Net Ordinary Income Vs Net Operating Income And the easiest way to do it is to look at the income the expenses and the line that says net ordinary income If the financial statement that they re giving you does not say net operating income but instead it says net ordinary income you know that they are not using a property management accounting software program

The above equation helps us identify the relationship between operating and net income Operating income on the one hand identifies the income generated from the operating activities of the business net income on the other hand quantifies any income generated by the business entity either from operations or from interests earned from investments or even an income generated by liquidating As far as I know the ordinary income is the taxable income and is used for calculating the taxes in tax accounting I think that it should be net operating income not net ordinary income because this P L is based on the financial accounting and the expense here also includes non deductible expenses

Net Ordinary Income Vs Net Operating Income

Net Ordinary Income Vs Net Operating Income

https://i.ytimg.com/vi/gAHI9vTvSBg/maxresdefault.jpg

What Is Profit Gross Profit Operating Profit Net Income From A

https://i.ytimg.com/vi/R8voRf5BjdA/maxresdefault.jpg

EBIT Vs EBITDA Vs Net Income How They Differ And How New Accounting

https://i.ytimg.com/vi/ZxhAD5KdP2k/maxresdefault.jpg

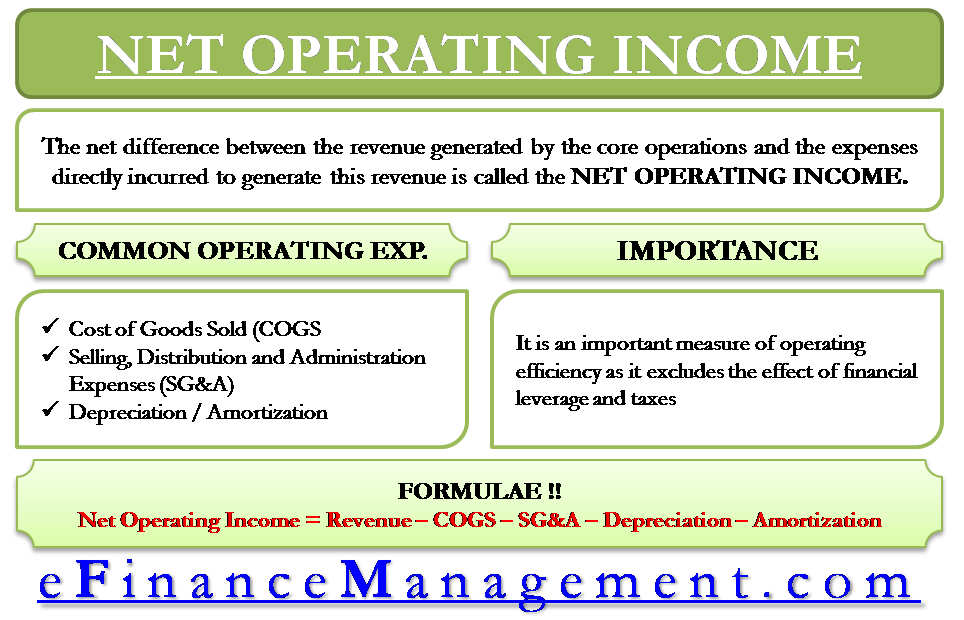

Operating expenses These are ordinary and necessary expenses you incur in everyday business operations Even though operating income and net income both measure your company s profitability understanding each figure can help you make decisions for your business in specific aspects For instance operating income is useful for business Understanding the distinction between operating income and net income is critical for analyzing a company s financial health These metrics reveal various aspects of business performance helping stakeholders make informed decisions Operating income reflects core business activities while net income includes all revenue and expenses

The difference between operating income and net income is that operating income does not take into consideration non operating income such as the income from investments expenses from financing taxes and non recurring expenses or income items such as the gain on the sale of an asset Net income on the other hand is the bottom line profit that factors in all expenses debts additional Operating income tells you your business income based on the regular expenses associated with operating our business Net income also accounts for any non operating expenses or unusual expenses that you don t anticipate coming up again for a while Understanding both operating and net income is important

More picture related to Net Ordinary Income Vs Net Operating Income

EBITDA Vs Net Income Vs Operating Profit Vs Gross Income

https://i.ytimg.com/vi/WLBY03YpiL0/maxresdefault.jpg

EBIT Vs Net Income FundsNet

https://fundsnetservices.com/wp-content/uploads/Screen-Shot-2021-12-06-at-12.59.22-PM.png

Operating Profit

https://efinancemanagement.com/wp-content/uploads/2016/04/Net-Operating-Income.png

What is operating income vs net income Operating income reflects a company s profitability before taxes and interest isolating core operational efficiency Conversely net income encompasses all revenue and expenses providing a comprehensive financial snapshot including non operational elements Wrap Up Operating income vs net income Comparing operating income vs net income The difference between operation and net income comes down to what exactly is deducted from your startup s gross income Operating income is only what you earn after direct and indirect costs are subtracted from gross profits However net income is your bottom line

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/Term-Definitions_noi-4eae808a643c4ca9b130f12fed343370.jpg)

Net Income Equation

https://www.investopedia.com/thmb/kDKrnQnY9w3JctpFuQ58wPL-Zzs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_noi-4eae808a643c4ca9b130f12fed343370.jpg

What Is Operating Income Operating Income Formula And EBITDA Vs

https://remote-tools-images.s3.amazonaws.com/Operatingincome.jpg

Net Ordinary Income Vs Net Operating Income - The difference between operating income and net income is that operating income does not take into consideration non operating income such as the income from investments expenses from financing taxes and non recurring expenses or income items such as the gain on the sale of an asset Net income on the other hand is the bottom line profit that factors in all expenses debts additional