Paycheck Calculator Utah Adp If you earn wages in excess of 200 000 single filers 250 000 joint filers or 125 000 married people filing separately you have to pay a 0 9 Medicare surtax Your employer does not match this surtax In most cases you re only responsible for paying 50 of your FICA taxes on your own

Now you can use this powerful online payroll calculator tool from Roll to perform gross to net calculations to estimate take home pay in all 50 states Simply fill out the fields below to the best of your knowledge and get your earnings estimate Just give us the data and our gross income calculator will do the math for you Utah Utah Salary Paycheck Calculator Calculate your Utah net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Utah paycheck calculator Switch to hourly calculator Utah paycheck FAQs Utah payroll State Date State Utah Change state Check Date

Paycheck Calculator Utah Adp

Paycheck Calculator Utah Adp

https://www.paycheckcity.com/static/66073f031d01ca37d4cb368888cadd23/vermont.jpg

Adp Paycheck Calculator Texas FalahSofiia

https://media.trustradius.com/product-screenshots/0T/7C/7813X6MKHT65.png

Paycheck Calculator California Adp HasyimRobson

https://i.pinimg.com/736x/cd/6f/74/cd6f74cd8dea99386d52f3836de5740a.jpg

Important Note on Calculator The calculator on this page is designed to provide general guidance and estimates It should not be relied upon to calculate exact taxes payroll or other financial data These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution Use Gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in Utah We ll do the math for you all you need to do is enter the applicable information on salary federal and state W 4s deductions and benefits Paid by the hour Switch to hourly Salaried Employee

To effectively use the Utah Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of allowances you claim Add any additional withholdings or deductions such as retirement contributions or health insurance premiums The Utah Hourly Paycheck Calculator is a valuable tool for individuals in Utah to quickly estimate their gross pay based on hourly wages and hours worked While it simplifies the calculation process users should be aware of its limitations and use additional tools for comprehensive financial planning Efficiently calculate your hourly paycheck

More picture related to Paycheck Calculator Utah Adp

Paycheck Calculator Adp Small Business DuncanCeiren

https://managementhelp.org/wp-content/uploads/2022/05/ADP-payroll-dashboard-1024x655.png

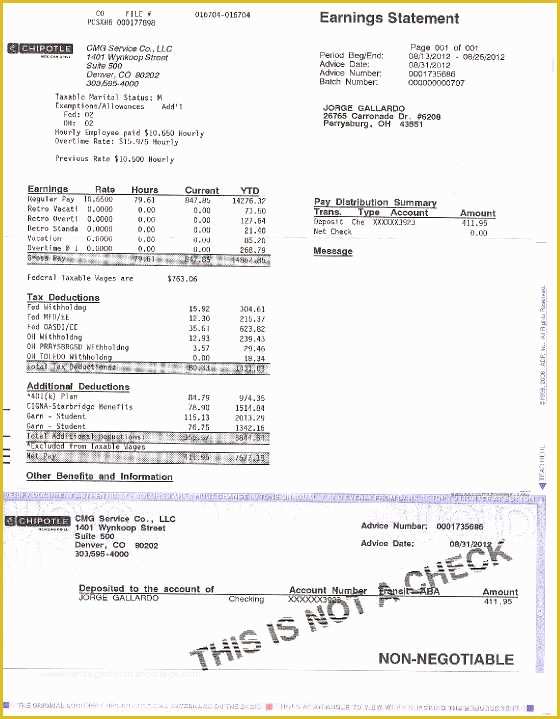

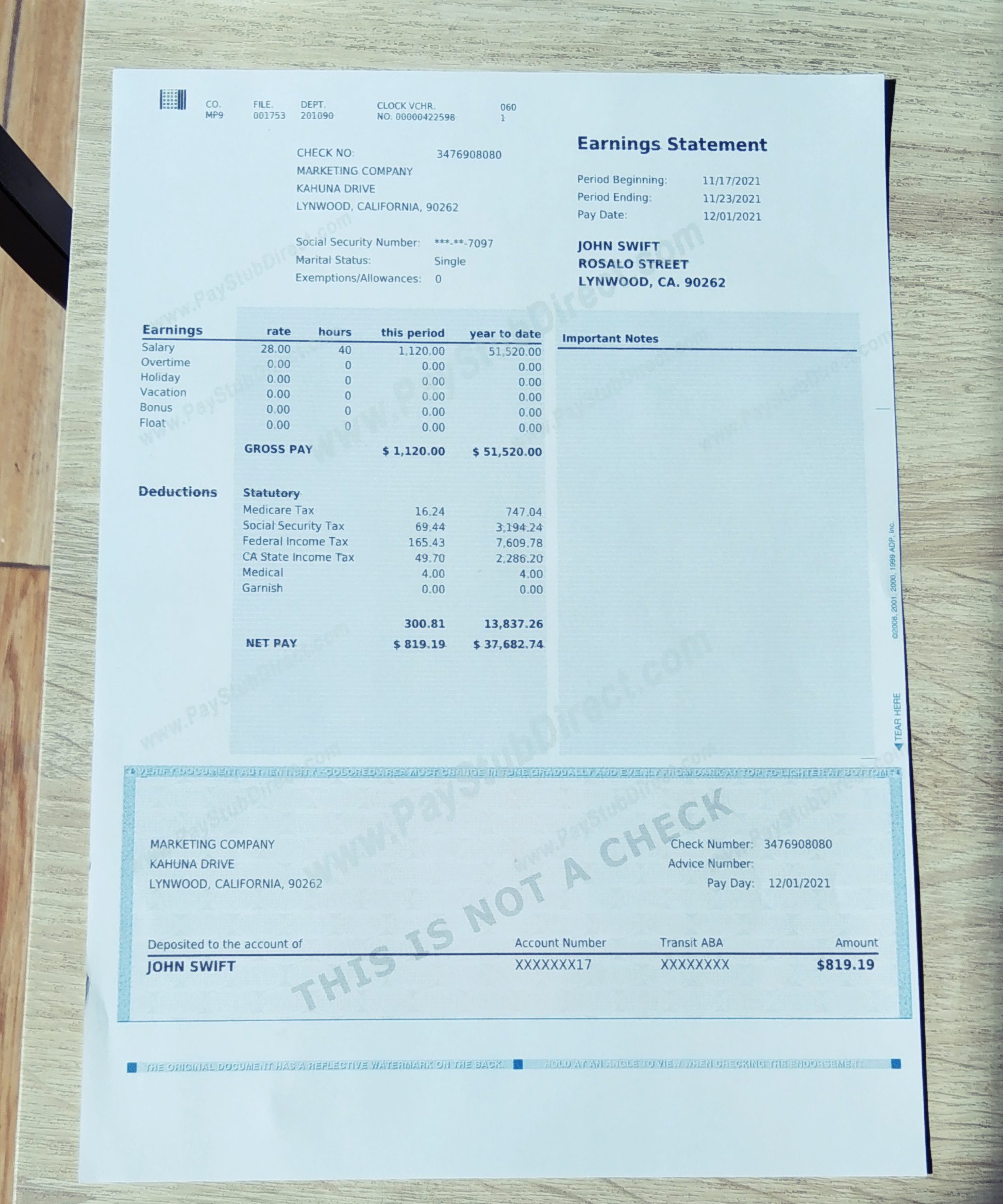

Free Download Pay Stub Rawasl

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/adp-paycheck-stub-template-free-of-adp-paycheck-stub-template-employer-and-pay-me-back-of-adp-paycheck-stub-template-free.jpg

Calculate My Paycheck Utah CALCULATOR PWQ

https://i2.wp.com/www.paycheckstubonline.com/wp-content/uploads/2013/12/Modern-Paystub-template.jpg

Use PayCalculation s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and your average monthly expenses 79 449 Bi Weekly Paycheck Taxable Income 0 00 Federal Tax 0 00 State Tax 0 00 0 00 NaN of gross income Total income taxes 0 00 NaN Total payroll taxes 0 00 NaN Total pre tax deductions 0 00 NaN Total post tax deductions 0 00 NaN State income taxes are based on tax year 2023 figures Breakdown for tax year 2024 Calculation not correct Request new features Paycheck calculators by state

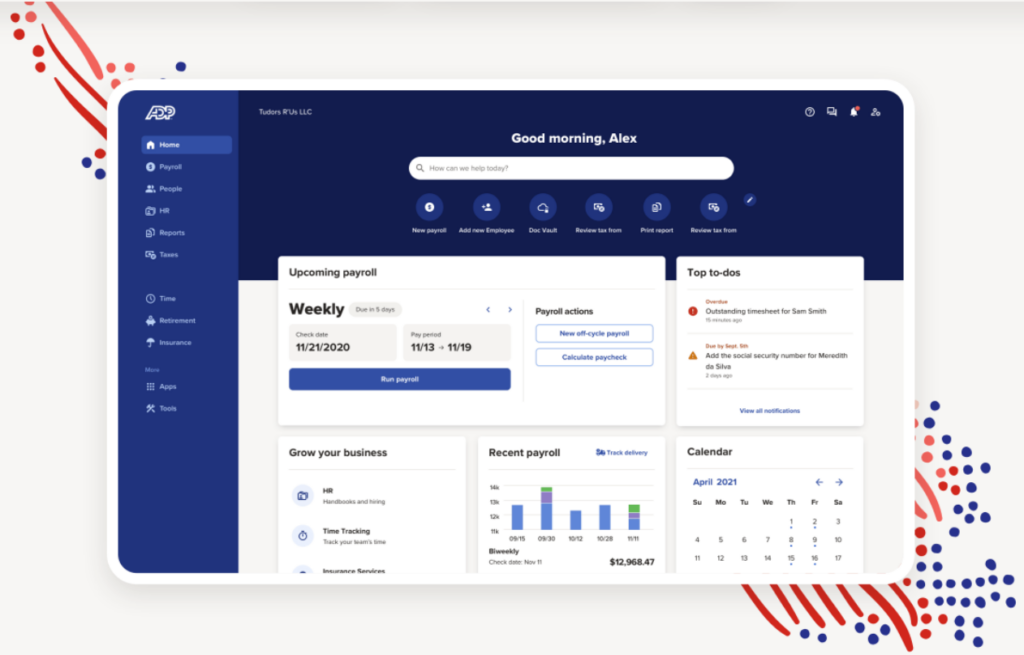

Federal Paycheck Calculator Photo credit iStock RyanJLane Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 The ADP Hourly Paycheck Calculator is a valuable tool for both employers and employees providing a convenient means to estimate net pay based on hourly wage hours worked and various deductions ADP a leading provider of human resources and payroll solutions offers this calculator to facilitate accurate and transparent payroll calculations

Adp Bi Weekly Paycheck Calculator FahadManahial

https://assets-global.website-files.com/5f06190cf2ec276d6e8ec57b/616db8fa53dfd3c45c18993f_ADP-use-cases.jpg

Adp Paycheck Estimator AemiliaSofie

https://static.paystubdirect.com/uploads/2021/12/portra.jpg

Paycheck Calculator Utah Adp - Calculate Gross Wages For all your hourly employees multiply their hours worked by the pay rate Don t forget to increase the rate for any overtime hours For all your salaried employees divide each employee s annual salary by the number of pay periods you have Also add in commissions tips or bonuses into gross wages