Payslip Sample Philippines 2023 The payroll process also includes computing deductions from an employee s monthly salary as mandated by the government Examples of these include the following Withholding tax Philippine employees earning more than Php 250 000 are required to pay taxes

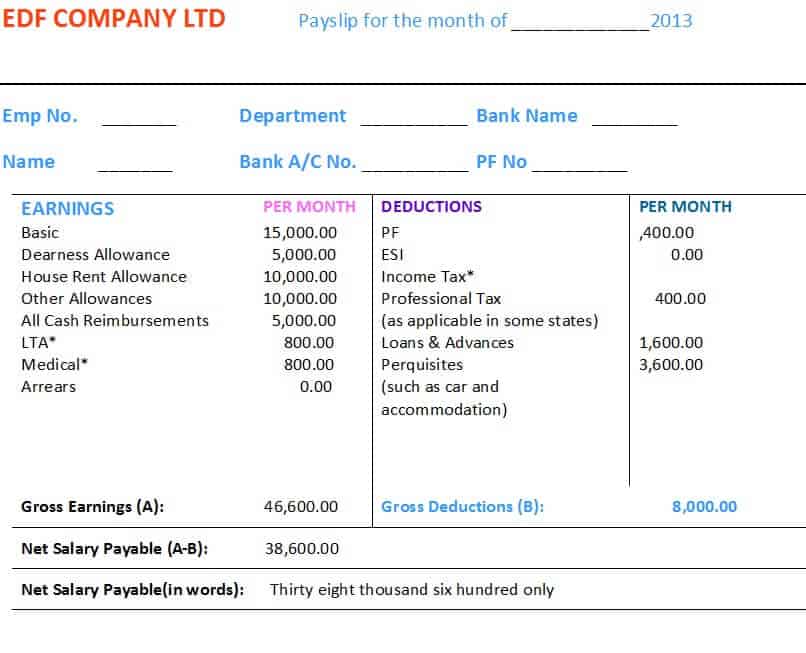

This payslip template comes with a how to guide that includes an example of how to fill one out In short you ll enter wages or salary earned then note down deductions for things like tax and retirement There s also a field on this payslip template where you can note down reimbursements This might include repayments made to your Creating a payslip may seem daunting but it doesn t have to be Here are a few simple tips to help you get started 1 First gather the relevant information You ll need to know the employee s name salary and any deductions that need to be made 2 Next calculate the appropriate deductions

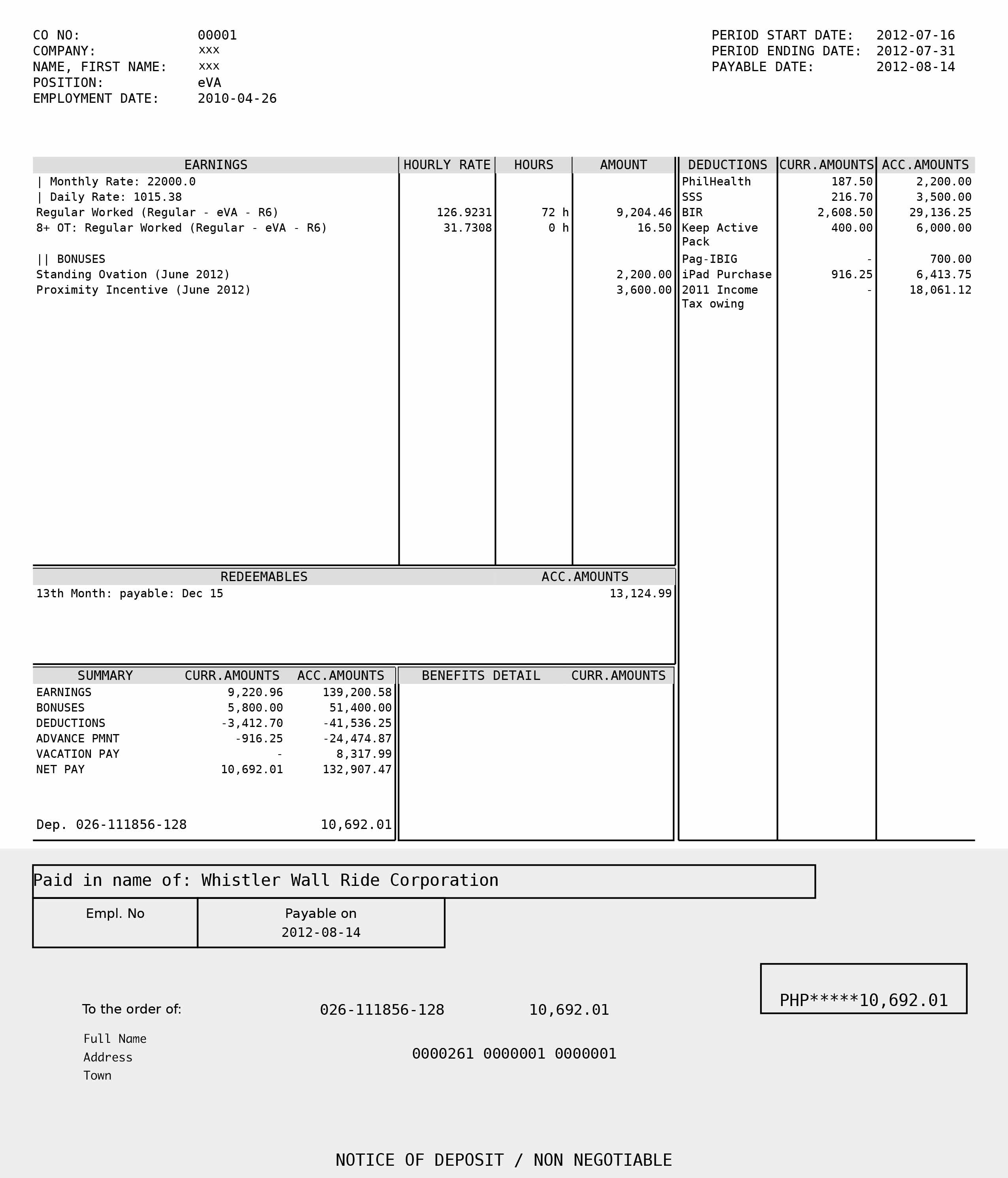

Payslip Sample Philippines 2023

Payslip Sample Philippines 2023

https://www.contractorumbrella.com/wp-content/uploads/2019/01/Payslip_for_period_ending_05_08_2018.png

Payslip Sample Template Paysliper Edu svet gob gt

https://paysliper.com/assets/templates/image/grid1.jpg

Salary Slip Format 40 FREE Excel And Word Templates In 2021 Word

https://i.pinimg.com/originals/c7/02/38/c702386542d4a0d0ee3146f792ce3dba.png

This should be the total salary per payment period as selected at step 2 Press calculate The Philippines Payroll Calculator will then produce your payroll cost calculation Understanding and getting familiar with payroll deductions and payroll costs in Philippines in 2023 can be a real drain on your time and business resources Download Toll Pinas an app that you can use to find out the toll fee you need to pay for expressways in the Philippines Input Employment Type Type Private Employee Government Employee 2023 2024 Basic Pay 0 00 Taxable Allowance 0 00 Non taxable Allowance 0 00 Please do not use the app as a replacement for payroll personnel

This tool allows you to quickly create a salary example for Philippines with income tax deductions health insurance deductions pension deductions and other wage deductions and tax allowances in the 2024 tax year The aim of this tool is to allow you to calculate your income tax in Philippines Create a new row in the YTD worksheet Enter all the information for a pay date pay period hours and payment amounts Select the pay date from the drop down at the top of the free payslip template The hours and amounts will update Double check print and send the payslip to the employees

More picture related to Payslip Sample Philippines 2023

Generate Employee Pay Stubs In Seconds For Your Employees

https://payrollhero.ph/ph/img/product-payslip.jpg

Payslip Sample Philippines Excel Ideas Of Europedias

https://www.freesampletemplates.com/wp-content/uploads/2018/10/payslip-7-1.jpg

Free Payslip Template Philippines Free Printable Templates

https://3.bp.blogspot.com/-XAUn-nieerE/WUonQkzj4jI/AAAAAAAAa_w/AuxDxeUW8_o2VJrAvlafKN4JAAst64A4wCLcBGAs/s1600/Capture.JPG

Using the payslip template To utilise a payslip template effectively follow these steps Customise the template Tailor the template to match your company s payroll system adjusting for payment frequency tax deductions and any unique benefits or allowances Input employee data Gather accurate information such as personal details hours worked gross pay deductions and net pay then By Johnny Mapalad March 15 2023 March 15 2023 blog Understanding the basic anatomy of a payslip in the Philippines is essential for employees and employers alike A payslip is a document that shows the details of an employee s salary for a specific period typically issued by the employer to the employee as proof of payment for the work

The Annual Salary Calculator is updated with the latest income tax rates in Philippines for 2023 and is a great calculator for working out your income tax and salary after tax based on a Annual income The calculator is designed to be used online with mobile desktop and tablet devices Employers in the Philippines collect and withhold their employees personal income tax through payroll deductions This is why you have the withholding tax on your monthly payslip Among salary deductions the withholding tax is the most painful to compute as much as it hurts the wallet except for tax exempt employees with a monthly salary

Sample Payslip Format Philippines

https://shieldgeo.com/wp-content/uploads/2020/08/Philippines-Payslip-Explained-e1597166419246-1024x780.png

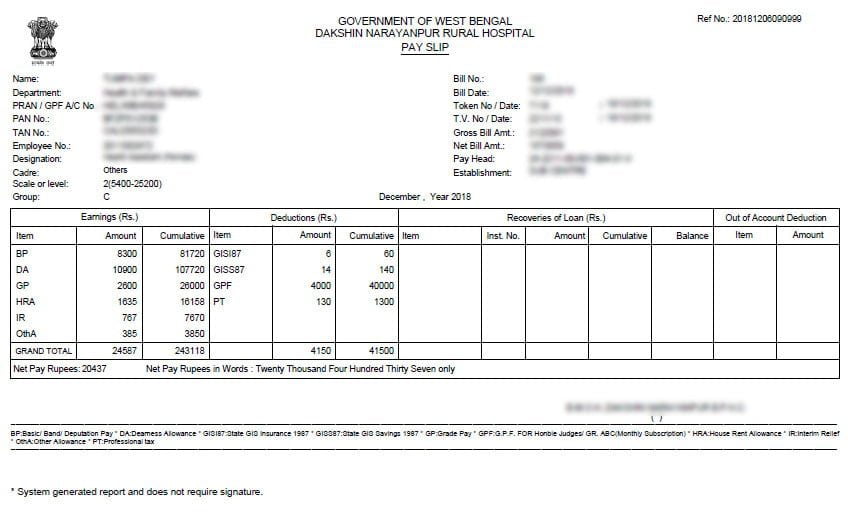

How To Download Payslip Form WBIFMS In 2023

https://wbpay.in/wp-content/uploads/2019/01/Sample-copy-of-a-payslip.jpg

Payslip Sample Philippines 2023 - Payroll Cycle Payroll in the Philippines follows a monthly cycle depending on the employer and the sector Employers must pay salaries once every two weeks at intervals of not more than 16 days The Philippines has a 13th pay provision a bonus of one extra month of the employee s regular salary