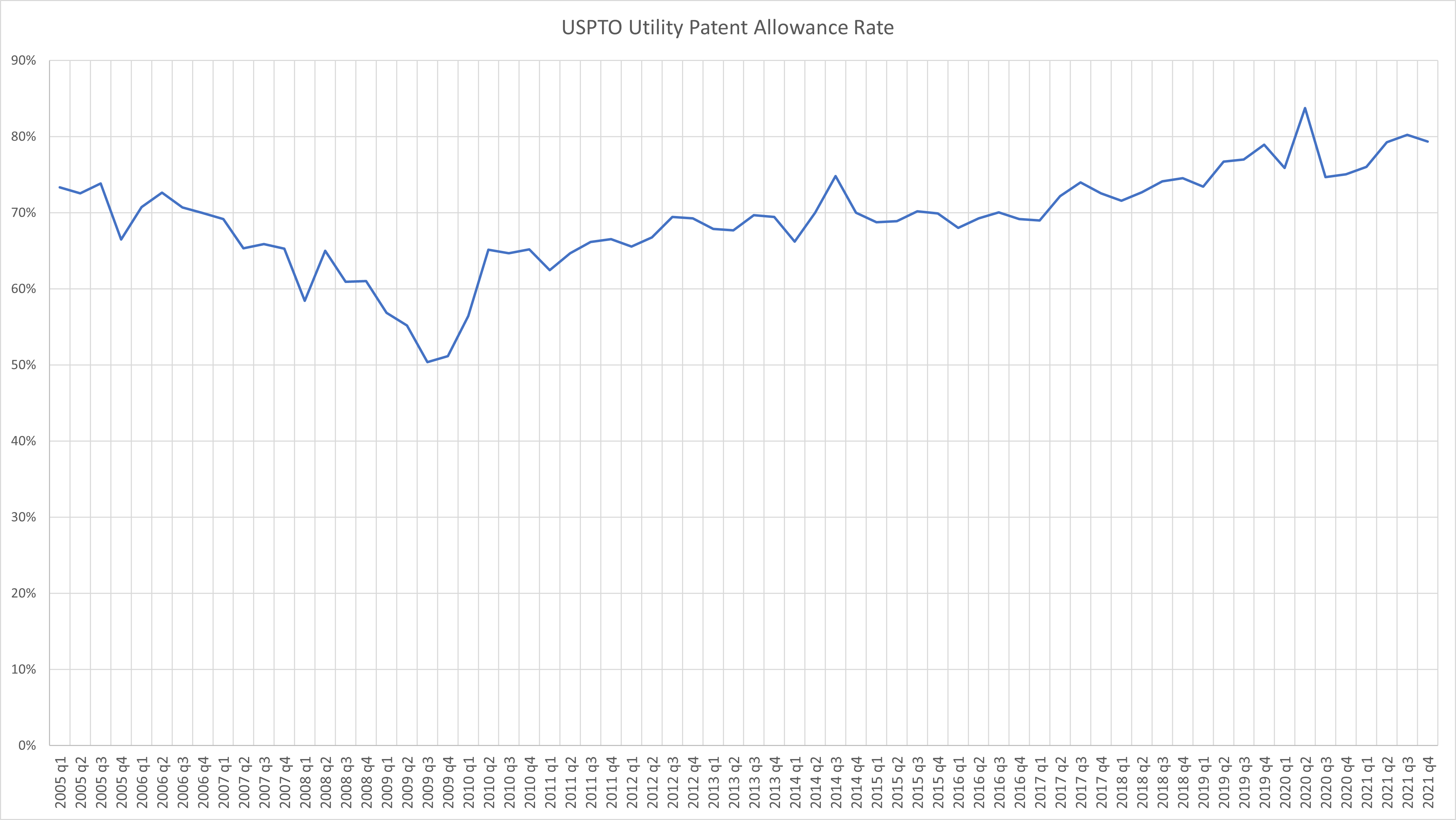

Status Of US Utility Patent Applications

https://patentlyo.com/media/2022/02/USPTOAllowanceRate2022-1.png

Pllc Tax Rate - How Its Taxed FAQs Overview There are about 30 states that have adopted provisions allowing the formation of a PLLC Another nine states allow a licensed professional to form a regular LLC