Pa Employee Income Tax Withholding Form An employer is any individual partnership association corporation government body or other entity that employs one or more persons which is required under the Internal Revenue Code to withhold federal income tax from wages paid to an employee Employers currently withhold and remit employees taxes on wage and salary income according to

Pennsylvania does not have a form exactly like the federal W 4 form since Pennsylvania Personal Income Tax is based on a flat tax rate and everyone pays the same rate of 3 07 percent Pennsylvania does not have allowances based on the number of dependents claimed marital status age etc However you may be entitled to non withholding of PA Pennsylvania law requires the withholding of Pennsylvania per sonal income tax from compensation of resident employees for services performed within or outside Pennsylvania

Pa Employee Income Tax Withholding Form

Pa Employee Income Tax Withholding Form

x-raw-image:///f43025b9cf6a751e42f937dc564cd59b55b91a1f4c4d0247bb51067c8b68b7b8

2019 PA Schedule W-2S - Wage Statement Summary (PA-40 W-2S)

x-raw-image:///460ac479e4abe7045d33dfab74aefb3afef8eb39c318661b5f126dbfecd6140c

Pa form pa w3: Fill out & sign online | DocHub

https://www.pdffiller.com/preview/29/481/29481219/large.png

Every employer paying compensation subject to withholding must withhold Pennsylvania personal income tax from each payment of taxable compensation to their employees To obtain an employer withholding account complete the Pennsylvania Online Business Tax Registration You will receive your registration notice in the mail in 7 to 10 business The employee that is a resident of a reciprocal state must complete Pennsylvania Form REV 419 Employee Non Withholding Application If your employee is a resident of a reciprocal state contact that state s Department of Revenue to determine if you must register to withhold that state s tax Here is the link to the REV 580 which is an

2024 Form W 4 Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 More information about your business s responsibility to withhold personal income tax from employees compensation and wage and salary reporting requirements visit the Pennsylvania Department of Revenue s Employer Withholding page

More picture related to Pa Employee Income Tax Withholding Form

Rev 1832: Fill out & sign online | DocHub

https://www.pdffiller.com/preview/560/828/560828685/large.png

20 1099-MISC WITHHOLDING EXEMPTION CERTIFICATE

x-raw-image:///b04d7f32183c6201fdc20a6d4381fd6903fab9780a794236512fe3ece4564cde

State W-4 Form | Detailed Withholding Forms by State Chart

https://www.patriotsoftware.com/wp-content/uploads/2020/01/state-w4-forms-1.jpg

How can a business with worksite locations in multiple tax collection districts remit local income tax withholdings to a single local tax collector Does Act 32 apply to employees who live and or work in Philadelphia As an employer where do I register for local income tax withholdings REV 580 SU 02 23 Employers are required to withhold PA personal income tax at a flat rate of 3 07 percent of compensation from resident and nonresident employees earning income in Pennsylvania This rate remains in effect unless you receive notice of a change from the Department of Revenue For detailed information on employer withholding

Local Income Tax Requirements for Employers Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA If you elect to withhold the reciprocal state s tax you should contact the reciprocal state s Department of Revenue to register to withhold that state s tax You and your employee must also complete Pennsylvania Form REV 419 Employee Non Withholding Application As the employer you must keep a copy of the REV 419 in your records

Pennsylvania (PA) Tax Forms | H&R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/11/tax-forms.jpg

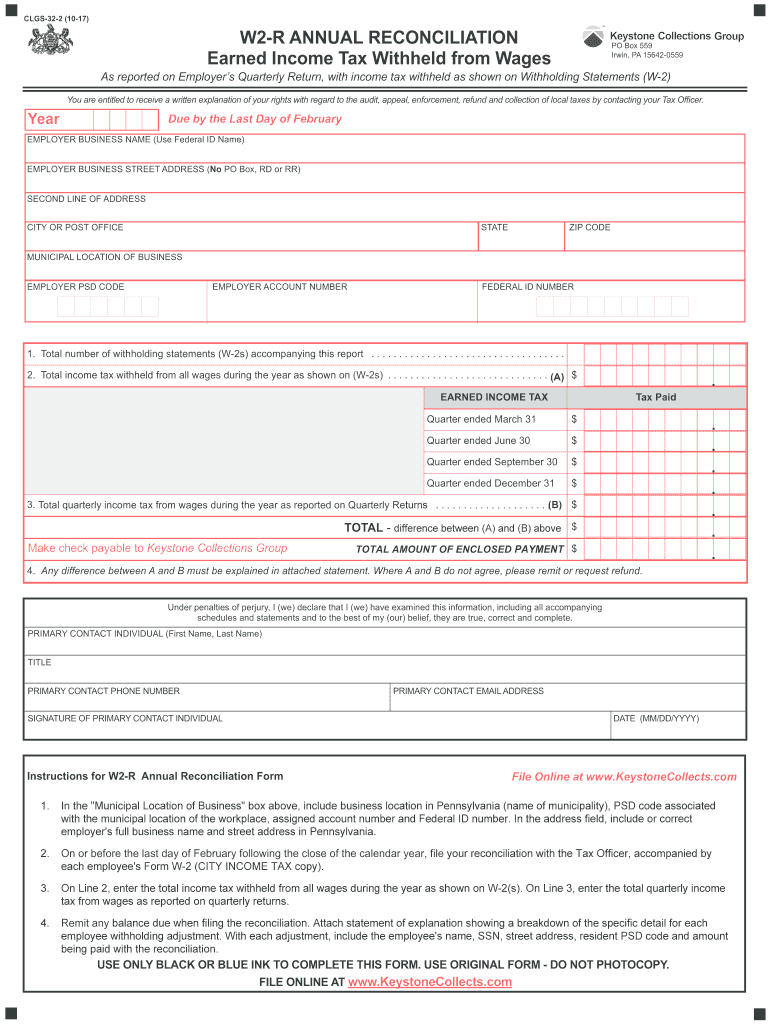

Clgs 32 4: Fill out & sign online | DocHub

https://www.pdffiller.com/preview/490/332/490332866/large.png

Pa Employee Income Tax Withholding Form - REV 419 EX 05 10 Employee s Nonwithholding Application PA DEPARTMENT OF Certificate20 REVENUE Purpose Complete Form REV 419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay Complete a new Form REV 419 every year or when your personal or financial situa tion changes